- Home

- »

- Medical Devices

- »

-

Body Augmentation Fillers Market Size & Share Report, 2030GVR Report cover

![Body Augmentation Fillers Market Size, Share & Trends Report]()

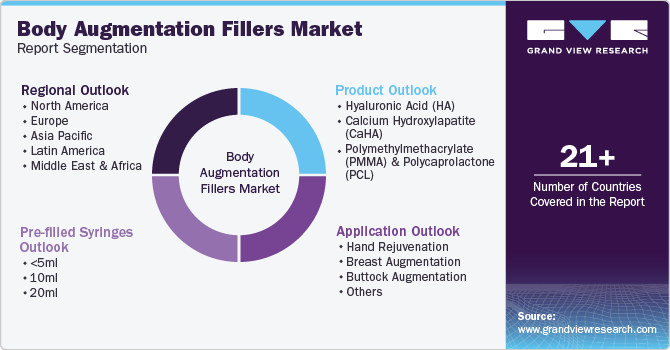

Body Augmentation Fillers Market Size, Share & Trends Analysis Report By Product (Hyaluronic Acid, Calcium Hydroxylapatite (CaHA)), By Application (Hand Rejuvenation, Buttock Augmentation), By Pre-filled Syringes, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-484-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Body Augmentation Fillers Market Trends

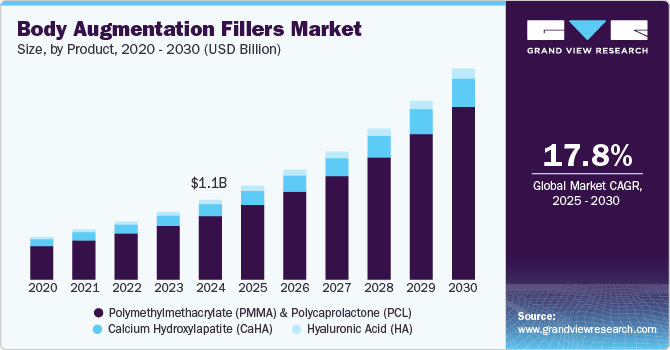

The body augmentation fillers market size was estimated at USD 1.14 billion in 2024 and is projected to grow at a CAGR of 17.8% from 2025 to 2030. The market is driven by increasing demand for aesthetic procedures, technological advancements in filler products, and growing awareness and acceptance of non-surgical options. Based on the ISAPS survey for 2023, 1,892,777 breast augmentation procedures were conducted globally, with women undergoing 1,868,360 of these procedures. Body augmentation fillers for breast augmentation involve the injection of biocompatible materials to enhance breast size and shape. This minimally invasive procedure offers a temporary alternative to surgical implants.

Rising demand for aesthetic procedures among various demographics drives market growth. As societal standards evolve, more individuals seek cosmetic enhancements such as body augmentation fillers to improve their appearance and boost self-esteem. This trend is particularly pronounced among younger populations who are increasingly influenced by social media and celebrity culture, leading to a greater acceptance of body fillers. For instance, According to 2023 American Society of Plastic Surgeons (ASPS) Procedural Statistics Release, ASPS Member Surgeons in the U.S. performed 1,575,244 cosmetic procedures.

Continuous technological advancements in body augmentation filler products contributes to market growth. Innovations in body augmentation fillers such as longer-lasting formulations, improved safety profiles, and minimally invasive application techniques have made these procedures more appealing to consumers. Developing biocompatible materials and introducing new body filler types, such as those that stimulate collagen production, have expanded the market’s offerings and attracted a broader clientele. In August 2023, Maypharm introduced SEDY FILL, a hyaluronic acid-based body filler designed to enhance body contours non-surgically, ensuring high customer satisfaction. This product stands out due to its cross-linked hyaluronic acid, created using advanced HENM technology, offering a customizable solution among the variety of hyaluronic acid fillers available for both doctors and patients.

Consumers are increasingly aware and accepting of non-surgical options such as hyaluronic acid fillers for body enhancement. Educational campaigns and increased visibility through digital platforms have demystified these procedures, making them more accessible. As people become more informed about the benefits and risks associated with fillers, they are more likely to consider these options as viable alternatives to traditional surgical methods. For instance, as per the 2023 ISAPS report, there were 15,813,353 surgical and 19,182,141 non-surgical procedures carried out during the year.

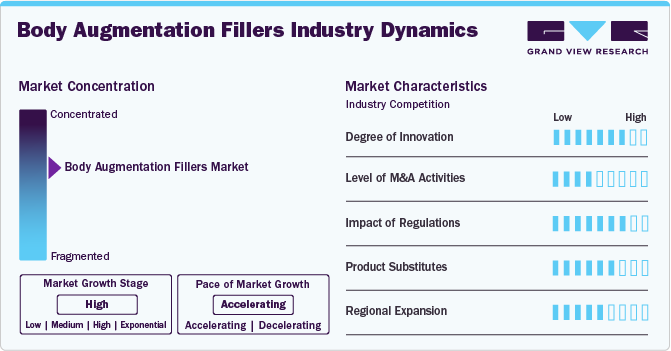

Market Concentration & Characteristics

The degree of innovation in the global market is currently high, driven by technological advancements and materials that enhance product efficacy and safety. Companies invest significantly in research and development to create novel formulations, such as biocompatible body fillers that offer longer-lasting results with fewer side effects. In April 2022, liquid butt lift, a non-surgical technique to increase buttocks size was introduced, merging Sculptra with Hyaluronic Acid (HA) dermal fillers. This innovative method avoids the risks and recovery time associated with surgical procedures. This advanced treatment is available at Skinly Aesthetics, a cosmetic dermatology clinic situated on the Upper East Side of Manhattan, New York.

The level of mergers and acquisitions (M&A) activities within the market is moderate. While there have been notable consolidations among key players seeking to expand their product portfolios and geographic reach, the market remains fragmented. This fragmentation allows smaller companies to thrive, although larger firms increasingly seek to acquire innovative startups to bolster their offerings. In August 2024, Crown Laboratories and Revance Therapeutics merged, forming a company valued at USD 924 million. This merger pooled resources and expertise from prominent skin care and aesthetics brands like Daxxify, the RHA Collection, SkinPen, PanOxyl, Blue Lizard, and StriVectin.

Impact of regulations on market is high, as stringent guidelines govern product safety, efficacy, and marketing practices. Regulatory bodies like the FDA in the U.S. impose rigorous testing requirements before products can enter the market, influencing both development timelines and costs. Compliance with these regulations is essential for companies aiming to establish credibility and trust with consumers. In January 2024, Health Canada announced Galderma's approval for Restylane SHAYPE, a hyaluronic acid injectable aimed at temporarily augmenting the chin area. Designed for deep injection to mimic bone, Restylane SHAYPE will be available in Canada starting February 2024.

Product and service expansion in this sector is characterized as high, with companies actively diversifying their offerings beyond traditional dermal fillers to include complementary services such as skin rejuvenation treatments. This expansion strategy caters to a broader customer base and enhances revenue streams by providing comprehensive aesthetic solutions that meet evolving consumer preferences.

Regional expansion within the market is assessed as moderate, with significant growth opportunities identified in emerging markets across Asia-Pacific and Latin America. While established markets such as North America and Europe continue to dominate due to higher disposable incomes and awareness, companies are increasingly targeting regions where aesthetic procedures are gaining popularity, albeit at a slower pace compared to mature markets.

Product Insights

The Hyaluronic acid (HA) segment led the market with the largest revenue share of 79.8% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Hyaluronic acid (HA) dominates due to its biocompatibility, safety profile, and ability to retain moisture. As a naturally occurring substance in the human body, HA is widely used for aesthetic procedures, including facial volumization and body contouring. Its unique properties allow for smooth integration into tissues, resulting in natural-looking enhancements with minimal downtime. In October 2024, Allergan Aesthetics, a part of AbbVie, made JUVÉDERM VOLUMA XC widely available across the nation for treating temple hollowing. This comes after its U.S. FDA approval in March 2024, marking it as the first hyaluronic acid (HA) filler authorized for correcting moderate to severe temple hollowing in individuals aged 21 and above.

The Calcium Hydroxylapatite (CaHA) is the second largest segment in this market. It is a biocompatible and biodegradable material widely used in body augmentation fillers, particularly for facial volumization and contouring. As a naturally occurring mineral form of calcium apatite, CaHA provides structural support and stimulates collagen production, enhancing skin elasticity and firmness. Its gel-like consistency allows for smooth injection and immediate results, making it a popular choice among practitioners.

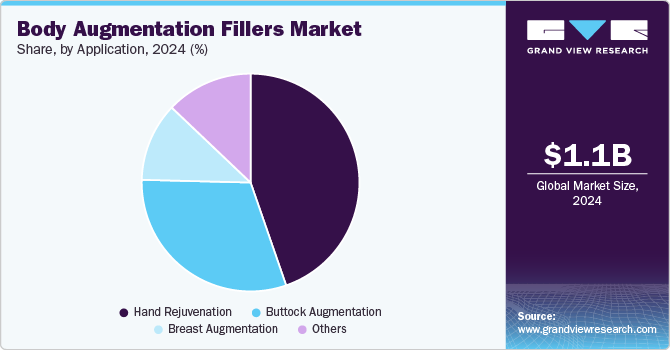

Application Insights

Based on application, the hand rejuvenation segment led the market with the largest revenue share of 44.7% in 2024. The growing popularity of non-surgical cosmetic procedures has contributed to expanding the market segment, appealing particularly to an aging population seeking to maintain a youthful appearance. Innovations in filler formulations and techniques have further enhanced the effectiveness and safety of hand rejuvenation treatments. Social media influence and celebrity endorsements have played a crucial role in normalizing these procedures, leading to increased acceptance among various demographics. Based on the 2023, ASPS Procedural Statistics Release, there were 207,887 reconstructive hand surgery procedures (such as for carpal tunnel, arthritis, and trigger finger) performed, with these counts reflecting the work of ASPS Member Surgeons exclusively.

The buttock augmentation segment is anticipated to grow at the fastest CAGR over the forecast period. It is driven by increasing consumer demand for enhanced body aesthetics. This procedure typically involves using body augmentation fillers or fat grafting techniques to achieve fuller and more contoured buttocks, appealing particularly to individuals seeking non-surgical options. According to the 2023 ISAPS survey, plastic surgeons worldwide performed 771,333 buttock augmentation procedures in 2023.

Pre-filled Syringes Insights

Based on pre-filled syringes, the <5ml segment accounted for the largest revenue share in 2024. The segment of pre-filled syringes containing less than 5ml is gaining significant traction in the global market due to its convenience and precision in administration. These smaller-volume syringes allow for more controlled dosing, which is particularly beneficial for cosmetic procedures that require meticulous application to achieve desired aesthetic results. The rise in minimally invasive procedures led to an increased demand for such products, as they reduce waste and enhance patient safety by minimizing the risk of contamination.

The 10ml segment is anticipated to grow at the fastest CAGR over the forecast period. The 10ml segment of pre-filled syringes in the market is gaining traction due to its convenience and efficiency in administering larger volumes of filler material. This segment caters to both aesthetic and reconstructive procedures, allowing practitioners to perform multiple injections without the need for frequent refills. Demand for 10ml pre-filled syringes is driven by an increase in minimally invasive cosmetic procedures, where patients seek longer-lasting results with fewer sessions.

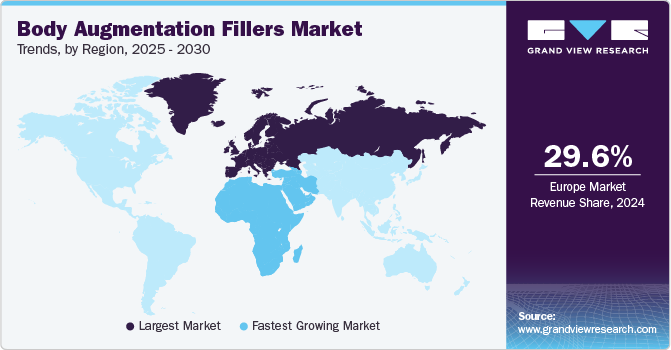

Regional Insights

The body augmentation fillers market in North America held a significant market share in 2024. The North America market is characterized by a growing demand for cosmetic procedures, driven by increasing awareness of aesthetic enhancements and the rising influence of social media. The region is home to advanced healthcare infrastructure and a high concentration of skilled practitioners, which facilitates the adoption of innovative filler technologies. In 2023, there were 450 plastic surgeons in Canada, making up 0.8% of the total number of surgeons in the country.

U.S. Body Augmentation Fillers Market Trends

The body augmentation fillers market in the U.S. is anticipated to grow at the fastest CAGR over the forecast period. In the U.S., the market is particularly robust due to a cultural emphasis on beauty and self-improvement, with many individuals opting for minimally invasive procedures over traditional surgical options. The market is supported by a diverse range of body augmentation filler products that cater to various aesthetic needs, including hyaluronic acid-based fillers and collagen stimulators. In July 2024, Allergan Aesthetics, a subsidiary of AbbVie, revealed the comeback of JUVÉDERM Day. Following its initial success, the event is returning with special limited-time promotions, discounts, and exclusive offers accessible through Allē, the loyalty rewards program by Allergan Aesthetics.

Europe Body Augmentation Fillers Market Trends

Europe dominated the body augmentation fillers market with the largest revenue share of 29.6% in 2024. In Europe, the market is well-established, with a diverse range of products available due to stringent regulatory standards that ensure quality and safety. Countries such as Germany, France, and Italy are at the forefront of innovation within this sector, leading trends that influence global practices. In March 2024, at the IMCAS event, Evolus Inc. announced during their earnings call that they are on schedule for the worldwide launch of their first Cold HA Technology, branded as Evolysse in the US and Estyme in the UK and Europe, in 2025. The Estyme Lift filler, known for its versatility and high volume, has received CE Mark approval in Europe and is set to be submitted to the FDA in the summer of 2024, with anticipated approval by 2025.

The body augmentation fillers market in the UK is expected to grow at the fastest CAGR over the forecast period. In the UK, the market has experienced substantial growth fueled by an increasing acceptance of cosmetic procedures among both men and women. In the UK, in 2023, there were 1,875 buttock augmentation procedures and 31,542 breast augmentation procedures performed. Demand for non-surgical enhancements has been bolstered by advancements in filler technology that offer longer-lasting results with minimal downtime. Regulatory bodies such as the Care Quality Commission (CQC) oversee cosmetic practices to ensure patient safety and quality standards are met.

The Germany body augmentation fillers market is expected to grow at a significant CAGR over the forecast period. Germany is recognized as one of Europe’s largest markets, driven by high consumer spending on aesthetic treatments and a strong emphasis on technological innovation within medical aesthetics. In 2023, Germany saw 5,085 buttock augmentation procedures and 71,464 breast augmentation surgeries performed. German population exhibits a growing interest in non-invasive procedures that provide effective results without extensive recovery times. This trend is supported by stringent regulations from authorities like the Federal Institute for Drugs and Medical Devices (BfArM), which ensures that only safe and effective products are available on the market.

The body augmentation fillers market in France is expected to grow at a substantial CAGR over the forecast period. France holds a prominent position in the European market due to its rich history in cosmetic surgery and aesthetics. French consumers increasingly opt for subtle enhancements that align with natural beauty ideals, which led to a preference for high-quality hyaluronic acid fillers known for their safety profiles. In September 2022, it was announced by Allergan Aesthetics, a branch of AbbVie, that its manufacturing plant in France achieved a significant milestone by producing and distributing 100 million syringes of JUVÉDERM products worldwide.

Asia Pacific Body Augmentation Fillers Market Trends

The body augmentation fillers market in Asia Pacificis expected to experience at a rapid CAGR of 21.7% from 2025 to 2030. Asia Pacific region represents one of the fastest-growing markets globally, fueled by rising disposable incomes and changing beauty standards. Countries like South Korea and Japan lead the way with advanced technology and high consumer engagement in cosmetic procedures. In January 2024, Suneva Medical, Inc. announced its expansion of Bellafill in South Korea, a significant aesthetic market, through a new distribution deal with Renaissance Bio. It highlighted the increasing worldwide demand for biostimulatory fillers such as Bellafill and expressed excitement about a partnership with Renaissance Bio.

The China body augmentation fillers market is anticipated to grow at the fastest CAGR over the forecast period. The market in China is experiencing rapid growth, driven by increasing disposable incomes and a rising demand for aesthetic procedures among the urban population. In 2023, there were 3,000 plastic surgeons in China, making up 5.4% of the total. The Chinese government has also been supportive of the cosmetic industry, leading to an influx of international brands and innovative products. In addition, cultural acceptance of cosmetic enhancements is contributing to a booming market, with both surgical and non-surgical options gaining popularity.

The body augmentation fillers market in Japan is expected to witness at a rapid CAGR over the forecast period. In Japan, the market is characterized by a strong preference for minimally invasive procedures. Japanese consumers tend to prioritize safety and quality, which has led to a demand for high-end products with proven efficacy. Furthermore, the aging population in Japan is driving interest in anti-aging treatments, including dermal fillers that enhance facial volume and contour.

The India body augmentation fillers market is anticipated to grow at a rapid CAGR over the forecast period. India presents a unique landscape for body augmentation fillers, where affordability plays a crucial role in consumer choices. The growing middle class and increased awareness about aesthetic treatments are propelling market growth. However, regulatory challenges and varying standards across different regions can impact product availability and consumer trust. Despite these hurdles, India’s burgeoning beauty industry continues to attract both domestic and international players looking to capitalize on this expanding market. According to the 2023 survey by ISAPS in India, there were 9,223 buttock augmentation procedures and 47,690 breast augmentation procedures.

Latin America Body Augmentation Fillers Market Trends

The body augmentation fillers market in Latin America is witnessing a significant trend. The market in Latin America is characterized by significant growth driven by increasing aesthetic awareness and demand for cosmetic procedures. Brazil leads the region, being one of the largest markets due to its cultural acceptance of beauty enhancements and a robust medical tourism sector. Countries such as Argentina and Colombia are also emerging as key players, benefiting from local demand and international clientele seeking affordable options. In 2023, the ISAPS 2023 survey reported that there were 15,575 buttock augmentations and 77,83 breast augmentations in Argentina.

The Brazil body augmentation fillers market is expected to grow at the fastest CAGR over the forecast period. Brazil stands out as a key player in the market within Latin America, renowned for its vibrant beauty industry and cultural acceptance of cosmetic procedures. However, they face some restraint from certain communities. In December 2023, Save Face partnered with ITV to initiate a campaign prohibiting the use of dermal fillers for BBL and breast augmentation procedures. They collaborated with ITV News to highlight the severe consequences of these procedures when they fail and the alarmingly inadequate training provided to non-professionals aspiring to perform these procedures. An undercover reporter's investigation into a one-day BBL course revealed startling findings.

Middle East And Africa Body Augmentation Fillers Market Trends

The body augmentation fillers market in the Middle East and Africa is poised to grow at the fastest CAGR during the forecast period. In the Middle East, the market is rapidly expanding due to a combination of cultural factors and increased disposable income among consumers. Countries such as the UAE and Saudi Arabia are witnessing a surge in demand for aesthetic treatments as societal norms shift towards embracing cosmetic enhancements. The region’s affluent population is keen on maintaining youthful appearances, leading to higher adoption rates of fillers for various applications. In 2023, the ISAPS survey revealed 17,330 buttock augmentations, and 53,800 breast augmentations were performed in Turkey. This underscores the growing trend of body augmentation procedures in the region.

The Saudi Arabia body augmentation fillers market is expected to grow at a significant CAGR over the forecast period. An increase in disposable income among people has resulted in a higher demand for cosmetic improvements, especially among the younger population. The impact of social media and celebrity endorsements has been significant in influencing consumer inclinations towards body fillers. In May 2023, according to Arab News, there's been a noticeable increase in Saudi men seeking cosmetic procedures. This trend is largely due to shifting societal norms regarding male grooming and personal care, which are now seen as essential for men, marking a departure from the past when these practices were predominantly associated with women.

The body augmentation fillers market in Kuwait is anticipated to grow at the fastest CAGR over the forecast period. In Kuwait, the market is characterized by a growing trend towards non-invasive cosmetic procedures. Their affluent population demonstrates a keen interest in aesthetic treatments, with many seeking out advanced filler options to enhance their appearance. Medical professionals increasingly adopt innovative techniques and products that cater to local preferences and skin types. The presence of high-quality clinics offering specialized services contributes to consumer trust and satisfaction.

Key Body Augmentation Fillers Company Insights

Key players operating in the global market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key Body Augmentation Fillers Companies:

The following are the leading companies in the body augmentation fillers market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie

- Galderma

- Merz GmbH and Co. KGaA

- IBSA Farmaceutici Italia Srl

- Teoxane

- Sinclair

- BioScience GmbH

- Hugel

- BioPlus

- Medytox, Inc.

Recent Developments

-

In May 2024, Galderma unveiled its Restylane VOLYME hyaluronic acid filler in China, alongside its Shape Up Holistic Individualized Treatment (HIT) for aging signs in the mid-face due to structural support loss. These launches highlight Galderma's dedication to fulfilling the demands of patients and injectors in China.

-

In March 2024, Allergan Aesthetics, a subsidiary of AbbVie, was granted clearance by the U.S. FDA for its product, JUVÉDERM VOLUMA XC. This approval signifies the first instance in the U.S. of a hyaluronic acid (HA) dermal filler being authorized for the correction of moderate to severe hollowing in the temple area for individuals aged 21 and older, with the effects lasting as long as 13 months with appropriate treatment.

-

In November 2023, Genese Labs France revealed their latest innovation, the RG60 Body Filler. This cutting-edge injectable boasts a robust concentration of 24mg/ml of cross-linked hyaluronic acid, poised to transform the realm of non-surgical body sculpting. Upholding the belief that beauty is akin to fine art, Genese Labs France presents the RG60 Body Filler, a testament to their dedication to offering the finest tools for the craftsmanship of aesthetic beauty.

Body Augmentation Fillers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.33 billion

Revenue forecast in 2030

USD 3.03 billion

Growth rate

CAGR of 17.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, pre-filled syringes, region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Turkey; Iran; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie; Galderma; Merz GmbH and Co. KGaA; IBSA Farmaceutici Italia Srl; Teoxane; Sinclair; BioScience GmbH; Hugel; BioPlus; Medytox, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Augmentation Fillers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global body augmentation fillers market report based on product, application, pre-filled syringe, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hyaluronic Acid (HA)

-

Calcium Hydroxylapatite (CaHA)

-

Polymethylmethacrylate (PMMA) & Polycaprolactone (PCL)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hand Rejuvenation

-

Breast Augmentation

-

Buttock Augmentation

-

Others

-

-

Pre-filled Syringes Outlook (Revenue, USD Million, 2018 - 2030)

-

<5ml

-

10ml

-

20ml

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

Turkey

-

Iran

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global body augmentation fillers market size was estimated at USD 1.14 billion in 2024 and is expected to reach USD 1.33 billion in 2025.

b. The global body augmentation fillers market is expected to grow at a compound annual growth rate of 17.8% from 2025 to 2030 to reach USD 3.03 billion by 2030.

b. Europe dominated the body augmentation fillers market with a share of 29.6% in 2024. In Europe, body augmentation fillers market is well-established, with a diverse range of products available due to stringent regulatory standards that ensure quality and safety. Countries such as Germany, France, and Italy are at the forefront of innovation within this sector, leading trends that influence global practices.

b. Some of the players operating in this market are AbbVie; Galderma; Merz GmbH and Co. KGaA; IBSA Farmaceutici Italia Srl; Teoxane; Sinclair; BioScience GmbH; Hugel; BioPlus; Medytox, Inc

b. Key factors that are driving the body augmentation fillers market growth include the increasing demand for aesthetic procedures, technological advancements in filler products, and growing awareness and acceptance of non-surgical options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."