- Home

- »

- Next Generation Technologies

- »

-

Body Armor Plates Market Size, Share, Growth Report, 2030GVR Report cover

![Body Armor Plates Market Size, Share & Trends Report]()

Body Armor Plates Market (2023 - 2030) Size, Share & Trends Analysis Report By Level (Level II, Level IV), By Application (Defense, Law Enforcement Protection), By Material (Steel, Aramid, Composite Ceramic), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-278-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Body Armor Plates Market Summary

The global body armor plates market size was valued at USD 1.89 billion in 2022 and is projected to reach USD 2.90 billion by 2030, growing at a CAGR of 5.5% from 2023 to 2030. The body armor plates function as shields and provide a protection layer in protection suits.

Key Market Trends & Insights

- The North American region dominated the market in 2022, accounting for over 32% share of the global revenue.

- The Body Armor Plates market in the U.S. is anticipated to grow at a CAGR of around 14% from 2024 to 2030.

- By material, the composite ceramic material segment led the market in 2022 and accounted for the largest share of over 34% of the global revenue.

- By application, the defense application segment dominated the industry and accounted for over 54% share of the global revenue in 2022.

- By level, the Level IV body armor plate segment led the market in 2022, accounting for over 25% share of the global revenue.

Market Size & Forecast

- 2022 Market Size: USD 1.89 Billion

- 2030 Projected Market Size: USD 2.90 Billion

- CAGR (2023-2030): 5.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

They are typically made from a combination of ceramics and bullet-resistant fabrics or materials. These are often used in bullet-resistant vests to provide additional protection from rifle and pistol bullets. In recent years, the demand for armor plates has increased significantly due to the growing number of territorial disputes between countries around the globe. Moreover, the rising demand for protection shields among civilians has also created several industry growth opportunities.This high demand for civilian use can be attributed to increased crimes, burglaries, home invasions, and similar activities. Citizen Armor, a U.S.-based protection equipment manufacturing company, offers ballistic plates for civilians. The relatively low cost of steel plates has led to their re-emergence in manufacturing body armor for civilian use in the American market. In addition, metal plates are advantageous over ceramic plates since they protect against multiple hits. For instance, in January 2023, TenCate Protective, a prominent geosynthetics and industrial fabrics provider, announced the release of a thinner level III armor ballistic plate. The body armor showcases TenCate Protective’s enhanced heat stress reduction and proprietary trauma reduction technology, allowing thinner plates to be compelling against rifle ammunition.

The growing number of soldier casualties and inflicting fatal injuries due to the rising terrorism and hostile activities worldwide propel the need for ballistic protection suits for safeguarding armed forces. The rise in asymmetric warfare activities and cross-border tension worldwide pushes several governments to develop modernization programs to increase soldiers’ survivability. The program includes acquiring modern protection equipment and shields for the armed forces. The modernization program has also created several opportunities for industry participants, leading to alliances with military agencies in a contractual environment.

Furthermore, the growing demand for soft shields or plates globally boosts investments in various R&D activities to improve these plates’ operational efficiency. Moreover, these R&D activities mainly focus on providing the material with various properties, such as low density, high tenacity, high tensile modulus, and low elongation at break, which is paramount for soft body armor plates. Meanwhile, the companies focus on producing protection suits with different materials complying with National Institute of Justice (NIJ) standards to provide efficient soft body armor plates and maintain competitiveness in the market. The technological advancements and rising availability of lightweight body armor globally are expected to drive market growth over the forecast period.

For instance, Kevlar vests’ liquid armor is an enhanced technology innovated at the U.S. Army Research Laboratory to safeguard soldiers. It is flexible and lightweight, which allows soldiers to move more efficiently while running or aiming their weapons. It turns into a rigid material once the bullet knocks the armor, thus protecting soldiers from being shot. Furthermore, enhanced body armor systems are being developed to ease discomfort and reduce the fatigue that reduces the soldier’s tactical effectiveness. Sensor Products Inc. is developing a body mapping pressure system called Tactilus to help designers and engineers build ballistic protection suits capable of optimally distributing the soldiers’ load.

Level Insights

The Level IV body armor plate segment led the market in 2022, accounting for over 25% share of the global revenue. This growth is attributed to the introduction of the final version of NIJ Standard 0101.07, which is anticipated to improve the test methods and the performance requirements for the ballistic resistance levels. In addition, the new NIJ standard is expected to bring new threat levels for rifle protection levels. The increased vulnerability to rifle protection levels is expected to contribute to segment growth. For instance, in August 2021, KIHOMAC announced the launch of new Ceridium body armor plates. These devices are certified by the NIJ and represent the highest level of quality.

Moreover, the new plates are lightweight and multi-hit capable with a SAPI-cut design, multi-curve, and an innovative thermoplastic spall cover. The level II segment is expected to showcase lucrative growth over the forecast period. Body armor is certified as level II if it can stop the bullets fired from lightweight and small handguns. Council workforce officers mostly use these devices. The segment growth is attributed to the fact that level II devices offer one of the highest levels of protection. They are developed to stop a 0.357 magnum Jacketed Soft Point (JSP) at 1,430 ft/s and a 0.9mm Full Metal Jacket (FMJ) at approximately 1,245 ft/s. They are conventionally light, soft, and comfortable to conceal.

Material Insights

The composite ceramic material segment led the market in 2022 and accounted for the largest share of over 34% of the global revenue. This high share is attributed to the prominence of alumina ceramic among armor manufacturers, as it offers better thermal stability. Hence, plates made from alumina ceramic are mainly provided to personnel deployed in areas where resistance to high temperatures is essential. In some cases, silicon carbide is also used to create ceramic plates. However, designed ceramic plates tend to be more expensive than alumina ceramic. For instance, in July 2021, SINTX Technologies, Inc., an OEM-based ceramics company, announced its asset purchase agreement with B4C Technologies, Inc., a producer of ceramic materials used in body armor plates.

Furthermore, the company also purchased a technology license agreement with Precision Ceramics USA, which offers ceramic components. Moreover, the acquisition of asset purchase from B4C Technologies, Inc. and the technology license agreement with Precision Ceramics USA aims to let the company develop more body armor plates, aircraft, and armored vehicles. The others segment is expected to register the fastest CAGR over the forecast period. The segment includes metal, plastic, and nanomaterials. These materials are among the most commonly used protection shields and plate materials. Moreover, these materials are cost-effective and can offer protection against several types of rounds and projectiles. An armored plate can also be concealed under the user’s garment, making it ideal for an individual.

Application Insights

The defense application segment dominated the industry and accounted for over 54% share of the global revenue in 2022. This high share is attributed to the ever-increasing need for defense suits supported with enhanced ballistic and stabs resistance for soldiers. The defense agencies in developed countries, such as the U.S., France, and Canada, emphasize enhancing personal protection for armed forces; thus, focusing on upgrading the traditional body armor capabilities and protective headgear. For instance, in August 2022, N.P. Aerospace, a provider of advanced and high-performance armor systems, delivered and manufactured 20,000 life-saving carrier vests and body armor plates for Ukraine's military personnel.

The law enforcement protection segment is anticipated to register the second-fastest growth rate over the forecast period, as NIJ has been pivotal in developing modern body armor for police officers. In addition, the rising crime and riot instances in different parts of civil society globally are fostering the product demand in various law enforcement agencies. For instance, the St. Clair police department in the U.S. has declared body armor mandatory for most police officers during area patrolling.

Regional Insights

The North American region dominated the market in 2022, accounting for over 32% share of the global revenue. The government military programs, such as the Extremity Protection Program (EPP) and Soldier Protection System–Torso (SPS-T), provide full body armor to the armed forces. For instance, the EPP focuses on enhancing protection for soldiers’ arms and legs, while the SPS-T aims to provide advanced torso protection. These initiatives can create a ripple effect in the market by driving innovation and investment in protective gear, which are anticipated to incite growth in the regional market.

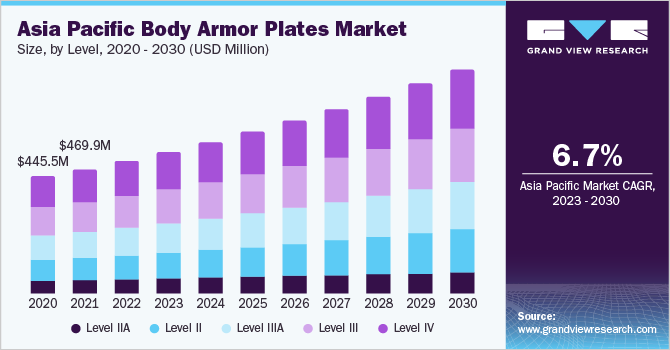

The Asia Pacific region is expected to grow at the fastest CAGR over the forecast period. The large-scale modernization activities of traditional systems and the rise in warfare & border disputes in economies, such as China, India, and South Korea, drive the demand for protection equipment plates in this region. These countries are investing heavily in their military capabilities, including developing and acquiring advanced protection equipment plates. Also, the need for providing personal protection to the ground troops in the Asia Pacific region, along with steady investments by the government for acquiring competitive arms and personal protection equipment, is expected to boost regional market growth.

Key Companies & Market Share Insights

The market is highly concentrated and competitive due to leading vendors offering advanced products, thereby driving internal rivalry. The key players are striving to increase their customer portfolio to gain a competitive advantage in the market. Hence, they focus on expansion activities, such as collaborations, partnerships, and mergers & acquisitions. For instance, in September 2021, the Center for Materials in Extreme Dynamic Environment, a research center, partnered with CoorsTek Inc., a provider of ceramics, to fabricate advanced ceramic materials for military armor applications. Both companies aim to bring expertise in developing advanced ceramic materials for military applications, leading to the development of more robust, lighter, and effective armor materials, such as body armor plates and body armor, among others. Some of the key players in the global body armor plates market are:

-

AEGIS Engineering Systems

-

Armored Republic, LLC.

-

BAE Systems

-

Ballistic Body Armour Pty.

-

Ceradyne Inc. (Subsidiary of 3M)

-

Craig International Ballistics Pty. Ltd.

-

Hellweg International

-

Kejo Limited Company

-

Pacific Safety Products

-

Point Blank Enterprises, Inc

-

Safariland, LLC

Body Armor Plates Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.00 billion

Revenue forecast in 2030

USD 2.90 billion

Growth Rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Level, application, material, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia; South Africa; UAE

Key companies profiled

AEGIS Engineering Systems; Armored Republic, LLC; BAE Systems; Ceradyne Inc. (Subsidiary of 3M); Hellweg International; Ballistic Body Armour Pty.; Craig International Ballistics Pty. Ltd.; Pacific Safety Products; Point Blank Enterprises, Inc.; Safariland, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Body Armor Plates Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the body armor plates market based on level, application, material, and region:

-

Level Outlook (Revenue, USD Million, 2017 - 2030)

-

Level IIA

-

Level II

-

Level IIIA

-

Level III

-

Level IV

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Defense

-

Law Enforcement Protection

-

Civilians

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Steel

-

UHMWPE

-

Aramid

-

Composite Ceramic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East And Africa (MEA)

-

Kingdom of Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global body armor plates market size was estimated at USD 1.89 billion in 2022 and is expected to reach USD 2.00 billion in 2023.

b. The global body armor plates market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 2.90 billion by 2030.

b. North America dominated the body armor plates market with a share of 33.0% in 2022. This is attributable to the defense and law enforcement agencies in developed countries, such as the U.S. and Canada, laying high emphasis on providing enhanced personal protection equipment for ground troops and armed forces.

b. Some key players operating in the body armor plates market include Aegis Engineering Ltd.; AR500 Armor; BAE Systems; Ballistic Body Armour Pty; Ceradyne Inc.; Craig International Ballistics Pty Ltd.; Hellweg International; Kejo Limited Company; Pacific Safety Products; Point Blank Enterprises, Inc.; and Safariland, LLC.

b. Key factors that are driving the body armor plates market growth include the proliferation of technologically advanced products; increasing demand for enhancing soldier safety and ensuring survivability across various regions; and continuous innovation of new materials for better ballistic resistance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.