Board Insulation Market Size, Share & Trends Analysis Report By Application (Building & Construction, Transportation, Industrial), By Region (North America, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-117-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Board Insulation Market Size & Trends

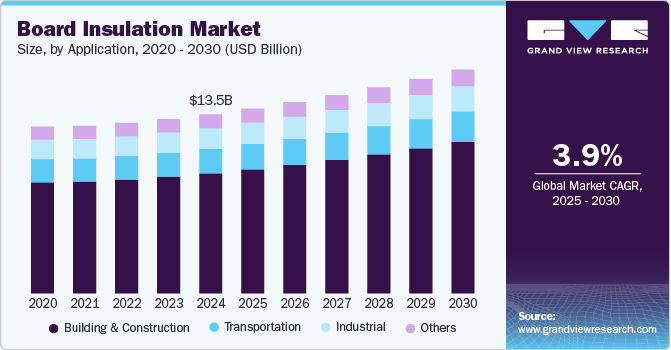

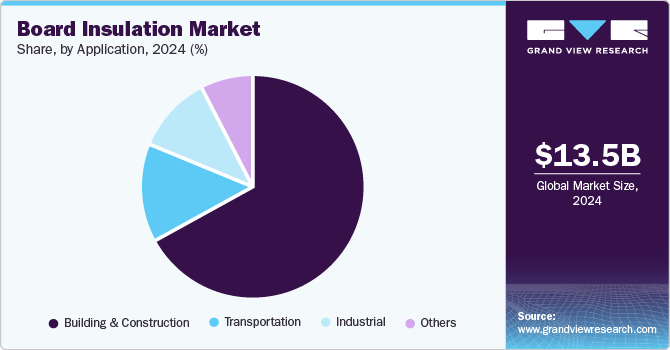

The global board insulation market size was estimated at USD 13.51 billion in 2024 and is expected to register a growth of CAGR 3.9% from 2025 to 2030. This growth can be attributed to the increased focus on energy efficiency and the growing demand for sustainable building materials across the globe. As the cost of energy increases, there is a growing demand for insulation materials that aid in reducing energy consumption. Board insulation is a highly effective way to insulate buildings, and this trend is expected to grow significantly during the forecast period.

Rigid board insulation is highly effective at insulating buildings to curb the energy requirements for heating and cooling. It is easy to install, and the operating cost makes it an ideal choice for most building contractors. This is particularly important in cold climates, where it is important to minimize heat loss. As a result, the demand for boards from the building and construction industry is expected to increase during the forecast period.

The rise in construction activities, especially in urban areas and developing economies, has led to a demand for effective insulation solutions. Board insulation is widely used in walls, roofs, and floors to enhance thermal management and improve indoor comfort, further supporting its market growth. The emphasis on green building standards and sustainable construction practices also propels the use of eco-friendly and energy-saving insulation materials.

Technological advancements in insulation materials have led to the development of products with enhanced thermal efficiency, moisture resistance, and durability. These innovations drive broader applications of board insulation in the construction sector and industries like automotive and manufacturing, where temperature control and energy efficiency are critical factors.

In addition, stringent government regulations and building codes have played a crucial role in driving the market. Various countries have implemented policies that mandate using insulation materials in new buildings and renovations to meet energy efficiency standards. This regulatory push has significantly increased the demand for high-performance insulation materials, including board insulation, in various construction projects.

Application Insights

The building & construction segment led the market and accounted for the largest share of 67.0% in 2024. Boards are commonly used in exterior and interior wall applications. Insulating exterior walls helps improve thermal efficiency, reduces energy consumption, and enhances comfort in buildings. Interior wall insulation is used for soundproofing and controlling temperature fluctuations. Besides, it is extensively used for roof applications, providing thermal resistance and protecting buildings from heat gain and loss. It reduces energy consumption while ensuring occupant comfort. As the construction industry prioritizes energy efficiency, sustainability, and occupant comfort, the demand for board insulation is expected to grow across various applications in the building sector.

Transportation is expected to grow significantly at 3.7% CAGR over the forecast period. In automotive insulation, boards reduce noise, vibration, and harshness levels inside the vehicle. The board helps to create a quieter and more comfortable interior environment for passengers. Besides, refrigerated transport, such as trucks and containers, is extensively used on interior walls to maintain a stable temperature, ensuring the safe transportation of perishable goods with the intent of reducing energy consumption. The transportation industry seeks to improve energy efficiency and passenger comfort, and the demand for boards is expected to grow during the forecast period.

Regional Insights

Asia Pacific board insulation market dominated and accounted for 40.4% of global revenue in 2024. The market growth in this region can be attributed to its economic growth, increased energy prices, and building regulations. Different countries in the region have varying building codes and regulations that dictate the minimum requirements for thermal insulation in buildings. These regulations have mandated all construction contractors to implement insulation materials in the construction industry. Rapid urbanization and industrialization have also led to increased construction activities, driving the demand for board insulation in this region. Increasing awareness of environmental sustainability has led to a preference for eco-friendly and recyclable materials.

The board insulation market in Asia Pacific is driven by rapid urbanization, increasing construction activities, and the growing demand for energy-efficient buildings across the region. One of the major drivers is the rising construction sector, particularly in countries like China, India, Japan, and Southeast Asian nations. The growth of infrastructure projects, including residential, commercial, and industrial buildings, is boosting the demand for insulation materials, such as board insulation, to enhance thermal efficiency and reduce energy consumption.

China board insulation market is expected to grow significantly in the Asia Pacific market.The growing focus on green building certifications, such as China’s Three-Star Green Building Rating System, encourages the adoption of board insulation. Developers and builders increasingly seek these certifications to meet regulatory requirements and market demand for sustainable buildings, leading to a rise in eco-friendly and energy-efficient insulation materials.

U.S. Board Insulation Market Trends

The U.S. board Insulation market is experiencing significant growth driven by the adoption of green building standards like LEED (Leadership in Energy and Environmental Design) and a growing focus on sustainability, which promote the use of eco-friendly and high-performance insulation materials. Consumers and businesses are becoming more conscious of their environmental impact, leading to greater demand for products that improve energy efficiency and reduce carbon footprints.

Middle East & Africa Board Insulation Market Trends

The Middle East & Africa board insulation market is anticipated to grow significantly at a CAGR of 3.1% over the forecast period. One of the primary drivers is the region's extreme climate conditions, particularly the high temperatures in the Middle East, which have led to an increasing demand for effective insulation materials to reduce cooling costs and improve indoor comfort. Governments in the region are promoting energy-efficient buildings through initiatives such as the UAE's Energy Strategy 2050 and Saudi Arabia’s Vision 2030, both of which emphasize sustainability and energy conservation. These policies encourage using insulation materials like board insulation in new construction and retrofitting projects.

Europe Board Insulation Market Trends

The board insulation market in Europe is experiencing notable growth, primarily fueled by increasing renovation and retrofitting activities in Europe are contributing to market growth. Many countries in the region have aging building stocks that need to be modernized to meet current energy efficiency standards. Governments are offering incentives and funding for energy-efficient renovations, such as the EU Renovation Wave initiative, which aims to improve the energy performance of millions of buildings across Europe. This initiative drives demand for insulation materials, including board insulation, to reduce energy waste in older buildings.

Key Board Insulation Company Insights

Some of the key players operating in the market include Owens Corning, Rockwell International, Saint-Gobain, and others;

-

Owens Corning offers a range of high-quality products, including FOAMULAR extruded polystyrene (XPS) insulation boards, renowned for their moisture resistance, durability, and thermal performance. Additionally, the company provides Thermafiber mineral wool insulation boards, which offer fire resistance and sound control, meeting the needs of both residential and commercial applications.

-

Rockwell International, a prominent player in the market, specializes in providing high-performance insulation solutions for commercial and industrial applications. With a focus on energy efficiency, sustainability, and durability, Rockwell's product portfolio includes an array of mineral wool insulation boards. These offerings cater to multiple needs, including thermal and acoustic insulation and fire resistance, making them suitable for walls, roofs, floors, and HVAC systems. The company’s board insulation products are engineered to meet stringent industry standards, supporting energy conservation efforts and enhancing the safety and comfort of building environments.

Key Board Insulation Companies:

The following are the leading companies in the board insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Owens Corning

- Rockwell International

- Saint-Gobain

- Knauf Insulation

- Llyod Insulations India Ltd

- Polybond Insulation Pvt Ltd

- Industrial insulation

- BASF

- Huntsman Corporation

- Mitsui Chemicals, inc.

- Rogers Corporation

- Duna.

Board Insulation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 13.94 billion |

|

Revenue forecast in 2030 |

USD 16.88 billion |

|

Growth rate |

CAGR of 3.9% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional Scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil |

|

Key companies profiled |

Owens Corning; Rockwell International; Saint-Gobain; Knauf Insulation; Llyod insualtions India Ltd; Polybond insulation Pvt Ltd; Industrial insulation; BASF SE; Huntsman Corporation; Mitsui Chemicals, Inc.; Rogers Corporation; Duna |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Board Insulation Market Report Segmentation

This report forecasts volume & revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global board insulation market based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Transportation

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The board insulation market size was estimated at USD 13.51 billion in 2024 and is expected to reach USD 13.94 billion in 2025.

b. The board insulation market is expected to grow at a compound annual growth rate of 3.9% from 2025 to 2030 to reach USD 16.88 billion by 2030

b. The building & construction segment led the market and accounted for the largest share of 67.0% in 2024. As the construction industry prioritizes energy efficiency, sustainability, and occupant comfort, the demand for board insulation is expected to grow across various applications in the building sector

b. Some of the key players operating in the Board Insulation market include Owens Corning, Rockwell International, Saint-Gobain, Knauf Insulation, Llyod Insulations India Ltd, Polybond Insulation Pvt Ltd, Industrial Insulation, BASF SE, Huntsman Corporation, Mitsui Chemicals, Inc., Rogers Corporation, and Duna.

b. Key factors that are driving the market growth include the rising demand for Board insulation in construction & building and transportation applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."