- Home

- »

- Conventional Energy

- »

-

Blowout Preventer Market Size, Share, Industry Report, 2030GVR Report cover

![Blowout Preventer Market Size, Share & Trends Report]()

Blowout Preventer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Annular Blowout Preventers, Ram Blowout Preventers, Hybrid Blowout Preventers), By End-use (Oil & Gas, Geothermal, Mining), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-513-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blowout Preventer Market Size & Trends

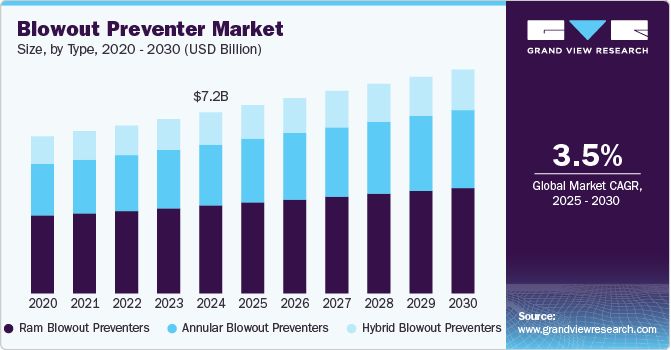

The global blowout preventer market size was valued at USD 7.16 billion in 2024 and is expected to grow at a CAGR of 3.51% from 2025 to 2030. The industry is primarily driven by the increasing global demand for oil and gas, which necessitates advanced safety measures in drilling operations. As exploration activities expand into deeper and more challenging offshore and onshore environments, the risk of uncontrolled well-blowouts rises, leading to stricter safety regulations. Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) and the American Petroleum Institute (API) impose stringent standards for well control equipment, pushing operators to invest in high-performance BOP systems.

Growing investments in deepwater and ultra-deepwater projects, particularly in regions like the Gulf of Mexico, North Sea, and offshore Brazil, further drive the adoption of technologically advanced BOPs to ensure operational safety and compliance.

Another key driver is the rapid advancement in BOP technology, including automated control systems, real-time monitoring, and improved sealing mechanisms. Innovations such as smart BOPs with predictive maintenance capabilities help reduce downtime and enhance operational efficiency. Moreover, the industry is witnessing a shift toward renewable energy transition, which compels oil and gas companies to optimize existing resources by minimizing risks and improving equipment reliability. The increasing focus on cost-effective and environmentally friendly drilling solutions also propels the market, as manufacturers develop BOPs with enhanced durability and lower maintenance costs. Furthermore, the rising number of mature oilfields and well intervention activities creates additional demand for BOP systems to ensure safe and efficient well control operations.

Type Insights

Based on the type, the ram blowout segment registered the largest revenue market share of over 49.0% in 2024 and is expected to grow at a significant CAGR of 2.95% during the forecast period. The Ram Blowout Preventers (BOP) market is primarily driven by the increasing global demand for oil and gas exploration and production, particularly in offshore and deepwater drilling operations. As energy consumption continues to rise, companies are expanding their drilling activities, necessitating advanced well control equipment to prevent blowouts and ensure operational safety. Stringent government regulations and industry standards, such as those set by the American Petroleum Institute (API) and the Bureau of Safety and Environmental Enforcement (BSEE), further drive the adoption of high-performance BOPs. Additionally, technological advancements in BOP systems, such as automated ram actuation and real-time monitoring, are enhancing their reliability and efficiency, making them essential for drilling contractors and operators.

The market for Annular Blowout Preventers (BOPs) is primarily driven by increasing offshore and onshore drilling activities, fueled by rising global energy demand and exploration of unconventional oil and gas reserves. As energy companies push deeper into high-pressure and high-temperature (HPHT) reservoirs, the need for advanced well control equipment, including annular BOPs, has grown. Additionally, stringent safety regulations from organizations such as API (American Petroleum Institute) and regulatory bodies worldwide have compelled drilling contractors and oilfield service companies to invest in high-performance BOP systems to mitigate the risks of well blowouts.

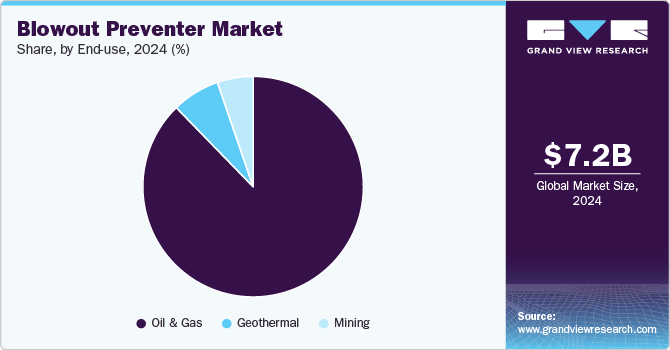

End Use Insights

Based on end-use, the oil & gas segment accounted for the highest revenue market share of over 88.0% in 2024. The segment is a primary driver in the blowout preventer (BOP) market due to the increasing global demand for energy and the rising exploration and production (E&P) activities in deepwater and ultra-deepwater regions. With stricter safety regulations and the need to prevent catastrophic well blowouts, oil & gas operators are investing heavily in advanced BOP systems. Technological advancements, such as smart BOPs with real-time monitoring and automated control systems, are further propelling the market. Additionally, the revival of offshore drilling projects, especially in regions like the Gulf of Mexico, the North Sea, and the Middle East, is boosting the demand for reliable and high-performance BOPs.

Another key factor driving the market is the increasing focus on unconventional oil & gas resources, including shale gas and tight oil, which require high-pressure drilling operations. The expansion of hydraulic fracturing (fracking) activities in North America and the development of new oilfields in Latin America and Africa are significantly contributing to BOP market growth. Furthermore, oil price stabilization and renewed investments by major oil companies in exploration projects are expected to sustain demand. As environmental and operational risks remain high in drilling operations, the need for robust and efficient blowout prevention systems will continue to drive the market in the oil & gas sector.

Regional Insights

North America blowout preventer market dominated the global industry and accounted for the largest revenue share of over 45.0% in 2024. The North American BOP industry is primarily driven by the region’s extensive offshore and onshore oil and gas exploration activities, particularly in the U.S. and Canada. The resurgence of shale gas and tight oil production, supported by advanced drilling technologies like hydraulic fracturing and horizontal drilling, has led to increased demand for BOP systems. Additionally, stringent safety and environmental regulations imposed by agencies like the Bureau of Safety and Environmental Enforcement (BSEE) in the U.S. have reinforced the need for reliable BOP equipment, driving market growth.

U.S. Blowout Preventer Market Trends

The blowout preventer industry in the U.S. is driven by the nation's thriving oil and gas industry, especially with offshore drilling operations. As a critical component to ensure well control and prevent the uncontrolled release of hydrocarbons, BOPs are essential for operations in the Gulf of Mexico and other offshore fields. The increasing demand for energy and the focus on safety regulations post-incidents like the Deepwater Horizon spill have pushed for stringent regulations and the adoption of advanced BOP technologies. This has made the U.S. a key player in BOP market growth, particularly in terms of innovation and regulatory compliance.

Europe Blowout Preventer Market Trends

The blowout preventer market in Europe is experiencing significant growth, driven by several key factors. The region's increasing energy insecurity, exacerbated by geopolitical tensions and reduced natural gas production, has heightened the demand for reliable oil and gas exploration and production equipment. In response, countries like Norway and the United Kingdom are boosting their oil and gas production to enhance energy security, thereby increasing the need for advanced BOP systems.

Key Blowout Preventer Company Insights

The global blowout preventer market is characterized by intense competition. Key players such as Schlumberger, Halliburton, Parker Tube Fitting, FMC Technologies, Baker Hughes, and Tenaris dominate the market. The competitive environment is further intensified by the entry of new players, partnerships, and collaborations aimed at enhancing efficiency, reducing costs, and increasing oil & gas activity. Regional players are leveraging government incentives and local production capabilities to gain market share, while established companies focus on R&D, vertical integration, and scaling production to maintain their competitive edge.

-

In June 2024, INTLEF launched the QL-type blowout preventer, which enables quick and effortless bonnet opening or closing for ram seal or assembly replacement.

Key Blowout Preventer Companies:

The following are the leading companies in the blowout preventer market. These companies collectively hold the largest market share and dictate industry trends.

- Schlumberger

- Halliburton

- Parker Tube Fitting

- FMC Technologies

- Baker Hughes

- Tenaris

- Valve Solutions

- National Oilwell Varco

- Cameron International

- GE

- Weatherford

- Parker Hannifin

- DrilQuip

- TechnipFMC

- Aker Solutions

Blowout Preventer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.45 billion

Revenue forecast in 2030

USD 8.86 billion

Growth rate

CAGR of 3.51% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia, UAE; South Africa

Key companies profiled

Schlumberger, Halliburton, Parker Tube Fitting, FMC Technologies, Baker Hughes, Tenaris, Valve Solutions, National Oilwell Varco, Cameron International, GE, Weatherford, Parker Hannifin, DrilQuip, TechnipFMC, Aker Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blowout Preventer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blowout preventer market report on the basis of type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Annular Blowout Preventers

-

Ram Blowout Preventers

-

Hybrid Blowout Preventers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Geothermal

-

Mining

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global blowout preventer market size was estimated at USD 7.16 billion in 2024 and is expected to reach USD 7.45 billion in 2025.

b. The global blowout preventer market is expected to grow at a compounded annual growth rate of 3.51% from 2025 to 2030 to reach USD 8.86 billion by 2030.

b. Ram blowout segment registered the largest revenue market share of over 49.0% in 2024 and is expected to grow at a significant CAGR of 2.95% during the forecast period. The segment is primarily driven by the increasing global demand for oil and gas exploration and production, particularly in offshore and deepwater drilling operations.

b. Some key players operating in the blowout preventer market include Schlumberger, Halliburton, Parker Tube Fitting, FMC Technologies, Baker Hughes, and Tenaris.

b. Key factors driving the blowout preventer market growth include increasing global demand for oil and gas, which necessitates advanced safety measures in drilling operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.