Blood Screening Market Size, Share & Trends Analysis Report By Technology (Nucleic Acid Amplification Test, ELISA, Western Blotting), By Product (Reagent, Instrument), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-215-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Blood Screening Market Size & Trends

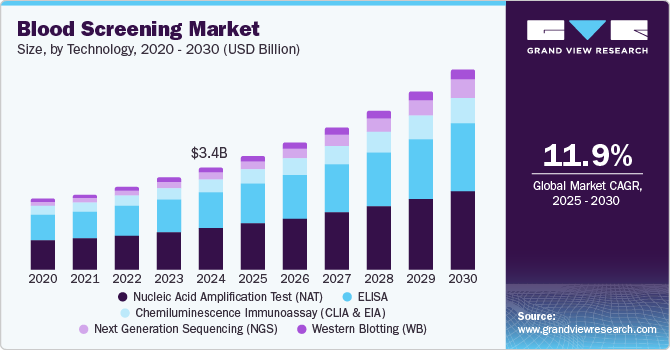

The global blood screening market size was valued at USD 3.40 billion in 2024 and is anticipated to grow at a CAGR of 11.9% from 2025 to 2030. This growth is attributed to the increasing number of blood donations worldwide is a primary catalyst, necessitating rigorous screening to ensure safety and detect transfusion-transmissible infections. In addition, technological advancements, particularly in automation and molecular platforms, enhance screening efficiency and accuracy. Furthermore, the rising prevalence of infectious diseases and government initiatives promoting blood safety further contribute to market expansion, alongside growing awareness among the public regarding the importance of safe blood transfusions.

Blood screening is a crucial medical procedure that analyzes blood samples to identify various health conditions and abnormalities. This diagnostic approach provides essential insights into an individual's overall well-being, facilitating early detection, prevention, and management of diseases. It involves assessing blood cell counts, detecting infectious agents such as viruses and bacteria, and measuring chemical levels such as cholesterol and glucose. The importance of blood screening lies in its ability to help healthcare providers identify potential health issues before symptoms arise, making it vital for diagnosing conditions such as anemia, diabetes, infections, and cardiovascular diseases.

Continuous technological advancements enhance the accuracy and efficiency of screening methods while increasing awareness about the significance of early disease detection promotes preventive healthcare practices. The aging population is another factor, as the rising prevalence of diseases requiring blood screening drives demand.

Furthermore, rising healthcare expenditures globally facilitate the adoption of advanced technologies and services in blood screening. These interconnected factors collectively contribute to the ongoing growth and evolution of the blood screening market, emphasizing its significance in proactive healthcare strategies aimed at improving patient outcomes and overall public health.

Technology Insights

Nucleic acid amplification tests (NAT) dominated the market and accounted for the largest revenue share of 41.2% in 2024 attributed to the increasing prevalence of infectious diseases, such as HIV and hepatitis, necessitating accurate and rapid testing methods that NAATs provide. These tests offer high sensitivity and specificity, enabling the detection of low viral loads that traditional methods may miss. Furthermore, the rising demand for early diagnosis and monitoring of diseases further drives the adoption of NAATs. Technological advancements in amplification techniques also enhance the efficiency and speed of these tests, making them more accessible in clinical settings.

Next Generation Sequencing (NGS) is expected to grow at a CAGR of 16.5% over the forecast period. The technology has revolutionized genomic analysis by significantly reducing sequencing costs while improving accuracy. In addition, NGS enables comprehensive profiling of genetic mutations, which is crucial for personalized medicine and targeted therapies. Furthermore, its ability to process multiple samples simultaneously enhances throughput in laboratories, making it an attractive option for healthcare providers. The continuous evolution of NGS technologies ensures their relevance in various applications, including early disease detection and monitoring, thus propelling market growth.

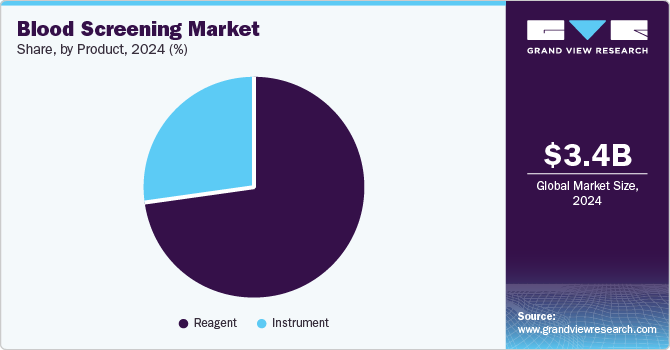

Product Insights

Reagents led the market and accounted for the largest revenue share of 73.4% in 2024. Reagents are essential components in diagnostic tests, providing the necessary chemical, biological, or immunological substances to elicit specific reactions for accurate results. In addition, the increasing demand for high specificity and accuracy in blood analysis fuels the need for innovative reagent formulations that enhance test performance. Furthermore, reagents are cost-effective, making them widely accessible and contributing to their dominant market share.

Instruments are expected to grow at the fastest CAGR of 10.8% over the forecast period, owing to technological advancements and increasing demand for effective diagnostic solutions. In addition, modern blood screening instruments are designed to improve accuracy and efficiency, catering to the need for rapid diagnostics in healthcare settings. Furthermore, innovations such as high-throughput analyzers and point-of-care testing devices enhance the user experience and accessibility of blood testing. Despite challenges such as high costs and the reusable nature of some devices, ongoing technological developments are expected to drive long-term growth in this segment as healthcare providers seek reliable and efficient tools for blood analysis.

Regional Insights

North America blood screening market dominated the global market and accounted for the largest revenue share of 38.4% in 2024 attributed to advanced healthcare infrastructure and a strong emphasis on patient safety. The region’s healthcare facilities have cutting-edge technology, ensuring accurate and efficient blood testing processes. In addition, there is a growing awareness of the importance of early disease detection, prompting healthcare providers to prioritize regular blood screenings. Furthermore, collaborative efforts between public health organizations and private sectors further enhance the accessibility and quality of blood screening services, fostering sustained market growth.

U.S. Blood Screening Market Trends

The U.S.blood screening market in thedominated the North American market and accounted for the largest revenue share in 2024, owing to a high number of blood donations and a robust regulatory framework. The country places great importance on ensuring the safety of blood transfusions, which drives the demand for comprehensive screening methods. In addition, technological advancements in testing procedures also contribute to this growth, improving accuracy and reducing turnaround times. Furthermore, favorable reimbursement policies encourage healthcare providers to adopt innovative blood screening technologies, enhancing overall public health outcomes.

Asia Pacific Blood Screening Market Trends

Asia Pacific blood screening market is expected to grow at a CAGR of 13.7% over the forecast period attributed to increasing healthcare awareness and economic development. Countries in this region are investing heavily in healthcare infrastructure, which enhances access to blood screening services. In addition, the rising prevalence of infectious diseases has heightened the need for effective screening processes. Furthermore, government initiatives aimed at promoting preventive healthcare are also driving demand for blood screening, positioning Asia Pacific as a key player in the global market with significant potential for innovation and expansion.

The blood screening market in Japan is expected to grow significantly over the forecast period, owing to its advanced technological landscape and a strong commitment to preventive health measures. In addition, the population is increasingly aware of the importance of regular health check-ups and blood safety. As the aging demographic grows, there is a heightened demand for diagnostic services to manage chronic diseases effectively. Furthermore, the Japanese government supports initiatives that improve blood donation rates and enhance screening technologies, ensuring that the country maintains high standards in blood safety practices.

Europe Blood Screening Market Trends

The Europe blood screening market is expected to grow substantially, driven by stringent regulatory standards and a focus on patient safety. Countries across the region have established comprehensive blood testing frameworks prioritizing quality assurance and risk management. In addition, the increasing incidence of infectious diseases drives demand for effective screening methods. Furthermore, collaborative efforts among public health organizations and private entities further enhance access to advanced blood screening technologies throughout Europe, promoting overall public health.

Germany Blood Screening Market Trends

The growth of the blood screening market in Germany is fueled by a strong emphasis on innovation and quality assurance within its healthcare system. The country prioritizes patient safety through rigorous testing protocols that ensure reliable results. In addition, growing awareness about blood-borne diseases drives demand for effective screening methods among healthcare providers. Furthermore, government initiatives promote regular health check-ups among citizens, while Germany's robust research environment fosters advancements in diagnostic technologies, ensuring that its blood screening practices remain efficient and effective in addressing public health needs.

Key Blood Screening Company Insights

Some of the key companies in the market include Bio-Rad Laboratories, Inc., Hoffman-La Roche Ltd., Grifols, S.A., and others. These companies adopt strategies such as strategic collaborations to enhance innovation, mergers, and acquisitions to expand capabilities, and new product launches to address evolving healthcare needs, ensuring competitiveness and a strong market presence.

-

Abbott manufactures specialized medical equipment that may utilize Blood Screening components for durability and lightweight properties. Beyond blood screening, Abbott operates in various segments, including laboratory diagnostics, cardiovascular devices, diabetes care, and nutrition products, thereby enhancing its portfolio and addressing diverse healthcare needs.

-

Bio-Rad Laboratories, Inc. develops diagnostic instruments that may incorporate Blood Screening materials for enhanced performance and reliability in relation to Blood Screening. The company also engages in other segments, such as quality control products, gene expression analysis, and protein purification, positioning itself as a leader in both research and clinical settings.

Key Blood Screening Companies:

The following are the leading companies in the blood screening market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Danaher Corporation (Beckman Coulter)

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Hoffman-La Roche Ltd.

- Grifols, S.A.

- Ortho-Clinical Diagnostics, Inc.

- Siemens Healthcare GmbH

- Thermo Fisher Scientific, Inc.

- SOFINA s.a (Biomerieux)

View a comprehensive list of companies in the Blood Screening Market

Recent Developments

- In May 2023, Siemens Healthineers launched two new analyzers, the Atellica HEMA 570 and Atellica HEMA 580, designed for high-volume hematology testing, crucial for blood screening. These advanced devices can streamline the complete blood count (CBC) process, offering rapid results and improved workflow efficiency. With the ability to process up to 120 tests per hour, these analyzers can address the growing demand for timely diagnostics in critical care settings.

Blood Screening Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.78 billion |

|

Revenue forecast in 2030 |

USD 6.62 billion |

|

Growth Rate |

CAGR of 11.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, India, China, South Korea, Brazil, Argentina, Saudi Arabia, and South Africa |

|

Key companies profiled |

Abbott; Danaher Corporation (Beckman Coulter); Becton Dickinson and Company; Bio-Rad Laboratories, Inc.; Hoffman-La Roche Ltd.; Grifols, S.A.; Ortho-Clinical Diagnostics, Inc.; Siemens Healthcare GmbH; Thermo Fisher Scientific, Inc.; SOFINA s.a (Biomerieux). |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Blood Screening Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global blood screening market report based on technology, product, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleic Acid Amplification Test (NAT)

-

ELISA

-

Chemiluminescence Immunoassay (CLIA & EIA )

-

Next Generation Sequencing (NGS)

-

Western Blotting (WB)

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagent

-

Instrument

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

India

-

Japan

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."