- Home

- »

- Medical Devices

- »

-

Blood Pressure Monitoring Devices Market Size Report, 2030GVR Report cover

![Blood Pressure Monitoring Devices Market Size, Share & Trends Report]()

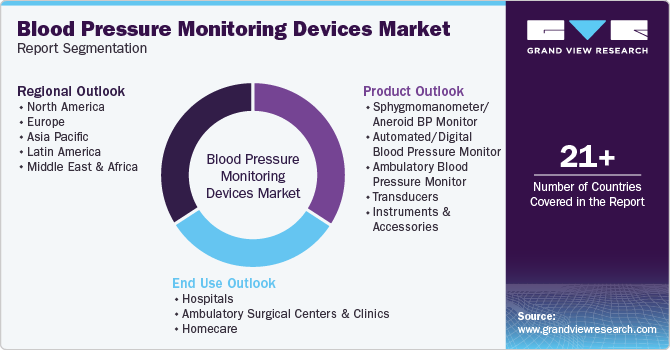

Blood Pressure Monitoring Devices Market Size, Share & Trends Analysis Report, By Product (Sphygmomanometers, Digital BP Monitor), By End Use (Hospitals, Homecare), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-586-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The global blood pressure monitoring devices market size was estimated at USD 5.0 billion in 2024 and is projected to grow at a CAGR of 9.6% from 2025 to 2030. Increasing incidences of hypertension due to changing lifestyles are the key factor attributing to the market's growth over the forecast period. According to the estimates published by the World Health Organization (WHO) in 2019, around 1.28 billion people around the globe have hypertension, which is a major cause of premature death worldwide. The demand for BP monitors is very high on account of the growing geriatric population base and increasing risk of lifestyle-associated disorders among a wide population base due to rising incidences of obesity & sedentary lifestyles.

Self-measured home blood pressure monitoring was vital even before COVID-19, and maintaining blood pressure under control is even more critical now. The American Heart Association and the American Society of Hypertension, as well as the European Society of Hypertension and the National Institute for Health and Care Excellence (NICE), strongly advise that blood pressure be monitored twice daily for seven consecutive days, preferably in the morning and evening, with two measurements taken 1-2 minutes apart on each occasion, hence fueling the demand for BP monitors.

Initiatives taken by the government, such as public blood pressure monitoring programs to create awareness amongst people and maintain the database produced by remotely operational BP monitors, are expected to propel further growth during the forecast period. For instance, in February 2019, an activity funded by the American Medical Association (AMA), named The Integrated Health Model Initiative (IHMI), launched a data management model for providing opportunities to improve health outcomes.

Advancements such as mobile-based BP monitoring systems and digital sphygmomanometers are anticipated to drive the demand. Improvements in devices for measuring blood pressure, such as wearable & portable devices and mobiles, are gaining popularity owing to associated benefits such as the wireless transmission of patient information and easy handling. New technologies such as mHealth, which support treatment & medication compliance for patients in chronic disease management, are expected to fuel market growth. It helps track the patient’s health information, medication schedule, and follow-up for the treatment. These associated advantages are some of the factors expected to propel growth.

The increasing burden of hypertension globally leads to an increase in the demand for home monitoring devices over the forecast period. In addition, the associated benefits of automated devices, such as repetitive blood pressure measurements to check accuracy and banned mercury devices, will contribute to market growth in the coming years. Self-measurement devices are gaining popularity during the forecast period due to associated benefits such as good monitoring, detection, and control, further anticipating the segment growth. Automated blood pressure monitors are available in different forms to measure blood pressure, including the arm, wrist, and fingers.

Product Insights

The automated/digital blood pressure monitor accounted for the largest market share at over 48.4% due to their growing demand in 2024. Technological advancements and new product launches are expected to fuel the demand for automated products globally.

The increasing demand for digital monitors can be associated directly with the rising awareness level among patients regarding cardiovascular disease, hypertension, and BP monitoring devices and the growing prevalence of hypertension worldwide. In addition, continuous technological advancements such as improvements in wearable technology, apps, & mobiles in the consumer healthcare segment, declining average selling prices for retailers & manufacturers, and rising penetration in the professional market are propelling market growth. For instance, in January 2022, Aktiia launched its 24/7 Blood Pressure Monitor in the U.S., introducing a new generation of clinical wearables designed to address the needs of both patients and physicians.

The blood pressure cuffs market is expected to grow significantly at a CAGR of over 8.0% over the forecast period due to the increasing usage of blood pressure monitors caused by the growing incidence of high blood pressure. These cuffs are available in different sizes, according to the patient type. Two types of cuffs, disposable and reusable, are available in the market. The disposable segment is anticipated to grow at a high CAGR due to the rising adoption of eco-friendly products and increasing concern about hospital-based cross-contamination events.

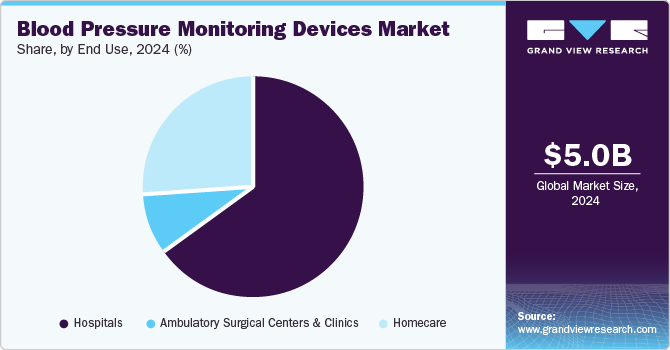

End Use Insights

Hospitals, ambulatory surgical centers, and home care are the end use segments analyzed in the market. The hospital segment accounted for the largest revenue share of 51.1% in 2024 due to a large patient pool. The need for cost-effective, fast, and accurate diagnostic tools for better health outcomes drives the adoption of BP monitoring devices.

Homecare is anticipated to exhibit a sturdy CAGR of around 11.5% over the forecast period.

The cost efficiency of this alternate option for BP monitoring and the availability of intelligent wearables that offer mobility are expected to support the growth. Therefore, the inclination towards independent living is expected to propel the market growth.

Ambulatory BP monitoring (ABMP) measures out-of-office BP readings at specific intervals over 24 hours. ABPM offers a better way to predict long-term cardiovascular disease outcomes.

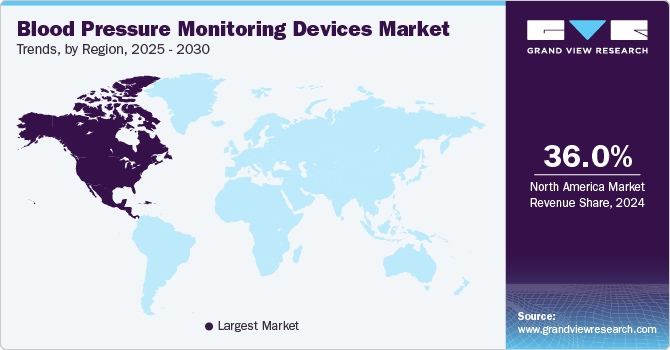

Regional Insights

North America blood pressure monitoring devices market held the most significant revenue with over 36.0% share in 2024, as it has a highly regulated & developed healthcare infrastructure. Increasing investments in creating accurate and adequate blood pressure monitors are among the key factors expected to fuel market growth in the coming years. Changing lifestyles and the rising geriatric population, which is prone to chronic diseases and requires BP monitoring devices for diagnosis & treatment of the diseases, are some of the factors contributing to the growth of this market.

U.S. Blood Pressure Monitoring Devices Market Trends

The U.S. blood pressure monitoring devices market accounted for a large share of the North American market. Rising CVD cases in the U.S. are further anticipated to fuel the market over the coming years. According to an article published in January 2024 by the American Heart Association, in the U.S., CVD results in about 2,552 deaths each day. Furthermore, nearly 119 million adults in the country had hypertension in 2019, and high BP was the primary cause of death for around 494,873 U.S. residents in the same year.

Canada blood pressure monitoring devices market is projected to witness the fastest growth over the forecast period, which can be attributed to the rising geriatric population in this region. For instance, as per Statistics Canada, there were more than 861,000 people aged 85 and older in 2021, more than twice as compared to the 2001 census. Moreover, this number is projected to triple by 2046 and reach 2.5 million per similar source. As the geriatric population is more susceptible to hypertension and related chronic disorders, the demand for blood pressure monitoring devices is expected to grow.

Europe Blood Pressure Monitoring Devices Market Trends

The blood pressure monitoring devices market in Europe is experiencing significant growth, driven by the rising prevalence of hypertension and cardiovascular diseases. As populations like Germany, the UK, France, and Italy age, healthcare systems prioritize early diagnosis and continuous monitoring of chronic conditions. This trend has accelerated the adoption of traditional and intelligent BP monitors, with consumers seeking at-home solutions for health management.

Germany blood pressure monitoring devices market held a substantial market share in 2024 and is expected to witness significant growth over the forecast period, owing to ongoing technological advancements coupled with improving healthcare infrastructure. Germany is the largest market for medical devices in Europe. It is four times larger than the UK medical devices market, significantly contributing to Europe.

The blood pressure monitoring devices market in the UK is projected to witness lucrative growth over the forecast period. This can be attributed to the growing population and increasing number of people suffering from several chronic disorders. For instance, per the Office for National Statistics, the UK population is estimated to grow by 2.1 million by 2030, representing 69.2 million, an increase of around 3.2%.

Asia Pacific Blood Pressure Monitoring Devices Market Trends

The Asia Pacificblood pressure monitoring devices market is expected to grow exponentially over the forecast period. Significant factors boosting growth are favorable government initiatives supporting the adoption of advanced medical devices, the growing geriatric population, and increasing healthcare expenditure.

The Japan blood pressure monitoring devices market growth is driven bythe presence of market leaders, such as Omron Healthcare and Nihon Kohden. For instance, in 2020, Omron’s healthcare business segment experienced increased demand for thermometers & blood pressure monitors in Europe, Japan, and Central & South America due to the high demand for at-home health management due to the pandemic.

China pressure monitoring devices market is anticipated to grow over the forecast period.According to WHO, nearly 270 million Chinese individuals have hypertension, with around 13.8% of the patients having their condition under control, indicating the need for constant monitoring and high growth potential for BP monitors in the country. In addition, as per the eHealth initiative to help meet high unmet needs, the government deployed eHealth and wearable medical devices with connectivity via Bluetooth or other health management systems, thereby driving the China market.

Latin American Blood Pressure Monitoring Devices Market Trends

The Latin American blood pressure monitoring devices market mainly includes Brazil and Argentina. The market in Latin America is expected to witness steady growth during the forecast period, owing to the rising number of people living with chronic diseases and cardiac disorders.

Middle East and Africa Blood Pressure Monitoring Devices Market Trends

The market of the Middle East and Africa blood pressure monitoring devices is anticipated to witness steady growth over the forecast period. The fundamental driving forces include supportive government initiatives, increasing healthcare expenditure, and growing awareness. Moreover, according to the World Health Observatory report by the WHO, nine Middle Eastern countries have the highest obesity statistics ranking among adults aged 18 and above. Obesity is one of the risk factors for developing hypertension, and the high prevalence of obesity is, thus, anticipated to fuel market growth.

Key Blood Pressure Monitoring Devices Company Insights

The global market for blood pressure monitoring devices is witnessing intense competition as it is price-sensitive. The companies are adopting competitive strategies such as mergers & acquisitions, strategic alliances, collaborative agreements, and partnerships to sustain the competition. The industry growth is directly associated with the rising investments by manufacturers to develop cost-effective, innovative, and easy-to-use products.

Key Blood Pressure Monitoring Devices Companies:

The following are the leading companies in the blood pressure monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Omron Healthcare

- Welch Allyn, Inc.

- A&D Medical Inc.

- SunTech Medical, Inc.

- American Diagnostics Corporation

- Withings

- Briggs Healthcare

- GE Healthcare

- Kaz Inc.

- Microlife AG

- Rossmax International Ltd.

- GF Health Products Inc.

- Spacelabs Healthcare Inc.

- Philips Healthcare.

- B. Braun SE

View a comprehensive list of companies in the Blood Pressure Monitoring Devices Market

Recent Developments

-

In September 2024, Nihon Kohden’s Board of Directors approved the purchase of a 71.4% stake in NeuroAdvanced Corp. (“NAC”), the parent company of Ad-Tech Medical Instrument Corporation (“Ad-Tech”) in the U.S. Following the acquisition, NAC and Ad-Tech were consolidated and designated as principal subsidiaries of Nihon Kohden, as their total capital represented 10% or more of Nihon Kohden’s overall capital.

-

In May 2024, OMRON Healthcare India partnered with AliveCor to introduce portable ECG monitoring devices in India. This collaboration aims to offer advanced, easy-to-use solutions for heart health monitoring, enabling users to track their ECG readings conveniently.

Blood Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.5 billion

Revenue Forecast in 2030

USD 8.6 billion

Growth rate

CAGR of 9.6% from 2025 to 2030

The base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2025 to 2030

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product, end use, region

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Omron Healthcare Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corporation; Withings; Briggs Healthcare; GE Healthcare; Kaz Inc.; Microlife AG; Rossmax International Ltd.; GF Health Products Inc.; Spacelabs Healthcare Inc.; Philips Healthcare; B. Braun

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Customized purchase options are available to meet your exact research needs. Explore purchase options

Global Blood Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global blood pressure monitoring devices market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sphygmomanometer/Aneroid BP Monitor

-

Automated/Digital Blood Pressure Monitor

-

Arm

-

Wrist

-

Finger

-

-

Ambulatory Blood Pressure Monitor

-

Transducers

-

Disposable

-

Reusable

-

-

Instruments and Accessories

-

Blood pressure cuffs

-

Disposable

-

Reusable

-

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers & Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

The Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood pressure monitoring devices market size was estimated at USD 5.0 billion in 2024 and is expected to reach USD 5.5 billion in 2025.

b. The global blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 8.6 billion by 2030.

b. North America dominated the blood pressure monitoring devices market with a share of over 36.0% in 2024. This is attributable to a highly regulated & developed healthcare infrastructure, increasing investments for the development of accurate, effective BP monitors, and increasing new product launches along with technological advancements.

b. Some key players operating in the blood pressure monitoring devices market include Omron Healthcare Welch Allyn, Inc., A&D Medical Inc., SunTech Medical, Inc., American Diagnostics Corporation, Withings, Briggs Healthcare, GE Healthcare, Kaz Inc., Microlife AG, Rossmax International Ltd., GF Health Products Inc., Spacelabs Healthcare Inc., and Philips Healthcare.

b. Key factors that are driving the blood pressure monitoring devices market growth include increasing incidences of hypertension due to changing lifestyles, growing geriatric population base, increasing the risk of lifestyle associated disorders, rising incidences of obesity & sedentary lifestyle, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."