- Home

- »

- Clinical Diagnostics

- »

-

Blood Cancer Diagnostics Market Size & Share Report, 2030GVR Report cover

![Blood Cancer Diagnostics Market Size, Share & Trends Report]()

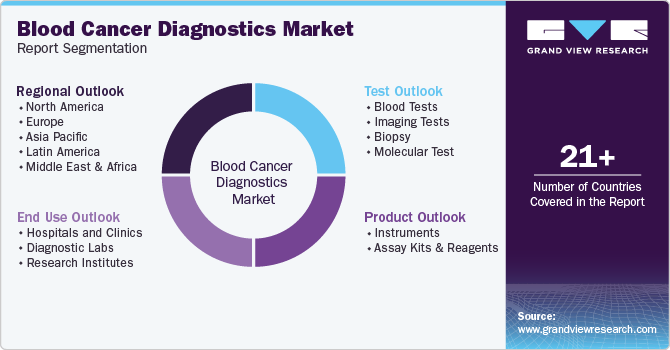

Blood Cancer Diagnostics Market Size, Share & Trends Analysis Report By Product (Instruments, Assay Kits And Reagents), By Test (Blood Test, Imaging Test), By End Use (Hospitals & Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-330-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Blood Cancer Diagnostics Market Trends

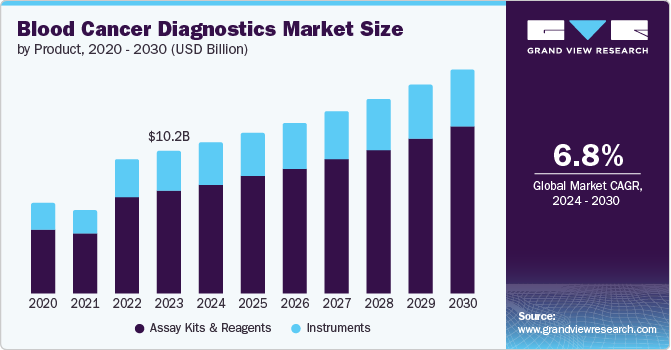

The global blood cancer diagnostics market size was estimated at USD 10.21 billion in 2023 and is expected to expand at a CAGR of 6.8% from 2024 to 2030. This growth is attributed to the increasing incidence of blood malignancies, such as leukemia, lymphoma, and myeloma. The market is expected to grow significantly due to the increasing elderly population, which is more susceptible to chronic diseases, including blood cancer. The consistent increase in risk factors for blood cancers, such as tobacco use and environmental factors, further contributes to market growth. Technological advancements, including NGS and other molecular diagnostic techniques, are improving the accuracy & efficiency of blood cancer diagnosis, which is likely to drive the market over the forecast period.

The increasing demand for blood cancer diagnostic tests and technologies is driven by rising incidence of leukemia and other blood cancers worldwide. Leukemia is one of the most prevalent cancer types globally. In the U.S., leukemia, lymphoma, or myeloma are diagnosed once every 3 minutes. As per Leukemia and Lymphoma Society statistics, approximately 59,610 individuals were expected to be diagnosed with leukemia in the US in 2023; an estimated 437,337 people are living with or in remission from leukemia.

Clinical trials for blood cancers are carefully controlled research studies that aim to improve the care and treatment of cancer patients. These trials involve testing new cancer drugs and treatments to improve patient outcomes. Universities, medical institutions, pharmaceutical companies, and diagnostic developers across the globe are collaborating and investing heavily in R&D programs dedicated to blood cancer detection and monitoring. These initiatives aim to develop more sensitive, specific, and minimally invasive diagnostic tools that can improve early detection rates & enable personalized treatment selection.

In January 2024, Merck initiated Phase 3 trials for four investigational candidates from its pipeline in hematologic malignancies and solid tumors. Of the four trials, the BELLWAVE-011 clinical trial (NCT06136559) evaluates nemtabrutinib, a Bruton’s Tyrosine Kinase (BTK) inhibitor for treating CLL and SLL. These trials aim to improve treatment options for patients with various blood cancers. The trials are designed to evaluate the efficacy and safety of investigational candidates in different patient populations & settings.

The advancements in diagnostics technology have enabled and enhanced diagnostic accuracy, streamlined workflows, and improved patient experiences. Next-Generation Sequencing (NGS) can help diagnose blood cancers, monitor treatment response, and identify potential therapeutic targets. In blood cancer diagnosis, NGS has been shown to improve the accuracy and speed of diagnosis, enabling the identification of genetic mutations that may not be detectable using traditional diagnostic methods. Recent advancements include the identification of hundreds of genes in less time.

In November 2023, Roswell Park Comprehensive Cancer Center announced the launch of PanHeme. This NGS technology can identify mutations in hundreds of genes in under 72 hours, reducing the wait time for results from 3 to 4 weeks to under 72 hours. The PanHeme panel covers every hematological malignancy and every mutation required to diagnose, treat, and prognose these patients.

Several initiatives are developing personalized treatments for patients with blood cancers. For instance, the Precision Medicine Initiative (PMI) is a government-led initiative to develop personalized treatments for patients with blood cancers. The initiative helps identify genetic mutations and develop targeted therapies to improve patient outcomes. The NCI provides funding for research projects focused on blood cancer diagnostics, including NGS technologies and molecular diagnostics. Moreover, many countries are expanding reimbursement coverage and updating clinical practice guidelines to include advanced cancer diagnostic tests, such as liquid biopsies and molecular profiling assays. These policy-level changes can create a supportive commercial landscape promoting the adoption of innovative diagnostics.

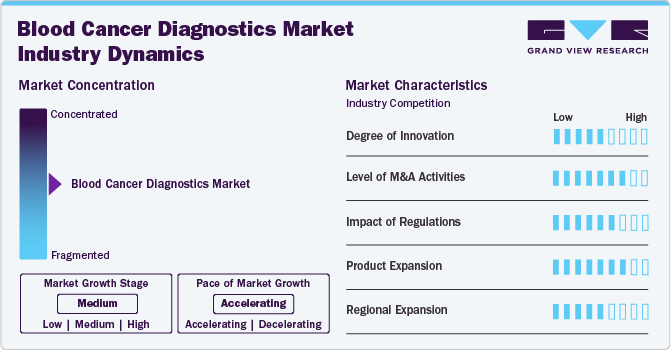

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by advancements in diagnostic technologies such as blood tests and imaging tests. Manufacturers are introducing platforms based on next-generation DNA sequencing technology, which are easy to use and can be integrated into clinical microbiology lab workflows. For instance, in April 2023, Alercell, Inc. launched the LENA Molecular Dx Leukemia Platform, a comprehensive suite of 12 molecular diagnostic tests designed for early detection of leukemia, treatment guidance, and minimal residual disease monitoring. The platform is based on next-generation DNA sequencing technology.

The market is characterized by the leading players with moderate levels of technology launches and merger and acquisition (M&A) activity. Market players like Quest and others are involved in new product launches and merger and acquisition activities. For instance, in February 2022, BD acquired Cytognos, a private company that specializes in flow cytometry solutions for diagnosing blood cancers, detecting minimal residual disease, and conducting immune monitoring research. This acquisition enhances BD’s portfolio of blood cancer.

Regulations have a significant impact on the blood cancer market. The increasing number of regulatory criteria and approval changes for blood cancer diagnostics products underscores the need for reliable tests and contributes to market growth. In January 2024, the UK government implemented new regulations for IVDs and medical devices. Under these regulations, IVDs compliant with the new IVDR, currently being implemented in the EU, can be marketed and sold in the UK until the expiration of their CE certificate or June 30, 2030, whichever comes first.

There is no direct substitute to existing blood cancer diagnostic products and treatments, as the introduction of various non-invasive blood tests that detect circulating tumor cells or cell-free DNA, along with AI-powered diagnostic tools with machine learning algorithms analyzing complex data for faster, more precise diagnoses, might carry a little threat to substitute. However, product substitute threat remains low due to the unavailability of more affordable and accessible genomic profiling for personalized diagnostics.

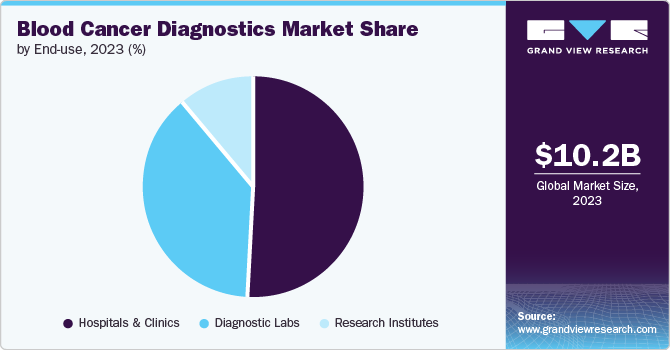

The market mostly comprises end users such as hospital and clinicians allowing them to purchase the necessary equipment and drugs needed to treat patients with leukemia, myeloma or other blood cancer. This concentration of end users in institutional settings drives the demand for reliable and accurate diagnostic tests, which in turn fuels the growth of the market.

Product Insights

Assay kits and reagents accounted for the largest revenue share of 72.12% in 2023. This high share is attributable to assay kits & reagents being designed to detect specific biomarkers, genetic mutations, and other indicators, enabling healthcare professionals to diagnose & treat the disease more effectively. The increasing demand for accurate and rapid diagnostic tests is expected to drive the adoption of assay kits and reagents. In addition, advancements in molecular diagnostics and the development of new technologies, such as Next-Generation Sequencing (NGS), are expected to contribute to market growth.

The segment is also anticipated to grow at the fastest rate of 7.3% CAGR over the forecast period. As manufacturers are undertaking strategic initiatives, such as product approvals, expansion, and collaboration, to develop these kits & reagents, offering a range of products that cater to diverse diagnostic needs. For instance, in December 2023, Sys mex expanded its sales in Europe, announcing the availability of its blood testing reagents-the HISCL β-Amyloid 1-42 and 1-40 assay kits-to identify the accumulation of Amyloid Beta in the brain.

Test Insights

Blood tests dominated the market and accounted for the largest share of 36.70% in 2023. The increasing prevalence of blood cancers and the need for early and accurate diagnosis are expected to drive the demand for blood tests. CBC tests are often the first line of diagnostic tools used to detect abnormalities in blood cell counts, which can indicate the presence of blood cancer. In addition, the development of specialized blood tests, such as multicancer detection, has revolutionized the diagnosis and monitoring of blood cancers. For instance, in June 2023, an NHS study highlighted that the Galleri test, a multicancer blood test by GRAIL, can detect over 50 types of cancer through a single blood draw. It was launched in 2021 and has shown 51.5% sensitivity and 99.5% specificity in clinical trials.

The molecular tests segment is anticipated to grow at the fastest rate of 8.4% CAGR over the forecast period. Molecular tests have revolutionized the diagnosis and management of blood cancers by enabling the detection of genetic abnormalities and molecular markers associated with specific cancer types. Techniques such as PCR, Fluorescence in Situ Hybridization (FISH), and NGS are widely used to identify gene mutations, chromosomal translocations, & gene rearrangements characteristic of certain blood cancers. In April 2024, OGT, a renowned global provider of genomic research and diagnostic solutions, announced the SureSeq Myeloid Fusion Panel, a cutting-edge RNA-based NGS technology designed to detect key fusion genes associated with AML. This innovative tool empowers researchers and clinicians to quickly and accurately identify the genetic drivers of AML, enabling more effective diagnosis, treatment, & patient care.

End Use Insights

Hospitals and clinics dominated the market with the largest share of 50.75% in 2023. Hospitals and Clinics are preferred for care due to the availability of various services under one roof. According to the National Cancer Institute, approximately 3,000 new ALL cases are diagnosed annually in the U.S. The rate of hospital admissions for ALL is higher in children and young adults. The greatest benefit of hospitals performing cancer diagnosis is that they can offer tests and results even in emergencies. The increasing acceptance and value of advanced cancer diagnostics in hospitals is further propelling their adoption. Developments in hospital laboratories are crucial to address the evolving needs of patients, and more hospitals aim to provide a wide range of services in their settings.

The segment is also anticipated to grow at a fast pace over the forecast period. The demand for accurate and timely diagnosis within these healthcare settings is expected to drive the adoption of advanced diagnostic tools & technologies. The availability of on-site diagnostic laboratories and the integration of comprehensive diagnostic services, including blood tests, imaging, biopsy, and molecular testing, are essential for streamlining the diagnostic process & ensuring prompt treatment initiation.

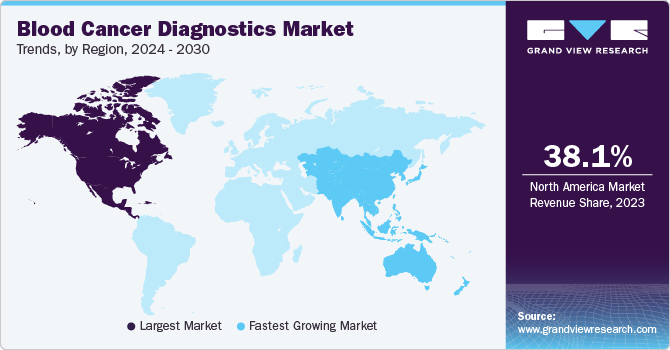

Regional Insights

North America blood cancer diagnostics market dominated the global industry and accounted for a 38.13% share in 2023. This high share is attributable to local presence of key global market players, such as Illumina, InVivoScribe, Danaher Corporation, Abbott and other key players. Moreover, increasing prevalence, increasing R&D studies and trials, and technological advancements in diagnostic methods are driving market growth. Various diagnostic tools & techniques are available in the market, including liquid biopsy, Positron Emission Tomography (PET), Next-Generation Sequencing (NGS) testing solutions, and molecular testing. For instance, Agilent Technologies licensed the blood cancer assay, PanHeme, developed by Roswell Park Cancer Center in North America. The market is further driven by ongoing government and institutional programs & initiatives in the region.

U.S. Blood Cancer Diagnostics Market Trends

The blood cancer diagnostics market in the U.S. is expected to grow substantially over the forecast period. Owing to the high prevalence of the disease in the U.S. can be attributed to several factors, including an aging population, environmental exposures, and genetic predispositions. In addition, advancements in diagnostic techniques have led to early detection and improved reporting of these cancers. Regardless of the underlying causes, the pervasiveness of blood cancer presents a formidable challenge for healthcare providers, researchers, and policymakers, necessitating a concerted effort to develop innovative strategies for prevention, early detection, & personalized treatment approaches.

Europe Blood Cancer Diagnostics Market Trends

The blood cancer diagnostics market in Europe was identified as a lucrative region in this industry. Increasing awareness about blood cancer diagnostics among healthcare professionals and patients are driving the growth of the market. According to the European Cancer Information System (ECIS), there were an estimated 467,733 new cases of blood cancers in Europe in the last few years, accounting for approximately 8.5% of all new cancer cases.

UK blood cancer diagnostics market is expected to grow over the forecast period due to the rising prevalence of cancer, including blood cancers, and supportive government initiatives for early cancer diagnosis and growing number of strategic initiatives from key players. For instance, in January 2023, Thermo Fisher Scientific, a leading life sciences company, completed its acquisition of The Binding Site Group, a UK-based company that develops & commercializes immunodiagnostic reagents & kits for the detection of blood cancers and monitoring of multiple myeloma.

The blood cancer diagnostics market in Germany is expected to grow over the forecast period. Germany's comprehensive healthcare system is renowned for its ability to detect blood cancers at an early stage, enabling prompt treatment initiation and, subsequently, better outcomes. The country's extensive range of treatment options allows healthcare professionals to develop personalized treatment plans that cater to each patient's unique needs.

Asia Pacific Blood Cancer Diagnostics Market Trends

The blood cancer diagnostics market in Asia Pacific is anticipated to witness the fastest growth over the forecast period. This is due to rising public awareness and increased research efforts to create new medications to treat blood cancer. Many countries in the Asia-Pacific region, including China, Japan, and India, are experiencing a rapid demographic shift towards an aging population. Key market players are actively involved in R&D, resulting in a robust pipeline of potential treatments. For instance, Kura Oncology's ongoing clinical trial for tipifarnib, a pipeline candidate being investigated for treating peripheral T-cell lymphoma, demonstrates the company's commitment to advancing innovative therapies for patients.

China blood cancer diagnostics market is expected to grow over the forecast period China's booming medical tourism industry is driving demand for oncological screening, including blood cancer diagnostics. This influx of international patients allows local healthcare providers and diagnostic companies to expand their services & offerings.

The blood cancer diagnostics market in Japan is expected to grow over the forecast period. Distinguishing itself from neighboring countries, Japan has implemented nationwide cancer screening initiatives, a proactive measure to address its rising cancer prevalence. For instance, in January 2021, Illumina partnered with Otsuka Pharmaceuticals to develop and commercialize an IVD genomic profiling testing kit for patients in Japan with blood cancers. Such partnerships are anticipated to drive market growth in the region.

Latin America Blood Cancer Diagnostics Market Trends

The blood cancer diagnostics market in Latin America is anticipated to grow at a substantial growth rate over the forecast period. The expansion of healthcare infrastructure and increased investment in the healthcare sector are propelling the growth of the blood cancer diagnostics market in Latin America. Many countries in the region are witnessing improvements in their healthcare systems, including the establishment of specialized cancer treatment centers and the modernization of diagnostic laboratories.

Brazil blood cancer diagnostics market is expected to grow over the forecast period. The Brazilian government has implemented various initiatives to improve cancer care, including national cancer control programs and funding for cancer research & diagnostics. Policies subsidizing diagnostic tests & treatments make these services more affordable and accessible to the general population. Furthermore, government support for research and innovation in medical diagnostics fosters the development of new & improved diagnostic technologies.

MEA Blood Cancer Diagnostics Market Trends

The blood cancer diagnostics market in the Middle East & Africa is estimated to grow over the forecast period as countries are increasingly adopting molecular and genetic testing into their diagnostic protocols. Moreover, the increasing number of clinical trials and research initiatives is driving innovation in diagnostics within the MEA region. Academic institutions, research centers, and pharmaceutical companies are conducting clinical trials to evaluate novel diagnostic technologies, biomarkers, and therapeutic interventions for hematologic malignancies.

Saudi Arabia blood cancer diagnostics market is expected to grow over the forecast period. The Saudi government has prioritized healthcare as a key sector for development, leading to the establishment of specialized oncology centers equipped with state-of-the-art diagnostic technologies. These centers, particularly in major cities like Riyadh, Jeddah, and Dammam, are equipped with advanced imaging modalities, molecular diagnostic tools, and pathology laboratories capable of conducting comprehensive diagnostic workups for hematologic malignancies.

Key Blood Cancer Diagnostics Company Insights

Some of the key players operating in the market include Danaher Corporation, Abbott, Sequenta (Adaptive biotechnologies), SkylineDx, Bio-Rad Laboratories and others. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Blood Cancer Diagnostics Companies:

The following are the leading companies in the blood cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics

- Illumina

- InVivoScribe

- Ipsogen (Qiagen)

- Asuragen(Bio-Techne)

- Danaher Corporation

- Abbott

- Sequenta (Adaptive biotechnologies)

- SkylineDx

- Bio-Rad Laboratories

- Alercell

- Sophia Genetics

Recent Developments

-

In March 2024, Asuragen received the Class C Certification under the new EU In Vitro Diagnostic Regulation (IVDR) for its QuantideX qPCR BCR-ABL IS Kit. This kit is designed to monitor CML patients by quantifying BCR-ABL1 and ABL1 transcripts in blood samples to determine their response to TKI therapy.

-

In December 2023, Adaptive Biotechnologies launched new datasets highlighting the clinical relevance of MRD testing, with the clonoSEQ assay in patients with blood cancers at the 65th ASH Annual Meeting. The data demonstrate the expanding use of clonoSEQ in assessing MRD in blood cancer patient care and clinical trials.

-

In October 2023, Abott received FDA approval for RealTime IDH1 Assay as a companion diagnostic with Tibsovo (ivosidenib) from Servier Pharmaceuticals in patients with relapsed or refractory MDS.

-

In May 2023, Cepheid (Danaher Corporation) received CE mark approval for its Xpert NPM1 Mutation test, a molecular diagnostic test for the detection of mutant NPM1 gene mutations in patients with AML. The test uses automated real-time RT-PCR technology to quantify the percentage of mutant NPM1 mRNA transcripts in peripheral blood samples, providing a reliable and accurate way to diagnose & monitor AML.

-

In March 2023, QIAGEN and Servier partnered to develop a companion diagnostic test for TIBSOVO, an Isocitrate Dehydrogenase-1 (IDH1) inhibitor used to treat AML. The test was likely to detect IDH1 gene mutations in AML patients using real-time PCR on the QIAGEN Rotor-Gene Q MDx device.

Blood Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.83 billion

Revenue forecast in 2030

USD 16.04 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Illumina; InVivoScribe; Ipsogen (Qiagen); Asuragen(Bio-Techne); Danaher Corporation; Abbott; Sequenta (Adaptive biotechnologies); SkylineDx; Bio-Rad Laboratories; Alercell; Sophia Genetics.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood cancer diagnostics market report based on product, test, end-use, region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Assay Kits and Reagents

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Tests

-

Imaging Tests

-

Biopsy

-

Molecular Test

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Diagnostic Labs

-

Research Institutes

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood cancer diagnostics market size was estimated at USD 10.21 billion in 2023 and is expected to reach USD 10.83 billion in 2024.

b. The global blood cancer diagnostics market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 16.04 billion by 2030.

b. North America dominated the blood cancer diagnostics market with a share of 38.13% in 2023. This is attributable to the increasing prevalence of blood cancer in the region

b. Some key players operating in the blood cancer diagnostics market include Illumina, InVivoScribe, Ipsogen (Qiagen), Asuragen(Bio-Techne), Danaher Corporation, Abbott, and Sequenta (Adaptive biotechnologies)

b. Key factors that are driving the market growth are increasing incidence of blood malignancies, such as leukemia, lymphoma, and myeloma. The market is expected to grow significantly due to the increasing elderly population, which is more susceptible to chronic diseases, including blood cancer. The consistent increase in risk factors for blood cancers, such as tobacco use and environmental factors, further contributes to market growth. Technological advancements, including NGS and other molecular diagnostic techniques, are improving the accuracy & efficiency of blood cancer diagnosis, which is likely to drive the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."