- Home

- »

- Clinical Diagnostics

- »

-

Blood-based Biomarker For Sports Medicine Market Report 2030GVR Report cover

![Blood-based Biomarker For Sports Medicine Market Size, Share & Trends Report]()

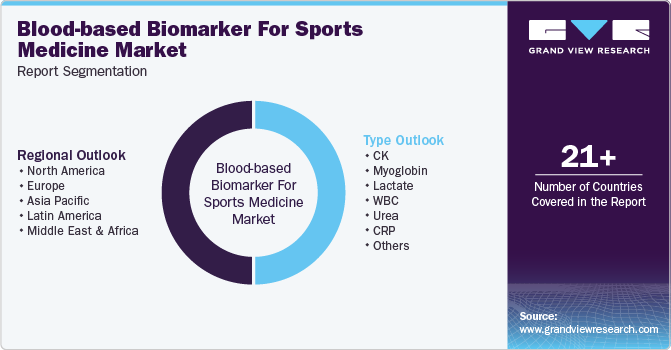

Blood-based Biomarker For Sports Medicine Market Size, Share & Trends Analysis Report By Type (CK, Myoglobin, Lactate, WBC, Urea, CRP), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-436-1

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

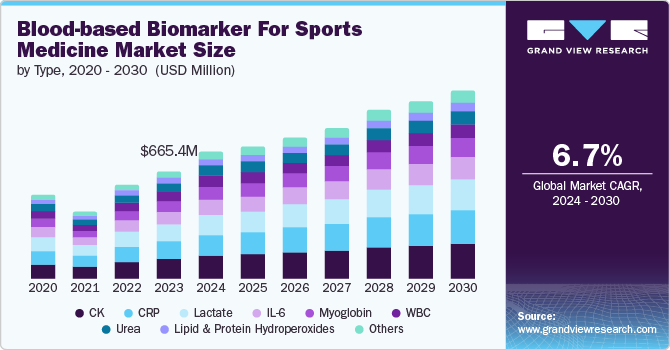

The global blood-based biomarker for sports medicine market was estimated at USD 665.4 million in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. The market is driven by increased focus on personalized health, advancements in biomarker technology, and growing demand for accurate performance & recovery assessments for athletes. Moreover, rising awareness of sports-related injuries and the need for precise diagnostics also contribute to market growth & innovation.

The increasing demand for personalized medicine is a primary driver of the blood-based biomarker market in sports medicine. Personalized medicine, which helps customize healthcare interventions to individual characteristics, transforms how athletes approach training, performance, and recovery. Blood-based biomarkers play a critical role in this transformation by providing detailed insights into an athlete’s unique physiological and metabolic profile. These biomarkers indicate muscle damage, inflammation, and overall health, allowing for highly customized training regimens and recovery plans. This approach helps athletes enhance their performance while minimizing the risk of injuries and overtraining, boosting the demand for personalized biomarker tests.

Moreover, the combined incorporation of genomics and big data with blood-based biomarkers is enhancing the capabilities of personalized medicine in sports medicine. By combining genetic information with biomarker data, sports professionals can develop highly detailed and predictive athlete profiles. These profiles enable more precise predictions of performance outcomes, injury risks, and recovery needs. The ability to analyze and interpret complex datasets in real time supports the development of personalized training and rehabilitation programs, which athletes and sports organizations increasingly adopt. This trend is expected further to enhance the market's innovation and investment scenario.

The increasing focus on injury prevention and recovery significantly propels the blood-based biomarker market in sports medicine. Athlete injuries are a significant concern in sports. According to the American Orthopaedic Society for Sports Medicine (AOSSM), approximately 3.5 million sports-related injuries occur annually among youth athletes in the U.S. Professional athletes are frequently affected, with soccer players experiencing around 14 injuries per 1,000 hours of play, and American football players encountering about 20 injuries per 1,000 hours, as reported in the British Journal of Sports Medicine. Muscle strains and ligament injuries are particularly common, accounting for roughly 30% of all sports injuries, with studies noting high incidences of hamstring and quadriceps strains in sports such as soccer & athletics.

Furthermore, the growing funding supports the commercialization of new biomarker tests and technologies. As sports organizations and athletic programs increasingly recognize the value of blood-based biomarkers for optimizing performance and managing injuries, there is a growing demand for innovative diagnostic solutions. This trend is prompting companies to accelerate the development and launch of new biomarker assays and related technologies. For instance, investments in biomarker-based monitoring systems and personalized health platforms are becoming more common, with companies leveraging R&D advancements to introduce advanced products. The commercialization of these products is expected to drive market growth further, as depicted by the increasing number of partnerships and collaborations between technology providers & sports organizations.

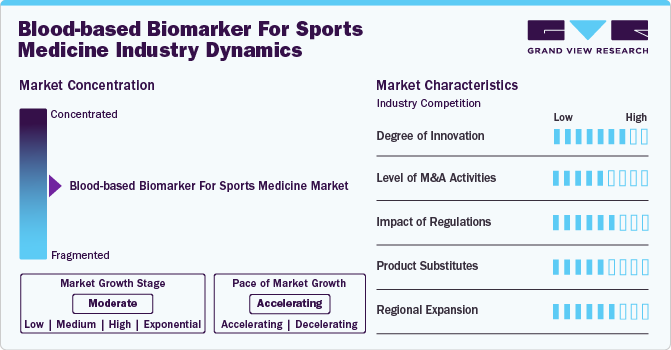

Market Characteristics & Concentration

The degree of innovation in the market is high. Innovations in biomarker detection technologies, such as high-throughput screening and mass spectrometry, make it easy to analyze a broad range of biomarkers with greater precision and efficiency. Integration of these technologies, aided by the incorporation of next-generation sequencing and advanced data analytics, has led to more accurate and specific levels of desired components for athletes. This has driven the development of more specialized and effective blood-based biomarker tests, focusing on meeting the diverse needs of sports medicine professionals. With the continued integration of technological advancements, the accuracy and reliability of these tests are expected to improve, further fueling the market.

The level of merger and acquisition activities within the market is considered medium. Strategic partnerships, collaborations, and acquisitions among critical players aim to enhance competitiveness, expand product portfolios, and strengthen market positions. For instance, in February 2024, Fujirebio and Abbott announced a collaboration to develop a research use assay for the Neurofilament-Light Chain (Nf-L) biomarker designed for Abbott’s Alinity platform. Research on the Nf-L biomarker is ongoing across various neurological conditions, including TBI and cognitive impairment

The impact of regulations on the blood-based biomarker for the sports medicine market is assessed as high, as regulatory bodies like the FDA impose stringent test approval and quality assurance requirements. The regulatory landscape for blood-based biomarkers in sports medicine involves several key components. The Clinical Laboratory Improvement Amendments (CLIA) govern clinical laboratories conducting tests on patient specimens, including blood-based biomarkers, establishing quality standards for accurate results. In addition, nonclinical laboratory studies must adhere to Good Laboratory Practice (GLP) regulations, ensuring that data submitted for market approval is reliable and valid. For instance, biomarkers that detect performance-enhancing substances are subject to the World Anti-Doping Agency (WADA) guidelines, which may impose additional regulatory requirements. Moreover, handling athlete data, particularly genetic information, must comply with privacy laws, such as the Health Insurance Portability and Accountability Act (HIPAA), ensuring the confidentiality and protection of sensitive information.

The market saw moderate product expansion, with innovative diagnostic technologies and the launch of new products. Companies such as bioMérieux are at the forefront of this development, contributing to market expansion through cutting-edge diagnostic solutions. For instance, bioMérieux’s work on blood-based tests, such as the VIDAS TBI (GFAP, UCH-L1) test for traumatic brain injury, exemplifies the innovation propelling the field forward.

The market is experiencing moderate regional expansion due to the growing funding initiatives in the various regions. For instance, funding for the expansion of sports companies in Latin America is rising as the popularity of sports continues to grow. In October 2023, Fz Sports expanded its Latin American rights business following a USD 74 million investment. The parent company of 1190 Sports secured funding from prominent investors, such as 777 Partners and MEP Capital.

Type Insights

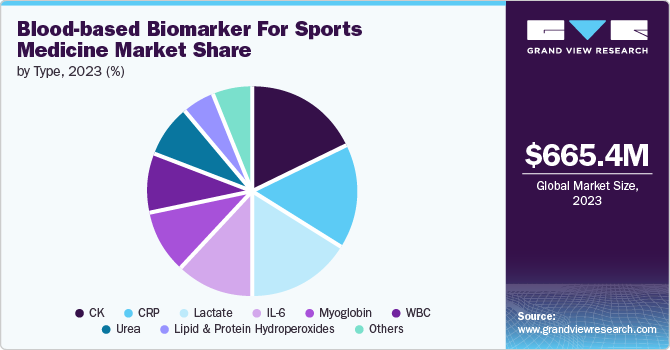

The creatine kinase (CK) segment dominated the overall market at 18.0% in 2023. The demand for CK testing is driven by the increasing focus on injury prevention and management and increasing awareness among athletes & sports teams about the importance of preventing overtraining and optimizing recovery. The adoption rate of CK testing is high among professional sports teams, physical therapists, & sports physicians, who use CK data to tailor recovery protocols and avoid long-term muscle damage.

The C-reactive protein (CRP) testing technology segment in the blood-based biomarker for sports medicine market is experiencing substantial growth due to several factors. The primary drivers for elevated CRP levels include acute and chronic inflammatory conditions, infections, and autoimmune disorders. The immune system activates and triggers an inflammatory response when the body encounters pathogens such as bacteria or viruses or experiences tissue injury. This response involves releasing inflammatory cells and cytokines that signal the liver to produce more CRP. Conditions such as bacterial infections, inflammatory bowel disease, rheumatoid arthritis, lupus, and other autoimmune diseases can significantly increase CRP levels.

Regional Insights

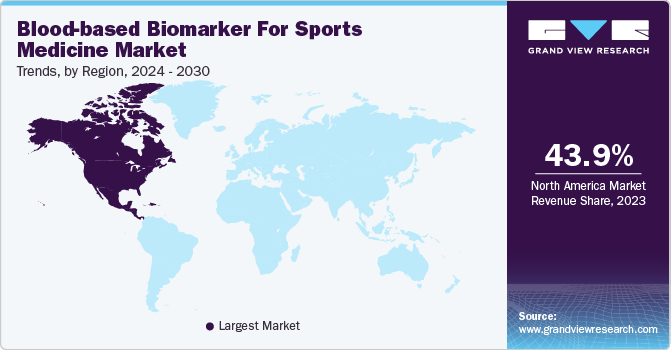

The North American blood-based biomarker for sports medicine market dominated the with a revenue share of 43.95% in 2023 and is anticipated to grow steadily during the forecast period, driven by increasing focus on diagnosing and managing sports injuries. Collaborative efforts between research institutions and key players are accelerating the development & commercialization of advanced biomarker technologies. For instance, in May 2024, Danaher collaborated with Johns Hopkins University to enhance neurological diagnosis. Scientists will assess novel blood-based biomarkers using advanced, highly sensitive technology from Beckman Coulter Diagnostics. This initiative aligns with the broader application of blood biomarkers in sports, where similar technologies are increasingly used to improve injury diagnosis, monitor recovery, and optimize athlete health.

U.S. Blood-based Biomarker For Sports Medicine Market Trends

The blood-based biomarker for sports medicine market in the U.S. is expected to have significant growth in the North American market. Sports participation in the U.S. is on the rise, leading to an increase in sports-related injuries. This trend is expected to facilitate significant growth in the U.S. market. These biomarkers offer a noninvasive, precise method for diagnosing & managing injuries, allowing for more effective treatment and faster recovery times. As athletes and healthcare providers increasingly prioritize injury prevention & recovery, the demand for advanced biomarker technologies is anticipated to grow. A study by Johns Hopkins Medicine reports that in the U.S., around 30 million children and teens engage in organized sports, with over 3.5 million sustaining injuries annually. In addition, around 8.6 million people aged 5 and older injure themselves annually while participating in sports. Ongoing R&D & collaborations between medical institutions and industry leaders support this growth.

Europe Blood-based Biomarker For Sports Medicine Market Trends

The blood-based biomarker for sports medicine market in Europe is witnessing significant growth, driven by technological advancements and increased research facilities. For instance, in October 2023, bioMérieux, announced the CE-marking of VIDAS TBI (GFAP, UCH-L1). This blood test aids in the assessment of patients with mild traumatic brain injury through the unique combination of two brain biomarkers. Cutting-edge technologies have enhanced the sensitivity and accuracy of biomarkers, making them crucial tools for diagnosing and managing sports-related injuries. Ongoing research is uncovering new biomarkers and refining existing ones, which is expected to expand their applications in injury prevention and recovery monitoring.

The UK blood-based biomarker for sports medicine market is witnessing significant growth during the forecast period. In the UK, this rising incidence of sports-related injuries is expected to drive significant market growth. A 2023 study conducted in England and Wales reported an overall annual sports injury incidence rate of 5.40 injuries per 100,000 participants. The data highlights that men experienced a higher incidence rate at 6.44 per 100,000 compared to women at 3.34 per 100,000. Among different activities, sports had the highest incidence rate at 9.88 per 100,000, significantly surpassing cycling (2.81 per 100,000), fitness (0.21 per 100,000), or walking (0.03 per 100,000). Specific activities showed even higher rates, with motorsports at 532.31 per 100,000, equestrian sports at 235.28 per 100,000, and gliding at 190.81 per 100,000. As the demand for more precise and efficient injury management solutions grows, the UK market is expected to grow rapidly, reflecting broader trends in athlete care and injury prevention.

The blood-based biomarker for sports medicine market in France is expected to grow, driven by the advancements in clinical research and innovation from key industry players. Companies like bioMérieux are at the forefront of this development, contributing to market expansion through cutting-edge diagnostic solutions. For instance, bioMérieux’s work on blood-based tests, such as the VIDAS TBI (GFAP, UCH-L1) test for traumatic brain injury, exemplifies the innovation propelling the field forward.

Asia Pacific Blood-based Biomarker For Sports Medicine Market Trends

The blood-based biomarker for sports medicine market in Asia Pacific is evolving due to the increasing investment in R&D. This surge is fueled by the rising awareness of the importance of personalized athlete health management and the need for advanced injury prevention & performance optimization. Partnerships and collaborations among these companies, research institutions, and sports organizations are enhancing the development & adoption of cutting-edge biomarker solutions. For instance, in October 2023, Fujirebio Holdings, Inc. and Sysmex Corporation announced a Basic Agreement on Business Collaboration. This agreement aims to enhance their multifaceted partnership, focusing on R&D, production, clinical development, and sales & marketing. These strategic alliances facilitate the sharing of expertise and resources, accelerating advancements in sports medicine and improving athlete health management across Asia Pacific.

Japan blood-based biomarker for sports medicine market is witnessing a significant rise in sports participation, contributing to increased sports-related injuries. As more individuals engage in various athletic activities, the need for effective injury management and prevention has become more pressing. According to a January 2024 report by the NIH, the 1-year prevalence of sports injuries among Japanese collegiate athletes was 50.01%, with 5,500 injuries reported out of 10,998 athletes. The prevalence of injuries was notably higher in males at 52.02% compared to females at 46.65%. This growing demand drives the growth of blood-based biomarkers in the sports medicine market.

The blood-based biomarker for sports medicine market in India is on the brink of significant growth due to the increasing rate of sports injuries, particularly among young athletes, which has sharply risen over the past 10 to 15 years. Football and cricket players are experiencing a 500% increase in knee & ankle injuries, while Anterior Cruciate Ligament (ACL) injuries have surged by 400%. This alarming trend highlights the need for advanced injury prevention and management strategies. In addition, according to a September 2020 report in the Journal of Clinical and Diagnostic Research, 42.5% of the 80 players studied were injured, and 62.5% had sustained injuries in the past 2 years.

Latin America Blood-based Biomarker For Sports Medicine Market Trends

The blood-based biomarker for sports medicine market in Latin America is witnessing significant trends driven by increasing focus on sports participation. This is expected to drive the demand for advanced medical technologies, including blood-based biomarkers for sports medicine. In Latin America, community sports programs are expanding significantly, aiming to engage 50,000 young people across 15 countries by 2025. As the region invests in sports development and athlete health, the market is expected to grow, reflecting a commitment to integrating cutting-edge solutions into sports medicine and improving overall athlete care.

Brazil blood-based biomarker for sports medicine market faces constraints due to rising federal government funding for sports. According to a March 2023 report, the Brazilian federal government allocated USD 4.9 billion to sports initiatives, representing 0.06% of the total federal budget. This funding was distributed across various areas: USD 3.2 billion for infrastructure, USD 712 million for educational & participation sports, USD 575 million for elite sports, and USD 436 million for management. This investment is part of a broader strategy to promote physical activity and support athletic development across the country.

Middle East & Africa Blood-based Biomarker For Sports Medicine Market Trends

The blood-based biomarker for sports medicine market in the Middle East and Africa is expected to grow significantly due to a growing focus on sports health driven by increasing awareness of athletes' well-being and performance. As the region invests more in sports at the grassroots and elite levels, there is a rising demand for advanced healthcare solutions that can support and enhance athletic performance. Furthermore, significant investments in sports infrastructure are transforming the region's athletic landscape, with football leading the charge. Football, as the most popular sport, is seeing substantial funding aimed at enhancing both participation and performance. In June 2024, the UAE Football Association introduced the Sports Excellence Funding Programme to offer financial, administrative, and logistical support to First Division League clubs. Led by Sheikh Hamdan bin Mubharak Al Nahyan, the Football Association has committed AED 12.5 million annually to this initiative, beginning with the 2024-2025 sports season.

Saudi Arabia blood-based biomarker for sports medicine market is expected to grow significantly over the forecast period. The prevalence of sports injuries is becoming a notable concern as more individuals participate in various sports. The increasing engagement in physical activities and competitive sports has highlighted the need for advanced solutions to manage and prevent injuries. According to a report published in June 2021 by the Journal of Nature and Science of Medicine, football was identified as the most common cause of sports-related injuries, accounting for 43.6% of the injury rate. Blood-based biomarkers are emerging as crucial tools in this context, offering precise insights into injury severity and recovery processes.

Key Blood-based Biomarker For Sports Medicine Company Insights

The blood-based biomarker for sports medicine market is characterized by a competitive landscape with several key players holding significant market shares. Key players in this market include biotechnology firms, diagnostic companies, and research institutions focused on developing advanced biomarker technologies. Moreover, the rise of personalized medicine has spurred competition among these entities to develop specific biomarkers that can provide insights into an athlete’s physiological state. This includes markers related to muscle damage, inflammation, hydration status, and metabolic responses to training.

Key Blood-based Biomarker For Sports Medicine Companies:

The following are the leading companies in the blood-based biomarker for sports medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- BIOMÉRIEUX

- F. Hoffmann-La Roche Ltd.

- ARUP Laboratories

- Siemens Healthineers AG

- RayBiotech, Inc

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc

- Beckman Coulter, Inc.

- Randox Laboratories Ltd.

Recent Developments

-

In October 2023, BIOMÉRIEUX announced the CE-marking of VIDAS TBI, a blood test designed to assist in assessing patients with mild Traumatic Brain Injury (TBI). This test utilizes a distinctive set of brain biomarkers, including GFAP and UCH-L1, to provide its analysis.

-

In February 2023, Roche broadened its collaboration with Janssen to further advance personalized healthcare through companion diagnostics. The new agreement extended their efforts to encompass a wide range of companion diagnostics, including both tissue and blood-based biomarkers.

Blood-based Biomarker for Sports Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 785.2 million

Revenue forecast in 2030

USD 1.16 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; Sweden; Denmark; Norway; Japan; China; India; Australia; New Zealand; Taiwan; Hong Kong; Singapore; Thailand; Vietnam; Brazil; Argentina; Chile; South Africa; Saudi Arabia; UAE; Egypt; Qatar

Key companies profiled

Abbott; BIOMÉRIEUX; F. Hoffmann-La Roche Ltd.; ARUP Laboratories; Siemens Healthineers AG; RayBiotech, Inc.; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Beckman Coulter, Inc.; Randox Laboratories Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood-based Biomarker for Sports Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blood-based biomarker for sports medicine market report based on type and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

CK

-

Myoglobin

-

Lactate

-

WBC

-

Urea

-

CRP

-

Lipid And Protein Hydroperoxides

-

IL-6

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

New Zealand

-

Taiwan

-

Hong Kong

-

Singapore

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global blood-based biomaker for sports medicine market size was estimated at USD 665.43 million in 2023 and is expected to reach USD 785.21 million in 2024.

b. The global blood-based biomaker for sports medicine market is expected to grow at a compound annual growth rate of 6.69% from 2024 to 2030 to reach USD 1,158.18 million by 2030.

b. North America dominated the blood-based biomaker for sports medicine market with a share of 43.95% in 2023. High sports participation rates, advanced healthcare infrastructure, and significant investments in sports research drive the regional market

b. Some key players operating in the blood-based biomaker for sports medicine market include Abbott; BIOMÉRIEUX; F. Hoffmann-La Roche Ltd.; ARUP Laboratories; Siemens Healthineers AG; RayBiotech, Inc; and Thermo Fisher Scientific, Inc.

b. The market is driven by increased focus on personalized health, advancements in biomarker technology, and growing demand for accurate performance & recovery assessments. Moreover, rising awareness of sports-related injuries and the need for precise diagnostics also contribute to market growth & innovation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."