- Home

- »

- Healthcare IT

- »

-

Blockchain Technology In Healthcare Market Report, 2030GVR Report cover

![Blockchain Technology In Healthcare Market Size, Share & Trends Report]()

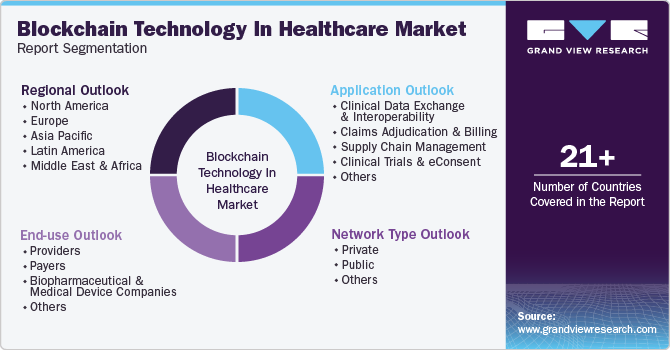

Blockchain Technology In Healthcare Market (2025 - 2030) Size, Share & Trends Analysis Report By Network Type (Private, Public), By End-use (Providers, Payers), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-889-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blockchain Technology In Healthcare Market Summary

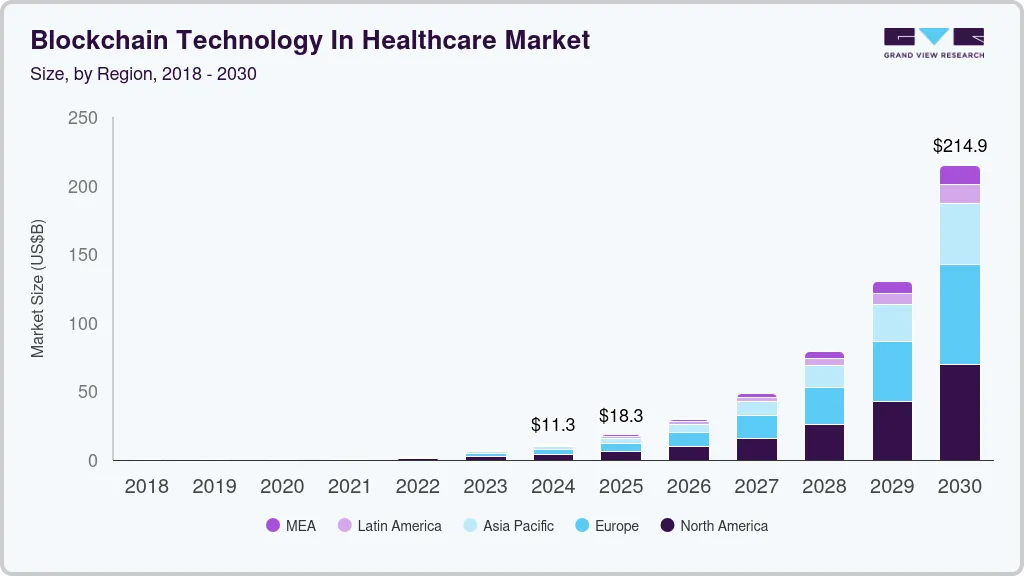

The global blockchain technology in healthcare market size was estimated at USD 11.32 billion in 2024 and is projected to reach USD 214.86 billion by 2030, growing at a CAGR of 63.6% from 2025 to 2030. The increasing need for secure and transparent data management systems has made blockchain attractive for healthcare organizations.

Key Market Trends & Insights

- Europe blockchain technology in healthcare market held the largest market share of 34.8% in the global market in 2023.

- The U.S. blockchain technology in healthcare market held the largest market share in 2023.

- Based on network type, the public segment dominated the market and held the largest market share of 43.17% in 2023.

- Based on application, the supply chain management segment accounted for the largest market share in 2023.

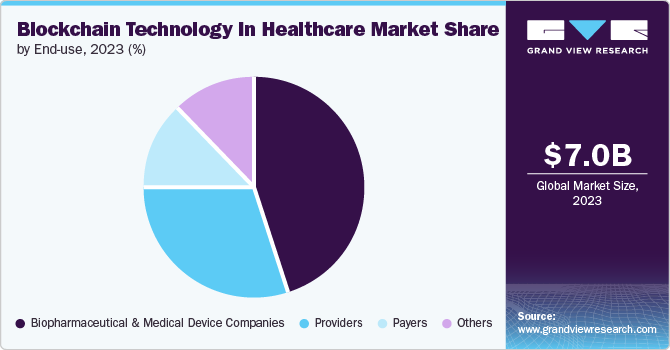

- Based on end use, biopharmaceutical & medical device companies segment held the largest share of 44.55% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 11.32 Billion

- 2030 Projected Market Size: USD 214.86 Billion

- CAGR (2025-2030): 63.6%

- Europe: Largest market in 2024

Blockchain's decentralized and immutable ledger ensures data integrity and reduces the risk of data breaches, which is crucial in handling sensitive patient information. In addition, the rising demand for efficient and streamlined processes in healthcare administration, such as billing, claims processing, and supply chain management, has led to the adoption of blockchain to enhance operational efficiency. Blockchain technology revolutionizes healthcare by providing an immutable patient data record, ensuring privacy and security. It is instrumental in managing Electronic Health Records (EHRs), providing a secure and decentralized system for sharing patient data across healthcare providers. Blockchain also enhances supply chain management for pharmaceuticals and medical devices, enhancing transparency and enabling new healthcare delivery and payment models. It employs strong cryptographic methods to encrypt each block in the chain, creating an unbreakable link resistant to tampering.

Blockchain provides transparency in tracking and auditing patient data movement, enhancing system security and mitigating fraud risks. According to an article published by PubMed in October 2021, the Center for Public Interest in the U.S. stated that global sales of counterfeit drugs exceeded USD 75 billion in 2021, reflecting a 90% increase in the previous five years. According to the WHO, 10% of the world's medicines are counterfeit, with developing nations accounting for 30%. These counterfeit drugs, with their substandard dose and purity, pose a significant risk to people's physical and mental health.

The increasing incidence of healthcare data breaches drives the growth of blockchain technology in the healthcare market. Traditional centralized systems are vulnerable to cyber-attacks, compromising the confidentiality and integrity of sensitive patient data. For instance, as per the data revealed by cybersecurity think tank CyberPeace Foundation and Autobot Infosec Private Ltd., the healthcare industry in India witnessed 1.9 million cyberattacks in 2022. The report highlights that attackers predominantly focused on exploiting vulnerable internet-facing systems, such as Remote Desktop Protocol (RDP), susceptible Server Message Blocks (SMB), database services, and outdated Windows server platform.

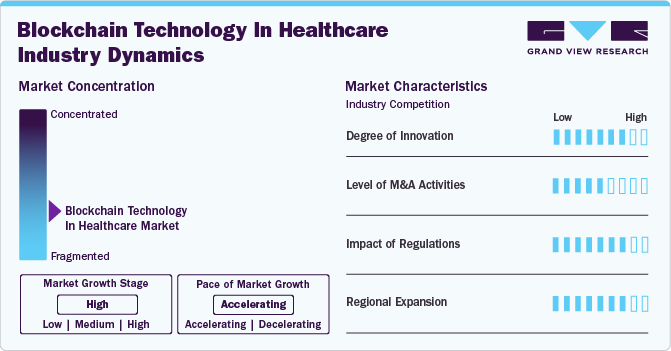

Market Concentration & Characteristics

Innovation in blockchain technology within the healthcare market is notably high. Blockchain is fundamentally transforming healthcare data storage, management, and sharing. Innovations like smart contracts, decentralized data storage, and enhanced security protocols address long-standing challenges such as data interoperability, patient privacy, and fraud prevention. For instance, in March 2023, Solve.Care launched Care.Chain, a healthcare Layer-2 decentralized blockchain infrastructure.Care. The chain provides a globally interconnected, open network architecture, enabling all participants in the healthcare ecosystem to interact on a peer-to-peer basis with transparency, trust, and security.

Mergers and acquisitions (M&A) in the blockchain technology healthcare market are rising. As the technology matures and its benefits become apparent, more extensive healthcare and tech companies are acquiring smaller, innovative blockchain startups to enhance their capabilities and competitive edge. For instance, in July 2023, Solve.Care partnered with Decentralized Healthcare Records Access (DeHRA) to create a groundbreaking decentralized network that simplifies the execution of clinical trials and enhances their accuracy and results.

Regulations significantly impact the adoption and implementation of blockchain technology in the healthcare market. Regulatory frameworks, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe, mandate stringent data privacy and security standards that blockchain technology must meet. While these regulations present challenges, they also offer opportunities for blockchain solutions that comply with these rigorous standards.

Regional expansion in the healthcare blockchain technology market ranges from medium to high, with companies strategically increasing their global presence. This expansion is driven by the need to meet growing demand, capitalize on emerging healthcare markets, and promote blockchain technology within the industry. Developed regions like North America and Europe often lead to adoption due to advanced healthcare infrastructure, regulatory frameworks that encourage innovation, and higher investments in technology. Collaboration among stakeholders, including healthcare providers, technology companies, research institutions, and regulatory bodies, further accelerates adoption. For instance, in July 2022, Solve. Care partnered with eMediHealth to integrate its smart ring into its healthcare blockchain platform and expand its business in South Korea.

Case Study Insights

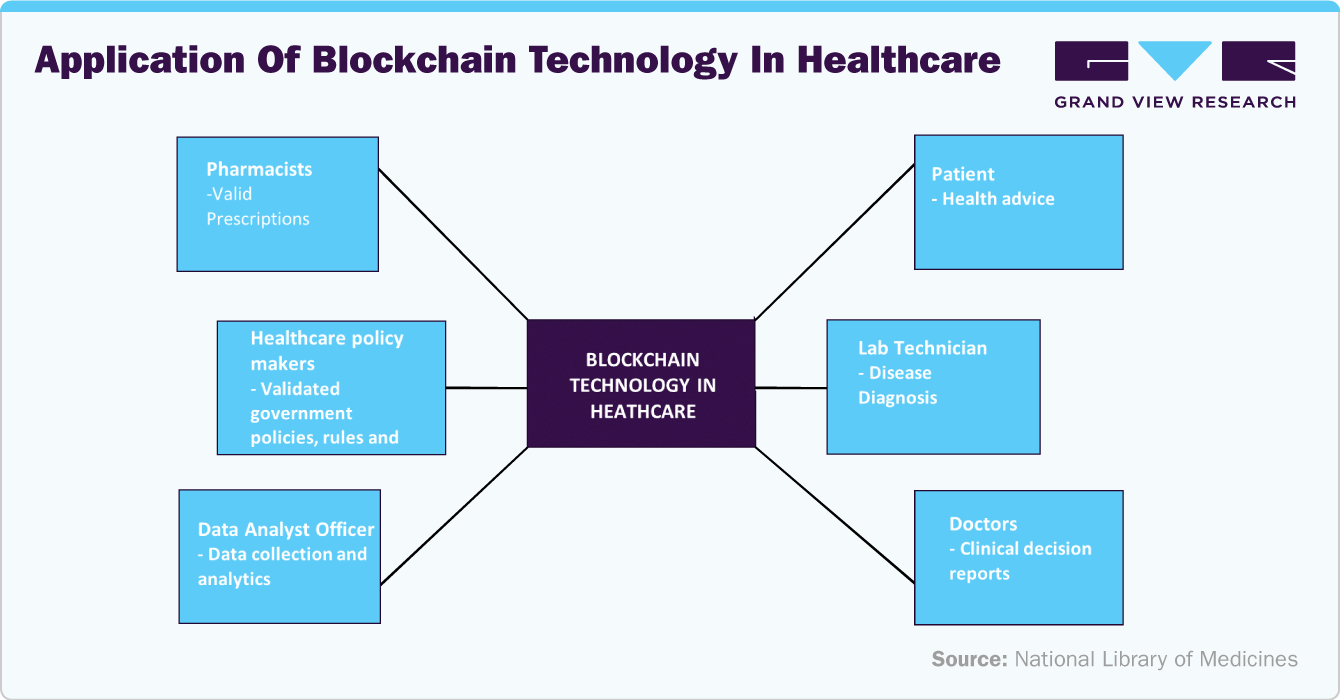

Blockchain Technology Application in Healthcare

Objective:

The primary objective of the study was to explore and implement blockchain technology to enhance various healthcare applications and ensure the secure, transparent, and efficient management of medical data.

Solution:

Blockchain technology offers decentralized, immutable ledgers that can address critical issues in healthcare, such as patient data security, interoperability, and efficient process management.

Implementation:

Blockchain enhances data security, improves interoperability among different healthcare systems, reduces fraud, and streamlines administrative processes. However, challenges such as scalability, regulatory compliance, and the need for standardization remain.

Outcome:

Implementing blockchain technology in healthcare has improved data integrity, increased stakeholder trust, reduced administrative costs, and improved patient outcomes. The technology can revolutionize the healthcare industry by ensuring secure and efficient medical data management.

Application Insights

The supply chain management segment accounted for the largest market share in 2023 and is expected to grow at the fastest CAGR during the forecast period. Blockchain technology enables end-to-end visibility across the supply chain, allowing healthcare organizations to verify medical products' origin, manufacturing processes, and distribution paths in real-time. This transparency helps to mitigate fraud, reduce the risk of counterfeits, and enhance regulatory compliance. In addition, blockchain streamlines inventory management and logistics, reducing inefficiencies and costs associated with manual record-keeping and intermediaries. The ability of blockchain technology to trace every transaction and shipment back to its source enhances are expected to fuel the segment growth over the forecast period.

Clinical Trials & eConsent segment is expected to grow significantly during the forecast period. Leveraging blockchain technology for managing clinical trial databases can significantly advance pharmaceutical research and reduce reliance on outdated data management platforms. This approach addresses various issues in clinical trials, improving their management by regulatory bodies and research institutes, thereby enhancing the credibility of clinical studies. For example, in September 2022, the Mayo Clinic integrated a blockchain-powered platform developed by Triall for a multicenter pulmonary arterial hypertension trial. This platform ensured data integrity and transparency, providing a secure, decentralized ecosystem for data capture, document management, study monitoring, and electronic consent, benefiting clinical trial companies.

Network Type Insights

The public segment dominated the market and held the largest market share of 43.17% in 2023. Public blockchain networks, characterized by their open and decentralized nature, provide transparency, security, and immutability—highly valued in the healthcare industry. These networks allow all participants to access and verify data, ensuring trust and integrity in critical applications such as patient records, supply chain management, and clinical trials. The decentralized aspect of public blockchains mitigates risks associated with centralized data storage, such as single points of failure and data breaches. Furthermore, the transparency of public blockchains fosters accountability and trust among stakeholders, including patients, healthcare providers, and regulatory bodies. As healthcare increasingly prioritizes data security, interoperability, and efficient management, public blockchain networks stand out for their ability to meet these needs, driving their widespread adoption and market dominance.

The private segment is expected to grow at the fastest CAGR of 64.6% during the forecast period. A private blockchain refers to a blockchain network operating within specific thresholds, like a closed network, and under the control of a single entity. Its operations are similar to a public blockchain, involving linked connectivity & decentralization, but on a smaller scale. Unlike public blockchains, private networks are permitted, restricting access to a select group of verified participants. This controlled environment aligns well with healthcare's stringent privacy and compliance requirements, such as those mandated by HIPAA and GDPR. Such factors are expected to drive the segment growth over the forecast period.

End-use Insights

Based on end use, biopharmaceutical & medical device companies held the largest share of 44.55% in 2023. Biopharmaceutical companies face complex supply chains, often requiring transparent and secure tracking of drugs and medical devices. Blockchain can streamline processes, enhance transparency, and improve efficiency by securely sharing data while maintaining patient confidentiality. It also offers enhanced security features like encryption, decentralized storage, and cryptographic hashing, ensuring data privacy and authorized access to healthcare professionals and researchers. Blockchain integration into quality control mechanisms and counterfeit detection ensures public safety and promotes market growth for blockchain in biopharmaceutical and medical device companies. In January 2022, NHS Wales and Roche Diagnostics partnered with Digipharm to utilize its blockchain platform to enhance healthcare outcomes. The platform allows quicker diagnostics, shorter patient wait times, sustainable procurement policies, and an acceptable payment structure for offered services.

The payers segment is expected to grow at the fastest CAGR during the forecast period. Payers, including insurance companies and government agencies, leverage blockchain to streamline operations, enhance transparency, and reduce fraud. Blockchain's decentralized and immutable ledger capabilities ensure that all transactions are recorded accurately and can be verified by all parties involved. This transparency helps to eliminate discrepancies and disputes related to billing and claims, which are common issues in the healthcare industry. For instance, Change Healthcare has been a leading supporter of this technology. It is the first to introduce blockchain at an enterprise scale for its healthcare customers through the “Intelligent Healthcare Network.” The network serves a vast user base comprising both commercial & government payers, physicians, hospitals, and providers. It processes claims totaling over USD 2 trillion annually, emphasizing the substantial impact of blockchain in healthcare.

Regional Insights

Blockchain technology in healthcare market in North America held a significant market share in 2023. Blockchain technology is revolutionizing the region’s healthcare industry by providing a decentralized, secure, and transparent digital ledger system. The adoption of blockchain technology in North America is driven by several factors, including regulatory compliance requirements, the critical need to secure patient data, and the persistent rise in healthcare costs.

U.S. Blockchain Technology In Healthcare Market Trends

The U.S. blockchain technology in healthcare market held the largest market share in 2023. Strategic initiatives by the key players in the U.S. highlighted the expanding market growth of blockchain technology within the healthcare sector. For instance, in January 2022, Avaneer Health, a key player in healthcare blockchain technology based in the U.S., offered significant support from major healthcare entities. These organizations have collectively guaranteed substantial seed funding of USD 50 million towards the Avaneer Health network.

Europe Blockchain Technology In Healthcare Market Trends

Europe blockchain technology in healthcare market held the largest market share of 34.8% in the global market in 2023. The increasing adoption of blockchain technology in countries such as France, Germany, and the UK is significantly driving market growth. Companies like IBM, Accenture, etc., actively develop and implement blockchain solutions in healthcare, highlighting the technology's potential to enhance data security, streamline operations, and improve patient outcomes. In February 2022, Epillo Health Systems, a European digital healthcare company, launched INTRx, a blockchain-based digital therapeutic product. This innovation leverages AI, machine learning, and blockchain within digital healthcare applications. Epillo Health Systems' integration of blockchain in healthcare is a significant driver of market growth, improving efficiency, security, and transparency in managing prescription drug plans and related healthcare services.

Blockchain technology in healthcare in Germany accounted for the largest market share in 2023, owing to the rapid adoption of advanced healthcare technologies and increasing government spending. Various initiatives and collaborations are underway to explore and implement blockchain in healthcare applications, showcasing the country's commitment to leveraging technology for the healthcare sector's benefit. For instance, in April 2018, the German Camelot Consulting Group established a blockchain-based solution for managing sensitive medical data. The company presented the healthcare sector with a secure digital platform for seamless patient data exchange, utilizing its Hypertrust X-Chain data management system.

The UK blockchain technology in healthcare market is expected to grow significantly over the forecast period. The National Health Service (NHS) is exploring the potential for securely managing health data, drug traceability, and streamlining administrative processes. NHS is exploring blockchain's potential for securely managing health data, drug traceability, and streamlining administrative processes. The UK government's interest and ongoing projects highlighted the growing importance of blockchain in enhancing data security, interoperability, and overall efficiency within the healthcare sector. For instance, Guardtime, a software company, launched the MyPCR blockchain platform for the UK NHS, offering instant access to primary care information for 30 million UK patients via smartphone. This platform interfaces with all three major UK NHS GP platforms and was developed in partnership with Healthcare Gateway and Instant Access Medical. These factors are expected to drive market growth in the UK.

Asia Pacific Blockchain Technology In Healthcare Market Trends

Blockchain technology's use in the healthcare market in the Asia Pacific is expected to grow significantly over the forecast period. Governments across the region are increasingly interested in blockchain technology's potential and actively support its development through policy shifts and strategic initiatives.

Japan blockchain technology in healthcare market held the largest market share in 2023. Japanese companies are actively exploring blockchain technology's potential to enhance the healthcare and pharmaceutical sectors. For instance, in April 2019, startup Susmed Inc. initiated a certified pilot project integrating blockchain and mobile health apps for secure clinical data monitoring. Similarly, pharmaceutical giant Takeda co-leaded a global initiative, employing blockchain to create secure patient registries and rare disease patient passports. This move aligns with efforts to prevent data falsification cases.

Blockchain technology in healthcare market in China will grow significantly in the coming years. The Chinese healthcare system rapidly adopts blockchain to improve data accuracy, transparency, and patient-centric care. Moreover, the government is actively piloting projects to enhance drug traceability and streamline the sharing of medical records among institutions. Companies in the country launched blockchain solutions to manage medical data, prescriptions, and insurance claims securely. For instance, in May 2021, Tencent, a major Chinese tech company, joined forces with Waterdrop, a crowdfunded health insurance firm, to utilize blockchain technology for medical and insurance solutions. The plan included integrating this solution into Tencent's popular WeChat messenger, with an extensive monthly user base exceeding a billion active Chinese users. This collaboration aimed to enable efficient and secure access to medical bills for users by leveraging blockchain technology.

Key Blockchain Technology In The Healthcare Company Insights

Numerous market players are expanding their global footprint by establishing collaborations, partnerships, and acquisitions to tap into new markets and countries. Collaborations with healthcare providers, research institutions, and academic medical centers are opportunistic to access expertise and assess their technologies in real-world clinical settings. For instance, in August 2023, IBM acquired Apptio. The businesses will have a 360-degree technology management platform to optimize and automate decisions across their IT landscapes when Apptio products and IBM's IT automation portfolio are combined.

Key Blockchain Technology In The Healthcare Companies:

The following are the leading companies in the blockchain technology in the healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- PATIENTORY INC.

- Guardtime

- iSolve, LLC

- Solve.Care

- Oracle

- Change Healthcare (acquired by UnitedHealth Group's Optum)

- BurstIQ

- Medicalchain SA

- Blockpharma

Recent Developments

- In October 2023, Solve.Care partnered with Binance to expand the integration of cryptocurrency in healthcare sectors. The connection broadens the applications for cryptocurrencies, making it easier and more convenient to use them to pay for healthcare services.

“Insurers, government programs, and varying fee structures often result in confusion and added administration for patients, providers, and payers. By integrating Binance Pay into Solve.Care’s Care.Wallet, we are taking a momentous step towards making healthcare payments more effortless and seamless for all our Care.Wallet users. The potential impact of this partnership is immense, considering the sheer scale of the healthcare industry, valued at over $8 trillion.”

- Pradeep Goel, CEO of Solve.Care

- In August 2023, Solve Care launched a novel Care.Trials Network. This cutting-edge network, backed by blockchain and Zero-knowledge (ZK) technology, offered novel solutions to conduct clinical trials.

“The launch of Care.Trials Network is a historic milestone for humanity. We are reshaping the landscape of healthcare, blockchain, and crypto industries in a way that brings immeasurable benefits to patients, doctors, and researchers worldwide. By combining the potential of blockchain, zero-knowledge technology, and digital currency, we are empowering individuals and unlocking the full potential of medical research.”

- Pradeep Goel, CEO of Solve.Care

- In December 2018, PokitDok was acquired by Change Healthcare to extend the capabilities and technology of its Intelligent Healthcare Network by leveraging PokitDok's DokChain technology as well as blockchain use cases. Furthermore, in October 2022, UnitedHealth Group's Optum completed its acquisition of Change Healthcare to simplify core administrative, clinical, and payment processes.

Blockchain Technology In Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.30 billion

Revenue forecast in 2030

USD 214.86 billion

Growth rate

CAGR of 63.6% from 2025 to 2030

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Network type, application, end use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain;Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IBM; PATIENTORY INC.; Guardtime; iSolve, LLC; Solve.Care; Oracle; Change Healthcare; BurstIQ; Medicalchain SA; Blockpharma

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blockchain Technology In Healthcare Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global blockchain technology in healthcare market report on the basis of network type, application, end-use, and region:

-

Network Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Private

-

Public

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Data Exchange & Interoperability

-

Claims Adjudication & Billing

-

Supply Chain Management

-

Clinical Trials & eConsent

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Providers

-

Payers

-

Biopharmaceutical & Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Switzerland

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

Thailand

-

Singapore

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blockchain technology in healthcare market size was estimated at USD 7.04 billion in 2023 and is expected to reach USD 11.33 billion in 2024.

b. The global blockchain technology in healthcare market is expected to grow at a compound annual growth rate of 63.3% from 2024 to 2030 to reach USD 214.86 billion by 2030.

b. Europe dominated the blockchain technology in healthcare market with a revenue share of 34.81% in 2023. The increasing adoption of blockchain technology in countries such as France, Germany, and the UK drives market growth. Leading companies like IBM, Accenture, and Deloitte actively develop and implement blockchain solutions in healthcare, highlighting the technology's potential to enhance data security, streamline operations, and improve patient outcomes.

b. Some key players operating in the blockchain technology in healthcare market include IBM, PATIENTORY INC., Guardtime, iSolve, LLC, Solve.Care, Oracle, Change Healthcare, BurstIQ, Medicalchain SA, and Blockpharma.

b. Key factors that are driving the blockchain technology in healthcare market growth include the increasing incidence of information leaks and data breaches, coupled with the rising requirement to curb these issues, strategic initiatives by the key players, the high demand to reduce drug counterfeiting, the need for an efficient health data management system, and rising investment in the development of an efficient healthcare record system, wearable device cryptography, and medical examination systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.