- Home

- »

- Pharmaceuticals

- »

-

Blockbuster Oncology Brands Market, Industry Report, 2030GVR Report cover

![Blockbuster Oncology Brands Market Size, Share & Trends Report]()

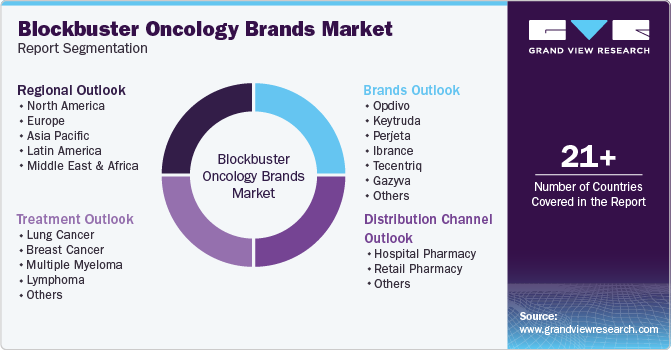

Blockbuster Oncology Brands Market (2024 - 2030) Size, Share & Trends Analysis Report By Brands (Opdivo, Keytruda, Perjeta, Ibrance), By Treatment (Lung Cancer, Lymphoma), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Other), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-603-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Blockbuster Oncology Brands Market Summary

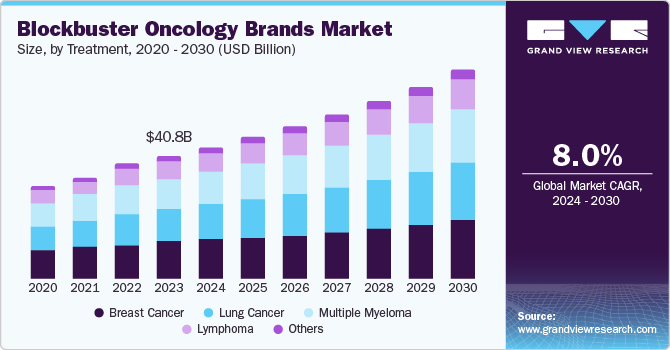

The global blockbuster oncology brands market size was estimated at USD 40.80 billion in 2023 and is projected to reach USD 69.56 billion by 2030, growing at a CAGR of 8.0% from 2024 to 2030. The increasing incidence of various cancer types across different age demographics, advancements in oncology research, and the emergence of diverse treatment modalities such as immunotherapy, targeted therapy, and cellular therapies, offer patients a wider range of options for treatment, thereby stimulating market growth.

Key Market Trends & Insights

- The North America dominated the market with a revenue share of 37.7% in 2023.

- Based on brands, the opdivo segment accounted for the highest market revenue share of 14.0% in 2023.

- Based on treatment, the breast cancer segment held the highest market revenue share in 2023.

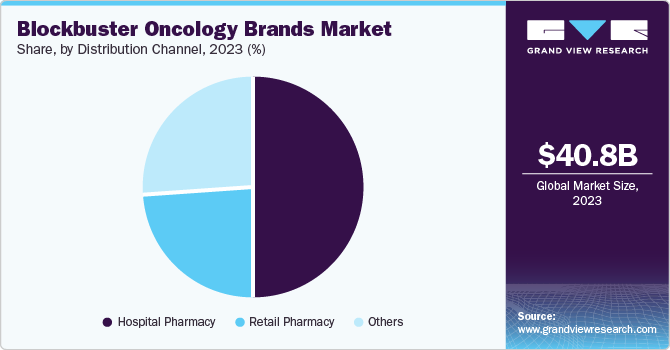

- Based on distribution channel, the hospital pharmacies segment accounted for the highest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 40.80 Billion

- 2030 Projected Market USD 69.56 Billion

- CAGR (2024-2030): 8.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

A blockbuster drug is a highly sought-after drug that generates annual sales of USD 1 billion or more for a pharmaceutical company. Regulatory bodies worldwide have accelerated approval rates for new drug therapies as a first-in-line treatment. Additionally, companies have invested heavily in research and development efforts for new drug formulations. These factors have collectively contributed to the high growth trajectory of the global market for blockbuster oncology brands.

According to the International Agency for Research on Cancer (IARC) under the World Health Organization (WHO), about 20 million new patients with cancer were reported globally in 2022, with this number expected to rise to more than 35 million by 2050. The most common types of cancer, according to IARC, were lung and prostate cancer for men and breast cancer for women. Such a significant mortality rate associated with cancer patients compels pharmaceutical companies to expedite their research for novel drug therapies. These new drug therapies come at a high cost to patients; however, supportive reimbursement frameworks for oncology drugs contribute to market expansion by improving patient affordability.

Regulatory bodies worldwide, such as the Food and Drug Administration (FDA), the European Medicines Agency (EMA), the Medicines and Healthcare Products Regulatory Agency (MHRA), and others, have fast-tracked their approval rates for the application of innovative drug therapies in cancer treatment, such as targeted immunotherapy, CAR-T cell therapy, monoclonal antibodies, and many others. Tailored treatment approaches employed by oncologists, based on genetic and molecular profiling of tumors, further enhance treatment efficacy and drive market demand.

Brands Insights

Opdivo accounted for the highest market revenue share of 14.0% in 2023. Also known as Nivolumab, this drug has demonstrated clinical efficacy across a wide range of cancer symptoms, such as lung, melanoma, kidney, and other solid tumors. This broad therapeutic spectrum has expanded the drug's market potential and solidified its position as a preferred treatment option for oncologists. Furthermore, comprehensive clinical data supporting Opdivo's safety and efficacy has been instrumental in gaining its widespread adoption among healthcare professionals. This has resulted in increased prescription rates for Opdivo, thereby resulting in market dominance.

Zejula is expected to register the fastest CAGR from 2024 to 2030. Rising cases of cancer in women such as ovarian cancer and fallopian tube cancer, along with the response of cancer to platinum-based therapy, has led to the increased adoption of Zejula by oncology professionals. According to the Ovarian Cancer Research Alliance, women have a 1 in 87 lifetime risk of developing ovarian cancer with a high mortality rate. Clinical trials for the drug have indicated that the use of Zejula is useful in delaying the progression of cancer up to a median of 14 months. These factors are expected to boost the adoption of Zejula among the medical community, accounting for its faster growth rate.

Treatment Insights

Breast cancer held the highest market revenue share in 2023. Breast cancer is among the most common forms of cancer in 157 countries worldwide. For instance, the WHO estimated that in 2022, approximately 2.3 million women had been diagnosed with breast cancer and around 670,000 deaths occurred globally. Advancements in screening technologies and increased public awareness have led to earlier diagnosis of breast cancer. This has facilitated the timely initiation of treatment, contributing to improved patient outcomes and, consequently, higher drug utilization. Additionally, there has been a concentrated focus on developing and commercializing innovative therapies for this patient population, further strengthening the market share of breast cancer-targeted blockbuster brands.

Lymphoma treatment is expected to register the fastest growth during the forecast period. A notable surge in lymphoma incidence rates globally has driven the demand for effective treatment options. According to the Leukemia & Lymphoma Society (LLS), around 90,000 people in the U.S. were expected to be diagnosed with lymphoma (both Hodgkin and non-Hodgkin lymphoma (NHL)) in 2023, and this number is expected to steadily keep rising in the coming years. This epidemiological shift has created a substantial market opportunity for innovative therapies. Moreover, the introduction of high-priced and effective lymphoma treatments has contributed to the positive growth trajectory of this segment.

Distribution Channel Insights

Hospital pharmacies accounted for the highest market revenue share in 2023. This is attributed to a complex treatment regimen associated with oncology procedures, along with the availability of expertise and continuous monitoring required for drug administration in hospitals. For instance, oncology treatments require intricate drug regimens, specialized administration, and intensive care. Hospital pharmacies possess the requisite infrastructure, expertise, and personnel to manage such functions effectively. Furthermore, a significant proportion of oncology drugs are administered through injections, requiring a controlled environment and medical professionals for administration. Hospital pharmacies are uniquely equipped to handle these drug delivery modalities, leading to their strong share.

The distribution through the retail pharmacy channel segment is expected to grow at a significant CAGR during the forecast period. The increasing prevalence of cancer, advancements in precision medicine and targeted therapies, and the introduction of effective new oncology drugs collectively enhance the availability and appeal of innovative cancer treatments in the retail pharmacy sector. The introduction of novel oncology brands with blockbuster potential, such as Eli Lilly's Jaypirca, Genmab/AbbVie's Epkinly, and Johnson & Johnson's Talvey, has further contributed to the rising demand in retail pharmacies.

Regional Insights

North America dominated the market with a revenue share of 37.7% in 2023. The region experiences a relatively high incidence rate of various types of cancer. As per Statistique Canada, cancer is the leading cause of death in Canada; meanwhile, the CDC states that this disorder was the second-leading cause of mortality in the U.S. in 2022. A comparatively higher per capita healthcare spending in this region enables greater access to advanced oncology therapies for patients and facilitates market penetration for blockbuster drugs. Furthermore, a well-established ecosystem of pharmaceutical companies, biotechnology firms, and academic institutions nurtures the development of innovative oncology treatments.

U.S. Blockbuster Oncology Brands Market Trends

The U.S. held the largest share of the regional market in 2023. This is owing to a high disease burden faced by the country with regard to cancer. For instance, the American Cancer Society has estimated more than 2 million new cancer cases and over 600,000 deaths due to cancer in 2024 in the country. Lung cancer was the most commonly occurring form of cancer. Effective formulation of regulatory frameworks from the FDA have expedited the market entry of novel oncology products, contributing to this country’s strong positioning. Additionally, rigorous intellectual property protection in the country safeguards the exclusivity of blockbuster oncology brands, allowing for substantial revenue generation.

Europe Blockbuster Oncology Brands Market Trends

Europe accounted for a considerable market share in 2023. The European Commission, through the European Cancer Information System (ECIS), estimated around 3.5 million new cases of cancer in 2022. The present trajectory is showing rising incidences of new patients and associated deaths. This has resulted in an increased spending by regional authorities and stakeholders on novel drug therapies such as immunotherapy. Additionally, a strong research and development landscape nurtures innovations in the pharmaceuticals field, further posing promising growth prospects for blockbuster oncology brands.

The UK held a notable revenue share of the regional market in 2023. According to Cancer Research UK, the country faces a high incidence rate of cancer and about 38% of the cases can be prevented with regular medications and hospitalization. Breast, lung, bowel, and prostate cancer are among the most common types of cancer among the country’s population. Innovations in immunotherapy and monoclonal antibodies have shown promising results in the first-line treatment of these cancer types. This trend is anticipated to drive market growth in the UK.

Asia Pacific Blockbuster Oncology Brands Market Trends

Asia Pacific is expected to register the fastest growth from 2024 to 2030. According to a study by The Lancet published in January 2024, cancer has emerged as one of the most prominent public health threats in recent years. This poses a serious challenge for regional governments to tackle the growing incidences of cancer-related deaths. In recent years, significant investments in healthcare infrastructure, including hospitals, clinics, and research facilities, have improved the access to advanced cancer treatments. Moreover, the development of specialized oncology centers and increased healthcare expenditure have boosted the adoption of innovative therapies. These factors have led to steady market growth in the region.

As per the latest Health of the Nation 2024 report published by Apollo Hospitals, India is experiencing a sharp rise in number of cancer cases in recent years, with a growth rate of over 13.0% projected between 2020 and 2025. This has made India the cancer capital of the world. Additionally, the median age for cancer diagnosis among Indians was lesser than the global average, leading to occurrence of this disease at a younger age. This scenario poses a significant market opportunity for newer drug therapies for cancer treatment. Additionally, government initiatives for cancer treatment have enabled the low-income class to opt for high-priced immunotherapies, leading to a high patient base for new therapies.

Key Blockbuster Oncology Brands Company Insights

Some key companies involved in the blockbuster oncology brands market include Bristol-Myers Squibb, Amgen Inc., and Merck & Co., Inc., among others.

-

Bristol-Myers Squibb is a multinational biopharmaceutical company offering pharmaceutical medicines and research and development services in oncology, immunology, cardiovascular disease, and hematology. The company has pioneered immune oncology by making immunotherapy accessible to cancer patients globally. The company offers support to cancer patients and oncology professionals through its various initiatives, such as disease awareness campaigns, sponsorships, and events. Notable oncology medicines provided by Bristol-Myers Squibb include Abraxane, Yervoy, and Opdivo.

-

Merck & Co., Inc. is a multinational pharmaceutical company that offers a variety of products such as vaccines, medicines, generic drugs, diagnostics, biologics therapies, and veterinary medicines. The company is involved in research and development for oncology products, addressing over 30 types of tumors, such as breast, blood, bladder, and lung cancer, among others. The company has focused on three areas of oncology research, i.e., immune-oncology, tissue targeting, and precision molecular targeting. Through various programs such as Focus on Your Lungs and Uncovering TNBC, Merck engages in cancer awareness and educational initiatives.

Key Blockbuster Oncology Brands Companies:

The following are the leading companies in the blockbuster oncology brands market. These companies collectively hold the largest market share and dictate industry trends.

- Bristol-Myers Squibb Company

- Merck & Co., Inc.

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- AstraZeneca

- GSK plc

- Novartis AG

- Johnson & Johnson Services, Inc.

- AbbVie Inc.

- Amgen Inc.

Recent Developments

-

In July 2024, Bristol-Myers Squibb received validation for its Type II variation application from the European Medicines Agency (EMA) for Opdivo (nivolumab) plus Yervoy (ipilimumab) as a first-line treatment for unresectable or advanced hepatocellular carcinoma (HCC) in adult patients. The therapy is expected to potentially ensure improved treatment outcomes for European patients with HCC.

-

In July 2024, Merck announced its research partnership with Orion Corporation for the exclusive global licensing of the opevesostat investigational CYP11A1 inhibitor, and other drugs designed to treat prostate cancer. With financial assistance from Merck, Orion will be accelerating its research efforts toward drug development for patients suffering from this form of cancer.

Blockbuster Oncology Brands Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 43.72 billion

Revenue Forecast in 2030

USD 69.56 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Brands, treatment, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; Australia; South Korea; India; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bristol-Myers Squibb Company; Merck & Co., Inc.; Pfizer Inc.; F. Hoffmann-La Roche Ltd; AstraZeneca; GSK plc; Novartis AG; Johnson & Johnson Services, Inc.; AbbVie Inc.; Amgen Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blockbuster Oncology Brands Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global blockbuster oncology brands market report based on brands, treatment, distribution channel, and region.

-

Brands Outlook (Revenue, USD Billion, 2018 - 2030)

-

Opdivo

-

Keytruda

-

Perjeta

-

Ibrance

-

Tecentriq

-

Gazyva

-

Tagrisso

-

Darzalex

-

Zejula

-

Revlimid

-

Imbruvica

-

Others

-

-

Treatment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lung cancer

-

Breast cancer

-

Multiple myeloma

-

Lymphoma

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.