Blasting Automation Services Market Size, Share & Trends Analysis Report By Application (Metal Mining, Non-metal Mining), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-220-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Blasting Automation Services Market Trends

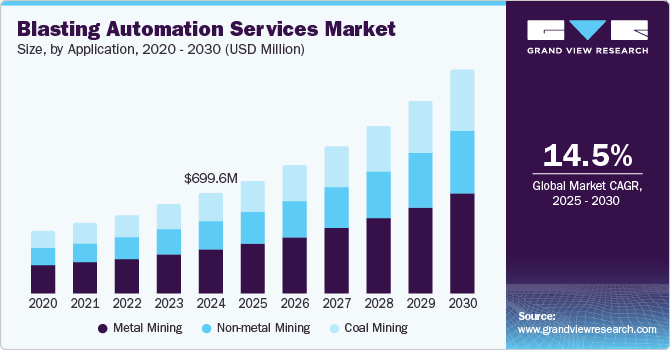

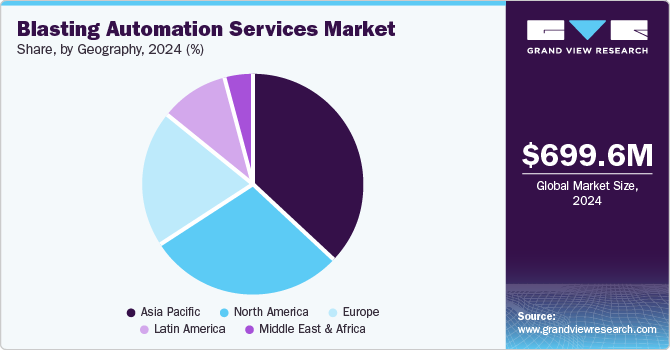

The global blasting automation services market size was valued at USD 699.6 million in 2024 and is projected to grow at a CAGR of 14.5% from 2025 to 2030. Substantial growth in mining activities globally and the need to implement solutions that can boost process efficiency and enhance worker safety while simultaneously lowering the risk of environmental damage has driven the adoption of automation in this sector. Blasting remains one of the most dangerous activities in mining, with potential risks including flying debris, vibrations, and accidental detonation. Automation eliminates the need for workers to be physically present near the blast site, improving worker safety by allowing remote monitoring and operation of blasting systems. Automated blasting offers more consistent results regarding fragmentation size and blast performance. It means less variability in the size of the material extracted, leading to more efficient and predictable downstream processes.

The process of mining involves the extraction and excavation of various critical metals and minerals, which are necessary components in several industries, including healthcare, manufacturing, and consumer electronics. As the need for such devices and products continues increasing globally, mining companies are encouraged to conduct operations in challenging environments, leading to higher in-ground stress that can prove to be fatal for workers. It has led to the adoption of automation technologies to conduct various mining activities from remote distances that can address safety and health concerns due to the constant presence of dust, vibration, and noise. Moreover, such technologies are also instrumental in accelerating operations and boosting efficiency and profit margins.

Companies are investing significantly in expanding their fleet and incorporating advanced technologies such as automation and artificial intelligence (AI) in their offerings. For instance, the Avatel technology developed by Orica in collaboration with Epiroc aims to provide miners safe access to challenging orebodies. This is achieved by automating every aspect of the explosive-handling process needed for underground blasting and completely removing any manual processes. In addition, Orica has developed the WebGen wireless electronic explosion initiation system that prevents workers from returning to the face after loading to detonate the explosives, thus improving their safety and streamlining the overall blasting operation. Another company, Hexagon, released its AI-powered 3D blast movement offering, the Hexagon Blast Movement Intelligence (BMI), in September 2024. This solution offers improved blasting efficiency and better visibility into ore dilution to delineate ore and waste after the blast accurately.

Growing pressure by regional governments to ensure the safety of miners and minimal environmental damage has further shaped the industry by encouraging operators to utilize innovative blasting machinery. Automated blasting systems help companies meet local and international environmental regulations, such as noise and air pollution limits, by optimizing blast parameters for minimal environmental impact. Moreover, real-time monitoring and automated feedback allow operators to adjust blasting parameters to meet regulatory requirements related to blast vibrations, air quality, and noise levels.

Application Insights

The metal mining segment accounted for a leading revenue share of 44.4% in the global market in 2024 and is further expected to expand at the fastest CAGR during the forecast period. This can be attributed to the consistently rising demand for different types of metals for industrial use cases and the resulting growth in mining activities for these metals. Copper, silver, lead, iron, and nickel are some notable metals that are extensively mined to be utilized as raw materials in verticals such as automotive, healthcare, and consumer electronics. Blasting is one of the most important activities in metal mining, as it creates the initial fragmentation of rock, which is then processed to extract valuable metals such as gold, copper, iron, and zinc. Automation of blasting processes can bring significant benefits in terms of operational efficiency, safety, and environmental sustainability. It further ensures better accuracy in long-hole drilling and blasting activities carried out at lower crust depths, along with the safe extraction of metalliferous ores.

The non-metal mining segment is anticipated to advance at a significant CAGR from 2025 to 2030, on account of the rapidly increasing demand for minerals such as barite, talc, gypsum, and gemstones. The presence of air pockets in non-metallic oxides prevents miners from utilizing manual blasting and drilling processes, owing to the risk of exposure to inflammable and toxic gases. The use of automation technologies in such scenarios can help detect the density of rocks, angle of slopes, and the amount of explosives needed to optimize the operation while ensuring safety and precision. Automation allows for real-time data collection and analysis, ensuring that blasts are designed more efficiently for the rock type and material being extracted. This results in better fragmentation and easier material handling, reducing the need for secondary blasting and lessening the wear on crushers and mills.

Regional Insights

North America is anticipated to advance at a substantial CAGR during the forecast period, on account of the continued expansion of mining operations and introduction of innovative technologies in the regional industry. Additionally, the presence of several established companies and focus on the development of sustainable practices has helped in the launch of advanced services. The U.S. and Canada are considered major hubs for the development of cutting-edge blasting automation solutions that leverage technologies such as the internet of things (IoT) and artificial intelligence (AI). Mining companies in North America face increasing pressure from governments and stakeholders to adopt safer and more sustainable mining practices. For instance, the Surface Mining Control and Reclamation Act of 1977 is the primary federal regulation concerning the environmental impact of coal mining in the U.S. Automation allows mining organizations to comply with stricter environmental regulations by reducing emissions and mitigating the impact of blasting on local ecosystems.

U.S. Blasting Automation Services Market Trends

The demand for blasting automation services in the U.S. mining sector has been rising steadily, driven by factors such as the need for enhanced safety, operational efficiency, cost reduction, and environmental sustainability in these activities. States such as Arizona, Nevada, and Texas have significant mineral deposits, resulting in frequent mining operations. Mining companies are increasingly adopting automation technologies to streamline processes, improve productivity, and address the challenges posed by labor shortages, stringent regulatory requirements, and the pressure to reduce environmental impact. Additionally, the availability of advanced technologies such as machine learning, AI, real-time data analytics, and the Internet of Things (IoT) has made the automation of blasting operations more feasible and cost-effective.

Asia Pacific Blasting Automation Services Market Trends

Asia Pacific accounted for the largest revenue share of 36.7% in the global blasting automation services market in 2024. The region is known for its vast volumes of natural resources that has compelled mining companies to undertake extensive operations aimed at excavating different types of minerals, metals, and coal. These materials are utilized across several critical industries, including manufacturing, automotive, and consumer electronics, both regionally as well as globally. Governments in the region are aiming to introduce technological enhancements in mining activities that can improve process efficiency while also improving worker safety. This has created a strong demand for the incorporation of automation features in blasting operations.

China Blasting Automation Services Market Trends

China accounts for a dominant revenue share in the regional market, aided by the well-established mining sector in the country and the introduction of several technological innovations in mining operations. China is a leading producer of over 20 metals globally, including aluminum, graphite, iron, steel, lead, and magnesium, among others. Additionally, it has also emerged as a leader in coal mining, excavating around 4.66 billion tons of coal in 2023, as reported by the nation’s statistics bureau. Such rich deposits of metals and non-metal resources have encouraged the government to undertake various initiatives that have driven the incorporation of automated processes. For instance, the country’s industry ministry announced in November 2024 that it would boost the domestic exploration of mineral resources such as cobalt, lithium, and nickel. This objective is part of a draft plan released by the Ministry of Industry and Information Technology (MIIT) that aims to support the advancement of the energy storage manufacturing sector. These developments are expected to increase the frequency of mining operations in China, providing potential growth opportunities to providers of blasting automation services.

Latin America Blasting Automation Services Market Trends

The Latin American market for blasting automation services is anticipated to expand at the second-fastest CAGR from 2025 to 2030. Blasting automation in the mining sector has become increasingly crucial in this region, where large-scale operations dominate the extraction businesses. Latin America is home to some of the largest mining locations globally, including Chile (copper), Peru (gold and silver), and Brazil (iron ore). According to the publication ‘Lexology Panoramic: Mining 2024,’ the region accounts for around 48% of the global copper reserves, 20% of global gold reserves, and 50% of overall silver reserves. Latin America is also rich in lithium and potash, accounting for over 60% of the former’s worldwide reserves. As a result, the market demand for advanced mining equipment has expanded steadily due to various key factors related to productivity, safety, environmental impact, cost reduction, and technological advancements.

Brazil Blasting Automation Services Market Trends

Brazil accounted for a leading revenue share in the regional market in 2024. The varied geology found in the economy due to its extensive area has created a suitable environment for the availability of various precious minerals, metals, and rare earths. Brazil is emerging as the fifth-largest lithium producer globally, with around 45 lithium deposits having been identified in the economy. This ensures a sustainable supply of this mineral for the energy transition business. The country has introduced stringent safety standards that aim to benefit both the environment and mining workers while also enhancing process efficiency. Blasting automation plays a critical role in meeting safety regulations, helping mining companies stay compliant with local and international safety laws. The country’s mining sector faces a shortage of skilled labor, especially in remote or challenging mining environments. The adoption of automation technology helps address this gap by reducing the reliance on manual labor for hazardous activities such as blasting.

Key Blasting Automation Services Company Insights

Some of the major companies involved in the global blasting automation services market include ABB, Dyno Nobel, and Epiroc, among others.

-

ABB is a technology company specializing in automation and electrification solutions. The company is mainly involved in developing and distributing products, solutions, systems, and services concerning electrification products, motion, and industrial automation. In the mining segment, ABB’s offerings span across various stages of operations, including exploration, extraction, processing, transportation, and reclamation. ABB provides solutions that enhance the efficiency, productivity, and sustainability of operations, offering technologies ranging from electrical equipment and automation systems to data-driven services and digital transformation tools. For instance, its 800xA control system or Symphony Plus can be used for integrating blast control with overall mine process automation. Moreover, digital monitoring technologies from the company enable mining operators to collect data in real time regarding rock fragmentation, vibration levels, and environmental conditions before, during, and after a blast.

-

Epiroc AB is a Swedish company involved mainly in the mining and infrastructure sectors, providing advanced equipment, technology, and services. The company operates in various segments, including mining, construction, demolition, and natural resource extraction. It offers both underground mining and surface mining & quarrying solutions and has integrated automation in several processes. Epiroc’s Mobilaris technology provides real-time location-based services that help track vehicles, personnel, and equipment, enhancing operational efficiency and safety.

Key Blasting Automation Services Companies:

The following are the leading companies in the blasting automation services market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Dyno Nobel

- Epiroc

- iRing Inc.

- Mineware Consulting

- Komatsu

- Orica Limited

- Rio Tinto

- Rockwell Automation

- Sasol

Recent Developments

-

In October 2024, Dyno Nobel announced the expansion of its electronic detonator product suite with the launch of the DigiShot XR range that has been designed to withstand extreme shock levels. It includes three solutions: the DigiShot XR, the DigiShot Plus XR, and the DigiShot Plus XRS. These solutions offer EMP and shock resistance on account of designed stress relief, along with precise placement of components and selection of materials. Additionally, DigiShot Plus XRS and DigiShot Plus XR offer 30% higher programmable time delay for improved design flexibility.

-

In January 2024, Epiroc Canada and Vale Canada, a subsidiary of Vale Base Metals, announced that they had signed a non-binding Memorandum of Understanding to develop, test, and leverage innovative mining equipment and techniques to ensure robust safety processes and build advanced solutions while enhancing productivity. As per the agreement, the companies would utilize Epiroc’s offerings in automation, digitalization, and electrification in the underground mining cycle across areas including long-hole drilling, blasting, face drilling, mucking, and hauling.

-

In October 2023, ABB announced that in collaboration with mine operators LKAB and Boliden, it had successfully conducted the testing of a first-of-its-kind automated robot charging technology indicated for underground mines. The program was carried out at Boliden Garpenberg, the world's most productive underground zinc mine located in Sweden. The ABB Robot Charger detects boreholes automatically and fills these boreholes with charges without any manual involvement, preventing people from being near the unsupported rock face at the time of blasting activities.

Blasting Automation Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 790.5 million |

|

Revenue forecast in 2030 |

USD 1,557.9 million |

|

Growth Rate |

CAGR of 14.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, Poland, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

ABB; Dyno Nobel; Epiroc; iRing Inc.; Mineware Consulting; Komatsu; Orica Limited; Rio Tinto; Rockwell Automation; Sasol |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Blasting Automation Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the blasting automation services market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Metal Mining

-

Non-metal Mining

-

Coal Mining

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Poland

-

-

Asia Pacific

-

China

-

JapanIndia

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."