- Home

- »

- Beauty & Personal Care

- »

-

Black Seed Oil Market Size, Share & Growth Report, 2030GVR Report cover

![Black Seed Oil Market Size, Share & Trends Report]()

Black Seed Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Nutraceuticals/Supplements, Cosmetics & Personal Care, Food & Beverage, Medicinal), By Type (Conventional, Organic), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-941-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Black Seed Oil Market Summary

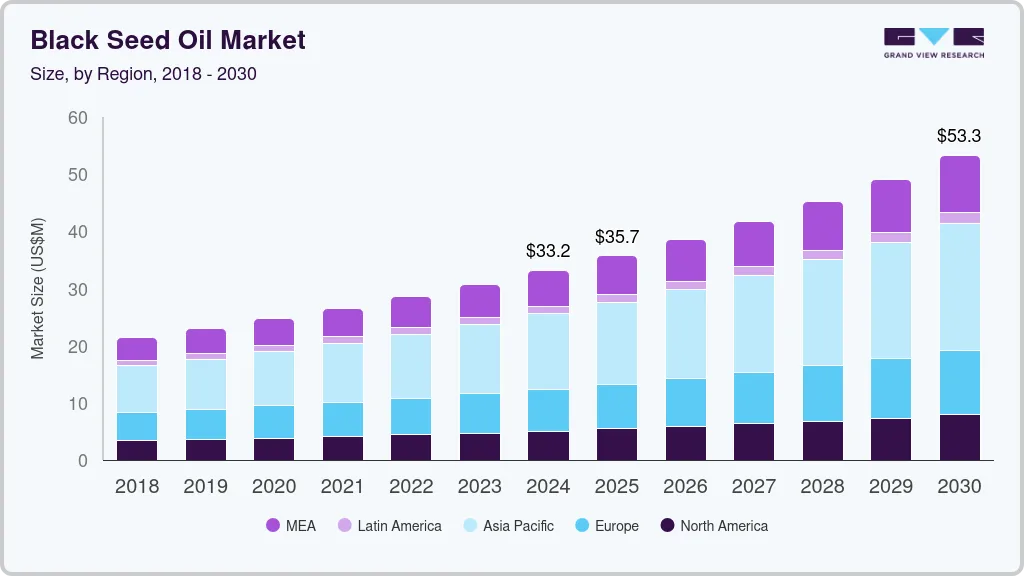

The global black seed oil market size was estimated at USD 33.11 million in 2024 and is projected to reach USD 53.33 million by 2030, growing at a CAGR of 8.3% from 2025 to 2030. This growth is attributed to increasing consumer awareness of the health benefits associated with black seed oil, such as its antioxidant and anti-inflammatory properties, driving demand for nutraceuticals and personal care products.

Key Market Trends & Insights

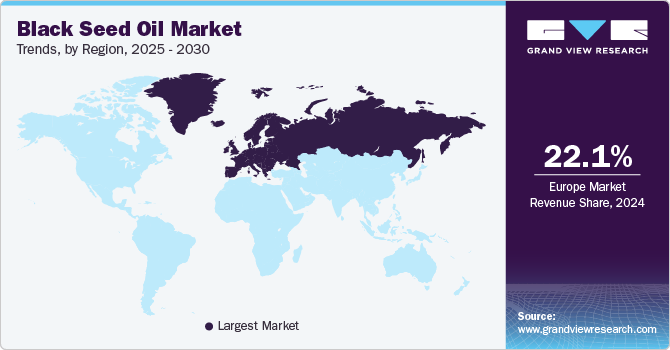

- Black seed oil market in Europe accounted for a share of 22.1% of the global market revenue in 2024.

- Black seed oil market in the U.S. is expected to grow at a CAGR of 7.9% from 2025 to 2030.

- By application, the demand for black seed oil in nutraceuticals/supplements segment accounted for a share of over 47% in 2024.

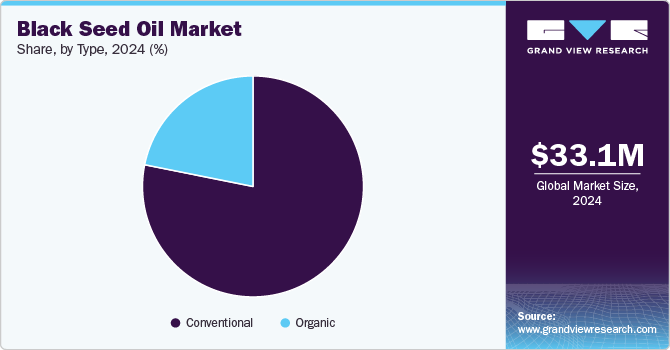

- By type, conventional black seed oil segment sales accounted for a share of over 78% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.11 Million

- 2030 Projected Market Size: USD 53.33 Million

- CAGR (2025-2030): 8.3%

- Europe: Largest market in 2024

Additionally, the rising trend toward natural and organic ingredients in various industries is further propelling market growth as consumers seek effective and natural alternatives for health and wellness solutions. The black seed oil market is witnessing notable trends contributing to its growth trajectory. The increasing inclination toward natural remedies and organic ingredients has heightened consumer demand for black seed oil, particularly in dietary supplements and health foods. This surge in demand is attributed to black seed oil's rich profile of omega fatty acids and antioxidants, which appeal to health-conscious consumers seeking holistic wellness solutions.

Additionally, the expansion of black seed oil in the beauty and personal care sector is driving market growth. Companies are innovating by incorporating black seed oil into skincare and haircare products, capitalizing on its nourishing properties. Consumers are seeking premium, clean-label products such as sustainable and chemical-free options, which is driving the demand for black seed oil.

One significant challenge in the market is the increasing competition from alternative oils and natural supplements. As consumers become more health-conscious, they have a wide array of options, including oils like coconut, argan, and hemp, which may offer similar health benefits. This competition can dilute the market share for black seed oil. Moreover, the lack of standardized production methods can lead to discrepancies in the concentration of active ingredients, such as thymoquinone, which is essential for the oil's efficacy. This inconsistency can undermine consumer trust and hinder the overall market growth.

Application Insights

The demand for black seed oil in nutraceuticals/supplements accounted for a share of over 47% in 2024, driven by increasing consumer awareness of the health benefits associated with its active compounds, particularly thymoquinone. As consumers increasingly seek natural remedies for various health concerns, including immune support and anti-inflammatory effects, black seed oil has become a versatile ingredient in dietary supplements, further enhancing its market presence.

Thymenol, a new nutraceutical supplement developed through a partnership between Market America, Barrington Nutritionals, and TriNutra, combines ThymoQuin—a cold-pressed black seed oil standardized to 3% thymoquinone—and Pycnogenol, a pine bark extract. Such innovative blends support cognitive, cardiovascular, and immune health, showcasing the powerful antioxidant properties of ThymoQuin. The cold-pressed extraction method preserves the integrity of the oil in supplement form, ensuring that its active ingredients remain effective. As a significant advancement in the nutraceutical market, Thymenol highlights the growing application of black seed oil in health supplements, particularly in promoting overall well-being and supporting various health functions.

The demand for black seed oil in cosmetics & personal care applications is projected to grow at a CAGR of 9.2% from 2025 to 2030. This growth is driven by increasing consumer preferences for natural and organic ingredients in beauty products, as well as the oil's proven benefits for skin health, including its anti-inflammatory and antioxidant properties. As consumers become more aware of the effectiveness of plant-based formulations, brands are responding with innovative products that incorporate black seed oil.

The demand for black seed oil in food and beverage applications is projected to grow at a CAGR of 8.6% from 2025 to 2030, driven by the increasing awareness of health benefits associated with black seed oil such as increased immunity and therapeutic benefits, is driving consumers toward incorporating it into their diets.

In May 2021, Speaking Herbs, an organic wellness brand based in New Delhi, India, launched a Cold-Pressed Black Seed Oil that is 100% free from chemical additives, including mineral oil and artificial fragrances. Known as Kalonji oil in India, this food-grade, extra virgin black seed oil is derived from non-GMO seeds of Nigella sativa, a plant with a rich history in skincare, hair care, and wellness remedies dating back to ancient Egyptian civilization. The oil is celebrated for its health benefits, particularly due to its high content of Thymoquinone, which is known to enhance immunity, protect lung health, and provide therapeutic effects against diabetes and cancer.

Type Insights

Conventional black seed oil sales accounted for a share of over 78% in 2024, primarily due to its affordability and widespread availability compared to organic alternatives. The established supply chains and lower production costs associated with conventional farming practices have contributed to this dominance. Additionally, consumer familiarity and trust in conventional products, driven by their long-standing presence in the market, have further bolstered their popularity, making them the preferred choice for many consumers seeking the health benefits of black seed oil.

Organic black seed oil demand is projected to grow at a CAGR of 9.0% from 2025 to 2030. The demand for organic black seed oil is on the rise, driven by increasing consumer awareness of natural skincare solutions and the benefits of plant-based ingredients. As more individuals seek holistic approaches to skincare, organic formulations that harness the power of black seed oil are gaining popularity. In line with this trend, in May 2024, Eminence Organic Skin Care launched its Charcoal & Black Seed Collection, which includes a clay mask, a clarifying oil, and a gel featuring ingredients such as black seed extracts.

Regional Insights

The black seed oil market in North Americaaccounted for a share of 15.3% of the global market revenue in 2024, largely driven by increasing consumer awareness of natural health products and the growing trend of using dietary supplements. For instance, in May 2022, KIKI Health launched its organic black seed oil aligning with the growing trend towards natural, high-quality health supplements. As a manufacturer of plant-based products, KIKI Health emphasizes the purity and efficacy of its offerings, aligning with consumer demand for transparency and organic certification. This new product, made from the cold-pressed seeds of the Nigella sativa plant, is not only rich in essential fatty acids and antioxidants but also boasts a significant thymoquinone content of 2.4%, underscoring its health benefits for skin, hair, and joint health. The decision to use only cold-pressing technology reflects a commitment to preserving the oil's nutritional integrity, resonating with the increasing U.S. consumer preference for minimally processed health products.

U.S. Black Seed Oil Market Trends

Black seed oil market in the U.S. is expected to grow at a CAGR of 7.9% from 2025 to 2030, fueled by a surge in demand for natural and organic products across various sectors, particularly in health and wellness. The rising incidence of lifestyle-related health issues in the U.S., such as obesity and diabetes, is driving consumers to seek natural remedies, with black seed oil being recognized for its potential benefits in supporting metabolic health and immune function. Furthermore, the increasing availability of black seed oil in mainstream retail outlets and online platforms, such as Amazon and Walmart, is expected to enhance market penetration, as evidenced by the WOW Skin Science product line recently launched in 400 Walmart stores.

Europe Black Seed Oil Market Trends

Black seed oil market in Europe accounted for a share of 22.1% of the global market revenue in 2024 driven by the rising consumer preference for natural health products and wellness trends. Countries like Germany and the UK are leading this growth, where the demand for organic and ethically sourced ingredients such as black seed oil is particularly strong. Additionally, the increasing prevalence of skin care and nutraceutical products utilizing black seed oil, such as the growing popularity of cold-pressed options in European health stores, further boosts market growth.

Asia Pacific Black Seed Oil Market Trends

The Asia Pacific black seed oil market is expected to grow at a CAGR of 9.1% from 2025 to 2030, primarily driven by the increasing demand for natural health and wellness products in countries like India and China.Traditional practices, such as Ayurveda in India and Traditional Chinese Medicine (TCM), often incorporate black seed oil, further boosting its acceptance and usage.

Key Black Seed Oil Company Insights

The black seed oil market is characterized by its fragmented nature, with numerous players competing for market share across various regions.Key strategies employed by companies in the black seed oil market include leveraging product differentiation through the development of innovative formulations that combine black seed oil with other beneficial ingredients, catering to diverse consumer preferences. Emphasis is placed on enhancing product quality by utilizing cold-press extraction methods and ensuring organic certification, which appeals to health-conscious buyers. Companies also focus on expanding distribution channels by partnering with both online and brick-and-mortar retailers to increase market accessibility.

Key Black Seed Oil Companies:

The following are the leading companies in the black seed oil market. These companies collectively hold the largest market share and dictate industry trends.

- TriNutra Ltd

- Z-Company BV

- Sabinsa Corporation

- FLAVEX Naturextrakte GmbH

- Safa Honey

- ConnOils

- SanaBio GmbH

- Medikonda Nutrients

- Amazing Herbs

- OPW Ingredients GmbH

Recent Developments

- In May 2024, WOW Skin Science launched its highly acclaimed Red Onion Black Seed Oil product line at 400 Walmart stores in the U.S. and online. This popular haircare line includes hair oil, shampoo, and conditioner, all formulated to strengthen and nourish hair, promote hair growth, and prevent hair loss. The unique combination of red onion and black seed oil works to stimulate hair follicles and enhance collagen production. The products are vegan, hypoallergenic, and cruelty-free, catering to all hair types while providing anti-frizz and shine benefits.

- In 2023, Zatik Naturals launched a new line of revolutionary black seed oil, which is produced in-house using USDA certified organic oil. This announcement was made at the Natural Products Expo West 2023, highlighting the company's commitment to high-quality, organic ingredients in its product offerings.

Black Seed Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.71 million

Revenue forecast in 2030

USD 53.33 million

Growth rate (Revenue)

CAGR of 8.3% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; China; Japan; India; Australia; Brazil; Saudi Arabia; South Africa; Turkey; Egypt

Key companies profiled

TriNutra Ltd; Z-Company BV; Sabinsa Corporation; FLAVEX Naturextrakte GmbH; Safa Honey; ConnOils; SanaBio GmbH; Medikonda Nutrients; Amazing Herbs; OPW Ingredients GmbH

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Black Seed Oil Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global black seed oil market based on application, type, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Nutraceuticals/Supplements

-

Cosmetics & Personal Care

-

Food & Beverage

-

Medicinal

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Turkey

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global black seed oil market size was estimated at USD 33.11 million in 2024 and is expected to reach USD 35.71 million in 2025.

b. The global black seed oil market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2030 to reach USD 53.33 million by 2030.

b. Asia Pacific dominated the black seed oil market with a share of 39.80% in 2024. This is attributable to rising demand for immunity-boosting elements and foods.

b. Some key players operating in the black seed oil market include TriNutra Ltd, Z-Company BV, Sabinsa Corporation, FLAVEX Naturextrakte GmbH, Safa Honey, ConnOils, SanaBio GmbH, Medikonda Nutrients, Amazing Herbs, and OPW Ingredients GmbH.

b. Key factors that are driving the black seed oil market growth include the increasing awareness of the health benefits of black seed oil, such as anti-inflammatory, antioxidant, and immune-boosting properties, increased use of black seed oil in cosmetics, and global focus on preventive health care and wellness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.