- Home

- »

- Medical Devices

- »

-

Biosurgery Market Size, Share And Trends Report, 2030GVR Report cover

![Biosurgery Market Size, Share & Trends Report]()

Biosurgery Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Sealants, Hemostatic Agents, Adhesion Barriers, Soft Tissue Attachments), By Application (General Surgery, Orthopedic Surgery), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-992-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biosurgery Market Summary

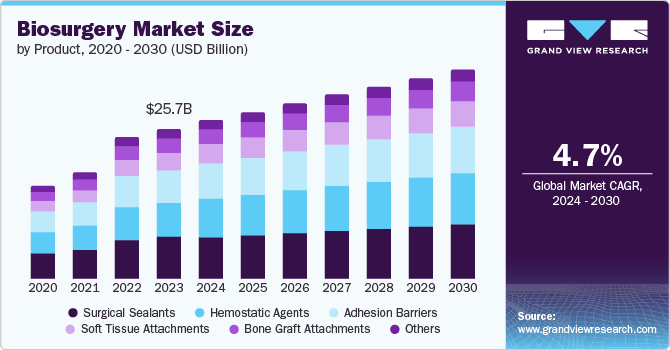

The global biosurgery market size was estimated at USD 25.69 billion in 2023 and is projected to reach USD 35.85 billion by 2030, growing at a CAGR of 4.7% from 2024 to 2030. The anticipated growth is attributed to increasing demand for minimally invasive surgical procedures and advancements in scientific technologies related to the healthcare industry.

Key Market Trends & Insights

- The North America biosurgery market dominated the global industry and accounted for the largest revenue share of 50.1% in 2023.

- The Asia-Pacific biosurgery market is anticipated to witness the fastest CAGR of 6.0% during the forecast period.

- Based on product, the surgical sealants segment dominated the biosurgery market with a revenue share of 26.9% in 2023.

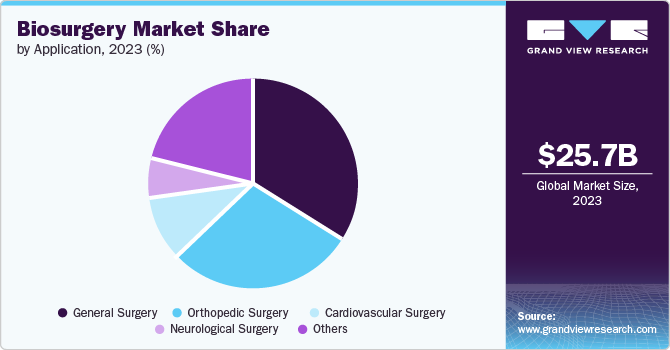

- Based on application, the general surgery segment dominated the global industry for biosurgery in 2023.

Market Size & Forecast

- 2023 Market Size: USD 25.69 Billion

- 2030 Projected Market USD 35.85 Billion

- CAGR (2024-2030): 4.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growing prevalence of chronic diseases such as cancer, cardiovascular disease, non-communicable disease, arthritis, and other health disorders is expected to generate greater demand for this industry in the approaching years.

Moreover, the increasing geriatric population in multiple countries that need constant medical assistance and are prone to numerous ailments is most likely to influence the growth of this industry during the forecast period. Biosurgery is a surgical procedure performed utilizing biomaterials instead of synthetic materials. These surgeries aim to reconstruct tissue inside the subject’s body. It aims to improve surgical outcomes, enhance patient recovery, and promote tissue regeneration. The major factors driving the growth of the biosurgery market are the increasing geriatric population, the rising prevalence of cardiovascular disease, and the surge in the number of accidents and sports-related injuries.

According to the World Health Organization (WHO), injuries, unintentional and caused by violence, result in the death of nearly 4.4 million people each year worldwide. It accounts for 8% of the total deaths in a year. Almost 1 in 3 of injury-related deaths are caused by road traffic crashes. These aspects are expected to increase demand for biosurgery in the next few years.

Increasing advancements in biosurgical product development and the adoption of innovation by the key market participants have significantly influenced the demand for this industry. Some of the increasingly used products, such as surgical sealants, adhesion barriers, and others, are assisting professionals and facilities to enhance the effectiveness and final result of minimally invasive surgeries. The integration of biosurgical procedures and advanced tools used by surgeons is adding to the growth opportunities of this market.

Product Insights

Surgical sealants dominated the biosurgery market with a revenue share of 26.9% in 2023. The growth of this segment is primarily influenced by the growing number of surgeries performed for various reasons. This product is used as a barrier to prevent leaks of fluids, blood, urine, and air. Some of the most common types of surgical sealants are fibrin, cyanoacrylates, glutaraldehyde-albumin, and polyethylene-glycol-based. Continuous research & development are expected to assist this segment in attaining rapid growth in the approaching years. For instance, to address the primary therapeutic gap between the need for effective surgical sealants to prevent pulmonary air leaks during lung surgeries and the available range of products, the lung-mimetic sealant is designed and developed with the help of hydrofoam material. The porous ultrastructure and viscoelastic characteristics, like lungs, are crucial to developing this product.

The soft tissue attachments segment is anticipated to witness the fastest CAGR over the forecast period. The expected growth is attributed to the increasing number of minimally invasive surgeries, the rising number of road fatalities, and the growing prevalence of chronic diseases. Soft tissue attachments are often used in orthopedic surgeries, dental surgeries, oral surgeries, plastic surgeries, regenerative or reconstructive surgeries, and augmentation surgeries. Tendon repairs, flap surgeries, would closure, dental implants, and gastrointestinal surgeries involve using soft tissue attachments on a larger scale. A growing number of trauma-related injuries, a rising prevalence of oral infections, and increasing cases of ligament injuries in sports and outdoor activities are expected to develop growth for this segment in the approaching years. According to the American Association for the Surgery of Trauma, injury is identified as a cause of nearly 150,000 demises. Several non-fatal injuries account for more than 3 million per year in the country.

Application Insights

The general surgery application segment dominated the global industry for biosurgery in 2023. Some of the most commonly performed general surgery procedures include appendectomy, colorectal surgery, endocrine surgery, hernia repair, breast surgeries, vascular surgeries, surgical oncology, trauma surgeries, and vascular surgeries. According to the 2023 ASPS Procedural Statistics Release by the American Society of Plastic Surgeons, breast enhancement surgeries consolidated their rank as a perennial favorite in the field of aesthetic surgeries. Breast augmentation procedures in 2023 accounted for 304,181 surgeries. This is identified as 2% of 298,568 procedures from 2022. The growing availability of trauma care, government initiatives, and support for the provision of general surgeries at minimal costs, as well as enhancements in health infrastructure, are expected to generate greater growth for this segment in the coming years.

The cardiovascular surgery application segment is expected to experience the fastest CAGR from 2024 to 2030. This growth is attributed to multiple aspects, such as the growing prevalence of cardiovascular diseases (CVD )coupled with increasing obesity and new cases of diabetes, increased availability and accessibility to care and surgical procedures, enhancements in diagnostic tools and methods, changed lifestyles leading to increased CVDs, and others. According to WHO (World Health Organization), cardiovascular deaths are one of the leading causes of loss of life worldwide. It indicates the growing need for cardiovascular surgeries performed across the globe. WHO states that unceasing use of tobacco, unhealthy dietary habits, lack of physical activity, and harmful consumption of alcohol are some of the key factors that lead to the development of risks associated with heart disease.

Regional Insights

North America biosurgery market dominated the global industry and accounted for the largest revenue share of 50.1% in 2023. Some key factors impacting this regional industry's growth include the availability of well-developed health infrastructure, increasing expenditure capacities, and a growing inclination towards minimally invasive procedures. The presence of key market players and high healthcare expenditure contributes to regional dominance. Furthermore, the increasing prevalence of chronic diseases such as cancer and heart disease increases the demand for biosurgery products and procedures in the region. For instance, according to the U.S. Centers for Disease Control and Prevention, some individual in the U.S. experiences a heart attack every 40 seconds.

U.S. Biosurgery Market Trends

The U.S. biosurgery market held the largest share of regional industry in 2023. The growth is driven by robust healthcare infrastructure, high adoption of biosurgical products and advanced surgical techniques. In addition, new cases of health diseases and a surge in minimally invasive surgery procedures are expected to generate growth for this industry in the coming years. For instance, approximately 7,02,880 deaths occur due to heart disease, according to the Center for Disease Control and Prevention, accelerating growth for biosurgery in the region.

Europe Biosurgery Market Trends

Europe biosurgery market held a significant share of global industry in 2023. This market is primarily driven by enhanced healthcare infrastructure, highly skilled surgeons, and a growing geriatric population. According to WHO, the number of individuals aged 60 and older is expected to reach over 300 million by 2050. The presence of multiple talented professionals, advanced healthcare facilities providing improved assistance with surgical procedures, and the availability of surgical equipment in the region are expected to drive growth for this industry.

Germany biosurgery market is expected to experience a significant CAGR from 2024 to 2030. This market is mainly influenced by factors such as the cost-effectiveness offered by the procedure, the noteworthy volume of surgeries performed in the country, the growing number of orthopedic and cardiovascular procedures, the unceasing prevalence of chronic diseases, and ease of availability.

Asia Pacific Biosurgery Market Trends

The Asia-Pacific biosurgery market is anticipated to witness the fastest CAGR of 6.0% during the forecast period. The projected growth rate is attributed to rapid economic growth in countries such as China and India, increasing disposable income levels, and rising healthcare infrastructure. An unceasing increase in trauma-related injuries and new cases of cardiovascular diseases in the region are expected to fuel growth for this industry. For instance, according to the Economic and Social Commission for Asia Pacific, one death occurs every 44 seconds due to road accidents in Asia Pacific.

China biosurgery market is most likely to experience rapid growth rate during forecast period. The growth of this market is primarily driven by aspects such as the presence of a large geriatric population in the country, the growing prevalence of diseases such as heart diseases, non-communicable diseases, and cardiovascular disease, rapid urbanization leading to changed lifestyles, and enhancements in healthcare infrastructure developed in the country.

Key Biosurgery Company Insights

Some of the key companies in the biosurgery market include, Medtronic, Sanofi, Baxter, Pfizer Inc. and others. To address the rising competition in the industry, the key companies operating in this market are adopting strategies such as product differentiation, collaboration, innovation based new product developments and more.

-

Baxter is one of the prominent companies operating in the products and therapies associated with advanced healthcare offerings. It provides a vast product portfolio, including surgical hemostats and sealants. Some of its key products related to the biosurgery industry include the Floseal Hemostatic Matrix, PERCLOT Absorbable Hemostatic Powder, TISSEEL fibrin sealant, ARTISS fibrin sealant, COSEAL surgical sealant, PREVELEAK surgical sealant, and others.

-

Artivion, Inc., formerly known as Cryolife|Jotec, is a key market participant in the medical and surgical technology industry. It offers a variety of products, such as heart valve solutions, aortic arch solutions, abdominal aorta stent grafts, peripheral aorta stent grafts, surgical sealants, and cardiac and vascular ancillary solutions. Its surgical sealant offering is BioGlue surgical adhesive.

Key Biosurgery Companies:

The following are the leading companies in the biosurgery market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- Baxter

- INTEGRA LIFESCIENCES

- Medtronic

- B. Braun SE

- Pfizer Inc

- Stryker

- Johnson & Johnson Services, Inc

- BD

- Artivion, Inc (CryoLife, Inc.)

Recent Developments

-

In May 2024, Sanofi announced to invest over USD 1.10 billion in biomanufacturing in France, in addition to the USD 2.74 billion already allocated for major projects. This investment underscores Sanofi's strategic focus on enhancing health sovereignty and aims to strengthen Sanofi's capabilities in biomanufacturing within France.

-

In November 2023, a Johnson and Johnson MedTech company, Ethicon, announced approval from ETHIZIA Hemostatic sealing patch, designed to manage and stop disruptive bleeding during surgical procedures effectively. The addition of this hemostatic patch enhances Ethicon's extensive biosurgery portfolio, allowing the company to meet urgent requirements in managing bleeding effectively.

Biosurgery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.14 billion

Revenue forecast in 2030

USD 35.85 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; APAC; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Sanofi; Baxter; INTEGRA LIFESCIENCES; Medtronic; B. Braun SE; Pfizer Inc; Stryker; Johnson & Johnson Services, Inc; BD; Artivion, Inc (CryoLife, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biosurgery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the biosurgery market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical sealants

-

Hemostatic agents

-

Adhesion barriers

-

Soft Tissue attachments

-

Bone graft attachments

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General surgery

-

Orthopedic surgery

-

Cardiovascular surgery

-

Neurological surgery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biosurgery market size was estimated at USD 12.5 billion in 2019 and is expected to reach USD 13.6 billion in 2020.

b. The global biosurgery market is expected to grow at a compound annual growth rate of 7.1% from 2019 to 2026 to reach USD 20.1 billion by 2026.

b. North America dominated the biosurgery market with a share of 47.0% in 2019. This is attributable to the well-established healthcare sector, increasing prevalence of obesity, and cardiovascular diseases.

b. Some key players operating in the biosurgery market include Johnson & Johnson (Ethicon); Medtronic Plc; Strykers; Baxter International Inc.; C.R. Bard; Sanofi; Pfizer; B. Braun Melsungen AG; and Integra Lifesciences Corporation.

b. Key factors that are driving the market growth include increasing number of surgical procedures, increasing incidence of diabetes and chronic diseases and rising geriatric population across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.