- Home

- »

- Agrochemicals & Fertilizers

- »

-

Biostimulants Market Size & Share, Industry Report, 2033GVR Report cover

![Biostimulants Market Size, Share & Trends Report]()

Biostimulants Market (2026 - 2033) Size, Share & Trends Analysis Report By Active Ingredients (Acid Based, Microbial), By Crop Type (Row Crops And Cereals, Fruits And Vegetables, Turf And Ornamentals), By Application (Foliar, Soil Treatment), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-346-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biostimulants Market Summary

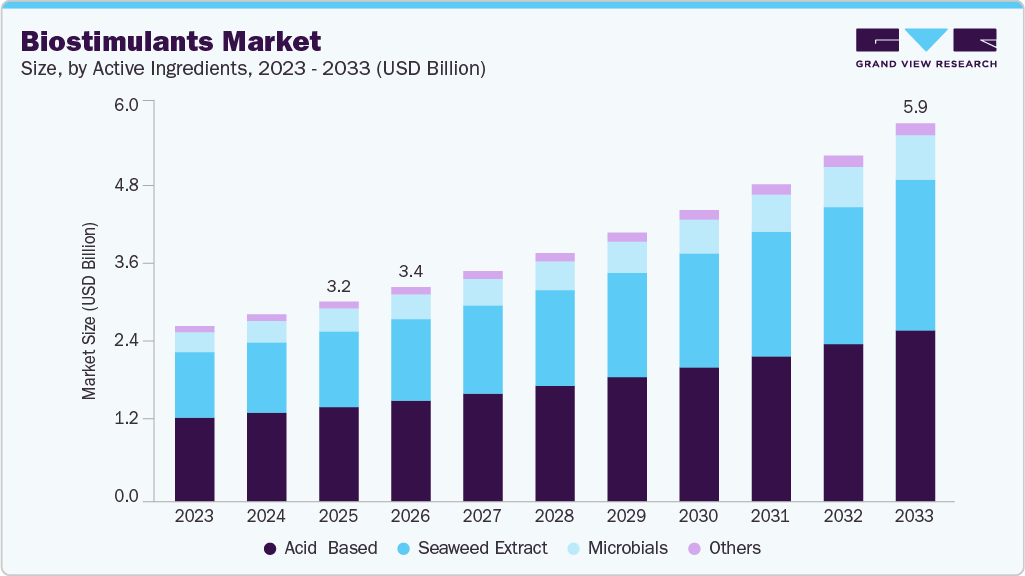

The global biostimulants market size was valued at USD 3,167.9 million in 2025 and is anticipated to reach USD 5,996.3 million by 2033, expanding at a CAGR of 8.5% from 2026 to 2033. The industry is driven by the increasing focus on sustainable agriculture, as growers seek solutions that enhance plant growth, nutrient uptake, and soil health while minimizing the environmental impact of conventional agrochemicals.

Key Market Trends & Insights

- Europe dominated the biostimulants market with the largest revenue share of 36.0% in 2025.

- By active ingredients, the seaweed extract segment is expected to grow at the fastest CAGR of 9.2% from 2026 to 2033.

- By crop type, the row crops & cereals segment is expected to grow at the fastest CAGR of 8.8% from 2026 to 2033.

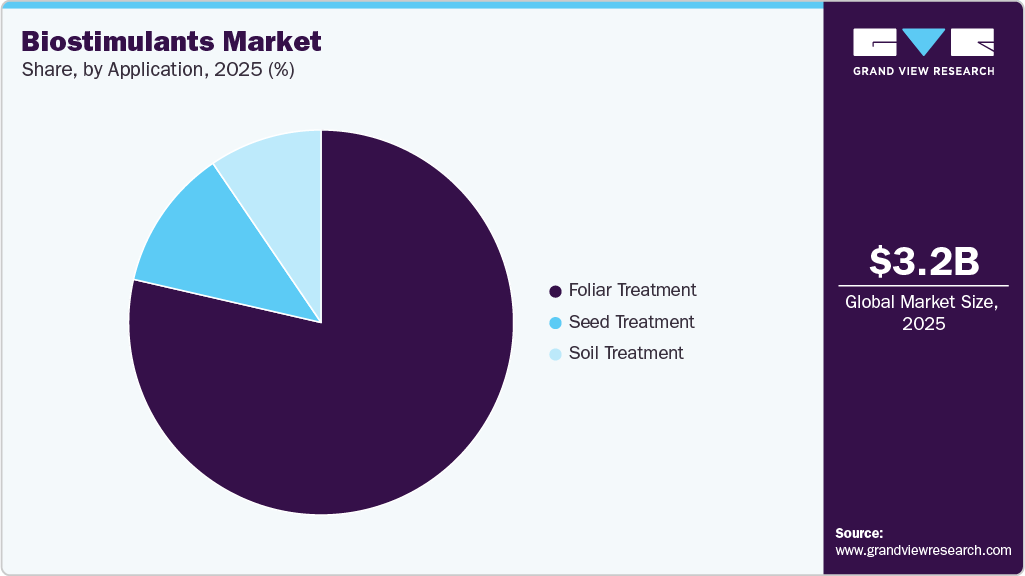

- By application, the foliar treatment segment held the largest revenue share of 79.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3,167.9 Million

- 2033 Projected Market Size: USD 5,996.3 Million

- CAGR (2026-2033): 8.5%

- Europe: Largest Market in 2025

- Asia Pacific: Fastest Growing market

Increasing climate variability, including droughts, heat stress, and soil salinity, is creating pressure on farmers to protect crop performance. Biostimulants help improve plant tolerance to abiotic stress and support consistent growth under challenging conditions. They also enhance root development and nutrient utilization, leading to more stable yields. As a result, growers are increasingly adopting biostimulants to safeguard productivity and reduce yield volatility.

The biostimulants market presents a strong growth opportunity through increasing adoption in precision farming and high-value specialty crops such as fruits, vegetables, and horticultural produce. As growers focus on maximizing yield quality, resource efficiency, and return on investment, biostimulants are being integrated with data-driven crop management practices to deliver targeted performance benefits. This trend is further supported by rising export standards, premium food demand, and technological advancements in formulation and application methods, creating new revenue avenues for market participants.

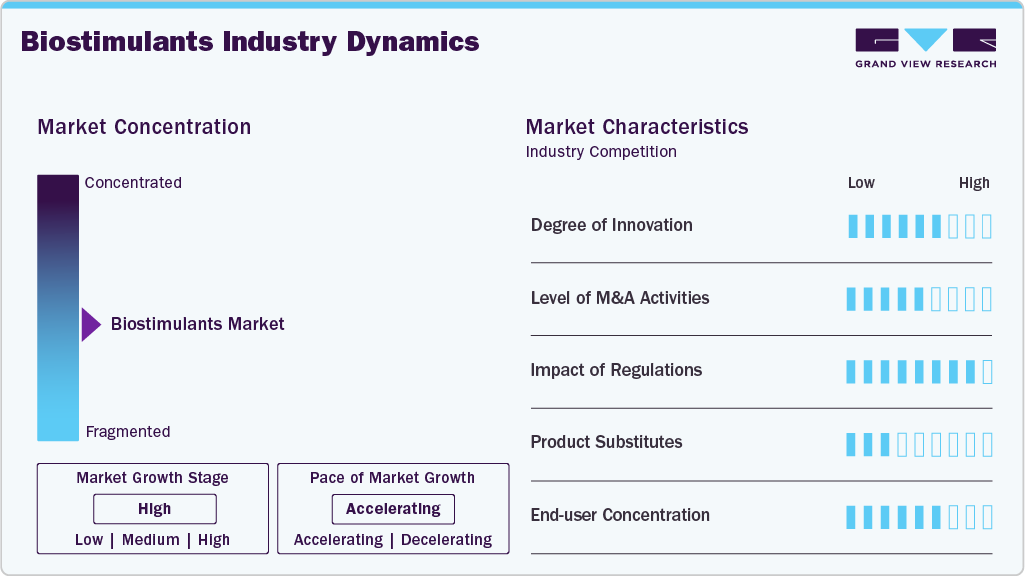

Market Concentration & Characteristics

The biostimulants industry is moderately fragmented, with the presence of a mix of global agrochemical companies, specialized biostimulant manufacturers, and emerging regional players. Large multinational firms leverage strong R&D capabilities, broad product portfolios, and established distribution networks to maintain competitive positions, while smaller players compete through niche formulations, biological innovations, and crop-specific solutions. Strategic partnerships, acquisitions, and product launches are common as companies seek to expand geographic reach and strengthen their biological input offerings.

The market is characterized by rapid innovation, regulatory evolution, and increasing customer awareness of biological crop inputs. Demand is largely driven by performance-based outcomes, such as yield improvement, stress tolerance, and crop quality enhancement, leading to strong emphasis on field validation and agronomic support.

Additionally, the market shows high adoption in high-value crops and regions with advanced farming practices, while pricing and product differentiation are influenced by formulation complexity, raw material sourcing, and proven efficacy.

Active Ingredients Insights

The acid-based segment dominated the industry with a revenue share of over 47.2% in 2025, due to its proven ability to improve soil structure, enhance nutrient availability, and support root development across a wide range of crops. Their broad applicability, cost-effectiveness, and consistent agronomic performance make them the preferred choice among farmers, particularly in large-scale and field crop applications.

Seaweed extract biostimulants are witnessing rapid growth with a projected CAGR of 9.2% from 2026 to 2033, driven by rising demand for natural, plant-based inputs that enhance stress tolerance and crop vigor. Rich in bioactive compounds such as hormones and polysaccharides, these products support yield quality and resilience, aligning well with organic farming trends and premium crop production requirements.

Crop Type Insights

Row crops & cereals dominated the market with a revenue share of over 61.7% in 2025, due to their large cultivation area and the increasing need to enhance yield stability and input efficiency in high-volume crop production. Farmers adopt biostimulants to improve nutrient uptake, root development, and stress tolerance, enabling better productivity and cost optimization in large-scale farming systems.

The fruits and vegetables segment is witnessing significant growth with a projected CAGR of 8.5%, driven by rising demand for high-quality, residue-free produce and improved shelf life. Biostimulants support crop quality, yield uniformity, and stress resistance, making them increasingly attractive for high-value horticultural crops and export-oriented production.

Application Insights

The foliar treatment application dominated the market with a revenue share of over 78.6% in 2025, due to its rapid nutrient absorption and immediate physiological response in plants. This method allows growers to quickly address nutrient deficiencies and stress conditions, making it widely adopted across diverse crops and growth stages.

Seed treatment is the fastest growing application segment with a CAGR of 10.2%, as farmers increasingly focus on early-stage crop vigor and uniform germination. Biostimulants applied at the seed level enhance root development and stress tolerance from the initial growth phase, offering cost-effective yield improvement and reduced input dependency.

Regional Insights

Europe Biostimulants Market Trends

The biostimulants market in Europe dominated the global industry with a revenue share of 36.0% in 2025, due to strong regulatory support for sustainable agriculture and widespread adoption of biological crop inputs. Stringent restrictions on chemical fertilizers and pesticides, combined with high awareness among farmers, continue to drive consistent demand across major agricultural economies.

Germany’s biostimulants market is supported by strong regulatory emphasis on environmentally friendly agriculture and high penetration of organic farming. Farmers increasingly adopt biostimulants to comply with sustainability standards while maintaining crop productivity.

North America Biostimulants Market Trends

The biostimulants market in North America is driven by increasing adoption of advanced farming practices and growing focus on yield optimization and soil health. Large-scale commercial farming and rising interest in biological and organic inputs are supporting steady uptake of biostimulants.

U.S. Biostimulants Market Trends

The biostimulants market in the U.S. is driven by large-scale commercial agriculture and a growing focus on improving yield consistency and stress management. Integration of biostimulants into precision agriculture programs is further supporting adoption.

Asia Pacific Biostimulants Market Trends

The biostimulants market in Asia Pacific is expected to witness a CAGR of 10.6%, fueled by rising food demand, expanding agricultural production, and increasing awareness of yield-enhancing technologies. Government initiatives to promote sustainable farming and improve farmer access to modern agri-inputs are accelerating biostimulant adoption.

China’s biostimulants market is driven by government-led efforts to reduce chemical fertilizer usage and improve soil health. Rising adoption of sustainable inputs in high-intensity farming systems is supporting market expansion.

Latin America Biostimulants Market Trends

The biostimulants market in Latin America is driven by large-scale cultivation of row crops and export-oriented agriculture. Farmers increasingly use biostimulants to improve productivity, stress tolerance, and input efficiency under variable climatic conditions.

Middle East & Africa Biostimulants Market Trends

The biostimulants market in the Middle East & Africa is supported by the need to improve crop performance under water scarcity and challenging soil conditions. Biostimulants are gaining traction as tools to enhance stress resistance and optimize yields in arid and semi-arid regions.

Key Biostimulants Companies Insights

The competitive scenario of the biostimulants market involves consolidation, competitive advantage, and market penetration by various players. The industry is comparatively newer than other agrochemical industries. It is an emerging industry that is involved in developing a wide array of innovative products to cater to agronomic market needs arising from sustainable activities.

Key Biostimulants Companies:

The following key companies have been profiled for this study on the biostimulants market

- Isagro Group

- BASF SE

- Biolchim S.P.A.

- Sapec Agro S.A.

- Platform Specialty Products Corporation

- Novozymes A/S

- Valagro SpA

- Italpollina SAP

- Koppert B.V.

- Biostadt India Limited

Recent Developments

-

In December 2025, Valent BioSciences and Seipasa formed a strategic partnership to bring novel biostimulant products to the U.S. market, aiming to combine expertise and expand technological offerings in biostimulant solutions.

Biostimulants Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3,396.6 million

Revenue forecast in 2033

USD 5,996.3 million

Growth rate

CAGR of 8.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in million-hectare; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Active ingredients, crop type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Isagro Group; Sapec Agro S.A.; Biolchim S.P.A.; Novozymes A/S; Platform Specialty Products Corporation; Valagro SpA; Koppert B.V.; Italpollina SAP; Biostadt India Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biostimulants Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global biostimulants market report on the basis of active ingredients, crop type, application, and region:

-

Active Ingredient Outlook (Volume, Million Hectare; Revenue, USD Million, 2018 - 2033)

-

Acid Based

-

Seaweed Extract

-

Microbial

-

Others

-

-

Crop Type Outlook (Volume, Million Hectare; Revenue, USD Million, 2018 - 2033)

-

Row Crops and Cereals

-

Fruits and Vegetables

-

Turf and Ornamentals

-

Others

-

-

Application Outlook (Volume, Million Hectare; Revenue, USD Million, 2018 - 2033)

-

Foliar Treatment

-

Soil Treatment

-

Seed Treatment

-

-

Regional Outlook (Volume, Million Hectare; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the biostimulants market include BASF SE; Isagro Group; Sapec Agro S.A.; Biolchim S.P.A.; Novozymes A/S; Platform Specialty Products Corporation; Valagro SpA; Koppert B.V.; Italpollina SAP; Biostadt India Limited.

b. The market is driven by the increasing focus on sustainable agriculture, as growers seek solutions that enhance plant growth, nutrient uptake, and soil health while minimizing the environmental impact of conventional agrochemicals

b. The global biostimulants market size was estimated at USD 3,167.9 million in 2025 and is expected to reach USD 3,396.6 million in 2026.

b. The global biostimulants market is expected to grow at a compound annual growth rate of 8.5% from 2026 to 2033 to reach USD 5,996.3 million by 2033.

b. Europe dominated the market with a revenue share of over 36.0% in 2025, due to strong regulatory support for sustainable agriculture and widespread adoption of biological crop inputs. Stringent restrictions on chemical fertilizers and pesticides, combined with high awareness among farmers, continue to drive consistent demand across major agricultural economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.