- Home

- »

- Medical Devices

- »

-

Bioresorbable Vascular Scaffold Market Size Report, 2030GVR Report cover

![Bioresorbable Vascular Scaffold Market Size, Share & Trends Report]()

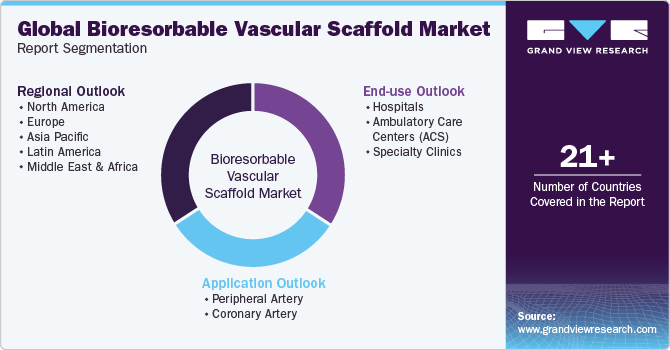

Bioresorbable Vascular Scaffold Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Peripheral Artery, Coronary Artery), By End-use ((Hospitals, Ambulatory Care Centers, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-313-5

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global bioresorbable vascular scaffold market size was estimated at USD 399.44 million in 2023 and is expected to expand at a CAGR of 8.7% from 2024 to 2030. The growth of the bioresorbable vascular scaffold (BVS) market is primarily driven by the increasing prevalence of cardiovascular diseases (CVDs) and the need for effective, minimally invasive treatments. Additionally, the expanding market is bolstered by the global aging population, which leads to a higher prevalence of cardiovascular diseases (CVDs). This demographic shift necessitates innovative solutions like BVSs, which can mitigate long-term complications associated with permanent implants.

According to a British Heart Foundation article, the world population in 2023 is 8 billion, with around 620 million people living with heart and circulatory diseases (CVDs) globally. This equates to approximately 1 in 13 people being affected by CVDs, with around 60 million new cases diagnosed each year. CVDs are responsible for around 1 in 3 deaths globally, accounting for an estimated 20.5 million deaths in 2021, or one death every 1.5 seconds. This trend is exacerbated by demographic shifts, including an aging population and lifestyle changes that contribute to the incidence of CVDs.

The market's growth is significantly driven by the increasing adoption of minimally invasive procedures, which align with the inherent advantages of bioresorbable vascular scaffolds (BVSs). These advantages include reduced invasiveness and a lower risk of complications than traditional surgical interventions. BVSs present multiple benefits over conventional metal stents, such as the ability to naturally degrade within the body, thereby reducing the need for subsequent surgeries.

Moreover, key manufacturers' technological advancements and investments in research and development (R&D) are crucial to expanding the bioresorbable vascular scaffold (BVS) market. Manufacturers actively develop innovative products and expand their portfolios through strategic partnerships and collaborations. This focus on innovation not only addresses the evolving needs of patients but also positions BVSs as a superior alternative to traditional metal stents, thereby enhancing their market appeal.

For instance, in September 2023, Zeus launched its next-generation tubing for BVSs, Absorb XSE-oriented tubing. This product offers a highly customizable platform for design and provides an alternative to metallic products implanted permanently in the human body. With such advancements, BVSs are becoming a more attractive option for patients and healthcare providers, as they offer improved patient outcomes and reduced long-term complications compared to traditional metal stents. As a result, the demand for BVSs is expected to continue to grow in the coming years, driven by technological advancements and a focus on innovation by key manufacturers.

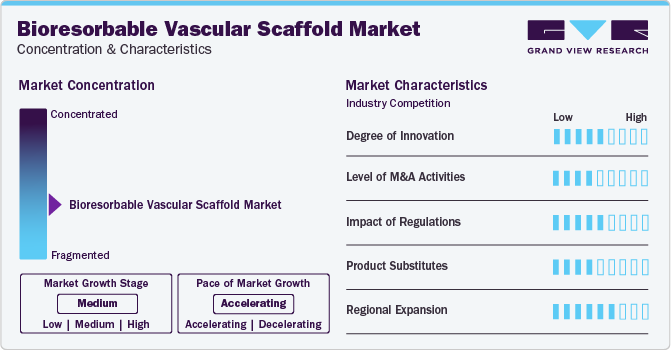

Market Concentration & Characteristics

The market is consolidated, with a few key players dominating the industry. This consolidation is due to rapid growth in the cardiovascular disease space, attracting significant investment from key players. Advancements in stent technology, such as drug-eluting stents (DES) and bioresorbable vascular scaffolds (BVS), have revolutionized patient outcomes by reducing restenosis rates and minimizing long-term complications. In May 2024, Abbott launched its XIENCE Sierra Everolimus Eluting Coronary Stent System for heart patients in India. This initiative reflects the ongoing commitment to improving cardiovascular care in regions with high CAD prevalence, demonstrating the strategic alignment of technological advancements with the pressing healthcare needs of the population.

The market is witnessing ongoing research and development activities to innovate and improve existing products. This is driven by technological innovations that continue to advance scaffold design and materials, enhancing efficacy and reducing long-term complications associated with permanent implants. The growing prevalence of cardiovascular diseases globally boosts market demand, as these conditions necessitate innovative treatments.

The market has recently seen a surge in merger and acquisition (M&A) activities, companies like REVA Medical, Elixir Medical, Arterius, Meril Life Sciences Pvt. Ltd., S3V Vascular Technologies, Zorion Medical, and Medtronic. These companies have focused on strengthening their positions in the industry through product launches, divestitures, mergers & acquisitions, and partnerships. Such strategic actions reflect the competitive nature of the market and the desire of these key players to expand their product portfolios, enter new markets, and secure a stronger foothold in the rapidly evolving bioresorbable vascular scaffold market.

The regulatory scenario in the market is complex and varies by region. This complexity arises from differing regulatory bodies and approval processes across continents, such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Health Canada, each with its regulations and requirements for medical device approval. Factors influencing this variability include the pace of innovation, the type of device, and the specific indications for use. For instance, the FDA's stringent premarket approval process contrasts with the EMA's more flexible approach, affecting how quickly new products can be introduced to the market.

Major market players are actively pursuing market expansion strategies. For instance, in March 2021, Meril Life Sciences marked a significant milestone by launching its indigenously researched and developed bioresorbable scaffold (BRS), MeRes100, in India. This launch represents a strategic move by the company to expand its market presence and capitalize on the growing interest in bioresorbable vascular scaffolds. MeRes100, a non-metallic, temporary mesh tube similar to stents, offers a novel approach to treating blocked arteries by dissolving over time post-procedure, aligning with the global trend towards less invasive and more patient-friendly cardiovascular treatments.

Application Insights

The coronary artery segment dominated the market and held the largest revenue share of over 84.59% in 2023. The widespread prevalence of coronary artery diseases (CAD), a leading cause of death globally, significantly drives the demand for stents, essential tools for revascularization procedures. According to a PCR Online article published in September 2023, Cardiovascular disease (CVD) remains the leading cause of death globally for both men and women.

Out of the 8 billion people in the world population in 2023, approximately 620 million are affected by heart and circulatory diseases worldwide. Additionally, as per the American College of Cardiology study December 2023, ischemic heart disease is the leading cause of global cardiovascular disease (CVD) mortality, with an age-standardized rate per 100,000 being 108.8 deaths.

Peripheral artery segment is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030. The global aging population, projected to reach 2.1 billion by 2050, is driving the expansion of the peripheral artery disease (PAD) devices market due to the higher incidence of PAD caused by age-related physiological changes such as arterial stiffness and atherosclerosis.

This demographic shift has created a need for specialized medical devices, and advancements in the field, such as Reva Medical's CE mark clearance for its Motiv bioresorbable scaffold for below-the-knee PAD treatment, are expected to drive the market growth further. As the first drug-eluting bioresorbable scaffold, Motiv not only meets the specific needs of PAD patients but also sets a precedent for future developments, demonstrating the industry's commitment to advancing patient care through technological advancements.

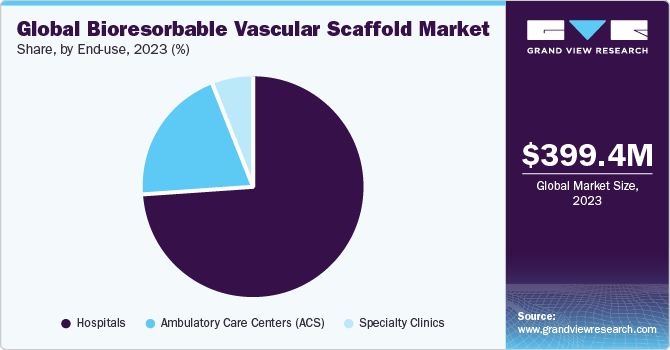

End-Use Insights

The hospital segment dominated the market and held the largest revenue share of over 74.21% in 2023. Hospitals play an important role in diagnosing and treating cardiovascular diseases, including placing bioresorbable vascular scaffolds (BVS). Hospitals possess the necessary infrastructure, including advanced imaging technologies and experienced medical staff, to perform complex procedures involving BVS. This segment's growth is further supported by the increasing prevalence of cardiovascular diseases globally, necessitating applications of improved cardiac care.

For instance, in May 2024, BM Birla Heart Hospital embraced technology with a digital-first initiative 'Enhanced Cardiac Care' programme. The hospital is taking a significant leap towards proactive healthcare by incorporating Dozee’s AI-driven contactless remote patient monitoring (RPM) and early warning system (EWS) into all ward beds. This move signifies a shift from reactive approaches to continuous monitoring aimed at early detection and management of clinical deterioration.

The ambulatory care centers (ACS) segment is expected to witness the fastest CAGR over the forecast period from 2024 to 2030. Ambulatory care centers are increasingly becoming integral to modern healthcare delivery, offering convenient and efficient medical services outside of traditional hospital settings. This shift aligns with the growing trend towards outpatient care, driven by factors such as cost-effectiveness, patient preference for less invasive treatments, and advancements in medical technology.

Additionally, the increasing adoption of minimally invasive procedures in ambulatory care settings further enhances the appeal of bioresorbable vascular scaffolds, as they align with the ethos of patient-centered, less disruptive interventions. As ambulatory care centers continue to play a pivotal role in shaping the future of healthcare delivery, their integration with innovative medical technologies like bioresorbable vascular scaffolds is poised to drive further advancements in patient care and outcomes.

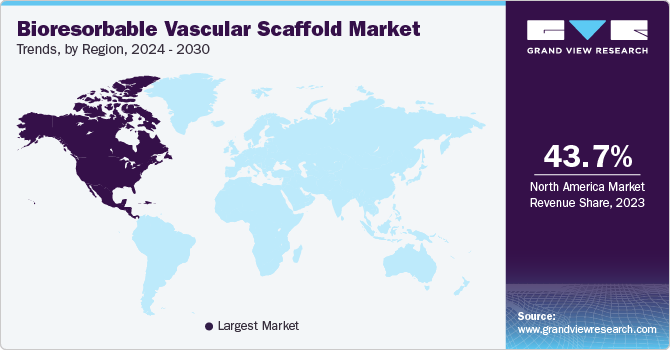

Regional Insights

The bioresorbable vascular scaffold market in North America held the largest revenue share of 43.69% in 2023. The growth is attributed to the region's advanced healthcare infrastructure and growing medical technology & innovation. Moreover, the combination of these technologies and the substantial burden of cardiovascular disease provides a favorable environment for the adoption and advancement of bioresorbable vascular scaffolds. For instance, the U.S. Food and Drug Administration's approval in April 2024 of an everolimus-eluting bioresorbable scaffold (Esprit BTK) for patients with below-the-knee (BTK) infrapopliteal disease. This approval, announced by manufacturer Abbott, marks a significant milestone in treating peripheral artery diseases, showcasing the industry's commitment to advancing patient care through technological innovation and addressing the unmet needs of patients with BTK disease.

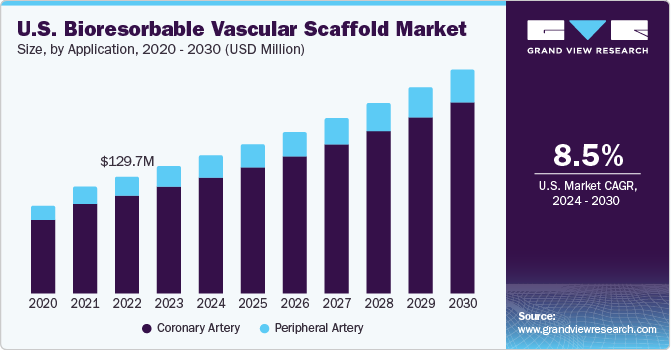

U.S. Bioresorbable Vascular Scaffold Market Trends

The U.S. bioresorbable vascular scaffold market dominated with a revenue share of 81.0% in 2023 due to its advanced healthcare infrastructure capable of swiftly adopting and implementing cutting-edge medical technologies. This infrastructure supports the rapid integration of bioresorbable vascular scaffolds into clinical practice, facilitating their widespread use. Secondly, the high prevalence of cardiovascular diseases in the U.S., coupled with a rapidly aging population, significantly increases the demand for innovative treatments like bioresorbable vascular scaffolds.

Europe Bioresorbable Vascular Scaffold Market Trends

The bioresorbable vascular scaffold market in Europe is expected to witness the fastest CAGR of 9.0% from 2024 to 2030 due to the rising prevalence of risk factors such as diabetes, obesity, and an aging population significantly contributing to Europe's demand for bioresorbable vascular scaffolds. These conditions increase the incidence of cardiovascular diseases, necessitating innovative treatments like bioresorbable vascular scaffolds. Furthermore, technological advancements in the bioresorbable vascular scaffold (BVS) sector and a robust product pipeline are fostering market growth. For instance, R3 Vascular's MAGNITUDE, the thinnest bioresorbable scaffold created to date, showcases the industry's commitment to developing cutting-edge solutions that address the evolving needs of patients and healthcare providers.

Germany bioresorbable vascular scaffold market held the largest market share of 21.41% in 2023. Europe, where the market is highly competitive and characterized by significant investments in research & development activities. Key manufacturers, including Abbott, Kyoto Medical, Biotronik, Elixir Medical, and others, are actively involved in developing innovative products and expanding their product portfolios to cater to the growing demand for bioresorbable vascular scaffolds. The high prevalence of cardiovascular diseases and the rise in adoption of minimally invasive procedures, coupled with Germany's advanced healthcare infrastructure and strong regulatory framework, have contributed to the robust performance of the German market.

The bioresorbable vascular scaffold market in UK dominated the market in 2023. The UK has a strong healthcare infrastructure and a strong emphasis on research and development in medical technology, creating a conducive environment for the adoption and development of innovative treatments like bioresorbable vascular scaffolds. Secondly, the high prevalence of cardiovascular diseases in the UK, coupled with a rapidly aging population, significantly increases the demand for such treatments. The UK's National Health Service (NHS) has been proactive in incorporating new technologies into its service delivery, including bioresorbable vascular scaffolds for patients undergoing percutaneous coronary interventions.

Asia Pacific Bioresorbable Vascular Scaffold Market Trends

The Asia Pacificbioresorbable vascular scaffold market is expected to witness lucrative growth during the forecast period. This growth is driven by a rise in the prevalence of cardiovascular diseases, increased demand for minimally invasive procedures, and advancements in healthcare infrastructure. Countries like Japan and South Korea are emerging as major exporters from the region, benefiting from their technologically advanced production processes. Additionally, the market's growth is supported by the investment in research & development activities by key manufacturers focused on developing innovative products and expanding their product portfolios. Strategic partnerships and collaborations also play a crucial role in expanding market presence.

The bioresorbable vascular scaffold market in China held the largest revenue market share of 22.91% in 2023 due to the country's burgeoning healthcare sector, rapid economic growth, and increasing prevalence of cardiovascular diseases. China's healthcare infrastructure has seen significant improvements, with a growing emphasis on adopting advanced medical technologies. This has created a favorable environment for introducing and accepting bioresorbable vascular scaffolds, which offer a promising alternative to traditional metal stents. The Chinese government's efforts to modernize the healthcare system and the rising demand for minimally invasive procedures have further propelled the market's growth. Additionally, the active participation of local and international manufacturers in research and development activities aimed at tailoring products to meet the specific needs of the Chinese population has contributed to the market's success.

The Japan bioresorbable vascular scaffold market held the second-largest market share in Asia. This is due to the country's advanced healthcare system, high disposable income, and increased awareness of minimally invasive procedures. Furthermore, the Japanese government's support for medical innovation and the presence of prominent market players in the region contribute to the market's growth.

The bioresorbable vascular scaffold market in India is anticipated to witness the second-highest CAGR of 9.4% during the forecast period. This is due to the increasing prevalence of cardiovascular diseases, a growing elderly population, and the rising demand for minimally invasive treatments. Additionally, advancements in medical technology, government initiatives to improve healthcare infrastructure, and the expanding medical tourism industry in India contribute to the market's expansion.

Latin America Bioresorbable Vascular Scaffold Market Trends

The Latin America bioresorbable vascular scaffold market is expected to witness lucrative growth during the forecast period. The increasing prevalence of cardiovascular diseases in the region drives the demand for minimally invasive treatments, such as bioresorbable vascular scaffolds. Secondly, the region's aging population and growing awareness of advanced medical technologies contribute to the market's expansion. Developing innovative products and strategic partnerships among key manufacturers further fuel the market's growth.

The bioresorbable vascular scaffold market in Brazil is expected to grow due to a rise in cardiovascular diseases, increased adoption of minimally invasive procedures, and advancements in medical technology. This growth is driven by the benefits of bioresorbable scaffolds, which dissolve over time, allowing the natural healing of vessels. However, challenges like high costs and the need for skilled professionals may hinder market expansion. In Brazil specifically, the market is expected to grow in response to the increasing prevalence of cardiovascular diseases and the demand for innovative treatment options like bioresorbable vascular scaffolds.

MEA Bioresorbable Vascular Scaffold Market Trends

The MEA bioresorbable vascular scaffold market is expected to grow lucratively due to the rising adoption of minimally invasive procedures and advancements in medical technology. This growth is further fuelled by the region's focus on developing sustainable and environmentally friendly solutions, driving the demand for bioresorbable vascular scaffolds across various industries. Additionally, the market expansion is supported by the growing demand for bio-based components and the development of innovative scaffolds to address cardiovascular disorders in the region.

The bioresorbable vascular scaffold market in South Africa held the largest revenue market share during 2023. This is due to the increasing prevalence of cardiovascular diseases in the region, the growing adoption of minimally invasive procedures, and the rising demand for advanced medical technologies. This market dominance reflects the region's focus on innovative treatment options and the development of sustainable healthcare solutions, driving the demand for bioresorbable vascular scaffolds to address cardiovascular disorders effectively.

Key Bioresorbable Vascular Scaffold Company Insights

The market is experiencing substantial expansion, propelled by key companies broadening their product lines and incorporating cutting-edge technologies to secure a larger market presence and engage a broader audience. In September 2023, Zeus launched next-generation tubing for bioresorbable vascular scaffolds to prevent oral care product packaging from ending up in landfills and reduce plastic pollution. This initiative showcases the industry's commitment to sustainability and innovation, further fuelling the market's expansion.

Key Bioresorbable Vascular Scaffold Companies:

The following are the leading companies in the bioresorbable vascular scaffold market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Kyoto Medical

- Biotronik

- Elixir Medical (MedImpact Healthcare Systems, Inc.)

- C. R. Bard, Inc. (Becton, Dickinson and Company)

- Teleflex Incorporated

- B. Braun Melsungen AG

- Medtronic

- Argon Medical Devices, Inc (Shandong Weigao Group Medical Polymer Co. Ltd.)

Recent Developments

-

In April 2024, the FDA granted approval to Abbott's Esprit BTK, an everolimus-eluting bioresorbable scaffold, for treating patients with below-the-knee (BTK) infrapopliteal disease. This marks the first dedicated device authorized by the FDA for BTK lesions, with the approval based on results from the LIFE-BTK study demonstrating reduced risks of amputation, vessel occlusion, revascularization, and restenosis compared to conventional angioplasty.

-

In February 2024, MedImpact Healthcare Systems, Inc. announced the acquisition of Elixir Solutions. The acquisition is aimed to enhance the company’s range of clinical, technological, health risk management, and consumer empowerment capabilities.

-

In February 2024, BIOTRONIK received CE approval for its next-generation metallic bioresorbable scaffold, Freesolve. This approval marks a significant milestone in the development of innovative cardiovascular treatments. It enables the commercialization of Freesolve in the European market, offering a new option for patients requiring coronary artery interventions.

Bioresorbable Vascular Scaffold Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 433.59 million

Revenue forecast in 2030

USD 715.09 million

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Kyoto Medical; Biotronik; Elixir Medical; C. R. Bard, Inc.; Teleflex Incorporated; B. Braun Melsungen AG; Medtronic Plc; Argon Medical Devices, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioresorbable Vascular Scaffold Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioresorbable vascular scaffold market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Artery

-

Coronary Artery

-

-

End-use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers (ACS)

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioresorbable vascular scaffold market size was estimated at USD 399.44 million in 2023 and is expected to reach USD 433.59 million in 2024.

b. The global bioresorbable vascular scaffold market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 715.09 million by 2030.

b. North America held the largest revenue share of 43.69% in 2023. The growth is attributed to the region's advanced healthcare infrastructure and growing medical technology & innovation. Moreover, the combination of these technologies and the substantial burden of cardiovascular disease, provides a favourable environment for the adoption and advancement of bioresorbable vascular scaffolds.

b. Some of the key players operating in the bioresorbable vascular scaffold market are Abbott, Kyoto Medical, Biotronik, Elixir Medical, C. R. Bard, Inc., Teleflex Incorporated, B. Braun Melsungen AG, Medtronic Plc, Argon Medical Devices, Inc, among others.

b. The growth of the bioresorbable vascular scaffold market is primarily driven by the increasing prevalence of cardiovascular diseases (CVDs) and the need for effective, minimally invasive treatments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.