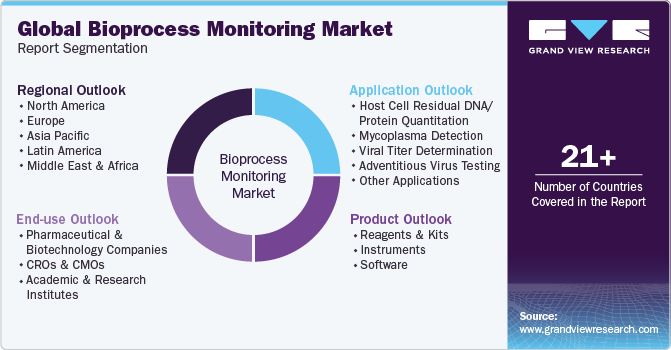

Bioprocess Monitoring Market Size, Share & Trends Analysis Report By Product (Reagents & Kits, Instruments, Software), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Bioprocess Monitoring Market Size & Trends

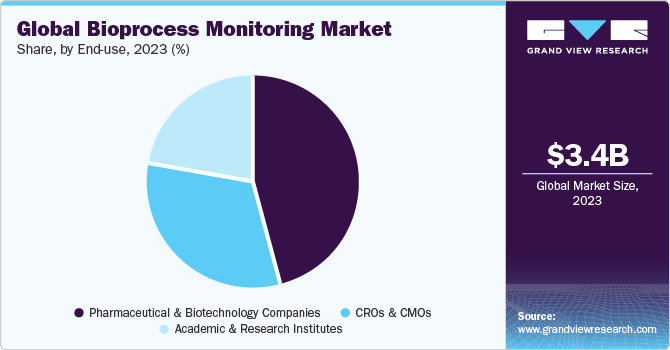

The global bioprocess monitoring market size was estimated at USD 3.36 billion in 2023 and is projected to grow at a CAGR of 9.45% from 2024 to 2030. There are a number of interrelated variables that are driving the market growth. More accurate and trustworthy bioprocess monitoring instruments are required as the market for cutting-edge and effective biopharmaceutical products such as vaccines, recombinant proteins, and monoclonal antibodies continues to grow.

These goods are essential for improving public health and treating a range of medical issues. Moreover, it is anticipated that the growing number of alliances and collaborations among industry participants will support market expansion. For instance, Beckman Coulter Life Sciences and Flownamics established a strategic alliance in August 2022 with the goal of creating a cutting-edge, automated solution for the real-time monitoring and management of bioprocess cultures. This collaboration combines Vi-CELL BLU Cell Viability Analyzer with Flownamics' Seg-Flow S3 Automated On-Line, aiming to enhance the efficiency and accuracy of bioprocess monitoring.

There are a number of reasons for the market expansion for bioprocess monitoring, but one of the main ones is the notable rise in capital expenditures made by pharmaceutical companies for the creation and manufacturing of biologics. The ability of biologics to treat a wide range of illnesses and enhance public health has made them more well-known in recent years. For instance, in January 2024, the multinational biopharmaceutical giant AbbVie invested USD 223 million in its Singapore manufacturing location to improve its biologics manufacturing capabilities. Pharmaceutical companies are making significant investments in R&D, manufacturing capacity, and regulatory compliance to bring these biologics to market as they work to create novel treatments.

In addition, government programs and financial support for biotechnology research have been crucial in promoting creativity and expansion in the bioprocess monitoring industry. The creation of cutting-edge technologies and their commercialization are the results of partnerships between government, business, and academia.

The biotechnology industry's boom in research and development (R&D) has greatly contributed to the market expansion for bioprocess monitoring. The development of cutting-edge tools and methods brought about by this surge in investment and creativity has completely changed how bioprocesses are observed and managed. The market for bioprocess monitoring is now growing quickly because of the sophisticated instruments and techniques that make it possible to measure several parameters precisely and efficiently while biological products are being produced.

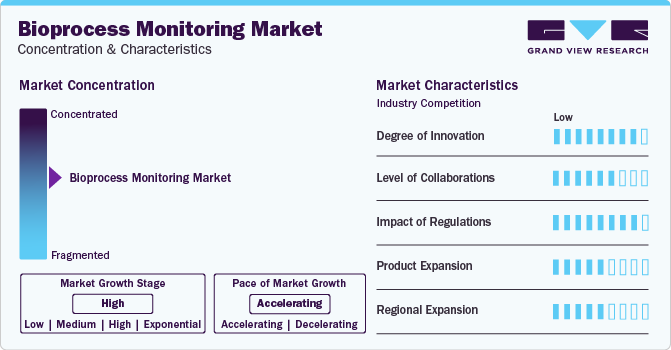

Market Concentration & Characteristics

The market has a very high level of innovation due to ongoing technological breakthroughs, the growing need for tailored medication, and mounting regulatory pressure. Ensuring product quality, safety, and consistency throughout the biopharmaceutical manufacturing process is contingent upon this innovation. For instance, QIAGEN, a provider of test technology and materials, added 13 new kits and assays to its QIAcuity PCR offering in July 2022. These cutting-edge devices make it easier to quantify leftover host cell DNA in cells and the viral titer of the Adeno-Associated Virus with greater accuracy.

Partnerships and collaborations are rather common in this market as different players pool their resources to create novel solutions and raise the general effectiveness and caliber of bioprocesses. Several parties collaborated on this project, including biopharmaceutical companies, academic institutions, research centers, and technology providers. For instance, Maravai Life Sciences and its biotech partners announced a strategic merger in March 2020. The cooperation will provide researchers and biotech partners with a wide range of solutions by combining MockV Solutions' proficiency in producing viral antigens with Maravai Life Sciences' broad range of life science reagents and services.

Since regulations guarantee the efficacy, safety, and quality of biopharmaceutical products, they have a substantial influence on the bioprocess monitoring industry. The market is affected by these regulations in a number of ways, such as product development, adoption of new technologies, and overall market growth.

The market is expanding due to ongoing technological developments, the rising need for precise and effective monitoring systems, and improved process control and optimization. The bioprocessing industry is witnessing the development of novel products such as sophisticated sensors, software, and analytical tools that enhance the overall quality and efficiency of bioprocesses. For instance, in October 2023, the US Pharmacopeia (USP) and the American Type Culture Collection (ATCC) established a new partnership to develop a range of cooperative solutions targeted at enhancing the quality control of vaccines and biological medicines. Through this collaboration, they have unveiled six cutting-edge products, all of which are centered on the identification and quantification of remaining host cell DNA.

Due to the growing need for cutting-edge technologies and solutions to guarantee the effectiveness, safety, and quality of biopharmaceutical production, the market is expanding significantly on a regional scale. This expansion is seen in a number of geographic locations as producers and academic institutions work to enhance their operations and keep a competitive advantage in the global market.

Product Insights

Based on product, the market is segmented into reagents & kits, instruments, and software. The reagents & kits segment led the market with the largest revenue share of 70.31% in 2023, due to several key factors. Firstly, reagents and kits are necessary for a lot of analytical techniques and bioprocess monitoring studies. They are essential for the identification, assessment, and analysis of critical variables such as protein concentration, metabolite levels, and cell viability. Ensuring product quality, complying with regulations, and optimizing bioprocesses all depend on this data. In addition, the market for bioprocess monitoring reagents and kits has seen a surge in demand because of the biotechnology sector's increased focus on R&D. In July 2023, for instance, QIAGEN and Niba Labs teamed to provide digital PCR test design solutions that are specifically tailored for biopharmaceutical firms. Due to this partnership, the CGT Viral Kit was created, which streamlines the process from cell lysates to accurate and trustworthy viral quantification.

The software segment is expected to register at the fastest CAGR over the forecast period. The software segment has experienced significant market growth due to several factors. The growing understanding of the significance of data management, analysis, and interpretation in bioprocesses is one of the main causes. Large volumes of data created during bioprocess monitoring can be captured, organized, and processed with the use of powerful tools provided by advanced software systems. These resources help researchers and producers get important insights, make wise decisions, and more successfully optimize their processes. For instance, Waters Corporation plans to introduce a number of cutting-edge walk-up solutions in September 2023. The core of these solutions will be the Waters OneLab software, which unifies the Waters BioAccord LC-MS equipment, Andrew+ robot, and upstream bioreactors seamlessly. These systems' main objective is to automate repetitive operations related to product quality assessment, hence improving their usability and efficiency for the biopharmaceutical business.

Application Insights

Based on application, the market is segmented into host cell residual DNA/protein quantitation, mycoplasma detection, viral titer determination, adventitious virus testing, and other applications. The host cell residual DNA/protein quantitation segment led the market with the largest revenue share of 30.87% in 2023. The need for precise evaluation and control of host cell impurities in the manufacturing of biopharmaceuticals is driving this expansion. Advanced quantitation technologies are becoming more and more popular because of strict regulations and increased focus on product quality assurance. Furthermore, industry cooperation is essential to the expansion of the host cell residual DNA/protein quantification market. For instance, in July 2021, Cygnus Technologies, a division of Maravai LifeSciences, and Gyros Protein Technologies, a Swedish pioneer in automated nanoliter-scale immunoassays, announced an extension of their collaboration. An important turning point in their combined efforts was the introduction of an enhanced HEK 293 HCP immunoassay solution as a consequence of their collaboration. In response to industry needs, the host cell residual DNA/protein quantitation segment is expected to grow at a steady CAGR during the forecast period, due to the growing biopharmaceutical sector and growing investments in bioprocessing.

The mycoplasma detection segment is expected to register at the fastest CAGR over the forecast period, fueled by heightened awareness of contamination risks in biopharmaceutical production. Companies are responding by launching new products tailored to this demand. For instance, in October 2022, Cambridge Molecular Diagnostics Limited unveiled a novel lateral flow test designed to detect Mycoplasma contamination rapidly. This innovative test is quick and simple to apply, yielding accurate findings in a couple of minutes. It uses an improved PCR technique. PCR-based testing and advanced culture methods are two examples of recent technological advancements that are increasing the sensitivity and accuracy of mycoplasma detection. The mycoplasma detection market will continue to rise as a result of these advancements, which could enhance bioprocessing workflows and ensure product safety.

End-use Insights

Based on end-use, the market is segmented into CMOs & CROs, pharmaceutical & biotechnology companies, and academic & research institutes. The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 46.90% in 2023. This is due to the growing demand for individualized medications, the increased emphasis on research and development for the creation of innovative therapeutics, and developments in bioprocessing monitoring. For instance, Merck and Agilent Technologies established a strategic alliance in June 2022. The alliance seeks to close the current downstream processing gap in Process Analytical Technologies (PAT). They are going to enable real-time release and encourage the adoption of Bioprocessing 4.0 by pooling their knowledge and resources. Through this partnership, Merck will be able to offer comprehensive solutions for effective downstream process monitoring and control, which will ultimately improve the overall effectiveness and caliber of biopharmaceutical production.

The CROs & CMOs segment is expected to grow at the fastest CAGR over the forecast period, due to the increasing outsourcing of research and manufacturing activities by pharmaceutical and biotechnology companies. These companies strive to be efficient and cost-effective while offering their customers high-quality services. In addition, the incorporation of state-of-the-art bioprocess monitoring technologies, such as Process Analytical Technologies (PAT) and real-time release testing, enables CROs and CMOs to provide their customers with more extensive services. Real-time data collecting, analysis, and decision-making are made possible by these technologies, which eventually leads to better product quality and shorter development times.

The development of complicated biologics and the increasing emphasis on customized medicine have also increased demand for sophisticated bioprocess monitoring systems. CROs and CMOs are essential in tackling these issues since they use their knowledge and resources to promote the expansion of the biopharmaceutical sector. Therefore, it is anticipated that the CROs & CMOs segment will keep growing strongly in the global market.

Regional Insights

North America dominated the bioprocess monitoring market with the largest revenue share of 43.24% in 2023, driven by rising demand for advanced technology, increasing regulatory compliance, and a focus on improving product quality. The biopharmaceutical industry's expansion, increased R&D spending, and the rise in chronic illness prevalence are major drivers of this growth. To accommodate the growing need for state-of-the-art biotechnology solutions, Cytiva and Pall Corporation, for instance, announced a combined investment of USD 1.5 billion over two years in July 2021. New factories focused on producing bioprocessing equipment will be opened across the U.S. as part of this initiative. Market growth is also being fueled by the area's well-established healthcare system and robust government funding for life sciences programs.

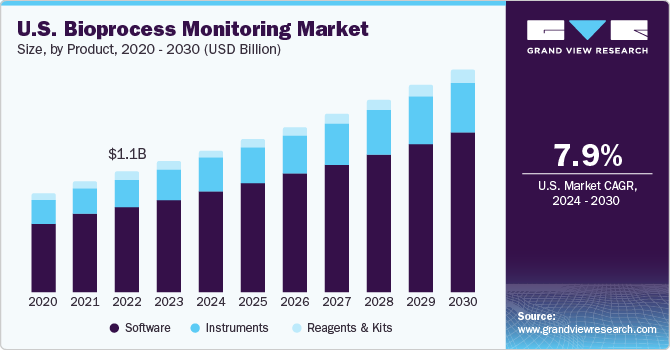

U.S. Bioprocess Monitoring Market Trends

The bioprocess monitoring market in the U.S. is expected to grow at the fastest CAGR over the forecast period, due to the presence of a large number of market players in the U.S., undergoing various strategic initiatives such as collaborations and partnerships. For instance, in February 2024, Dyadic International Inc., a U.S based company, and Cygnus Technologies, formed a strategic partnership to develop the C1-cells filamentous fungus Thermothelomyces heterothallic a for the quantification of Host Cell Proteins (HCP).

Europe Bioprocess Monitoring Market Trends

The bioprocess monitoring market in the Europe is expected to grow at the fastest CAGR over the forecast period. Evolving regulatory frameworks and increasing focus on bioprocess monitoring contribute to the market growth in Europe, fostering innovation and efficiency in the industry. For instance, in March 2024, the European Union (EU) is set to unveil plans for streamlining biotechnology regulation. EU policymakers are currently evaluating the introduction of new legislation aimed at accelerating the market entry of innovative biotech products, thereby fostering growth and competitiveness in the sector.

The UK bioprocess monitoring market held a significant share in 2023. The market growth of bioprocess monitoring in the UK can be attributed to the presence of local market players such asAppleton Woods Ltd, GeneFlow, and Fisher UK, who contribute to the development and innovation of monitoring devices, kits, and reagents. These companies not only cater to domestic demand but also expand their reach to international markets.

The bioprocess monitoring market in France is experiencing growth due to increased investments in R&D by various companies. This growth can be attributed to several factors, such as the rising demand for advanced technologies and innovative solutions in the bioprocessing industry. For instance, in June 2020, Sanofi, a French pharmaceutical company, invested over USD 500 million to establish a cutting-edge vaccine manufacturing facility in Neuville sur Saône and a brand-new research center in Marcy-l'Etoile. Both facilities are specifically dedicated to advancing vaccine development and production in France.

The Germany bioprocess monitoring market is witnessing growth due to significant technological advancements in the field. These innovations enable more efficient and accurate monitoring of bioprocesses, leading to improved product quality and increased productivity.

Asia Pacific Bioprocess Monitoring Market Trends

The bioprocess monitoring market in Asia Pacificis expected to grow at the fastest CAGR of 12.02% over the forecast period. This upsurge is attributed to the growing biotechnology & pharmaceutical sectors within the region, propelled by factors such as heightened healthcare spending and the expansion of research & development activities. As companies in these sectors are seeking to strengthen their capabilities in drug discovery, personalized medicine, and diagnostics, there is an increasing demand for cutting-edge technologies.

The China bioprocess monitoring market is expected to grow at the fastest CAGR over the forecast period can be attributed to the surge in biopharmaceutical and bioprocessing companies across the country. This expansion creates a heightened demand for advanced monitoring technologies, ensuring optimal process efficiency and product quality, ultimately contributing to the overall market growth. For instance, in November 2023, Asahi Kasei Medical officially inaugurated the Asahi Kasei (China) Bioprocess Technical Center in Jiangsu, China. As part of Asahi Kasei Medical's bioprocess division, the center focuses on offering a comprehensive range of products and services related to bioprocessing, such as biotherapeutic manufacturing, biosafety testing, and contract development and manufacturing organization (CDMO) operations.

The bioprocess monitoring market in Japan is witnessing rapid growth due to the presence of several pharmaceutical & biotechnology companies and the growing demand for preventive healthcare is anticipated to boost the demand for bioprocess monitoring for various research and clinical purposes.

Middle East & Africa Bioprocess Monitoring Market Trends

The bioprocess monitoring market in Middle East & Africais witnessing significant growth, driven by the increasing focus on biopharmaceutical research and development in the region. The rising demand for advanced monitoring systems in bioprocessing facilities is fueled by the need to maintain process efficiency, product quality, and compliance with regulatory standards. Furthermore, collaborations between local and international players, as well as government initiatives to boost the biotechnology sector, are expected to contribute to the continued expansion of the market in the coming years.

The Saudi Arabia bioprocess monitoring market is expected to grow at the fastest CAGR over the forecast period. In June 2023, The Public Investment Fund (PIF) will introduce Lifera, a commercial-scale Contract Development and Manufacturing Organization (CDMO), as part of its efforts to bolster Saudi Arabia's local biopharmaceutical industry. This strategic move aims to enhance the nation's capabilities in drug development, manufacturing, and overall contribution to the global healthcare sector.

The bioprocess monitoring market in Kuwait is anticipated to grow at the significant CAGR over the forecast period, owing to the increasing healthcare expenditure to improve healthcare infrastructure, services, and technology adoption.

Key Bioprocess Monitoring Company Insights

The market players operating in the global market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Bioprocess Monitoring Companies:

The following are the leading companies in the bioprocess monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- QIAGEN

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Bio-Rad Laboratories, Inc.

- Bio-Techne

- Enzo Life Sciences, Inc.,

- Maravai LifeSciences.

- Lonza

- Applied Biological Materials Inc.

Recent Developments

-

In February 2024, Dyadic International Inc. and Cygnus Technologies, a subsidiary of Maravai LifeSciences, formed a strategic alliance. The partnership focuses on measuring Host Cell Proteins from the exclusive and patent-protected C1-cells, which are derived from the filamentous fungus Thermothelomyces heterothallica

-

In October 2023, the US Pharmacopeia (USP) announced a new collaboration with the American Type Culture Collection (ATCC) to develop a suite of joint products aimed at improving the quality control of biological therapies and vaccines. As a result of this partnership, they have introduced six innovative products, which primarily focus on the detection and measurement of residual host cell DNA

-

In July 2023, QIAGEN collaborated with Niba Labs to provide tailored digital PCR assay design solutions for biopharmaceutical clients. This partnership caused the introduction of the CGT Viral Kit, which streamlines the process from cell lysates to accurate and precise quantification of viral titers

-

In October 2022, Bio-Techne Corporation and PROGEN introduced three new Simple Plex Adeno-Associated Virus (AAV) viral titer assays, specifically designed to accurately measure intact AAV capsid quantities

Bioprocess Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.66 billion |

|

Revenue forecast in 2030 |

USD 6.29 billion |

|

Growth rate |

CAGR of 9.45% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific Inc.; QIAGEN; Merck KGaA; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Bio-Techne; Enzo Life Sciences, Inc.,; Maravai LifeSciences.; Lonza ; Applied Biological Materials Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bioprocess Monitoring Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global bioprocess monitoring market based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

Instruments

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Host Cell Residual DNA/Protein Quantitation

-

Mycoplasma Detection

-

Viral Titer Determination

-

Adventitious Virus Testing

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bioprocess monitoring market size was estimated at USD 3.36 billion in 2023 and is expected to reach USD 3.66 billion in 2024.

b. The global bioprocess monitoring market is expected to grow at a compound annual growth rate of 9.45% from 2024 to 2030 to reach USD 6.29 billion by 2030.

b. The reagents & kits segment dominated the market in 2023. Reagents and kits are necessary for a lot of analytical techniques and bioprocess monitoring studies. They are essential for the identification, assessment, and analysis of critical variables such as protein concentration, metabolite levels, and cell viability.

b. The key players in bioprocess monitoring market include Thermo Fisher Scientific Inc.; QIAGEN; Merck KGaA; F. Hoffmann-La Roche Ltd; Bio-Rad Laboratories, Inc.; Bio-Techne; Enzo Life Sciences, Inc.,; Maravai LifeSciences.; Lonza ; Applied Biological Materials Inc.

b. The rise in capital expenditures made by pharmaceutical companies for the creation and manufacturing of biologics, and the growing number of alliances and collaborations among industry participants are some of the factors driving the market expansion

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."