Biopharmaceuticals Manufacturing Consumables Testing Market Size, Share & Trends Analysis Report By Service (Laboratory Testing, Custom Testing), By Raw Material (Formulation Excipients, API), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-398-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

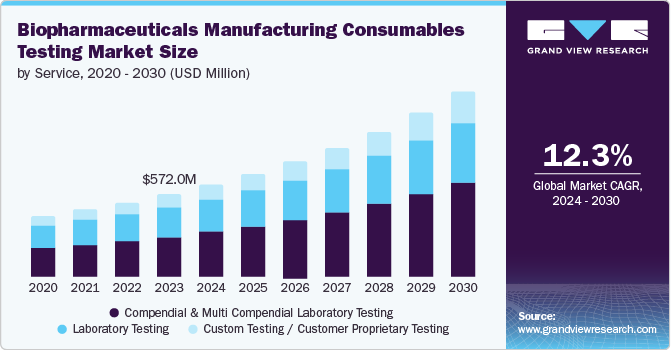

The global biopharmaceutical manufacturing consumables testing market size was valued at USD 636.5 million in 2024 and is projected to grow at a CAGR of 12.4% from 2025 to 2030. Successful and efficient biopharmaceutical manufacturing is largely dependent on the purity and quality of consumables used during production. With growing issues about the quality of novel therapeutics, such as poor solubility, increase in molecular sizes, and poor absorption properties, there is a rise in focus on exploring the various attributes of excipients and other raw materials.

Biopharmaceutical manufacturing consumables testing refers to the process of evaluating the quality and performance of materials used in the production of biopharmaceuticals, such as bioreactors, filtration systems, and chromatography columns. As the prevalence of chronic diseases such as cancer, autoimmune diseases, and neurological disorders increases, the demand for biopharmaceuticals grows, driven by their higher efficacy and specificity compared to traditional medications. Consequently, the healthcare industry is increasingly adopting biopharmaceuticals.

Quality standards have gradually evolved to support biologics production. Constant improvement in regulatory standards for biologic production also encompasses using proper raw materials and their qualification assessment. Characterization of raw materials by vendors in co-operation and collaboration with players in the pharma and biopharmaceutical industry helps address issues associated with the manufacturing process, thereby facilitating the rapid launch of the final product in the market. These issues include the quality-by-design and bioavailability of products.

Furthermore, the continuous introduction of new technologies and advancements in existing technologies for efficient large molecule production are key drivers of this market. While some advancements are solely focused on biopharmaceutical production, the industry is also witnessing technological innovations supporting thorough quality check-based processing, from raw materials to finished drugs.

Effective testing and quality control of biopharmaceuticals manufacturing consumables is crucial because these materials significantly impact the final product's quality and safety. Moreover, the trend toward personalized medicine, which involves tailoring treatments to individual genetic profiles, necessitates using specialized biopharmaceuticals. Similarly, the rise of biosimilars, which requires extensive testing to ensure safety and efficacy, also drives the demand for high-quality consumables testing.

Service Insights

The compendial and multicompendial laboratory testing segment dominated the market and accounted for the largest market share of 49.0% in 2024. This growth can be attributed to numerous providers offering services that are compliant with various compendia. The presence of region-specific pharmacopeias compels companies to perform full-monograph testing, which has been observed to be expensive, contributing to the high revenue of this segment.

The custom testing/customer proprietary testing segment is expected to grow at the fastest CAGR of 13.6% over the forecast period, owing to relatively fewer services in this segment. In addition, as biopharmaceuticals become more specialized, manufacturers require customized testing protocols to ensure product integrity and compliance with unique specifications. This demand is further amplified by adopting personalized medicine and biosimilars, necessitating highly specialized consumables testing. Moreover, changing customer requirements and the need for specific analysis for excipients are expected to lend this segment a much-needed boost in the coming years.

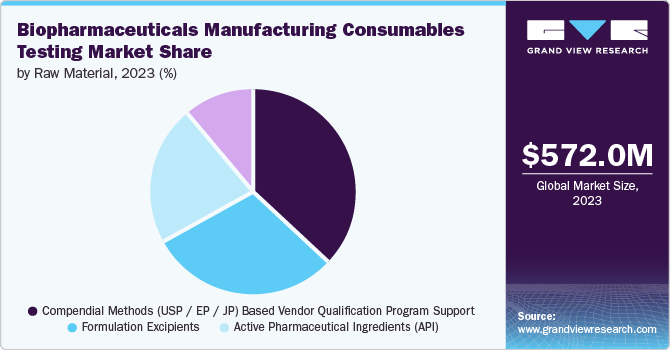

Raw Material Insights

The active pharmaceutical ingredients (API) segment dominated the global biopharmaceuticals manufacturing consumables testing industry with the highest revenue share of 58.7% in 2024. APIs are often mixed with excipients, also known as additives, to enhance the absorption, stability, and solution of the drugs. The use of API provides therapeutic advantages; drug products include several elements, such as coatings, to aid in delivery, patient adherence, and stability. According to PhRMA Org, the U.S. manufactured 53% of the USD 85.6 billion worth of APIs used in medicines consumed in 2021. The collaboration between API and drug consumables helps effectively to meet healthcare demands and improve patient results.

The compendial methods (USP / EP / JP) based vendor qualification program support segment is expected to register the fastest CAGR of 14.2% from 2025 to 2030. This growth can be attribute to the need for standardized testing protocols and compliance with international pharmacopeia standards such as USP, EP, and JP. These methods ensure reproducibility and reliability, reducing regulatory risks. Compendial methods are often optimized and validated, providing the most accurate and précised result. It involves using set standards in pharmacopeia to evaluate raw materials. The utilization of USP standards allows hospitals to work with assurance and minimal chances of inaccurate outcomes.

Regional Insights

North America biopharmaceuticals manufacturing consumables testing market dominated the global market and accounted for the largest revenue share of 35.4% in 2024, owing to a substantial number of biopharmaceutical manufacturing facilities in the region. In addition, the continuous development in the research and development industry is driving the demand for testing of consumables and making the region a global hub for the biopharmaceutical manufacturing industry. Furthermore, strategic acquisitions and investments in analytical equipment enhance testing capacities and contribute to market dominance.

U.S. Biopharmaceuticals Manufacturing Consumables Testing Market Trends

The biopharmaceuticals manufacturing consumables testing market in the U.S. dominated the North America market and accounted for the largest revenue share in 2024, driven by the development of advanced analytical equipment and methods, which leads to improvement in precise assessment of goods and testing capacities. In addition, the presence of key players, including major pharmaceutical companies, also drives market growth. Furthermore, the U.S. offers a favorable regulatory environment that encourages investment in consumables testing.

Asia Pacific Biopharmaceuticals Manufacturing Consumables Testing Market Trends

APAC biopharmaceuticals manufacturing consumables testing market is expected to grow at a CAGR of 13.3% over the forecast period, owing to growing patient population, rising prevalence of chronic diseases, and rising R&D investments. In addition, the region provides a strong edge in terms of labor competitiveness when compared to other countries. Furthermore, competitive labor costs attract biopharmaceutical manufacturing, driving demand for consumables testing. Moreover, the increasing focus on quality control and regulatory compliance further boosts demand.

The biopharmaceuticals manufacturing consumables testing market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by government support for biotechnology and a growing domestic market. In addition, increased focus on quality control and regulatory compliance boosts demand for consumables testing. Furthermore, this supports the development of biopharmaceuticals and encourages foreign investment in the sector. China's large patient population also fuels the need for reliable biopharmaceuticals, driving market expansion.

Europe Biopharmaceuticals Manufacturing Consumables Testing Market Trends

The Europe biopharmaceuticals manufacturing consumables testing market is expected to grow significantly over the forecast period, due to the strong establishment of biopharmaceutical sector including leading global pharmaceutical companies such as AstraZeneca, Novartis, and others. Furthermore, the region's stringent regulatory environment ensures high standards for testing, which in turn supports the development of innovative biopharmaceuticals. This environment fosters collaboration between manufacturers and testing providers.

The growth of the biopharmaceutical manufacturing consumables testing market in Germany is influenced by its robust pharmaceutical industry and stringent regulatory standards. In addition, the need for high-quality consumables testing to ensure compliance drives market expansion. This supports the country's pharmaceutical manufacturing sector, which is known for its quality and innovation. Moreover, Germany’s strong research environment and collaboration between industry and academia further contribute to the growth of consumables testing services.

Key Biopharmaceuticals Manufacturing Consumables Testing Company Insights

Some key companies in biopharmaceuticals manufacturing consumables testing market include Alcami Corporation, Merck KGaA, Catalent, Inc, Charles River Laboratories., and others. These service providers have formed strategic partnerships with various well-known biopharmaceutical companies worldwide. The companies are concentrating on complying with evolving regulatory needs and satisfying increasing demand.

-

Alcami Corporation provides pharmaceutical development and manufacturing services to small and mid-size pharmaceutical and biotechnology companies globally. The company's main services involve API development and manufacturing, clinical and commercial finished dosage form manufacturing, solid-state chemistry development, packaging and stability services, formulation development, and commercial finished dosage form manufacturing, packaging and stability services, as well as analytical development and testing services.

-

Agilent Technologies, Inc. operates in the life sciences and diagnostics segment, providing biopharmaceuticals manufacturing consumables testing solutions. The company manufactures and deals in various analytical instruments and consumables, including HPLC columns, standards, and reference materials. These products support the analysis of complex biotherapeutic molecules and critical quality attributes, facilitating quality control and testing in biopharmaceutical manufacturing processes.

Key Biopharmaceuticals Manufacturing Consumables Testing Companies:

The following are the leading companies in the biopharmaceuticals manufacturing consumables testing market. These companies collectively hold the largest market share and dictate industry trends.

- Alcami Corporation

- Merck KGaA

- Eurofins Scientific

- Agilent Technologies, Inc.

- Charles River Laboratories.

- Catalent, Inc

- Element Materials Technology (Avomeen Analytical Services)

- Pace Analytical Services, LLC

- Nelson Laboratories, LLC (Gibraltar Laboratories)

Recent Developments

-

In January 2025, Agilent Technologies is set to showcase its latest automated laboratory workflow solutions at the SLAS2025 International Conference & Exhibition. These solutions aim to boost lab productivity and reproducibility across various pipelines, from drug discovery to Biopharmaceuticals Manufacturing Consumables Testing and development. Agilent's automation includes sample preparation, auto dilution, and sample delivery, covering genomics, proteomics, and mass spectrometry. The company will also participate in discussions about robotic automation and its role in the future of laboratories, highlighting its commitment to advancing automation in the life sciences.

-

In September 2024, Pace Life Sciences broadened its offerings by acquiring Catalent's analytical services laboratory in Research Triangle Park, North Carolina. This acquisition strengthens Pace's network, adding expertise in small molecule Biopharmaceuticals Manufacturing Consumables Testing and analytical services to support pharmaceutical clients from early-stage development through commercialization. The expansion includes a team of scientists and enhances Pace's capacity to provide faster and more reliable solutions. With nine sites across the US and Puerto Rico, Pace Life Sciences offers services from analytical testing to early-stage drug product manufacturing.

-

In May 2024, Merck KGaA signed an agreement to acquire Mirus Bio, a life science company, for USD 600 million. Mirus Bio specializes in transfection reagents that are crucial for producing viral vectors used in cell and gene therapies. This acquisition aimed at enhancing Merck's integrated offerings for viral vector manufacturing, a key area in novel modalities. By combining Mirus Bio's technology with Merck's bioprocessing expertise, Merck aims to provide solutions for viral vector development and Biopharmaceuticals Manufacturing Consumables Testing, supporting customers in bringing cell and gene therapies to market. The deal is expected to close in the third quarter of 2024.

Biopharmaceuticals Manufacturing Consumables Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 709.9 million |

|

Revenue forecast in 2030 |

USD 1.27 billion |

|

Growth rate |

CAGR of 12.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Service, raw material, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Alcami Corporation; Merck KGaA; Eurofins Scientific; Agilent Technologies, Inc.; Charles River Laboratories.; Catalent, Inc; Element Materials Technology (Avomeen Analytical Services); Pace Analytical Services, LLC; Nelson Laboratories, LLC (Gibraltar Laboratories) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biopharmaceuticals Manufacturing Consumables Testing Market Report Segmentation

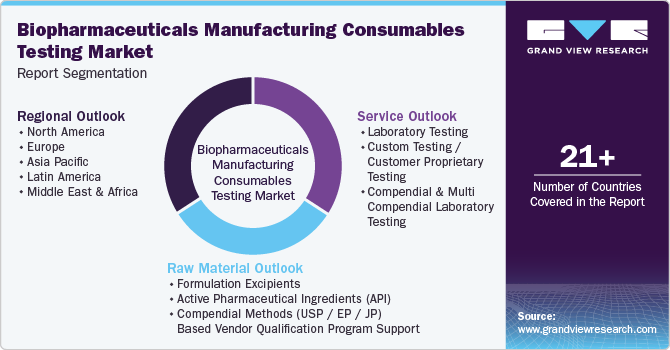

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biopharmaceuticals manufacturing consumables testing market report based on service, raw material, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Testing

-

Custom Testing / Customer Proprietary Testing

-

Compendial & Multi Compendial Laboratory Testing

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Formulation Excipients

-

Active Pharmaceutical Ingredients (API)

-

Compendial Methods (USP / EP / JP) Based Vendor Qualification Program Support

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."