- Home

- »

- Biotechnology

- »

-

Biopharmaceuticals Contract Manufacturing Market Report 2030GVR Report cover

![Biopharmaceuticals Contract Manufacturing Market Size, Share, & Trend Report]()

Biopharmaceuticals Contract Manufacturing Market Size, Share, & Trend Analysis Report By Source, By Service (Process Development), By Drug Type (Biologics, Biosimilars), By Type, By Scale of Operation, By Therapeutic Area, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-698-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

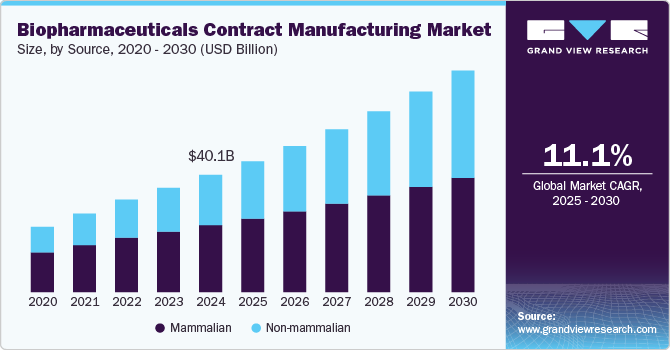

The global biopharmaceuticals contract manufacturing market size was estimated at USD 40.10 billion in 2024 and is projected to grow at a CAGR of 11.1% from 2025 to 2030. The market growth is primarily attributed to the rising number of biologics, the demand for advanced therapeutics to treat chronic ailments, advancements in manufacturing technologies, and ongoing regulatory reforms among several economies.

Moreover, biopharmaceutical contract manufacturing allows companies to streamline production, reduce overhead, and focus on core competencies such as research and development. With the rising demand for biologics, biosimilars, and advanced therapies such as cell and gene therapies, outsourcing production to contract manufacturing organizations (CMOs) has gradually become a key trend. These partnerships allow pharmaceutical companies to scale up production without the need for significant investments in manufacturing infrastructure and the complexities associated with the stringent regulatory requirements.

Rising R&D investments in biologics and the significant growth of the biosimilars market, owing to the expiration of patents for major biologic drugs, are further accelerating the need for contract manufacturing services. Additionally, the development of advanced therapies such as cell and gene therapies is accelerating demand for specialized manufacturing capabilities, as several low and medium-scale biopharma companies have a shortfall in the infrastructure required for these complex therapies. Thus, the growing need for cost-efficiency and operational flexibility will increase the adoption rate of biopharmaceutical contract manufacturing services. Moreover, the global COVID-19 pandemic enhanced demand for large-scale manufacturing capabilities for vaccines and treatments, further boosting the biopharmaceutical contract manufacturing sector.

Rapid increase in the number of biopharmaceuticals is one of the key trends for market growth. Increased number of pipeline products further boosts the demand for outsourcing services to reduce the time to market of these products. Both smaller and larger firms consider outsourcing as a cost-effective approach to improve product pipelines and enhance their share in the biopharmaceutical market. Hence, a robust pipeline and lack of adequate capacity are anticipated to drive the adoption of these services in the forthcoming years. A large number of biosimilars are likely to enter the market in the near future, including many blockbuster monoclonal antibodies, which, in turn, are anticipated to influence the adoption of contract services positively.

Moreover, biologics and biosimilars have gained significant popularity in treating autoimmune diseases, cancer, rare diseases, and others. Biopharmaceutical therapies, such as monoclonal antibodies & CAR-T cells are widely used biopharmaceuticals to treat cancer. Thus, the growing product approvals and launch of monoclonal antibodies further positively influence market demand. For instance, in October 2024, Astelles Pharma Inc. received approval for VYLOY(zolbetuximab-clzb) from the U.S. FDA to treat advanced gastric and GEJ cancer in the U.S. Thus, high burden of cancer globally and new launches of biopharmaceuticals are expected to have a positive impact on the market.

Continuous advancements in biotechnology and biomedical science techniques have considerably enhanced the process of biopharmaceutical development for the management of several chronic conditions. These advancements aim to better understand cell-line production & protein identification and expression & engineering. The rising utilization of machine learning/AI to collect data in biopharmaceutical manufacturing is expected to positively impact the market. Several biotechnology approaches for the production of self-adjuvanting antigen-adjuvant fusion protein subunit vaccines have been introduced in recent years. Furthermore, usage of nanosystems has increased in recent years as they help to address the delivery challenges pertaining to the application of mRNA therapeutics in the treatment of diseases.

Geographic expansion by biopharma companies is another key factor driving overall market growth. Asia-Pacific region, especially China and India are emerging as key markets due to lower production costs and favorable regulatory environments. There is a rise in regulatory standards, such as Good Manufacturing Practices (GMP), as CMOs offer compliance in complex regulatory landscapes, thereby witnessing market demand.

Source Insights

The mammalian source segment dominated the market and accounted for the largest share of 57.1% in 2024. Advancement in mammalian cell line development technologies is one of the major factors driving this segment. For instance, to develop precise models for mammalian cell culture and to address the problems regarding the production of MABs, a multistep nonlinear particle swarm optimization-based technique was introduced, which determines kinetic parameters that cannot be assessed experimentally.

On the other hand, the Non-mammalian segment is anticipated to register the higher CAGR over the analysis period. Non-mammalian cell lines, such as microbial cell lines, are recognized as potent factories. In particular, E. coli is a widely adopted cell culture for biopharmaceutical production owing to its versatility and cost-effective cultivation. Several firms continue to launch new bioprocessing equipment that supports microbial cell line-based bioproduction. For instance, the introduction of next-generation single-use microbial bioreactors is expected to increase the growth potential of microbial biopharmaceutical manufacturing systems.

Service Insights

Process development services held the largest revenue share in the global market in 2024. This is due to high capital expenditure on downstream processing. Moreover, downstream operations demand strong attention for final product recovery and purification steps to maintain product quality and prevent wastage. Further, the growing complexity of biologics, including monoclonal antibodies, vaccines, and cell and gene therapies, requires robust and tailored process development to enhance optimal yield, quality, and regulatory compliance. As biopharmaceutical companies increasingly focus on developing complex biologics, CMOs are investing in advanced process development capabilities to support these needs, including upstream and downstream process optimization, as well as the integration of new bioprocessing technologies.

The analytical & QC studies segment is expected to witness the fastest CAGR over the forecast period. Growing quality concerns and regulatory changes for biopharmaceutical development are expected to impel future growth opportunities for this segment. These market players offer various services that allow the production of biopharmaceuticals as per the established cGMP guidelines.The analytical capabilities and expertise offered by the market players have a wide range of technologies & services to support the proper launch of products in the market. These capabilities are implemented for mAbs, fusion proteins, chemically conjugated proteins, hormones, enzymes, and other biopharmaceuticals.

Drug Type Insights

Biologics accounted for the highest revenue in the global market in 2024. The biologics segment is further subdivided into mAbs, recombinant proteins, vaccines, antisense, RNAi, & molecular therapy, and others. The increasing prevalence of chronic diseases, particularly in areas such as oncology, autoimmune disorders, and rare diseases, as well as the heightened outsourcing budget directed toward biologics development, can be attributed to a large share held by this segment. The growing demand for targeted therapies such as monoclonal antibodies (mAbs), recombinant proteins, and vaccines has significantly expanded the need for biologics manufacturing. Further, technological advancements in bioprocessing techniques, the huge success of biologics, and high market competition amongst prominent players are some of the key factors driving segmental growth.

The biosimilar segment is anticipated to register the fastest CAGR over the forecast period. The rise of biosimilars following the patent expiry of major biological drugs has contributed to heightened demand. As biosimilars offer a cost-effective alternative to original biologics, pharmaceutical companies are increasingly turning to CMOs to support large-scale production, reducing capital investment while speeding time to market. The rapid advancements in cell and gene therapies have further fueled growth, with CMOs expanding their capabilities to cater to the complex production requirements of advanced biologics.

Type Insights

Based on type, the global market has been segmented into drug substances and finished drug products. The drug substance segment accounted for the largest revenue share in the global market in 2024. The segment growth is further fueled by advancements in bioprocessing technologies, such as single-use systems, which enhance manufacturing flexibility and reduce costs. Increasing complexity in biologics drug development, including monoclonal antibodies, recombinant proteins, and cell-based therapies, prompting pharmaceutical companies to outsource the production of complex API substances. Additionally, stringent regulatory requirements and the need for high-quality manufacturing processes encourage partnerships with specialized CMOs, thereby accelerating segment growth. The shift towards personalized medicine and emerging therapeutic modalities, including gene and RNA therapies, is expected to further bolster this segment's expansion.

The finished drug product segment is expected to register the fastest CAGR over the forecast period. The segment growth is owing to the growing demand for injectable biologics, especially pre-filled syringes, autoinjectors, and vials. The rise in complex formulations, such as lyophilized drugs and advanced delivery systems, requires specialized fill-and-finish capabilities, prompting companies to outsource these finished drug formulations. Increased regulatory scrutiny for product quality and sterility, particularly for biologics and biosimilars, drives the need for CMOs with robust quality control systems. Additionally, the trend towards personalized therapies, including small-batch production for orphan drugs and cell and gene therapies, is further stimulating demand in this segment.

Scale of Operation Insights

The commercial manufacturing segment held the larger market share in the global market in 2024. The growing demand for biologics such as monoclonal antibodies, vaccines, and biosimilars has spurred the need for large-scale production capacities. Increasing outsourcing trends among biopharma companies aim to reduce costs and accelerate time-to-market, driving segment demand. Additionally, the rise in advanced therapies, such as cell and gene therapies, requires specialized manufacturing expertise, further boosting demand for contract manufacturing services. Expanding regulatory requirements for GMP-compliant production and the globalization of drug supply chains require companies to partner with CMOs that can provide both capacity and regulatory adherence, enhancing the commercial manufacturing segment revenue growth.

The clinical segment is expected to register a higher CAGR over the forecast period. The rise in personalized medicine and orphan drugs further boosts demand for small-batch, flexible production capabilities. Outsourcing to contract manufacturers allows biopharma companies to focus on R&D while reducing time-to-market for clinical trials. Additionally, stringent regulatory requirements and the need for specialized manufacturing expertise, such as sterile fill-finish and cold-chain logistics, encourage companies to partner with experienced contract manufacturers to ensure quality and compliance in early-stage development and clinical trials, thus driving growth in the clinical segment.

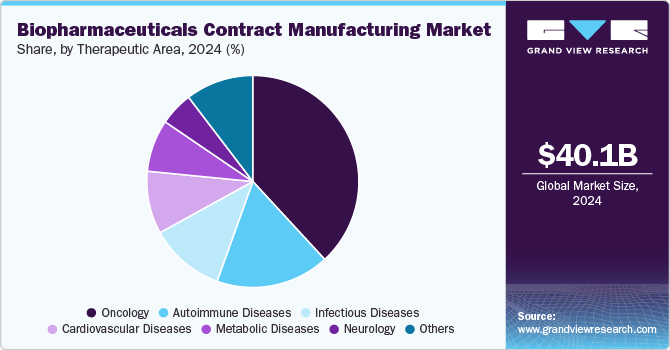

Therapeutic Area Insights

The oncology segment accounted for the highest revenue in the global market in 2024. The segment's growth is due to the increasing prevalence of cancer and the growing adoption of biologics, including monoclonal antibodies and immune checkpoint inhibitors for targeted cancer therapies. The surge in demand for personalized oncology treatments, such as CAR-T cell therapies, drives pharmaceutical companies to outsource complex manufacturing processes. Innovations in antibody-drug conjugates (ADCs) and gene therapies are further boosting the need for specialized production capabilities. Additionally, the rapid pace of oncology drug approvals and the expansion of cancer treatment pipelines encourage biopharma companies to leverage contract manufacturing organizations for large-scale production and clinical trial supplies, ensuring flexibility and faster time-to-market for novel cancer therapies.

The autoimmune diseases segment is anticipated to register significant growth potential over the forecast period. The segment growth is primarily attributed to the rising incidence of autoimmune disorders such as rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease. The growing adoption of biologics, particularly monoclonal antibodies and fusion proteins, as first-line therapies for these conditions has increased demand for large-scale, high-quality manufacturing. Advances in novel therapeutic approaches like cytokine inhibitors and B-cell-targeting therapies are also expanding the market, requiring specialized contract manufacturers with expertise in handling complex biological drugs. Additionally, the focus on developing biosimilars for autoimmune diseases due to the high costs of original biologics stimulates outsourcing as biopharma companies seek efficient, cost-effective production capabilities to meet global demand.

Regional Insights

North America biopharmaceutical contract manufacturing market dominated the global market in 2024 and accounted for the largest revenue share of 34.3%. This is attributed to the presence of substantial players in the region which are involved in the development and distribution of drugs. Approvals by the regulatory agencies for biopharmaceuticals are further promoting regional market growth. For instance, in August 2023, the FDA granted approval to BeyfortusTM (nirsevimab-alip), a monoclonal antibody, for prevention against lower respiratory tract disease caused by RSV in infants born during their initial RSV season and in children up to 2 years old who continue to be susceptible to RSV.

U.S. Biopharmaceutical Contract Manufacturing Market Trends

The biopharmaceutical contract manufacturing market in the U.S. accounted for the significant share in 2024 owing to rising R&D spending for the biologic’s development coupled with the presence of a large number of FDA-approved drugs in the country. U.S. is hosting a large number of biopharmaceutical pipeline in various stages of development. More than 900 biological molecules are under clinical investigation in the country. Steady growth in the number of new biological approvals in the country is anticipated to boost revenue generation for the U.S. market for biopharmaceutical contract manufacturing.

Europe Biopharmaceutical Contract Manufacturing Market Trends

The biopharmaceutical contract manufacturing market in Europe accounted for the second largest share in 2024 owing to the strong presence of established biopharma companies and the growing development of biosimilars, particularly in countries like Germany and Switzerland. Favorable regulatory frameworks for biologics and government initiatives supporting biotech innovation are enhancing the region’s appeal. Additionally, the demand for advanced manufacturing capabilities to support cell and gene therapies and complex biologics is rising. The region's focus on sustainability and green biomanufacturing practices further encourages adopting efficient production technologies and outsourcing to specialized contract manufacturing organizations.

Germany biopharmaceutical contract manufacturing market accounts for the highest share of the Europe biopharmaceutical contract manufacturing market, propelled by its position as a leading hub for biologics and biosimilars production in Europe. The country's advanced R&D infrastructure, supported by both government initiatives and private investments, encourages innovation in biomanufacturing. Germany’s robust regulatory environment and expertise in process optimization make it an attractive destination for outsourcing drug production, particularly for high-demand therapies including monoclonal antibodies and vaccines.

The biopharmaceutical contract manufacturing market in the UK plays a significant role, driven by its strong biotech ecosystem and leadership in advanced therapies like cell and gene therapies. The UK government's support for innovation, through initiatives such as the Life Sciences Industrial Strategy, fosters growth in biomanufacturing. The country's focus on bioprocessing advancements and collaborations between academic institutions and biopharma companies enhance development capabilities.

France biopharmaceutical contract manufacturing market is growing dueto its strong focus on biologics and biosimilar production. Government-backed initiatives like the “Innovation Santé 2030” plan are boosting investments in biopharma manufacturing and R&D. France's commitment to cutting-edge technologies, including bioprocess optimization and automation, is enhancing its manufacturing capabilities. The country’s extensive pharmaceutical network and expertise in regulatory compliance attract companies to outsource complex biologic drug production

Asia Pacific Biopharmaceutical Contract Manufacturing Market Trends

Asia Pacific biopharmaceuticals contract manufacturing market is growing at a lucrative pace and is expected to emerge as the fastest-growing geographical area for biopharmaceutical R&D and manufacturing. This growth can be attributed to several factors, such as regulatory changes, improving infrastructure, and the presence of a large number of potential study subjects. This region has been exhibiting continuous growth in biomanufacturing, which is anticipated to considerably boost biomanufacturing in China and India.

China biopharmaceutical contract manufacturing market is expected to benefit significantly from the local presence of prominent market leaders. Growth in overseas biopharma firms' outsourcing operations to Chinese market players is recognized as the major driver for the China biopharmaceutical contract manufacturing market. Global innovator companies outsource a significant portion of their research in an attempt to restructure R&D and cut costs.

Biopharmaceutical contract manufacturing market in India is emerging due to its cost-efficient production capabilities and growing expertise in biosimilars and vaccine manufacturing. The country’s large pool of skilled professionals and advanced biomanufacturing infrastructure supports large-scale production for global markets. Government initiatives like Make in India and regulatory harmonization with international standards attract foreign investments. Additionally, India’s expanding clinical trial industry and focus on bioprocess innovation are further propelling demand for outsourcing.

Japan biopharmaceutical contract manufacturing market is driven by its advanced expertise in biologics and regenerative medicine, including cell and gene therapies. The government’s support through initiatives like the Pharmaceuticals and Medical Devices Agency (PMDA) fast-tracking approvals for innovative therapies enhances the country’s biomanufacturing growth. Japan’s focus on personalized medicine, particularly in oncology, and its aging population are increasing the demand for biopharmaceuticals. Additionally, collaborations between domestic companies, global biopharma firms, and cutting-edge bioprocessing technologies are positioning Japan as a key player in high-quality, complex biologic drug manufacturing and development.

Key Biopharmaceuticals Contract Manufacturing Company Insights

Key companies in the biopharmaceutical contract manufacturing market include Lonza Group, Samsung Biologics, Boehringer Ingelheim, WuXi Biologics, Catalent, and Fujifilm Diosynth Biotechnologies which dominate the market due to their extensive manufacturing capabilities and advanced technologies. These players offer end-to-end services, from process development to commercial production, driving their market share. Emerging companies are also gaining traction with innovations in single-use technologies and cell and gene therapy manufacturing. Strategic partnerships, capacity expansions, and investments in biologics are key strategies shaping the competitive landscape.

Key Biopharmaceuticals Contract Manufacturing Companies:

The following are the leading companies in the biopharmaceuticals contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim GmbH

- Lonza

- Inno Biologics Sdn Bhd

- Rentschler Biotechnologie GmbH

- JRS PHARMA

- AGC Biologics

- ProBioGen

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Toyobo Co. Ltd.

- Samsung Biologics

- Thermo Fisher Scientific, Inc.

- Binex Co., Ltd.

- WuXi Biologics

- AbbVie, Inc.

- ADMA Biologics, Inc.

- Catalent, Inc

- Cambrex Corporation

- Pfizer Inc.

- Siegfried Holding AG

Recent Developments

-

In May 2024, Wuxi AppTec, Inc. announced its expansion by opening its new R&D and manufacturing facility in Singapore. This new facility provides API R&D and manufacturing services for peptides, small molecules, complex synthetic conjugates, & oligonucleotides.

-

In February 2024, Samsung Biologics partnered with LegoChem Biosciences for the development and manufacturing of ADCs. According to the partnership terms, the company would offer antibody development & drug substance manufacturing services to LegoChem Biosciences as a part of its ADC program designed to treat solid tumors.

-

In January 2024, Wuxi AppTec, Inc. announced a major multiple-site global expansion, including the opening of a 169-acre API manufacturing facility in Taixing, China, to meet the increasing demand and expand its peptides & oligonucleotides capacity.

-

In October 2023, Lonza announced the introduction of a new filling line specifically designed for the commercial supply of Antibody-Drug Conjugates (ADCs) for a dedicated customer. This state-of-the-art cGMP filling line, located at Lonza’s Stein (CH) site, is equipped to handle and fill bioconjugates for commercial distribution.

Biopharmaceuticals Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 44.73 billion

Revenue forecast in 2030

USD 75.80 billion

Growth rate

CAGR of 11.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, service, drug type, type, scale of operation, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boehringer Ingelheim GmbH; Lonza; Inno Biologics Sdn Bhd; Rentschler Biotechnologie GmbH; JRS Pharma; AGC Biologics; ProBioGen; Fujifilm Diosynth Biotechnologies U.S.A.; Inc.; Toyobo Co.; Ltd.; Samsung BioLogics; Thermo Fisher Scientific, Inc.; Binex Co., Ltd.; WuXi Biologics; AbbVie, Inc; Novartis AG; ADMA Biologics, Inc.; Catalent, Inc; Cambrex Corporation; Pfizer Inc.; Siegfried Holding AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biopharmaceutical Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biopharmaceuticals contract manufacturing market based on source, service, drug type, type, scale of operation, therapeutic area, and region:

-

Source Outlook (Revenue, USD Million, 2018- 2030)

-

Mammalian

-

Non-mammalian

-

-

Service Outlook (Revenue, USD Million, 2018- 2030)

-

Process Development

-

Downstream

-

Upstream

-

-

Fill & Finish Operations

-

Analytical & QC studies

-

Packaging & Labelling

-

Others

-

-

Drug Type Outlook (Revenue, USD Million, 2018- 2030)

-

Biologics

-

Monoclonal antibodies (mAbs)

-

Recombinant Proteins

-

Vaccines

-

Antisense, RNAi, & Molecular Therapy

-

Others

-

-

Biosimilars

-

-

Type Outlook (Revenue, USD Million, 2018- 2030)

-

Drug Substance

-

Finished Drug Product

-

-

Scale of Operation Outlook (Revenue, USD Million, 2018- 2030)

-

Clinical

-

Commercial

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018- 2030)

-

Oncology

-

Autoimmune Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Metabolic Diseases

-

Neurology

-

Others

-

-

RegionalOutlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biopharmaceuticals contract manufacturing market size was estimated at USD 40.10 billion in 2024 and is expected to reach USD 44.73 billion in 2025.

b. The global biopharmaceuticals contract manufacturing market is expected to grow at a compound annual growth rate of 11.13% from 2025 to 2030 to reach USD 75.80 billion by 2030.

b. North America dominated the biopharmaceuticals contract manufacturing market with a share of 34.28% in 2024. This is attributable to a reduction in overall investment required to bring a new drug product to market, providing access to expensive technologies, and quick entry of products in markets.

b. Some key players operating in the biopharmaceuticals contract manufacturing market include Boehringer Ingelheim GmbH; Lonza; Inno Biologics Sdn Bhd; Rentschler Biotechnologie GmbH; JRS PHARMA; AGC Biologics; ProBioGen; FUJIFILM Diosynth Biotechnologies U.S.A., Inc.; TOYOBO CO., LTD; Samsung Biologics; Thermo Fisher Scientific, Inc.; Binex Co., Ltd.; WuXi Biologics; and AbbVie, Inc.

b. Key factors that are driving the biopharmaceuticals contract manufacturing market growth include growing quality concerns and regulatory changes for biopharmaceutical development, and analytical and QC studies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."