Biopharmaceutical Market Size, Share & Trends Analysis Report By Molecule (Monoclonal Antibody, Insulin, Vaccine, Hormone), By Disease, By Drug Type, By Drug Development Type, By Formulation, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-534-1

- Number of Report Pages: 225

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Biopharmaceutical Market Size & Trends

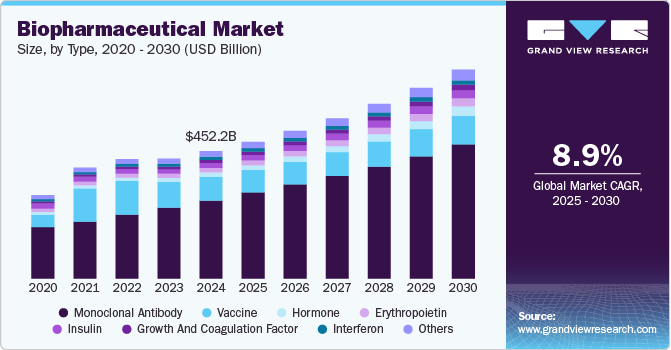

The global biopharmaceutical market size was estimated at USD 452.21 billion in 2024 and is projected to grow at a CAGR of 8.87% from 2025 to 2030. The biopharmaceutical industry’s growth is driven by the increasing demand for targeted therapies, advancements in biotechnology, rising prevalence of chronic diseases, and an aging population. Additionally, innovation in biologics, personalized medicine, and regulatory support for drug approvals further contribute to the market's growth and expansion.

The biopharmaceutical industry is witnessing rapid growth, driven by significant advancements in biotechnology and drug development. Innovations in vaccine technology, monoclonal antibodies, gene therapies, and next-generation biologics are transforming treatment paradigms across multiple therapeutic areas. These breakthroughs enhance treatment efficacy, improve patient outcomes, and address unmet medical needs. Recent developments highlight the impact of these advancements on the global healthcare landscape, underscoring the pivotal role of biopharmaceuticals in combating diseases.

In February 2025, Zydus Lifesciences introduced VaxiFlu-4, India's first quadrivalent influenza vaccine, marking a significant leap in vaccine technology. This novel flu protection vaccine, developed at Zydus's Vaccine Technology Centre in Ahmedabad, has been formulated according to the WHO recommended composition to combat emerging strains of the influenza virus. With clearance from the Central Drug Laboratory, VaxiFlu-4 is expected to play a crucial role in preventing flu outbreaks and addressing public health challenges. This innovation exemplifies how advancements in vaccine development are bolstering disease prevention strategies and contributing to the growth of the biopharmaceutical sector.

As companies seek to enhance their research and development capabilities, strengthen distribution networks, and improve patient access, strategic initiatives are emerging as a key driver of market growth. In January 2024, Barinthus Biotherapeutics announced a partnership with the Coalition for Epidemic Preparedness Innovations (CEPI) and the University of Oxford to advance the development of VTP-500, a vaccine targeting Middle East Respiratory Syndrome (MERS)-a highly fatal disease with no licensed vaccines or treatments. CEPI has committed an investment of up to USD 34.8 million to Barinthus Bio, supplementing prior funding allocated to the University of Oxford for emergency MERS vaccine stockpiling. The VTP-500 project leverages the ChAdOx1 platform, a proven vaccine technology, and its success in Phase 2 trials could pave the way for regulatory approval and rapid deployment during significant MERS outbreaks.

Thus, as pharmaceutical and biotech companies continue to forge new alliances, the industry is poised for sustained expansion, addressing unmet medical needs and accelerating the adoption of cutting-edge biopharmaceutical solutions.

The growing market adoption of biologics and modern medicines is another key driver of the biopharmaceutical market. As patients and healthcare providers become more aware of the effectiveness and affordability of new treatments, there is an increasing demand for cutting-edge therapies that offer better outcomes and fewer side effects. The uptake of biologics, gene therapies, and immunotherapies in oncology, autoimmune diseases, and other areas has been particularly notable. For example, the rapid adoption of monoclonal antibodies, such as those used in immuno-oncology, has transformed the treatment landscape, with market leaders like Keytruda and Opdivo showing impressive year-on-year sales growth. In July 2024, Amneal Pharmaceuticals, Inc. expanded its biosimilar pipeline with the addition of omalizumab, a monoclonal antibody referencing XOLAIR. Used for conditions like severe allergic asthma, chronic rhinosinusitis with nasal polyps, food allergies, and chronic spontaneous urticarial.

Pipeline Analysis

The biopharmaceuticals sector saw major breakthroughs, particularly in gene therapies, monoclonal antibodies, and respiratory treatments.

-

Regeneron & Sanofi’s Dupixent (NCT04456673): First biologic for COPD showed strong lung function improvements and reduced exacerbations, setting a new standard in respiratory medicine.

-

Vertex & CRISPR’s Exa-cel (Casgevy) (NCT03655678, NCT03745287, NCT04208529): A one-time gene therapy for sickle cell disease and beta-thalassemia, FDA & EMA approved, marking a milestone for CRISPR-based medicine.

-

Eli Lilly’s Donanemab (NCT04437511): Alzheimer’s monoclonal antibody significantly reduced amyloid plaque (84%), showing promise in slowing disease progression, pending regulatory approval.

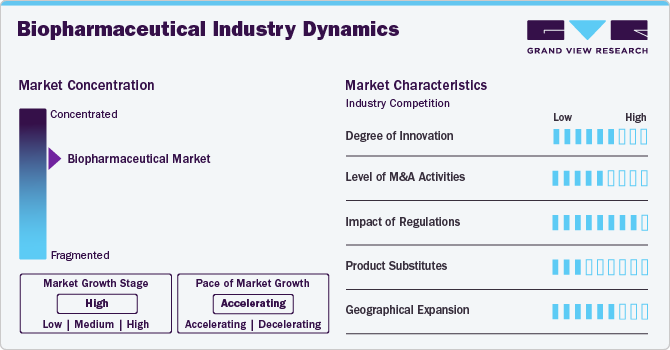

Market Concentration & Characteristics

The biopharmaceutical industry is rapidly evolving with advancements in monoclonal antibodies, gene therapies, and novel biologic formulations. Innovations in targeted drug delivery, extended half-life formulations, and combination biologics are enhancing treatment efficacy while reducing side effects. Emerging biologics are addressing oncology, metabolic disorders, autoimmune diseases, and infectious diseases, driving the next wave of transformative therapies.

Mergers and acquisitions play a crucial role in shaping the biopharmaceutical landscape, as large pharmaceutical companies acquire biotech firms to strengthen their biologics pipelines. Strategic collaborations focus on expanding manufacturing capabilities, integrating advanced delivery technologies, and accelerating clinical development. The rising demand for precision medicine and cell and gene therapies is fueling industry consolidation, enhancing competition and innovation.

Regulatory bodies such as the FDA and EMA enforce strict guidelines to ensure the safety, efficacy, and quality of biologics. The long and costly approval processes, involving extensive preclinical and clinical evaluations, impact market entry timelines. Additionally, pricing and reimbursement challenges influence the adoption of high-cost biologics. Global regulatory harmonization is essential to streamline approvals and improve patient access.

Biopharmaceuticals compete with small-molecule drugs, biosimilars, conventional therapies, and non-pharmacological treatments such as surgery and lifestyle modifications. However, biologics are gaining traction due to higher specificity, targeted action, and improved efficacy in treating complex and chronic conditions, particularly in oncology, autoimmune diseases, and rare genetic disorders.

Emerging markets in Asia-Pacific, Latin America, and the Middle East are experiencing rapid growth, driven by increasing disease prevalence, improved healthcare infrastructure, and expanding insurance coverage. Government support for biologics and rising biomanufacturing investments are enhancing market penetration. However, challenges such as pricing pressures, supply chain complexities, and regulatory disparities impact expansion strategies.

Molecule Type Insights

The monoclonal antibody (mAb) segment dominated the market, accounting for 61.05% in 2024, driven by their broad therapeutic applications in oncology, immunology, and infectious diseases. Their targeted mechanism of action and high efficacy in treating chronic and life-threatening conditions have made them a cornerstone of modern biopharmaceuticals. The monoclonal antibody (mAb) and biopharmaceutical market is experiencing robust growth, driven by the increasing prevalence of chronic diseases like cancer and autoimmune disorders. For instance, as per a report by National Cancer Institute, in 2024, it is projected that 2,001,140 new cancer cases will be diagnosed in the U.S., with an estimated 611,720 people expected to lose their lives to the disease. mAbs, engineered proteins that mimic the body's natural antibodies, offer highly targeted therapies, leading to improved efficacy and reduced side effects compared to traditional drugs.

Hormones represent the fastest-growing segment, fueled by increasing demand for recombinant insulin, growth hormones, and erythropoietin therapies. Advances in formulation and delivery technologies, including long-acting formulations, are further accelerating growth in this category. The market for hormone therapies has seen significant growth due to increasing global incidences of metabolic disorders, such as diabetes and obesity, as well as an aging population, which is more prone to hormone-related diseases. For instance, as per a report by WHO in February 2025, the global population of people aged 60 and older is expected to rise from 1.1 billion in 2023 to 1.4 billion by 2030, with this trend being especially rapid and noticeable in developing regions.

Disease Insights

Oncology remained the largest segment, comprising 31.00% of the market in 2024. The increasing incidence of cancer worldwide, coupled with strong clinical pipelines for targeted biologics and immunotherapies, is driving significant market expansion. The oncology segment is one of the most dynamic and rapidly growing areas of the biopharmaceutical industry, driven by the increasing prevalence of cancer worldwide and the continuous advancements in cancer treatment. For instance, as per a report by WHO in 2024, cancer is a leading cause of global mortality, responsible for approximately 1 in every 6 deaths and impacting nearly every household.

The immunology segment is rapidly growing, supported by the rising prevalence of autoimmune diseases and the adoption of biologic therapies for conditions like rheumatoid arthritis, psoriasis, and inflammatory bowel disease. The market is further fueled by advancements in precision medicine and biologic drug formulations. Drugs like tumor necrosis factor (TNF) and interleukin inhibitors have transformed the treatment of conditions like rheumatoid arthritis and psoriasis, offering patients more effective and safer alternatives to traditional therapies. In addition, the rise of immunotherapies in cancer treatment, such as checkpoint inhibitors, has opened new frontiers in immunology, allowing the immune system to recognize and attack cancer cells.

Drug Type Insights

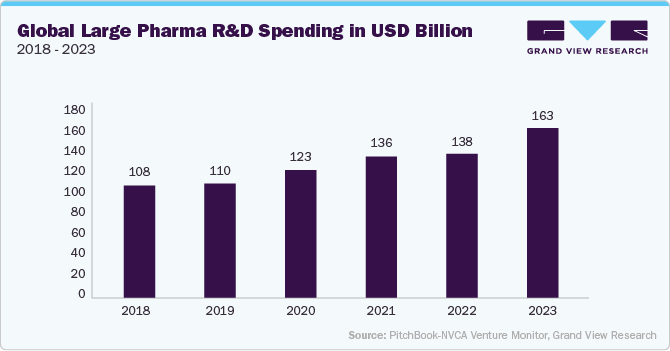

Proprietary (Branded) Biopharmaceuticals led the market, accounting for 77.86% in 2024. High R&D investments, patent protection, and continued innovation in biologics contribute to this dominance. These drugs are patented medications marketed under proprietary names, addressing multiple critical healthcare complications related to oncological, cardiovascular, neurological, immunological, and other diseases. These products are often priced on the premium side of the pricing spectrum. This pricing is the result of multiple factors like substantial investment in research, development, and regulatory approvals and the value they deliver in advancing treatment standards.

Biosimilars represent the fastest-growing segment, driven by increasing patent expirations of blockbuster biologics, regulatory approvals, and cost-effective alternatives improving patient accessibility. Key market leaders are capitalizing on this demand by actively seeking approvals for their biosimilar drug candidates. For instance, in May 2024, Biocon Biologics received US FDA approval for biosimilar for Yesafili, Aflibercept. This drug is a vascular endothelial growth factor (VEGF) inhibitor used for combating a variety of different types of ophthalmic diseases.

Drug Development Type Insights

The outsourced drug development segment was the largest, comprising 56.15% in 2024, as pharmaceutical companies increasingly partner with contract development and manufacturing organizations (CDMOs) to optimize costs and accelerate product launches. Outsourced drug development has become a key segment of the biopharmaceutical market as companies look to facilitate their research and production processes while reducing costs. Drug development is a complex and resource-intensive endeavor, requiring specialized expertise in various stages, from early-stage discovery to clinical trials and commercialization. By outsourcing certain phases of drug development to contract research organizations (CROs) and contract manufacturing organizations (CMOs), biopharmaceutical companies can focus on their core competencies and accelerate the time to market for new therapies.

In-house development remains the second-largest approach, mainly preferred by large biopharmaceutical firms investing in proprietary research and innovation. In-house drug development companies maintain complete control over discovering, developing, and manufacturing new drugs. This model allows biopharmaceutical firms to manage all aspects of drug development, from initial research and preclinical testing to clinical trials, regulatory approvals, and commercial production. By keeping the development process in-house, companies can closely monitor their products' quality, safety, and efficacy while protecting intellectual property and maintaining a high level of innovation.

Formulation Insights

Injectable formulations (IV, IM, SC) held the largest market share at 92.55% in 2024, as most biologics require parenteral administration for optimal bioavailability and therapeutic effect. Advances in auto-injectors and prefilled syringes continue to enhance patient convenience and compliance. Many biologics, such as monoclonal antibodies and hormone therapies, are administered via injection, as they cannot be taken orally due to their size and sensitivity to the digestive system. Innovations in drug delivery technologies, such as auto-injectors and prefilled syringes, have made injectable formulations more convenient and patient-friendly, reducing healthcare professional assistance and improving patient adherence.

Inhalation/Nasal spray formulations ranked as the second-largest category, with increasing adoption in respiratory diseases, vaccines, and RNA-based therapies. These formulations offer non-invasive delivery and improved patient adherence, making them an attractive alternative for certain biologics.

Route of Administration Insights

Parenteral administration (IV, IM, SC) led the market, with an 88.74% share in 2024, given the nature of biopharmaceuticals requiring systemic absorption.

Inhalation/Nasal delivery emerged as the second-largest route, reflecting advancements in pulmonary and nasal biologic formulations. This route is gaining traction in the treatment of asthma, COPD, and certain neurological conditions. Spray formulations are increasingly popular due to their convenience, ease of use, and rapid onset of action. These formulations are designed to deliver drugs directly to the targeted site, such as the nasal cavity, throat, or skin, providing fast relief for conditions like allergies, colds, asthma, and pain management. Nasal sprays, for example, are commonly used for treating allergic rhinitis, while oral sprays are used for conditions like sore throats and nausea. Moreover, the novel product launch drives the segment growth over the forecast period. For instance, in October 2024, Aero Pump and Resyca partnered to introduce the Ultra Soft Nasal Pump Spray to enhance precise nasal drug delivery applications.

Prescription Type Insights

Prescription medicines dominated and were the fastest-growing category, accounting for 96.90% in 2024. Given the complex nature of biologics, these therapies require strict physician oversight, prescription-based administration, and specialized monitoring. This segment primarily includes different types of drugs like branded, generic, and specialty drugs that are prescribed for management of a wide range of acute and chronic health conditions, like cardiovascular diseases, diabetes, cancer, and neurological disorders. These medicines play a pivotal role in driving revenue for biopharmaceutical companies, with growth fueled by robust innovation, a high prevalence of chronic diseases, and an aging population that requires long-term therapeutic interventions.

The over-the-counter (OTC) segment is a significant and growing category within the biopharmaceutical market, consisting of medications available without a prescription. These products cater to a wide range of common health conditions, including pain management, allergies, cold and flu. The OTC market is vital in empowering consumers to manage their health independently, offering convenience and cost savings compared to prescription alternatives.

Sales Channel Insights

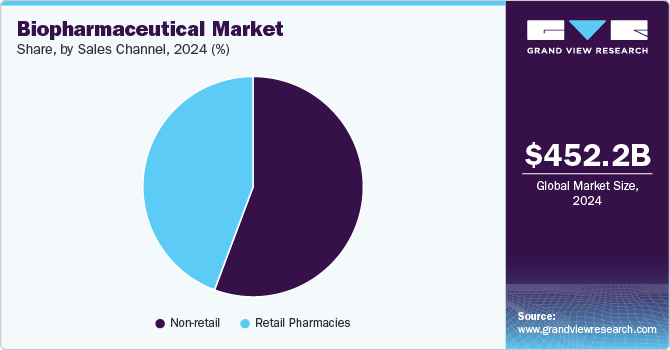

The non-retail sector (hospitals, specialty clinics, and online distribution) was the largest and fastest-growing segment, capturing 55.70% of the market. The increasing preference for hospital-administered biologics and specialty pharmacies reflects the complexity of these therapies, which often require cold chain logistics and specialized handling. This segment is vital for reaching patients who require specialized treatments, often for complex or chronic conditions, and for drugs typically administered in medical settings, such as injectables, biologics, and hospital-administered therapies.

Retail pharmacies continue to grow, particularly for biologics with self-administration options like insulin, growth hormones, and some monoclonal antibodies. This channel is crucial in making medications readily accessible to patients, allowing them to purchase prescription and over-the-counter drugs easily. Retail sales are an essential part of the healthcare system, as they offer a convenient way for patients to obtain their medications, whether for chronic conditions, short-term illnesses, or preventive care.

Regional Insights

North America biopharmaceutical market remains the largest industry in 2024, driven by high R&D investments, a well-established healthcare system, and strong regulatory frameworks. The region sees growing adoption of monoclonal antibodies, vaccines, and RNA-based therapies for oncology, immunology, and metabolic diseases. Hospital pharmacies play a dominant role in distributing biologic therapies, given their complex storage and administration requirements.

U.S. Biopharmaceutical Market Trends

The U.S. biopharmaceutical industry leads the North America market, supported by strong biopharma investments, early regulatory approvals, and a well-developed biotechnology industry. The rising prevalence of oncology, autoimmune, and metabolic disorders is fueling demand for injectable biologics, including monoclonal antibodies, recombinant proteins, and growth factors. The hospital sector remains the primary channel for biologic administration, ensuring patient monitoring and adherence to treatment protocols.

Europe Biopharmaceutical Market Trends

Europe’s biopharmaceutical industry is experiencing steady expansion, led by Germany, France, and the UK. The region benefits from a strong clinical research infrastructure, government-backed biotech innovation, and increased adoption of biosimilars. Monoclonal antibodies and vaccines continue to dominate, particularly in the treatment of oncology, immunological, and infectious diseases. Hospital pharmacies account for the largest share of biologic drug distribution, given the need for controlled administration and monitoring.

The UK biopharmaceutical market is supported by government funding in life sciences, growing clinical trials, and strong biologics adoption in respiratory and autoimmune conditions. The demand for monoclonal antibodies, recombinant hormones, and gene therapies is rising, especially in specialized hospital settings where biologics are administered under strict supervision.

The Germany biopharmaceutical market is expected to grow during the forecast period.Germany remains a leading player in Europe, benefiting from advanced biologic manufacturing capabilities and strong biotech investments. Increasing demand for oncology and immunology biologics is driving market expansion. The hospital sector dominates distribution, as most biologic therapies require intravenous or subcutaneous administration in controlled healthcare settings.

The biopharmaceutical market in France is expanding with rising adoption of biologics for autoimmune and inflammatory diseases. Government-backed healthcare initiatives support increased access to monoclonal antibodies and recombinant therapies. Dry powder and nebulized biologics are also gaining attention for respiratory applications. Hospital pharmacies remain the primary distribution channel, ensuring specialized handling and administration.

Asia Pacific Biopharmaceutical Market Trends

The Asia Pacific biopharmaceutical industry is rapidly growing, driven by expanding healthcare access, increasing chronic disease burden, and government support for biopharmaceutical innovation. Countries like China, India, and Japan are expanding local biologic manufacturing, strengthening regulatory frameworks, and increasing biosimilar adoption. Monoclonal antibodies, vaccines, and peptide-based biologics are in high demand, particularly for oncology, infectious diseases, and metabolic disorders. Hospital settings remain the leading distribution channel, given the complexity of biologic administration.

Japan’s biopharmaceutical market is driven by government funding for biologic R&D, rising aging-related disease prevalence, and increased precision medicine adoption. The use of monoclonal antibodies and hormone-based therapies is expanding, particularly in oncology and immunology. Hospital pharmacies play a dominant role in distributing biologic therapies.

The biopharmaceutical market in China is experiencing significant growth, supported by strong local biotech investments, government incentives, and increasing regulatory approvals. The demand for biologic treatments in oncology, diabetes, and infectious diseases is driving market expansion. Hospital pharmacies remain the primary channel for biologic drug distribution, ensuring specialized handling and administration.

Latin America Biopharmaceutical Market Trends

Latin America biopharmaceutical industry is witnessing increasing demand for biologic therapies, driven by government healthcare investments and growing biopharma manufacturing capabilities. Brazil stands out as the leading market, with increasing adoption of biologics in oncology, blood disorders, and metabolic diseases. Hospital pharmacies play a key role in administering complex biologic treatments.

Brazil’s biopharmaceutical market is growing due to government-led healthcare initiatives, rising local biologic production, and increased focus on biologic treatments for chronic conditions. The hospital sector leads in biologic drug distribution, ensuring specialized administration and patient monitoring.

Middle East & Africa Biopharmaceutical Market Trends

The Middle East & Africa region is expanding its biopharmaceutical industry, with Saudi Arabia emerging as a key player. Government investments in biotech infrastructure and healthcare modernization are driving biologic therapy adoption for oncology, metabolic diseases, and immunology. Hospital pharmacies dominate biologic distribution, given the need for cold chain logistics and trained administration.

Saudi Arabia’s biopharmaceutical market is growing rapidly, supported by government healthcare reforms, biotech R&D investments, and increasing demand for biologic treatments. The hospital sector remains the primary distribution channel, ensuring biologic therapies are administered under proper medical supervision.

Key Biopharmaceutical Company Insights

Some key players operating in the global market are Abbvie; AstraZeneca; Bristol Myers Squibb; GSK; Johnson & Johnson; Merck & Co; Novartis; Pfizer, Inc.; Roche Holding; and Sanofi. Biopharmaceutical market and drug development companies are constantly focusing on developing & upgrading existing technologies to enhance patient outcomes and significantly increase healthcare effectiveness and efficiency.

Key Biopharmaceutical Companies:

The following are the leading companies in the biopharmaceutical market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- AbbVie Inc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Sanofi

- GSK plc.

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Biogen

- Eli Lilly and Company

- Novo Nordisk A/S

- Amgen Inc.

View a comprehensive list of companies in the Biopharmaceutical Market

Recent Developments

-

In February 2025, Celltrion Inc. received European Commission (EC) approval for Avtozma (CT-P47), a biosimilar to RoActemra (tocilizumab), for all approved indications, including RA, sJIA, pJIA, and GCA.

-

In January 2025, Teva Pharmaceutical Industries Ltd entered a license, development, and commercialization agreement with Samsung Bioepis for EPYSQLI (eculizumab-aagh), a biosimilar to Soliris, in the U.S.

-

In September 2024, Regeneron Pharmaceuticals, Inc. announced that Dupixent (dupilumab) was approved in China as the first-ever biologic medicine for adults and adolescents with moderate-to-severe atopic dermatitis. This marks a significant milestone in providing innovative treatments for patients with this chronic skin condition in China.

-

In September 2024, Astellas Pharma announced the Japan’s Ministry of Health, Labour, and Welfare, conditional approval for Veozah (fezolinetant) for treating vasomotor symptoms associated with menopause. The approval reflects Astellas’ commitment to addressing women’s health issues.

Biopharmaceutical Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 484.38 billion |

|

Revenue forecast in 2030 |

USD 740.84 billion |

|

Growth rate |

CAGR of 8.87% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Molecule Type, Disease, Drug Type, Drug Development Type, Formulation, Route of Administration, Prescription Type, Sales Channel, Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

F. Hoffmann-La Roche Ltd; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi, GSK plc; AstraZeneca; Takeda Pharmaceutical Company Limited; Biogen; Eli Lilly and Company; Novo Nordisk A/S; and Amgen Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biopharmaceutical Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biopharmaceutical market report based on molecule type, disease, drug type, drug development type, formulation, route of administration, prescription type, sales channel, and region:

-

Molecule Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibody

-

Interferon

-

Insulin

-

Growth and Coagulation Factor

-

Erythropoietin

-

Vaccine

-

Hormone

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Blood Disorder

-

Metabolic Disease

-

Infectious Disease

-

Cardiovascular Disease

-

Neurological Disease

-

Immunology

-

Other Applications

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Proprietary (Branded)

-

Biosimilars

-

-

Drug Development Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Outsource

-

In-house

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectables (IV, IM, SC)

-

Inhalation/Nasal Sprays

-

Other Formulations

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral (IV, IM, SC)

-

Inhalation/Nasal

-

Other Routes

-

-

Prescription Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Medicines

-

Over-the-counter (OTC) Medicines

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Non-retail

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biopharmaceutical market size was estimated at USD 452.21 billion in 2024 and is expected to reach USD 484.38 billion in 2025.

b. The global biopharmaceutical market is expected to grow at a compound annual growth rate of 8.87% from 2025 to 2030 to reach USD 740.84 billion by 2030.

b. Based on molecule type, the monoclonal antibody (mAb) segment dominated the market, accounting for 61.05% in 2024, driven by their broad therapeutic applications in oncology, immunology, and infectious diseases. Their targeted mechanism of action and high efficacy in treating chronic and life-threatening conditions have made them a cornerstone of modern biopharmaceuticals.

b. Key players operating in the market are Abbvie, AstraZeneca, Bristol Myers Squibb, GSK, Johnson & Johnson, Merck & Co., Novartis, Pfizer, Inc.; Roche Holding, and Sanofi.

b. The biopharmaceutical industry’s growth market is driven by the increasing demand for targeted therapies, advancements in biotechnology, rising prevalence of chronic diseases, and an aging population. Additionally, innovation in biologics, personalized medicine, and regulatory support for drug approvals further contribute to the market's growth and expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."