- Home

- »

- Sensors & Controls

- »

-

Biometric Sensor Market Size, Share & Trends Report, 2030GVR Report cover

![Biometric Sensor Market Size, Share & Trends Report]()

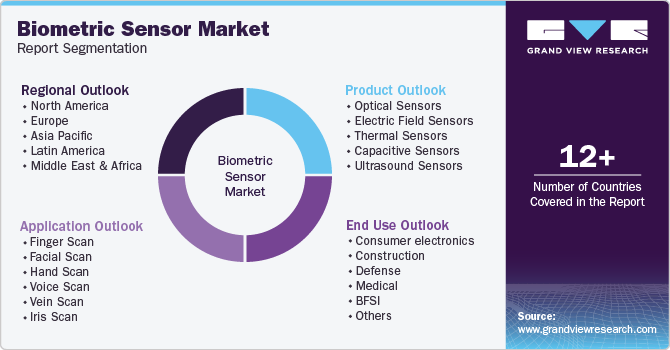

Biometric Sensor Market (2025 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Finger Scan, Facial Scan, Hand Scan, Voice Scan, Vein Scan, Iris Scan), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-898-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biometric Sensor Market Size & Trends

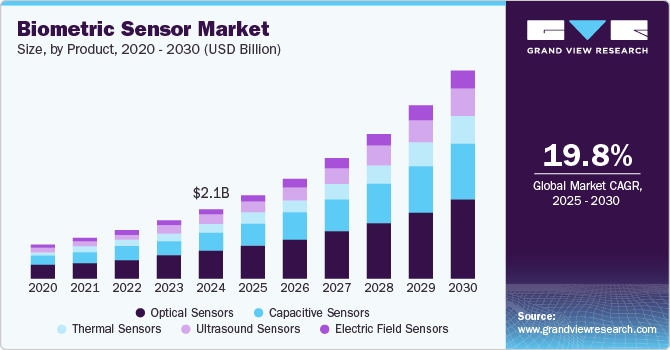

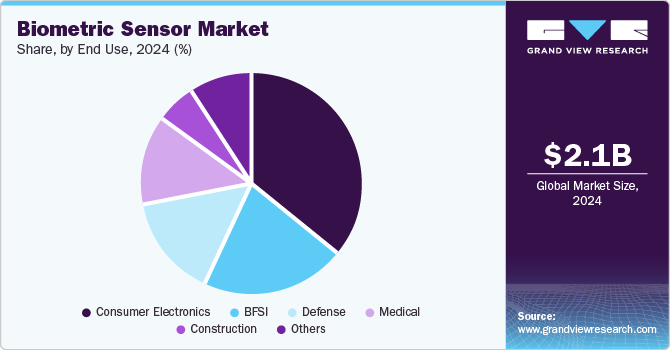

The global biometric sensor market size was valued at USD 2.09 billion in 2024 and is projected to grow at a CAGR of 19.8% from 2025 to 2030. Use of biometric sensors is primarily fueled by the adoption of advanced security and human capital management technologies by several industries and facility management service providers. Increasing utilization in military and defense, government buildings, federal agency offices, secured locations and vaults, BFSI service providers is generating upsurge in demand for biometric sensors. In addition, innovation driven systems and devices equipped with biometric sensors tailored for consumer electronics is adding to the growth opportunities for this market.

Increasing incidents of data theft, financial fraud, and internet-driven crimes have been a matter of concern for several industries, especially banking, financial services, and insurance providers. Bank professional impersonation, government employee impersonation, cyber-attacks, hacking, and several other types of crimes that directly impact the safety and security of individual’s private data, personal details, and even bank balance have posed major threats. To address such issues, where single-factor password protection isn’t enough, companies from the BFSI industry have started adopting multifactor authentication methods with the inclusion of biometrics technology.

For instance, in August 2024, Mastercard, one of the prominent payment card organizations and service providers in transaction processing, announced the global launch of its payment passkey service, characterized by a biometric authentication mechanism that allows users to choose between fingerprint, face, or PIN. The company emphasized its efforts to offer enhanced convenience for online shoppers while moving ahead toward more secure and safe transactions.

However, the extensive adoption of biometric sensor technology is not limited to the BFSI industry. Multiple industries, including wearables, digital healthcare, sports & nutrition, mental & well-being, fitness, and others, are adopting biometrics in their product offerings. For instance, in October 2024, Oura Health Oy, a health technology company from Finland, driven by innovation-based product offerings, launched its latest product, Oura Ring 4. A newly introduced addition to its wide-ranging and well-applauded portfolio is equipped with smart sensing technology. It is available for customers in twelve sizes, six colors, tungsten PVD coatings for enhanced durability, and more. The product that generates information regarding blood oxygen sensing (SpO2) management, breathing disturbance index (BDI), and daytime or nighttime heart rate helps users to put a step ahead into the future of health sensing.

Significant increases in the use of high-speed internet, the growing ubiquity of smartphone devices, and unceasing growth in dependency on data-driven technologies are adding to the rising need for biometric sensors in the military and defense industry. For instance, in October 2024, the U.S. Army granted a technical direction letter to Parsons Corporation, one of the prominent companies in the innovation and technology solutions industry. A significant project of the U.S. Army to develop the Next Generation Biometric Collection Capability (NXGBCC) is facilitated now by Parsons’ role in the integration of devices and its identity management and biometrics solution, Ares Gateway Transaction Manager.

Increasing inclusion of biometrics technology, rising use by multiple industries, ongoing research and development activities, availability of novel solutions tailored for application-specific purposes, increase in accessibility and availability of high-speed broadband connections, and sophisticated hardware of advanced electronic devices are projected to drive the growth of this market during approaching years.

Product Insights

Based on product, optical sensors dominated the global biometric sensors market with a revenue share of 40.3% in 2024. Optical sensors equipped with advanced technology to detect changes in light energy and generate an indicating signal for monitoring are extensively utilized in manufacturing facilities of industries such as chemical, automotive, food processing, medical devices, structural health management techniques, environmental monitoring, agriculture, and more. Innovation, continuous research related to optical sensors, and growing applications drive growth for this segment. For instance, in June 2024, Broadcom, a major market participant in the engineering and technology industry, announced its latest innovation linked with silicon photomultiplier (SiPM) technology. Highly advanced optical sensor technology SiPM was used in achieving resolution and quality of PET (positron emission tomography) images.

The thermal sensors segment is projected to experience the fastest CAGR of 20.7% from 2025 to 2030. Development of prior aligned faces facilitated by canonical coordinates for the adoption of thermal face recognition, see of noncontact face biometry technology, thermal fingerprint scanners, thermal sensors with the ability to recognize a hand print, face, scent, iris pattern, or thermal image is growing in multiple industries. Fail-proof characteristics of technology are anticipated to drive demand in defense, healthcare, and others.

Application Insights

Finger scan applications led the global market with the largest revenue share in 2024. The finger scanners are extensively used in multiple industries, including consumer electronics, software and technology, security, BFSI, government, facility management, etc. Using sensors for a series of functions, including image capture, followed by feature extraction, pattern matching, and database confirmation, is highly trusted by multiple businesses and user industries. Ease of use, convenience offered by the technology, and enhancements in experiences such as application use, shopping, and digital payments are adding to the growth opportunities for this segment.

The facial scan segment is projected to experience the fastest CAGR during the forecast period. The facial scan biometric technology uses sensors to identify the user’s facial features, such as distance between the eyes, nose shape, facial contours, and more. The facial scan biometrics technology is extensively used in security systems, smartphone devices, law enforcement agencies, video surveillance activities, airport passenger screening, and employee attendance management. Accuracy and enhanced security offered by the technology are expected to develop a growing demand for it over the forecast period.

End Use Insights

The consumer electronics segment dominated the global market for biometric sensors in 2024. Biometric sensor technology is primarily used in consumer electronics such as smartphone devices, advanced gadgets used in industry-specific applications, tablets, and others to ensure the safety and security of the data and information stored in the devices and accessed through using it. The growing adoption by smartphone developers, defense industry device manufacturers, and others are projected to contribute in growth of this segment.

The BFSI segment is projected to experience the fastest CAGR from 2025 to 2030. Operational excellence offered biometric sensor technology by enhancing user data's security and safety, securing access, and preventing unauthorized entry into systems, attracting multiple BFSI industry participants towards this technology. The rising use of technology-driven solutions such as online banking systems, digital insurance management, solutions used by businesses for digital payments, and others is adding to the growth of this segment. The Increasing number of digital transactions and rapid transformation from conventional methods of operations to digital methods are expected to generate a higher demand for biometric sensors in the BFSI industry.

Regional Insights

North America biometric sensor market dominated the global industry with revenue share of 31.6% in 2024. Presence of multiple technology and innovation companies with strong portfolio offerings in biometric sensors technology, rising use in security and video surveillance, growing demand from governments and defense forces for enhanced capabilities and easier monitoring, increasing utilization in industries such as BFSI, consumer electronics, healthcare technology and others is contributing to the growth of this regional market.

U.S. Biometric Sensor Market Trends

The U.S. biometric sensors market dominated the regional industry in 2024. The robust BFSI industry and higher adoption rates by sectors such as consumer electronics, medical devices, law enforcement, occupational security, human capital management, and others in the country have increased demand for biometric sensors in recent years. Innovations, ongoing research by educational institutes and organizations, growing adoption of technology advancements by the strong retail industry in the country, and increasing utilization in surveillance for public safety and crime investigation by federal agencies are expected to drive future trends in this market.

Europe Biometric Sensor Market Trends

Europe biometric sensors market held significant revenue share of global industry in 2024. The rapid pace of digital transformations with the focus on enhanced security of systems, infrastructures, buildings, devices, datasets, information, and more is primarily driving the growing use of biometric sensors in the region. The focus of BFSI organizations is to upgrade their security capabilities to prevent fraud, identify attempts to gain unauthorized access and ensure the protection of customers' assets, funds, data, and privacy is also contributing to the growth opportunities for this market.

The UK biometric sensor market dominated the regional industry in 2024 owing to the rapid pace of digital transformation, increasing adoption by BFSI industry participants, growing utilization in public safety, security, and surveillance management, increasing demand from law enforcement and internal security teams, and rising adoption of technology in multiple commercial buildings, government premises, and more.

Asia Pacific Biometric Sensor Market Trends

Asia Pacific biometric sensors market is projected to experience the fastest CAGR of 21.6% from 2025 to 2030. The rising availability of high-speed internet connections coupled with ease of accessibility and affordability of smartphone devices in the region, rising incidents of internet-based crimes and internet-driven financial frauds, unprecedented growth in the use of digital payment systems, growing dependency of businesses on data and significance of data security and protection are some of the key growth driving factors for this market.

China biometric sensors market held significant revenue share of the regional industry in 2024 due to the robust consumer electronics industry in the country, the growing focus of organizations and government to enhance security and protection capacities through improved authentication and access control systems and improved surveillance capacities, growing demand from the BFSI and medical devices industry, and more.

Key Biometric Sensor Company Insights

Some of the key companies operating in the biometric sensors market include IDEMIA, BioID, Synaptics Inc., Fujitsu, NEXT Biometrics and others. To address growing demand and rise in competition, the major industry participants are adopting strategies such as innovation, new product launches, collaboration and partnership with other organizations, acquisitions, portfolio expansions and more.

-

IDEMIA, one of the prominent companies in the identity security solutions and technology industry, offers a range of products and solutions related to secure transactions, public security, and smart identity. Its solutions include card issuance services, Payment cards, seamless public transit, corporate access credentials, investigations and evidence analysis, Passenger journey facilitation, Physical and digital ID credentials, Foundational ID systems, and more.

-

HID Global Corporation specializes in the delivery of authentication and verification solutions equipped with reliable identity assurance technology backed by fingerprint & facial recognition. It provides its expert solutions to industries such as air travel, retail, healthcare, BFSI, and others

Key Biometric Sensor Companies:

The following are the leading companies in the biometric sensor market. These companies collectively hold the largest market share and dictate industry trends.

- IDEMIA

- 3M

- BioID

- HID Global Corporation

- Fujitsu

- IDEX Biometrics ASA

- IrisGuard Ltd

- NEC Corporation

- NEXT Biometrics

- Synaptics Incorporated

- Thales

Recent Developments

-

In October 2024, IDEMIA Public Security North America, a division of IDEMIA group, announced that it is selected by National Institute of Standards and Technology’s (NIST), National Cybersecurity Center of Excellence (NCCoE) to participate in its project with biometric and identity expertise. The Mobile Driver’s License (mDL) project comprises of production of reference architectures, assist the adoption of digital identity standards, generation of representative workflows and facilitate the adoption of mDL in the BFSI industry.

-

In September 2024, NEC Corporation declared that it plans to launch novel biometric authentication technology driven system, equipped with capacities to quickly perform authentication process for large group of people at same time. It proposed commencement of delivery starting from September 2024, with initial focus on domestic market in Japan, the U.S. and Singapore market.

Biometric Sensor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.49 billion

Revenue forecast in 2030

USD 6.14 billion

Growth Rate

CAGR of 19.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

IDEMIA; 3M; BioID; HID Global Corporation; Fujitsu; IDEX Biometrics ASA; IrisGuard Ltd; NEC Corporation; NEXT Biometrics; Synaptics Incorporated; Thales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biometric Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biometric sensors market report based on product, application, end use and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Optical Sensors

-

Electric Field Sensors

-

Thermal Sensors

-

Capacitive Sensors

-

Ultrasound Sensors

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Finger Scan

-

Facial Scan

-

Hand Scan

-

Voice Scan

-

Vein Scan

-

Iris Scan

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer electronics

-

Construction

-

Defense

-

Medical

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.