Biomethane Market Size, Share & Trends Analysis Report By Source (Energy Crops, Animal Manure, Municipal Waste, Waste Water Sludge), By End Use (Construction, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-378-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 – 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Biomethane Market Size & Trends

“2030 biomethane market value to reach USD 17.03 billion.”

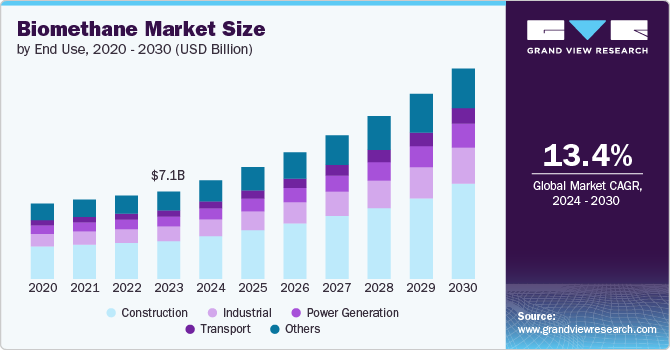

The global biomethane market size was estimated at USD 7.08 billion in 2023 and is estimated to grow at a CAGR of 13.4% from 2024 to 2030.Biomethane is a renewable source that is used for diverse applications such as construction, power generation, transportation, and industrial applications. The growing demand for efficient power transmission is anticipated to boost the market over the forecast period.

Biomethane is a type of gas derived from the biological breakdown of organic matter, such as agricultural waste, food waste, sewage, and other organic materials. It is a renewable energy source and is considered a sustainable alternative to fossil fuels. Biomethane is produced through a renewable process called anaerobic digestion, where microorganisms break down organic matter in the absence of oxygen, resulting in the production of biogas.

Drivers, Opportunities & Restraints

Energy sustainability and the net-zero decarbonization goal set forth by global governments are the key drivers for the market. It reduces dependence on imported fossil fuels and promotes the development of a circular economy since waste material is recycled to produce efficient and clean energy. The global transition towards the adoption of sustainable energy is anticipated to drive the market over the forecast period.

A key opportunity for the market lies in the generation potential of sources of biomethane. Specific energy crops that are low-cost and low-maintenance crops that are grown solely for energy production have played a vital part in the increase of biogas production across the world. Moreover, using waste and by-products can be aligned with sustainability goals across the world and assist in the generation of biomethane for diverse applications.

The market faces inherent restraints, such as the high manufacturing cost due to technological advancements. Its production cost remains higher than the production of conventional energy. Hence, this factor has restrained the widespread adoption and utilization of biomethane across the world, and its applications are hence limited to developed countries of Europe, where both generation and technology and widely adopted.

End Use Insights

“Construction accounted for the highest revenue share of over 43.0% in 2023.”

According to the IEA, bioenergy accounted for around 10% of the world’s primary energy demand in 2023. Most of the bioenergy is used in the form of biogas, i.e., biomethane. In the construction industry, biomethane is used for cooking and heating applications, and a vast portion is also used as an additive in the gas network as a transport fuel.

The industrial sectors such as food, drink, and chemicals produce byproducts with a high organic content that can be used to produce biomethane. At the same time, the demand for biomethane within the industrial sector is anticipated to be generated by its increasing role in reducing greenhouse gas emissions and the focus on sustainable production methods.

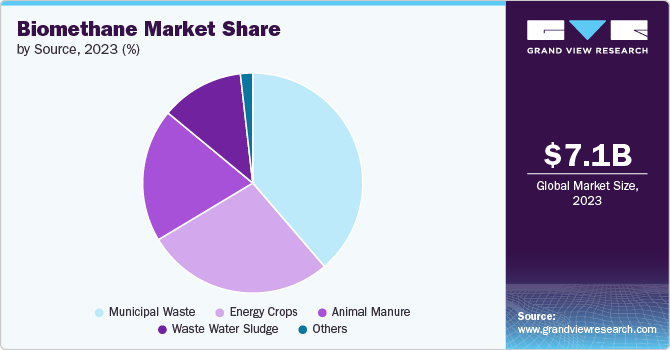

Source Insights

“Municipal waste accounted for the highest revenue share of about 38.0% in 2023.”

Organic municipal waste such as food and green waste, paper, wood and cardboard that is not utilized for composting or recycling accounted for the highest revenue share in 2023. This waste also includes waste from the food processing industry. It is also the most widely available source of biomethane available across the market today.

Biogas, produced through the process of anaerobic digestion mainly consists of methane. Upon further processing and purification, it is converted into biomethane. Significant growth in biogas industry is expected to prove fruitful for the market growth. For instance, in June 2024, Maruti Suzuki India Ltd., installed a pilot plant for biogas generation & purification. This establishment took place at Manesar Plant in Haryana, India.

Animal manure is another lucrative segment of the market. Biogas production through manure, which is derived from livestock farming has a positive impact on the economy and environment. According to the European Biogas Association’s database, in 2023, the agricultural sector (including manure, sequential crops, and other residues) contributed 64% of European biomethane production.

Regional Insights

“Germany held over 42.0% revenue share of the overall Europe biomethane market.”

Europe dominated the global market and accounted for over 45.0% revenue share of the global market in 2023. This growth is anticipated to continue from 2024 to 2030 owing to the increasing sources of biomethane, and the emphasis on alternate and renewable energy sources. To cut down on the cost of technology, European universities and research institutes are investing in conducting cutting-edge research for which they are provided grants and funding for R&D by the European Commission.

North America Biomethane Market Trends

The North America biomethane market is anticipated to witness a CAGR of 13.5% from 2024 to 2030. It is expected to be driven by the renewable energy transition and green material usage in industries that are the current trend in the U.S.

U.S. Biomethane Market Trends

The biomethane market in the U.S. dominated According to the American Biogas Council, about USD 1.8 billion in capital investment worth biogas projects came online in 2023. This includes methane capture system projects for the production of biomethane. The U.S. market is being driven by the increased usage of recyclable construction infrastructure and the requirement to reduce carbon emissions.

Asia Pacific Biomethane Market Trends

According to the World Biogas Association, the Asia Pacific region has immense potential to increase the generation of biogas and subsequently improve biomethane demand. This can be aligned with its waste management policies and help combat climate change.

Key Biomethane Company Insights

Some key players operating in the market include Air Liquide and Total Energies

-

France-based Air Liquide was founded in 1902 and is a provider of various gases including biomethane, along with associated technologies and services and caters to various industries.

-

France-based Total Energies was founded in 1924 and is an integrated company that produces oils and biofuels, natural gas and green gases, renewables, and electricity.

Key Biomethane Companies:

The following are the leading companies in the biomethane market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- Engie

- Nature Energy Biogas A/S

- Gasum

- Terega Solutions

- Waga Energy

- TotalEnergies

- Chevron

- Kinder Morgan

- Archea Energy

- Envitec Biogas AG

- Future Biogas Ltd.

- E.ON SE

- Verbio Vereinigte Bioenergie AG

- South Hills RNG

Recent Developments

-

In April 2024, France-based AirLiquide announced the expansion of its production capacity of biomethane in the U.S. with the construction of two new plants in Pennsylvania and Michigan. These plants will cater to the industrial and transport sectors in the region.

-

In January 2023, France-based Arkema signed a long-term agreement with France-based ENGIE for the supply of 300 GWh/year of biomethane. This deal is considered to be one of the largest agreements in Europe in the biomethane market and is aimed at enabling the former to reduce its carbon footprint in the chemical industry.

Biomethane Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.0 billion |

|

Revenue forecast in 2030 |

USD 17.03 billion |

|

Growth Rate |

CAGR of 13.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa |

|

Country scope |

U.S.; Germany; France; Italy; Denmark; Netherlands; China; India; Japan; South Korea |

|

Key companies profiled |

Air Liquide; Engie; Nature Energy Biogas A/S; Gasum; Terega Solutions; Waga Energy; TotalEnergies; Chevron; Kinder Morgan; Archea Energy; Envitec Biogas AG; Future Biogas Ltd.; E.ON SE; Verbio Vereinigte Bioenergie AG; South Hills RNG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biomethane Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomethane market report based on the source, end use and region.

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Crops

-

Animal Manure

-

Municipal Waste

-

Waste Water Sludge

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Industrial

-

Power Generation

-

Transport

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

Italy

-

Denmark

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global biomethane market size was estimated at USD 7.08 billion in 2023

b. The global biomethane market size was estimated at USD 7.08 billion in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 13.4% from 2024 to 2030.

b. Municipal waste was the dominant source and accounted for the revenue share of about 38.0% in 2023. Organic municipal waste such as food and green waste, paper, wood and cardboard that is not utilized for composting or recycling is majorly used for biomethane production.

b. Key players in the biomethane market include Air Liquide, Engie, Nature Energy Biogas A/S, Gasum, Terega Solutions, Waga Energy, TotalEnergies, Chevron, Kinder Morgan, Archea Energy, Envitec Biogas AG, Future Biogas Ltd., E.ON SE, Verbio Vereinigte Bioenergie AG, South Hills RNG

b. The growing demand for efficient power transmission is anticipated to boost the biomethane market over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."