- Home

- »

- Biotechnology

- »

-

Biomaterials Market Size & Share, Industry Report, 2033GVR Report cover

![Biomaterials Market Size, Share & Trends Report]()

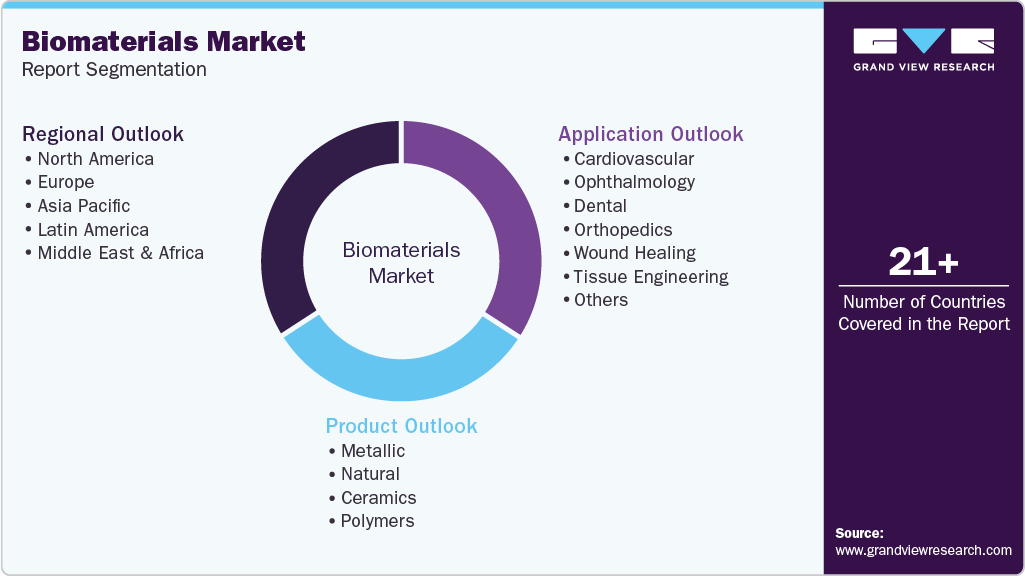

Biomaterials Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Natural, Metallic, Polymer), By Application (Cardiovascular, Orthopedics, Plastic Surgery), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-637-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biomaterials Market Summary

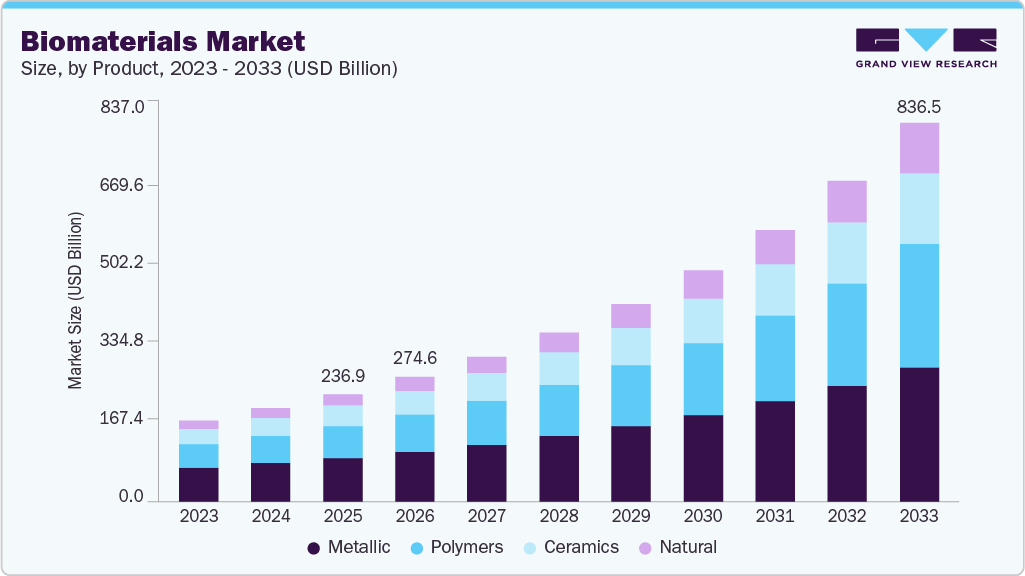

The global biomaterials market size was estimated at USD 236.99 billion in 2025 and is projected to reach USD 836.54 billion by 2033, growing at a CAGR of 17.25% from 2026 to 2033. The growing incidence of musculoskeletal and chronic skeletal medical conditions is expected to stimulate the demand for implants based on biomaterials, thereby enhancing market expansion.

Key Market Trends & Insights

- The North America biomaterials market held the largest share of 38.11% of the global market in 2025.

- The biomaterials industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the metallic segment held the largest market share of 40.56% in 2025.

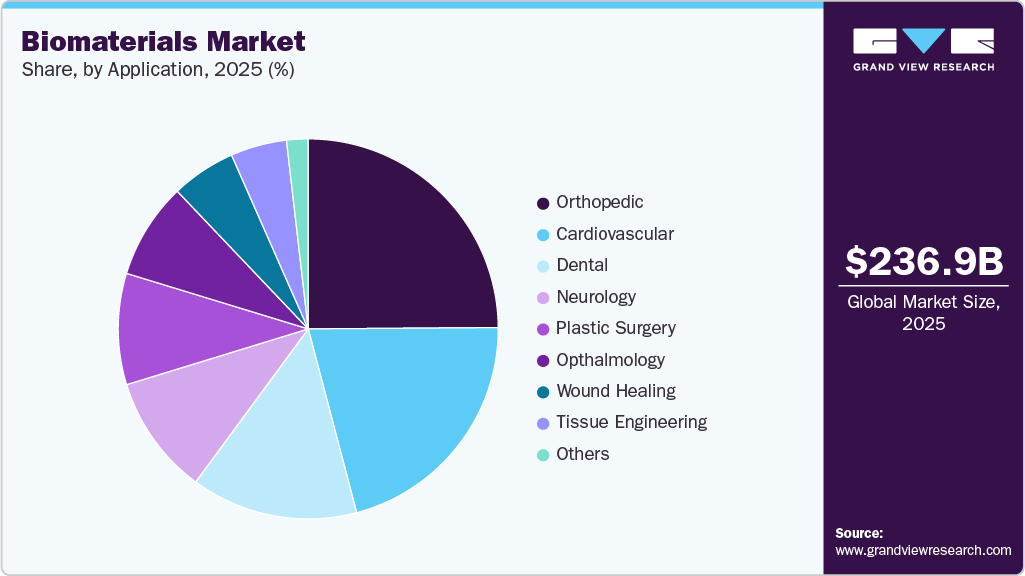

- Based on application, the orthopedic segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 236.99 Billion

- 2033 Projected Market Size: USD 836.54 Billion

- CAGR (2026-2033): 17.25%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Rise of Advanced Surgical Procedures

The global shift toward minimally invasive and technologically advanced surgical procedures is a major driver accelerating demand for biomaterials. Healthcare providers are increasingly adopting minimally invasive techniques due to their ability to reduce hospital stays, lower post-operative complications, and improve patient recovery timelines. These procedures require highly specialized biomaterials that are lightweight, high-strength, biocompatible, and often bioresorbable. As a result, demand for advanced polymers, composites, and bioactive materials is rising steadily across orthopedic, cardiovascular, and general surgical applications.

The growing use of robotic-assisted surgery, image-guided interventions, and catheter-based procedures is further strengthening the need for precision-engineered biomaterials with superior mechanical and biological performance. Biomaterials used in these procedures must offer enhanced flexibility, controlled degradation, and strong tissue interaction to ensure safety and long-term functionality. This is driving innovations in bioresorbable stents, minimally invasive orthopedic implants, and soft tissue scaffolds, enabling surgeons to achieve better procedural accuracy and improved patient outcomes.

In addition, increasing patient awareness, rising healthcare accessibility, and the growing burden of chronic diseases are contributing to the widespread adoption of advanced surgical solutions. Minimally invasive procedures are being favored for their cost-effectiveness over the long term, as they reduce rehabilitation expenses and revision surgery rates. This structural shift in surgical practice is reinforcing sustained demand for high-performance biomaterials, making it a critical growth engine for the global biomaterials industry.

Technological Advancements

Technological innovation is significantly accelerating the growth of the biomaterials market, with new research focused on improving biocompatibility, antimicrobial performance, and regenerative potential. Emerging materials, such as titanium implants functionalized with manganese-doped zinc oxide nanoparticles, demonstrate strong antibacterial activity while supporting tissue regeneration. These multifunctional characteristics address major challenges such as implant-associated infections and poor osteointegration, positioning advanced biomaterials as critical enablers of improved clinical outcomes.

Market demand is further strengthened by the rising prevalence of orthopedic disorders, increasing use of dental and maxillofacial implants, and the growing preference for minimally invasive procedures. As aging populations and chronic disease rates rise, healthcare providers are prioritizing durable, high-performance biomaterials that enhance patient recovery and reduce the need for revision surgeries. Concurrently, advancements in manufacturing technologies, including additive manufacturing and precision surface engineering, are improving scalability and customization, accelerating commercialization. Together, these innovations are establishing technologically advanced biomaterials as a central driver of market expansion.

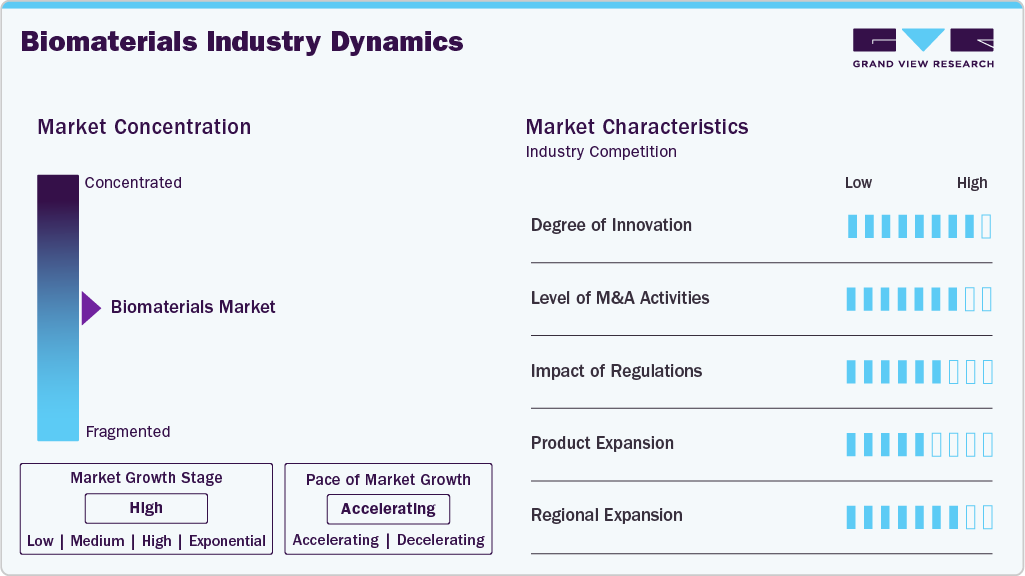

Market Concentration & Characteristics

Innovation intensity in the biomaterials industry remains high, supported by continuous developments in bioactive materials, nanotechnology-enabled coatings, and bioresorbable polymers. The growing focus on regenerative medicine, personalized implants, and infection-resistant materials is accelerating product innovation. Strong R&D spending by leading manufacturers and rapid adoption of advanced surgical technologies further reinforce the market’s high innovation momentum.

The biomaterials industry has witnessed a moderate level of mergers and acquisitions, primarily driven by strategic collaborations aimed at expanding product portfolios, acquiring novel technologies, and entering new geographic markets. Leading players are focusing on acquiring startups and innovative material developers to strengthen their presence in high-growth segments such as regenerative medicine and minimally invasive surgical solutions. However, large-scale consolidation remains limited due to high regulatory scrutiny and the specialized nature of biomaterial technologies.

Regulatory frameworks play a significant role in shaping the biomaterials market. Compliance with stringent safety, efficacy, and biocompatibility standards set by agencies such as the FDA, EMA, and ISO affects product development timelines, approval processes, and commercialization strategies. While regulations ensure patient safety and quality, they can also increase R&D costs and slow market entry. Companies that invest in regulatory expertise and early-stage clinical validation gain a competitive advantage, facilitating the faster adoption of innovative biomaterials.

Biomaterials companies are increasingly focusing on product expansion to capture a diverse range of healthcare applications. Innovations include bioresorbable polymers, nanocoated implants, and multifunctional composites for use in orthopedics, cardiovascular medicine, dentistry, and regenerative medicine. By broadening their product portfolios, manufacturers can address specific clinical needs, improve patient outcomes, and differentiate themselves in a competitive market.

Geographic diversification remains a key growth strategy, with a focus on high-potential emerging markets in the Asia Pacific, the Middle East, and Latin America. Increasing healthcare infrastructure, rising patient awareness, and growing adoption of advanced surgical procedures are driving demand in these regions. Expanding into new territories allows market players to capture growth opportunities while reducing reliance on mature markets in North America and Europe.

Product Insights

The metallic segment held the largest share of 40.56% in 2025 due to its unique combination of mechanical properties, biocompatibility, and corrosion resistance. Metals are the most widely used biomaterials and are generally used for manufacturing load-bearing implants. For instance, metallic implants are used on a large scale during orthopedic surgeries. They consist of simple wires, screws, fracture fixation plates, and total joint prostheses (artificial joints) for hips, knees, shoulders, and ankles, among others. Thus, the well-established track record of metallic biomaterials in medical applications, coupled with ongoing research to enhance their functionalities, solidifies their dominance in the market, contributing to their widespread use in various medical devices and implants.

The natural segment is expected to show lucrative growth during the forecast period due to its advantages in terms of biodegradability, biocompatibility, and remodeling compared to synthetic biomaterials. The product is increasingly utilized to replace or restore the structure and function of damaged organs or tissues. For instance, the biosensor, an analytical device employed to detect analytes such as biomolecules or biological elements produced by microorganisms, tissues, enzymes, and organelles, among others. Moreover, when implanted, natural biomaterials possess the capacity to facilitate cell adhesion, proliferation, and differentiation, thereby playing a crucial role in the anticipated growth of this segment in the coming years.

Application Insights

The orthopedic segment accounted for the largest revenue share of 24.89% in 2025. The growing adoption of metallic biomaterials in orthopedic applications, attributed to their high load-bearing capacity, is a key factor fueling the segment’s growth. In addition, the continuous efforts by market vendors to introduce advanced orthopedic implants are expected to drive revenue generation.

The plastic surgery segment is estimated to register the fastest CAGR over the forecast period due to the increasing demand for cosmetic procedures and the need for reconstructive surgeries after accidents or diseases. Additionally, advancements in biomaterial technology have led to the development of more durable and customizable implants, further driving the market. Moreover, the growing aging population, coupled with a rising obsession for youthful looks, is expected to fuel the demand for plastic surgery, thereby positively impacting the overall segment growth.

Regional Insights

The North America biomaterials industry dominated and accounted for the largest revenue share of 38.11% in 2025. This growth is attributed to advanced healthcare infrastructure, strong adoption of innovative surgical and regenerative technologies, high R&D investment, and the presence of leading market players, which drive continuous product development and commercialization.

U.S. Biomaterials Market Trends

The U.S. biomaterials industry is expected to expand robustly between 2025 and 2033, owing to increasing demand for advanced orthopedic, cardiovascular, and dental implants, growing adoption of minimally invasive and regenerative surgical procedures, and continuous innovation in bioresorbable and multifunctional biomaterials. Strong healthcare infrastructure, rising R&D investments, and supportive regulatory frameworks further bolster market growth, enabling faster commercialization of next-generation biomaterial solutions.

Europe Biomaterials Market Trends

The biomaterials industry in Europe is anticipated to grow over the forecast period, owing to the rising prevalence of chronic diseases, increasing demand for advanced orthopedic and dental implants, and the growing adoption of regenerative medicine solutions. Strong healthcare infrastructure, ongoing technological innovations, and supportive government initiatives for medical research and device approvals are further driving market expansion across key European countries.

The UK biomaterials industry is expected to grow at a significant rate over the forecast period due to increasing adoption of advanced surgical and minimally invasive procedures, rising demand for orthopedic, cardiovascular, and dental implants, and continuous innovations in bioresorbable and multifunctional biomaterials. Additionally, strong healthcare infrastructure, supportive regulatory frameworks, and ongoing R&D investments are driving the development and commercialization of next-generation biomaterial solutions.

The biomaterials industry in Germany is anticipated to experience notable growth from 2025 to 2033, driven by rising demand for advanced orthopedic, cardiovascular, and dental implants, increasing adoption of minimally invasive and regenerative surgical procedures, and ongoing innovations in bioresorbable and multifunctional biomaterials. Strong healthcare infrastructure, significant R&D investment, and favorable regulatory support further contribute to the market’s expansion during the forecast period.

Asia Pacific Biomaterials Market Trends

The Asia Pacific biomaterials industry is expected to experience the fastest growth, with a projected CAGR of 18.80% from 2026 to 2033. This is attributed to increasing healthcare infrastructure development, the rising prevalence of chronic diseases, growing adoption of advanced surgical and regenerative procedures, and expanding medical tourism in the region. Besides, government initiatives supporting healthcare innovation and the entry of global biomaterials manufacturers are driving rapid market expansion across key countries such as China, India, and Japan.

The biomaterials industry in China is anticipated to grow over the forecast period due to rising demand for advanced orthopedic, cardiovascular, and dental implants, increasing adoption of minimally invasive and regenerative medical procedures, and continuous innovation in bioresorbable and multifunctional biomaterials. The expansion of healthcare infrastructure, supportive government policies, and increasing investments by domestic and international manufacturers are further driving market growth in the country.

The Japan biomaterials industry is expected to witness rapid growth over the forecast period. This is driven by rising demand for advanced orthopedic and dental implants, growing adoption of minimally invasive and regenerative surgical procedures, and continuous innovations in bioresorbable and multifunctional biomaterials. Strong healthcare infrastructure, high R&D investment, and supportive regulatory frameworks further support the commercialization and adoption of next-generation biomaterial solutions in the country.

Middle East and Africa Biomaterials Market Trends

The biomaterials industry in the Middle East and Africa is poised to grow in the near future, driven by increasing healthcare infrastructure development, rising demand for advanced orthopedic, dental, and cardiovascular implants, and growing adoption of minimally invasive and regenerative medical procedures. Investments by key market players, supportive government initiatives, and expanding medical tourism across the region are further contributing to market growth.

The Kuwait biomaterials industry is anticipated to witness growth over the forecast period, owing to increasing demand for advanced orthopedic, dental, and cardiovascular implants, rising adoption of minimally invasive and regenerative surgical procedures, and ongoing innovations in bioresorbable and multifunctional biomaterials. Expansion of healthcare infrastructure, government support for medical technology, and investments by key market players further contribute to the market’s development.

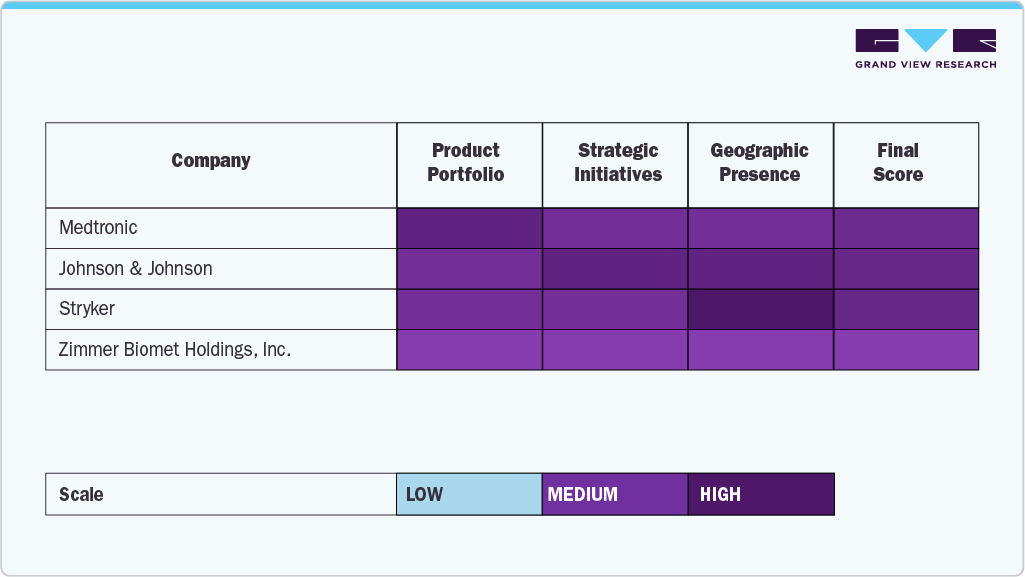

Key Biomaterials Company Insights

The global market is dominated by a mix of established multinational corporations and emerging specialized players. Major companies, including Thermo Fisher Scientific, Danaher, Merck KGaA, Sartorius Stedim Biotech, Lonza, WuXi AppTec, and Berkeley Lights, maintain a strong market presence through extensive product portfolios, robust R&D capabilities, and strategic partnerships. These players focus on innovation, acquisitions, and regional expansion to strengthen their competitive positioning in high-growth markets.

Regionally, North America holds the largest market share, supported by advanced healthcare infrastructure, high adoption of regenerative and minimally invasive surgical procedures, and the concentration of leading biomaterials manufacturers. Europe follows closely, driven by technological advancements, increasing demand for advanced implants, and supportive regulatory frameworks. The Asia Pacific region is projected to witness the fastest growth, fueled by expanding healthcare infrastructure, rising medical tourism, and the growing presence of global biomaterials companies targeting emerging economies such as China, India, and Japan.

Mid-sized and emerging companies are increasingly contributing to market growth through focused product development in niche segments, including bioresorbable polymers, multifunctional composites, and nanocoated implants. Companies such as Advanced Instruments, CircleDNA, Viome, and Bioniq are gaining traction by offering innovative solutions in regenerative medicine and personalized implants. Their agility in R&D and ability to meet specific clinical requirements enable them to compete with larger market players in specialized applications.

Strategic mergers, acquisitions, and collaborations continue to shape the competitive landscape. Companies are investing in scaling production, accessing new technologies, and expanding into untapped regional markets. The combination of innovation-driven startups and resource-rich established players ensures a dynamic market environment, supporting sustained growth and the adoption of next-generation biomaterials across a wide range of medical applications.

Key Biomaterials Companies:

The following are the leading companies in the biomaterials market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Evonik Industries AG

- Carpenter Technology Corporation

- Berkeley Advanced Biomaterials

- Invibio Ltd.

- Zimmer Biomet Holdings, Inc.

- BASF SE

- Covalon Technologies Ltd.

- Stryker

- Johnson & Johnson

- Dentsply Sirona

- CoorsTek Inc.

- Corbion

- Regenity Biosciences

Recent Developments

-

In April 2025, Covation Biomaterials LLC announced the launch of bioPTMEG, a bio-based alternative to conventional PTMEG, at Chinaplas 2025. The product aims to advance sustainable high-performance polymers, supporting the broader biomaterials industry, though it is primarily targeted at industrial and consumer applications rather than medical implants.

-

In April 2025, Northern Illinois University launched a new Biomaterials and Tissue Engineering laboratory to advance research in scaffold fabrication, cell culture, and regenerative medicine applications. The facility is expected to support innovation in biomedical biomaterials, potentially contributing to the development of future medical implants and tissue-engineering products.

Biomaterials Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 274.59 billion

Revenue forecast in 2033

USD 836.54 billion

Growth rate

CAGR of 17.25% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Medtronic; Evonik Industries AG; Carpenter Technology Corporation; Berkeley Advanced Biomaterials; Invibio Ltd.; Zimmer Biomet Holdings, Inc.; BASF SE; Covalon Technologies Ltd.; Stryker; Johnson & Johnson; Dentsply Sirona; CoorsTek Inc.;Corbion; Regenity Biosciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Biomaterials Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global biomaterials market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Metallic

-

Natural

-

Ceramics

-

Polymers

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cardiovascular

-

Sensors

-

Stents

-

Guidewires

-

Implantable Cardiac Defibrillators

-

Pacemakers

-

Vascular Grafts

-

Others

-

-

Ophthalmology

-

Synthetic Corneas

-

Intraocular Lens

-

Contact Lens

-

Ocular Tissue Replacement

-

Others

-

-

Dental

-

Tissue Regeneration Materials

-

Dental Implants

-

Bone Grafts & Substitutes

-

Dental Membranes

-

Others

-

-

Orthopedics

-

Joint Replacement biomaterials

-

Orthobiologics

-

Bioresorbable Tissue Fixation Products

-

Viscosupplementation

-

Spine Biomaterials

-

Others

-

-

Wound Healing

-

Fracture Healing Device

-

Adhesion Barrier

-

Skin Substitutes

-

Internal Tissue Sealant

-

Surgical Hemostats

-

Others

-

-

Tissue Engineering

-

Plastic Surgery

-

Facial Wrinkle Treatment

-

Soft Tissue Fillers

-

Craniofacial Surgery

-

Bioengineered Skins

-

Peripheral Nerve Repair

-

Acellular Dermal Matrices

-

Others

-

-

Neurology

-

Neural Stem Cell Encapsulation

-

Shunting Systems

-

Hydrogel Scaffold For CNS Repair

-

Cortical Neural Prosthetics

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomaterials market size was estimated at USD 236.99 billion in 2025 and is expected to reach USD 274.59 billion in 2026.

b. The global biomaterials market is expected to grow at a compound annual growth rate of 17.25% from 2026 to 2033 to reach USD 836.54 billion by 2033.

b. The metallic product segment dominated the biomaterials market with a share of 40.56% in 2025. The wide availability of metallic and advanced materials for tissue fixation and other orthopedic applications is expected to accelerate segment revenue generation.

b. Some key players operating in the biomaterials market include Medtronic plc; Evonik Industries AG; Carpenter Technology Corporation; Berkeley Advanced Biomaterials; Invibio Ltd.; Zimmer Biomet Holdings, Inc.; BASF SE; Covalon Technologies Ltd.; Stryker; Johnson & Johnson; Dentsply Sirona; CoorsTek Inc.;Corbion; and Collagen Matrix, Inc.

b. Key factors that are driving the biomaterials market growth include rising demand as a consequence of accidental injuries & chronic conditions, advances in biomaterials technologies, and expansion in the usage scope of biomaterials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.