- Home

- »

- Medical Devices

- »

-

Biomaterial Wound Dressing Market Size, Share Report 2030GVR Report cover

![Biomaterial Wound Dressing Market Size, Share & Trends Report]()

Biomaterial Wound Dressing Market Size, Share & Trends Analysis Report By Product (Natural, Synthetic), By Application (Chronic Wounds, Acute Wounds), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-199-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Biomaterial Wound Dressing Market Trends

The global biomaterial wound dressing market size was valued at USD 6.23 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.46% from 2024 to 2030. The rising prevalence of chronic diseases, the rising geriatric population, and advancements in wound dressings, which propel new product development are driving the demand for biomaterial wound dressings. For instance, in June 2022, Collagen Matrix, received the 510(k) clearance for a noval Fibrillar Collagen Wound Dressing, an absorbent microfibrillar matrix used to treat wounds. These factors are expected to propel the market.

The rising prevalence of chronic wounds is a key factor driving the market growth. For instance, as per the data published by Mary Ann Liebert, Inc. in October 2023, chronic wounds are now affecting 10.5 million U.S. Medicare beneficiaries, which is up by 2.3 million from the 2014 update. Furthermore, chronic wounds are impacting the quality of life of nearly 2.5% of the total population of the U. S. Similarly, as per the report by the National Library of Medicine (NCBI), in August 2023, about 9.1 to 26.1 million incidences of diabetic foot ulcers occurs each year globally. In addition, the rising incidences of burns is expected to propel the demand for collagen wound dressings. For instance, as per a report by Rosenfeld Injury Lawyers LLC, in March 2023, around 450,000 people suffer burn injuries in America each year. Moreover, as per a report published by World Health Organization (WHO) in October 2023, globally around 180,000 deaths each year caused by burns. The rising burden of chronic wounds and burn injuries are anticipated to drive the market growth.

The geriatric population is more prone to chronic disorders. The prevalence of chronic disorders that affect skin integrity, such as diabetes and peripheral vascular disease (venous hypertension, arterial insufficiency), is growing with rising geriatric population. These disorders frequently result in skin disintegration, ulceration, and development of persistent wounds. As per a report by National Council on Aging, Inc., in August 2023, about 95% of adults 60 and above have at least one chronic condition, moreover 80% have two or more chronic conditions. Thus, the rising geriatric population is expected to drive the demand for wound dressings. For instance, as per the data published by Visual Capitalist in May 2023, in 2022 about 771 million people aged 65 years and above globally. In addition, according to CDC, adults aged 65 years and above are more likely to suffer from heart diseases, COPD, diabetes, cancer, neurological problems, and other chronic illnesses. Patients with such illnesses require emergency & nonemergency hospital services, as well as surgeries, which expected to propel surgical dressing market.

The introduction of innovative and advanced wound products is projected to significantly impact the advanced wound care industry in the coming years. Advanced wound care & closure products due to their efficacy and effectiveness in wound management, allowing quicker healing, are gradually replacing traditional wound care and closure products. For instance, in November 2023, Kane Biotech Inc., in collaboration with ProgenaCare Global LLP, launched the novel rebranded revyve Antimicrobial Wound Gel, a combination of coactiv+ technology and PHMB, combined with a non-ionic pluronic surfactant with thermo-gelling properties. These products are designed to be more effective in treating chronic wounds and promoting healing. They are also more comfortable for patients to wear, which can improve patient compliance and outcomes. As a result, the demand for these products is increasing, which propels the market.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The biomaterial wound dressing market is characterized by a high degree of innovation owing to the rising prevalence of chronic diseases and increasing demand for advanced wound care products. Manufacturers are constantly developing new and improved materials that provide better performance, comfort, and healing outcomes for patients. Some of the latest innovations in biomaterial wound dressings include the use of nanotechnology, stem cells, and bioactive compounds to enhance the healing process and prevent infections.

The biomaterial wound dressing market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This strategy enables companies to increase their capabilities, expand product portfolios, and improve competencies.

The biomaterial wound dressing market is also subject to increasing regulatory scrutiny. This is due to concerns about the patient’s safety, efficacy, and quality of medical devices and products related to wound dressings. changes in regulations can impact on the market, as companies may need to reformulate or redesign products to meet new standards. Overall, regulations can both protect patients and create challenges for companies in the biomaterial wound dressings market.

There are various substitutes for biomaterial wound dressings in the market. Some of the commonly used alternatives include silver dressings, film dressings, gauze dressings. These products may provide similar benefits to biomaterial dressings such as wound protection and promoting healing, but they may not be as effective in preventing infections or have the same level of comfort for patients.

End-user concentration: The biomaterial wound dressing market is significantly affected by the concentration of end users. The prevalence of chronic wounds, an aging population, and the surging demand for advanced wound care products are some of the factors driving growth in the market. Therefore, manufacturers and suppliers of biomaterial wound dressings are likely to keep considering end-user concentration as a crucial factor.

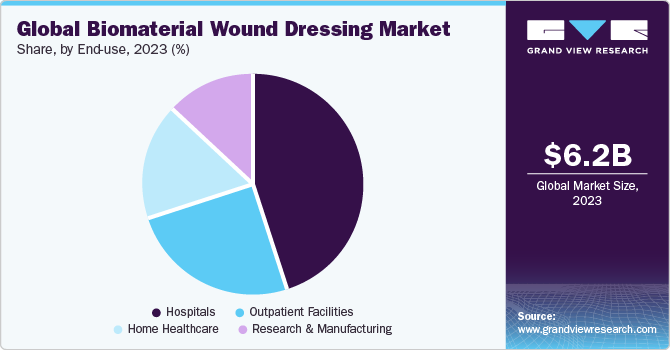

End-use Insights

Hospitals segment dominate the market revenue share and grow at a CAGR of 7.59% from 2024 to 2030. Hospitals often adopt advanced wound care technologies and treatments to optimize patient outcomes. In addition, hospitals handle a diverse patient population with varying wound care needs, from minor injuries to complex, hard-to-heal wounds, requiring a wide range of wound care products & interventions. For instance, as per the research data published in the AMA, 2022, chronic wounds affect approximately 450,000 Australians at any time, costing the health system around USD 3 billion annually.

The home healthcare segment is projected to witness the highest growth rate over the forecast period. The increasing need for cost-effective and convenient wound care solutions, as well as the growing prevalence of chronic wounds and diabetes-related ulcers. In addition, the rising demand for advanced wound care products that offer enhanced healing properties and reduced healing time is also expected to drive the growth of the biomaterial wound dressings market in the home healthcare segment.

Product Insights

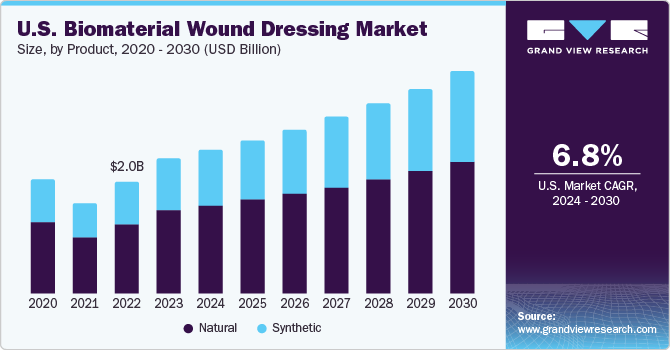

On the basis of product, the market is classified into natural and synthetic. The natural segment led the biomaterial wound dressing market and grow at a CAGR of 6.83% from 2024 to 2030. Amongst, alginate dressing is anticipated to have a substantial share in the forecast period. Alginate, unlike other biomaterials, is commonly employed as a wound dressing with drug release because to its homeostatic features. Alginate is an anionic polysaccharide can be utilized to make hydrogels at room temperature in typical conditions. This natural polymer is biocompatible, biodegradable, reasonably priced, and has an uncomplicated gelation process.

Alginate may be used as a biomaterial in various shapes, including gel-like structures generated by calcium ions acting as a binding agent. Alginate's elastic characteristics, secretory absorption, permeability, and ability to produce a humid environment in wounds make it a promising scaffold for tissue engineering. Therefore, such widespread application of the alginate dressing is anticipated to boost the growth of the studied segment over the estimated period.

Furthermore, hydrogel wound dressings that incorporate natural antibacterial bio-additives have gained widespread usage in wound management. These bio-additives have been found to enhance the antibacterial properties of hydrogel wound dressings and prevent the unfavorable proliferation of bacteria. These factors are propelling the segment growth.

Synthetic is expected to register the fastest CAGR during the forecast period. Synthetic wound dressings can be used on a variety of wounds, including burns, ulcers, and surgical wounds. They are designed to provide a moist environment for the wound to heal, while also protecting it from bacteria and other contaminants. Some synthetic dressings also contain substances that promote healing, such as silver or honey. In Addition, the rising prevalence of diabetes, skin cancers, and venous and arterial leg ulcers are propelling the segment growth. As per a report by The Lancet, in June 2023, an estimated 1.31 billion people could be living with diabetes by 2050. Similarly, as per a report by American Cancer Society, in 2023, about 97,610 new cases of melanomas are expected to be diagnosed in U.S. These factors are expected to propel the segment growth over the forecast period.

Application Insights

On the basis of application, the market is classified into chronic wounds and acute wounds. The chronic wounds segment is dominate the market and grow at a CAGR of 7.38% from 2024 to 2030. This segment dominance is anticipated due to the rising geriatric population along with the rising incidences of pressure ulcers, diabetic foot ulcers, and other chronic wounds is expected to drive the segment growth. For instance, as per a report by WHO, in October 2022, 1 in 6 people globally is expected to be aged over 60 years or above by 2030, which accounts for 1.4 billion people. Similarly, as per data published by JAMA Network, in November 2023, diabetic foot ulcers affect 18.6 million people globally and 1.6 million U.S. people each year. These factors are expected to propel the segment over the forecast period.

Regional Insights

The biomaterial wound dressing market in North America held the largest share and accounted for 45.49% of global revenue in 2023. This high share is attributable to the rising elderly population and the increasing prevalence of chronic disorders due to lifestyle changes, resulting in a higher volume of diabetic population.The growing population of diabetics is a primary driver of market expansion. For instance, according to the National Diabetes Statistics Report, which was updated in January 2022, 37.3 million individuals in the U.S. have diabetes, accounting for around 11.3% of the overall population. Furthermore, the report claimed that around 96 million persons aged 18 and up in the U.S. have prediabetes. Furthermore, according to American Diabetes Association statistics updated in February 2022, approximately 283,000 people under the age of 20 in the U.S. have been diagnosed with diabetes, accounting for roughly 35% of the population. In addition, well-developed healthcare infrastructure and the presence of key players in the region is one of the leading factors contributing to market growth

U.S. Biomaterial Wound Dressings Market Trends

U.S. biomaterial wound dressing market held the largest share in North America biomaterial wound dressings market in 2023. The increased utilization of surgical procedures, and the high prevalence of chronic disorders, are some of the major factors fueling the market. For instance, as per a report by the National Center for Chronic Disease Prevention and Health Promotion last reviewed in May 2023, six in ten people in the U.S. live with at least one chronic disorder, such as cancer, diabetes, strokes, and heart diseases. These factors are expected to drive the demand for biomaterial wound dressings. Thus, propelling the segment over the forecast period.

Europe Biomaterial Wound Dressings Market Trends

The biomaterial wound dressing market in Europe is driven by factors such as the increasing prevalence of chronic disorders, the presence of well-established healthcare infrastructure, and the availability of skilled professionals. For instance, as per a report by the European Union (EU) population, in November 2023, in Europe more than 36.1% of people out of the total EU population reported having a chronic disorder in 2022. In addition, the increasing geriatric population and rising cases of burns & trauma are also anticipated to drive the market.

The UK biomaterial wound dressing market is driven by the rising healthcare expenditure in the UK is expected to drive the UK biomaterial wound dressings market. For instance, as per a report by The Health Foundation, in December 2023, in 2022/2023, healthcare spending increased by 5.6% (196.59 billion) as compared to 2019/2020 healthcare spending.

The biomaterial wound dressing market in France is anticipated to witness significant growth over the forecast period owing to several key factors, such as presence of several key players in the market and the increasing prevalence of chronic diseases. The French government is undertaking initiatives to improve the healthcare infrastructure in France. As a result, major international players are collaborating with local players to launch, market, and distribute their products in the market. Therefore, owing to these collaborations, local players are gaining significant market share in the region.

Germany biomaterial wound dressings market is driven by factors, such as many companies are forming strategic partnerships, launching new products, and engaging in mergers and agreements. For instance, in June 2023, JeNaCell, an Evonik company, launched a wound dressing epicite balance for chronic wounds in the German market. Such factors are expected to boost the biomaterial wound dressings market in Germany and intensify the competition over the forecast period.

Asia Pacific Biomaterial Wound Dressings Market Trends

The biomaterial wound dressings market in Asia Pacific is anticipated to witness significant growth. Due to the increasing prevalence of chronic disorders, presence of major key players, and increasing healthcare expenditure. For instance, as per a report by Insurance Asia, healthcare spending in Asia Pacific is expected to surge 9.9% in 2024. These factors are expected to propel the market over the forecast period.

China biomaterial wound dressings market accounted for the largest share of the Asia Pacific biomaterial wound dressing market in 2023. Growth in the market is primarily propelled by the well-developed healthcare infrastructure, rising geriatric population and increasing prevalence of chronic disorders. As per the data published by Springer Nature, in 2022, about 280.04 million people aged 60 and above in China account for 19.8% of the nation's population. These factors are expected to drive the China biomaterial wound dressing market growth over the forecast period.

The biomaterial wound dressing market in Japan is moderately competitive, with the presence of some major companies offering wound care products. Major players in the market are adopting several strategies such as mergers & acquisitions and partnerships & collaborations to stay competitive in the market.

Latin America Biomaterial Wound Dressings Market Trends

Latin America biomaterial wound dressings market is driven due to the Latin American region becoming increasingly attractive for medical tourism due to the availability of advanced treatment options at low costs. Moreover, governments in this region are actively involved in improving healthcare infrastructure which is expected to further drive the growth of the biomaterial wound dressing market in the coming years.

MEA Advanced Wound Cares Market Trends

The advanced wound care market in the MEA region is expected to witness significant growth due to various factors, such as the increasing number of surgeries, a growing geriatric population, and a rise in sports-related injuries. Additionally, with increasing government initiatives to develop healthcare infrastructure in the region, the demand for biomaterial wound dressing products for postoperative care is expected to rise over the forecast period. The biomaterial wound dressings market in Saudi Arabia accounted for the largest share of the MEA market.

Key Biomaterial Wound Dressing Company Insights

Biomaterial wound dressings market trends are shaping industry leader’s strategies. Heavy investments in research and development for treating various wounds. Top players are adapting the shift towards user comfort through technological advancements, and innovative products. These innovative foam dressings improved wound healing both wound closure rate and histological parameters of skin wounds and no dermatological reactions occurred. These innovative products drive the market growth positively over the forecast period.

Key Biomaterial Wound Dressing Companies:

The following are the leading companies in the biomaterial wound dressing market. These companies collectively hold the largest market share and dictate industry trends.

- ConvaTec Group PLC

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- B. Braun Melsungen AG

- 3M

- URGO

- Coloplast Corp.

- Integra LifeSciences

- Medline Industries, Inc.

Recent Developments

-

In October 2023, DuPont launched a novel soft skin adhesive (SSA) DuPont Liveo MG 7-9960 that boasts higher adhesion and lower cyclic silicone. This advanced adhesive has been specifically designed to be used in wound care dressings and for attaching medical devices to the skin, allowing for extended wear time and gentle removal.

-

In June 2023, JeNaCell introduces the epicite balancing wound dressing to the German market. The dressing is especially well-suited and adapted for the management of chronic wounds with low to medium levels of exudation, including soft tissue lesions, diabetic foot ulcers, venous leg ulcers, and arterial leg ulcers.

-

In October 2022, Healthium Medtech introduced a new line of wound dressings "Theruptor Novo". For the treatment of persistent sores such as diabetic foot ulcers and leg ulcers.

Biomaterial Wound Dressing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.63 billion

Revenue forecast in 2030

USD 10.21 billion

Growth rate

CAGR of 7.46% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp.; Integra LifeSciences; Medline Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biomaterial Wound Dressing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomaterial wound dressing market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Alginate

-

Honey

-

Collagen

-

Chitosan

-

Carboxymethyl Cellulose (CMC)

-

Others

-

-

Synthetic

-

Polyurethane

-

Silicone

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Healthcare

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia-Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomaterial wound dressing market size was estimated at USD 6.23 billion in 2023 and is expected to reach USD 6.63 billion in 2024.

b. The global biomaterial wound dressing market is expected to grow at a compound annual growth rate of 7.46% from 2024 to 2030 to reach USD 10.21 billion by 2030.

b. The alginate dressing held the largest market share in the natural segment in 2023, owing to its wide usage in wound healing properties. Alginate dressing is usually made from seed wood, making it highly absorbent and offering a moist wound environment that is favorable for treating dry injuries.

b. Key players operating in the biomaterial wound dressing market include ConvaTec Group PLC; Smith & Nephew PLC; Mölnlycke Health Care AB; B. Braun Melsungen AG; 3M; URGO; Coloplast Corp.; Integra LifeSciences; Medline Industries, Inc.

b. The rising prevalence of chronic wounds, rising geriatric population, and technological advancements in wound dressings are some major factors that drive the growth of the biomaterial wound dressing market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."