Biomass Power Market Size, Share & Trends Analysis Report By Feedstock (Solid, Liquid Biofuels), By Technology (Combustion, Gasification, Anaerobic Digestion), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-936-4

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Biomass Power Market Size & Trends

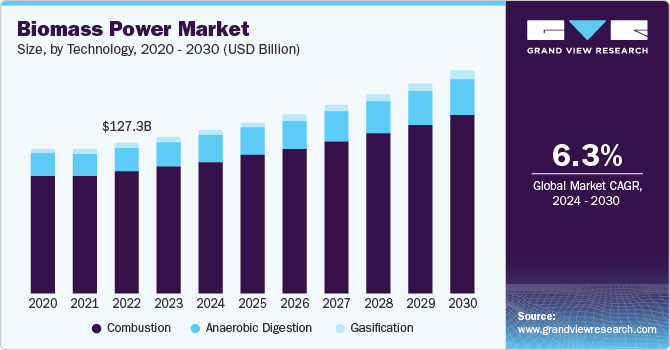

The global biomass power market size was estimated at USD 133.97 billion in 2023 and is expected to expand at a CAGR of 6.3% from 2024 to 2030. Biomass power growth has been witnessed with rise in environmental concerns which has resulted in various countries worldwide increasing the share of renewable energy in their power mix. Countries such as India, China, Germany, the UK, and France have announced renewable energy targets and are striving to become carbon neutral nations in the future.

The market is gaining adoption owing to favorable policies and regulations, Further, European Union countries are looking for coal-phase out which is expected to boost the demand for biomass power. Further, currently in countries such as India, the U.S., and China co-firing of coal-based power plants are done with biomass feedstock to limit carbon emissions from the plant. These factors are expected to boost the growth of the market in the forecast period.

Biomass power plants are witnessing increased interest from energy providers and utility firms that aim to diversify their energy mix and reduce their carbon footprint. Governments of different countries across the world are also introducing incentives and policies to encourage the development of biomass power infrastructure as they recognize it as a key part of the solution to mitigate climate change. At the same time, the effects of rising temperatures, such as droughts and forest fires, are also impacting the supply and availability of biomass feedstock such as wood pellets. This leads biomass power companies to explore new sources of organic waste materials and optimize their supply chains to ensure reliable and sustainable fuel sources.

One of the major challenges of the market is the sustainability and accessibility of biomass feedstock. The requirement for biomass resources can create a competitive environment with various industries such as agriculture and forestry, thereby leading to possible conflicts among them. Moreover, logistics and transportation challenges in obtaining and delivering biomass to power plants can surge costs of power.

Market Concentration & Characteristics

The biomass power market is dominated by a few major players, with various companies involved in different segments of the value chain. Leading companies like Mitsubishi Power Ltd., Suez, Xcel Energy Inc., Ramboll Group A/S, Babcock & Wilcox Enterprises, Inc., Orsted A/S, Ameresco Inc., General Electric, Veolia, and Vattenfall AB contribute significantly with their expertise in biomass power.

Companies and consortium are increasingly focusing on expansion and collaborations in order to penetrate in the market. For instance, in February 2024, Japan Petroleum Expansion Co., Ltd. announced the initial delivery of wood pellets for a 50-MW biomass power plant, marking progress in renewable energy development. This delivery signifies a step toward utilizing biomass resources for electricity generation, contributing to the growth of sustainable energy solutions.

Technology Insights

Combustion emerged as the largest segment with a market share of about 88.3% in 2023 and is expected to witness robust growth over forecast period. Biomass feedstock is directly combusted in a furnace with air, to convert water into steam. The produced steam is used to drive a steam turbine to generate electricity. Use of combustion technology involves a non-complex operation and it operates at a lesser cost compared to other advanced biomass power technologies. This is expected to drive the use of combustion technology in the market compared to other available technologies over the forecast period.

Combustion is the most common way of converting solid biomass fuels to energy. It is used for generating over 80%-90% of the global energy from biomass. A significant part of this energy generated from biomass using combustion technology is employed for traditional cooking and heating applications.

Gasification segment is anticipated to grow at the fastest rate over forecast period. Gasification technology involves the conversion of solid biomass into a combustible gas through various thermochemical reactions. The produced gas has a calorific value ranging from 1,000 to 1,200 kcal/Nm3. Major advantages of gasification over other biochemical conversion technologies include the processing speed with which the product can be obtained. In the case of gasification, it can be produced in a couple of minutes compared to biochemical conversion technology, such as anaerobic digestion, which requires several days.

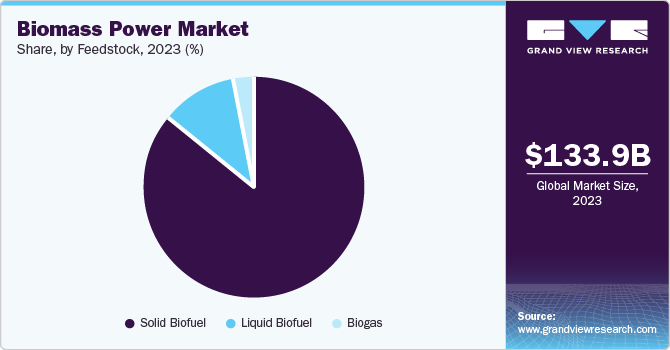

Feedstock Insights

Solid biofuel segment emerged as the largest segment with a market share of 85.8% in 2023 and is expected to register the highest growth over forecast period. Solid biofuel includes solid, organic, non-fossil-derived materials that are of biological origin. These are utilized either for electricity generation or heat production. They include products such as wood pellets, animal waste, fuelwood, vegetable material, and wood residues. Solid biofuel was the dominant feedstock segment in 2023 owing to the easy availability and low cost of solid biofuels, which has resulted in higher adoption over liquid biofuels and biogas for power generation applications.

Liquid Biofuel is anticipated to grow at the fastest rate over the forecast period. Liquid biofuels include liquid fuels that are of natural origin and are produced from biomass or waste. These fuels are suitable for blending and can also be used in place of liquid fossil fuels for transportation and power generation applications. Liquid biofuels include products such as biodiesel, bio-gasoline, and bio-jet kerosene, which are utilized in the transportation sector, as well as crude vegetable oils and animal fats, which are utilized for power generation applications.

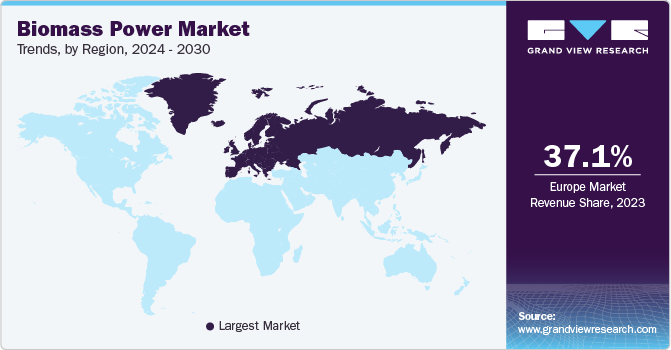

Regional Insights

The North American region is majorly dependent on coal for power generation. The recent discovery of shale gas reserves in the region has resulted in gas-based power generation, which has gained higher growth over coal-based power generation in the region in the past decade. The rise in environmental concerns has led North American countries to focus on renewable energy. As a result, favorable policies and regulations have been drafted by the U.S., Canada, and Mexico to support renewable power sources such as solar, wind, and biomass.

U.S. Biomass Power Market Trends

The growth of the U.S. market is driven by the governmental supportive policies and plans related to renewable energy adoption, coupled with the abundant availability of biomass feedstock in the country. The power scenario in the U.S. has been witnessing a change with more adoption of gas-based and renewable power sources than coal-based power generation. According to the International Renewable Energy Agency (IRENA), the total bioenergy capacity of the U.S. was 11.0 gigawatts (GW) in 2023.

Europe Biomass Power Market Trends

Europe dominated market and accounted for the largest revenue share of about 37.12% in 2023. The European Union, in its long-term strategy, has aimed to be carbon neutral by 2050. This objective is in line with the European Union’s commitments as part of the Paris Agreement. According to the European Green Deal, the European Commission in March 2020 passed the first-ever European Climate Law to achieve its 2050 climate-neutrality goal. Further, the European Union member countries are required to develop and implement national long-term strategies to achieve their commitments as per the Paris Agreement.

Germany biomass power market held over 18.6% share in the European market due to leading markets for biomass power installation in the region. Biomass Power is also utilized in the country, which had an installed capacity of 10.0 GW in 2023. Biomass Power has witnessed a lesser growth as compared to solar and wind energy in the country in the past decade. With the Climate Action Programme 2030, the government is aiming to increase the share of renewable energy up to 65% by 2030.

Biomass power market in UK is anticipated to grow at a CAGR of over 8.7%. In August 2023, the Government of the UK announced its Biomass Strategy 2023, which outlines the role of sustainable biomass in helping the country reach net-zero emissions by 2024. According to the UK Department of Energy Security and Net Zero Chief Scientific Advisor, biomass accounts for 8.6% of the energy supply in the country.

Asia Pacific Biomass Power Market Trends

Asia Pacific market is poised for significant growth, exceeding a projected CAGR of over 10.8% between 2024 and 2030. This boom is driven by factors like rising demand of biomass power in countries such as China, Japan, Thailand, and India.

China biomass power market held a dominant share of 36.6% in the Asia Pacific region in 2023. China is majorly dependent on coal for power generation. However, coal consumption in the country has witnessed a declining trend from 2013 to 2016 as the country committed its stance to steering the fight against global warming and carbon emissions. There has been a progressive rise in gas-based power plants and renewable energy plants based on solar, wind, biomass, and hydro in the country in the past five years.

The country has witnessed an increase in the installed capacity of bioenergy from 2014 onwards. For instance, the installed capacity of bioenergy in the country had increased from 6.7 GW in 2014 to 31.3 GW by 2023. The availability of abundant biomass resources in China from various sources such as agriculture, animal manure, and forestry has resulted in power plant manufacturers opting for biomass power. Moreover, supporting policies and plans for renewable energy are likely to positively influence the growth of the market.

Biomass power market in India is anticipated to register a CAGR of about 10.3% over forecast period. The country has the potential to have an installed capacity of around 18 GW of biomass power owing to the abundant availability of biomass resources in the country. The Ministry of New and Renewable Energy in India launched a financial support scheme in 2019 for biomass power projects. Under this scheme, shortlisted biomass-cogeneration projects will be provided a fund of USD 34,200 (INR 25 lakh) per MW and USD 68,500 (INR 50 lakh) per MW of surplus exportable power capacity and as per the type of biomass fuel used.

Key Biomass Power Company Insights

The market is moderately consolidated with presence of a few medium and large-sized companies. The market is a dynamic landscape with established players and innovative startups. Key companies are adopting several organic and inorganic growth strategies, such as new technological development, facility expansion, research & development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In March 2023, Renova, a Japanese renewable energy producer, commenced 75 MW Ishinomaki Hibarino biomass-based power plant operations in Miyagi prefecture. The plant utilizes wood pellets and palm kernel shells to generate approximately 530 GWh/yr of electricity. Despite initial delays, Renova successfully started the power plant, contributing to Japan's renewable energy landscape.

-

In February 2024, Seiko Epson Corporation announced its plans to build its first biomass power plant in Iida City, Nagano Prefecture, Japan. The company aims to have the plant operational by 2026, focusing on becoming carbon-negative and using renewable electricity to achieve its decarbonization goals.

Key Biomass Power Companies:

The following are the leading companies in the biomass power market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Heavy Industries, Ltd.

- Suez

- Xcel Energy Inc.

- Ramboll Group A/S

- Babcock & Wilcox Enterprises, Inc.

- Ørsted A/S

- Ameresco

- General Electric

- Veolia

- Vattenfall

Biomass Power Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 141.24 billion |

|

Revenue forecast in 2030 |

USD 203.61 billion |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

July 2024 |

|

Quantitative units |

Revenue in USD million/billion; Volume in Million MWh, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue Forecast, Volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Feedstock, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Italy; UK; Germany; China; India; Thailand; Brazil |

|

Key companies profiled |

Mitsubishi Power Ltd.; Suez; Xcel Energy Inc.; Ramboll Group A/S; Babcock & Wilcox Enterprises, Inc.; Ørsted A/S; Ameresco Inc; General Electric; Veolia; Vattenfall AB |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biomass Power Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomass power market report based on feedstock, technology, and region:

-

Technology Outlook (Revenue, USD Million; Volume, Million MWh, 2018 - 2030)

-

Combustion

-

Gasification

-

Anaerobic Digestion

-

-

Feedstock Outlook (Revenue, USD Million; Volume, Million MWh, 2018 - 2030)

-

Solid Biofuel

-

Liquid Biofuel

-

Biogas

-

-

Regional Outlook (Revenue, USD Million; Volume, Million MWh, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global biomass power market size was estimated at USD 133.97 billion in 2023 and is expected to reach USD 141.24 billion in 2024.

b. The global biomass power market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 203.61 billion by 2030.

b. Based on feedstock, solid biofuel was the dominant segment in 2023 with a share of about 86% in 2023, owing to the easy availability and low cost of solid biofuels, which has resulted in higher adoption over liquid biofuels and biogas for power generation applications.

b. Some of the key players operating in this industry include Mitsubishi Heavy Industries, Ltd., Suez, Xcel Energy Inc., Ramboll Group A/S, Babcock & Wilcox Enterprises among others.

b. Key factors driving the biomass power market growth include the minimize dependence on fossil fuels, reduce greenhouse gas emissions, and improving the security of the energy supply.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."