Biomarker Testing Services Market Size, Share & Trends Analysis Report By Service (Biomarker Assay Development & Validation, Flow Cytometry), By Application (Oncology, Drug Discovery & Development), By Type, By End-use,By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-986-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Biomarker Testing Services Market Trends

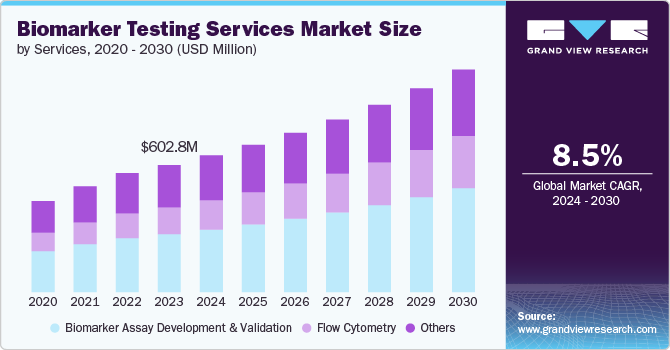

The global biomarker testing services market size was estimated at USD 648.8 million in 2024 and is projected to grow at a CAGR of 8.59% from 2025 to 2030. The market growth is mainly due to increasing demand for personalized medicine, prevalence rate of chronic diseases, and growing demand for biomarkers in drug development and clinical trials. Biomarkers are critical in drug development and clinical trials to assess drug efficacy, safety, and patient stratification. Pharmaceutical companies and biotechnology firms mainly outsource these activities to streamline drug development processes, reduce development costs, and accelerate regulatory approvals further contributing to the market growth.

Furthermore,the pandemic has further accelerated the demand for biomarker testing services. A substantial proportion of research was focused on COVID-19, with several products in clinical trials aimed at developing safe and effective therapeutics. Several advancements happened in the drug discovery field which consequently accelerated the need for biomarkers to facilitate thorough analysis. Thus, the aforementioned factors further contributed to the biomarker testing services market.

Increasing research and development activities by several industry players is major aspect contributing to the biomarker testing services industry growth. For instance, in November 2023, Charles River Laboratories entered into a partnership agreement with Aitia, Inc.to incorporate Logica, an innovative platform, into their discovery programs focused on oncology and neurodegenerative diseases. This collaboration aims to leverage Logica's capabilities in biomarker identification and validation, thereby enhancing the efficacy of drug discovery efforts. The integration is expected to drive advancements in the biomarker testing services industry.

Further, increasing prevalence of cancer globally enhanced the need for effective diagnostic and prognostic biomarkers. Biomarkers play a critical role in oncology by aiding in early detection, monitoring disease progression, predicting treatment response, and assessing recurrence risk. According to an article published in CancerCare in April 2023, biomarker testing has proven to be a valuable tool in determining optimal therapies for eligible cancer patients, ensuring timely and appropriate treatment while also yielding cost savings and improving patient outcomes.

Biomarkers, which includes several disease-specific types, are increasingly adopted by researchers to facilitate faster and accurate disease diagnoses. This not only streamlines the execution of clinical trials but also accelerates the drug development process by enabling more precise targeting of therapies. For instance, in oncology field biomarker testing services are crucial for identifying genetic mutations and molecular signatures that provides personalized treatment strategies, thereby improving patient outcomes. Therefore, the increasing need for enhanced diagnostic precision and therapeutic efficacy in clinical research and healthcare settings would further expand the industry.

Biomarker testing services are rapidly expanding because they can increase the production of novel and innovative medicines and biologic products needed to combat the pandemic. For instance, in March 2021, the U.S. FDA provided EUA for the Tiger Tech COVID Plus Monitor which is used to diagnose COVID-19 in asymptomatic individuals by using biomarkers; this also helps in the prevention of the disease. Similar initiatives by the regulatory authorities in the coming years are expected to support the market in the post-pandemic period.

Service Insights

The biomarker assay development & validation segment dominated the industry with the largest revenue share of 45.77% in 2024. The dominance is mainly due to its potential role in clinical research, stringent regulatory requirements, technological advancements, and the growing demand for personalized medicine solutions. Regulatory agencies such as the FDA in the U.S. require rigorous validation of biomarker assays to ensure their accuracy, precision, and reliability. Compliance with regulatory standards is necessary for obtaining approval or clearance for biomarker-based diagnostics and therapies, driving demand for robust assay development and validation services.

The flow cytometry segment is expected to witness the fastest growth from 2025 to 2030 as it provides highly detailed information on any single cell in a heterogeneous population, and due to this reason, it is used in preclinical and clinical settings for generating data. Flow cytometry supports dose selection in clinical trials and is also suitable for patients who receive transplants. Technological advancements such as the launch of microfluidic flow cytometry for biomarker analysis are further accelerating biomarker testing. Thus, these factors are contributing to market growth.

Application Insights

The oncology segment dominated the industry with 51.38% revenue share in 2024. The high segment growth is due to the increasing cancer prevalence rate and the demand for targeted therapies. As cancer treatments evolve toward more personalized approaches, precise biomarker identification and validation have become critical. Biomarkers are essential for patient stratification and help to identify individuals most likely to benefit from specific therapies, including immunotherapies and targeted drugs. This precision medicine approach accelerates the adoption of biomarker testing in oncology clinical trials, enabling more effective and tailored treatments.

The drug discovery & development segment is projected to witness considerable from 2025 to 2030. The increasing complexity of drug development processes and the demand for faster, more cost-effective solutions are key factors driving segment revenue growth. Biomarkers play a critical role in the early stages of drug discovery by identifying potential therapeutic targets, improving preclinical models, and allowing more efficient patient recruitment. Global pharmaceutical R&D spending reached over $260 billion in 2023, with a significant portion allocated to biomarker-driven research to streamline the drug development pipeline.

Type Insights

The molecular biomarkers segment dominated the industry in 2024. Molecular biomarkers, such as genetic mutations, RNA expression levels, and protein markers, offer critical insights into disease mechanisms, diagnosis, prognosis, and treatment response. They are widely used across various therapeutic areas, including oncology, infectious diseases, cardiovascular diseases, and neurology, due to their ability to provide precise and actionable information.

The cellular biomarkers is projected to witness the higher growth from 2025 to 2030. The rapid growth of immunotherapy and cell-based therapies, such as CAR-T cell therapy and stem cell therapies has increased the demand for cellular biomarkers. These includes immune cell subsets, activation markers, and functional assays, are crucial for monitoring treatment responses, predicting efficacy, and managing treatment-related toxicities.

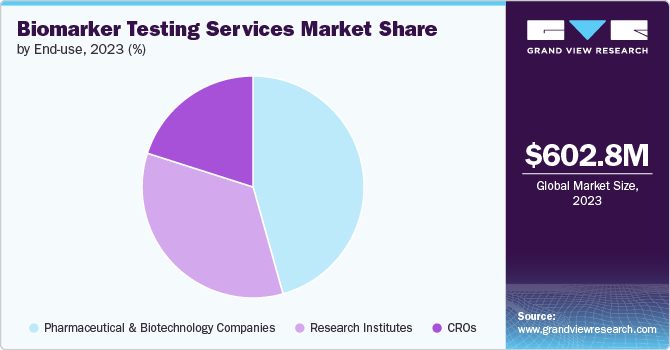

End Use Insights

Pharmaceutical and biotechnology companies segment held the largest revenue share of 45.45% in 2024. Increased funding for clinical research by pharmaceutical and biotechnology is one of the key reasons supporting the segment growth. Moreover, growing interest among pharmaceutical companies in developing targeted therapies for cancer treatment is also contributing to the segment growth. For instance, in September 2022, AstraZeneca and Roche entered into a partnership agreement to redefine the treatment and diagnosis of cancer in the Middle East and North Africa. The partnership aims to remove barriers in biomarker testing and expand access to precision medicines.

The CRO segment is expected to expand with the highest CAGR from 2025 to 2030. Pharmaceutical and biotechnology companies are increasingly outsourcing research and development activities to CROs to reduce costs, accelerate timelines, and access specialized expertise. CROs offer a range of services including clinical trials, biomarker testing, regulatory affairs, pharmacovigilance, and data management, making them integral to the drug development process.

Regional Insights

North America biomarker testing services market dominated the global market and accounted for a revenue share of 46.23% in 2024 owing to advanced healthcare infrastructure, supportive regulatory environment, and constant technological advancements. Strong presence of key market players providing biomarker testing services in this region; a rise in chronic disease burden that leads to an increase in laboratory diagnostic testing; the presence of advanced healthcare infrastructure; and growing R&D investment by the public organizations in the region are key factors supporting the market in the region.

U.S. Biomarker Testing Services Market Trends

The biomarker testing services market in the U.S. held the largest share in North America in 2024, owing to increasing demand for personalized medicine in the country coupled with growing research and development initiatives by the market players. Academic and research institutions in the U.S. are constantly conducting research in biomarker discovery and validation which is further contributing to the country’s market growth.

Europe Biomarker Testing Services Market Trends

The Europe biomarker testing services market is expected to grow significantly owing to the presence of key service providers offering specialized biomarker assays and diagnostics. Market competition, coupled with investments from healthcare companies are driving the innovation and overall market growth.

The biomarker testing services market in the UK witness significant market demand owing to growing emphasis on personalized medicine. Biomarker testing services play a pivotal role in identifying biomarkers that guide treatment decisions based on individual patient characteristics, thereby improving treatment efficacy and patient outcomes.

Germany biomarker testing services market held the largest share in 2024 in Europe. Germany has a well-developed healthcare system with state-of-the-art medical facilities, specialized laboratories, and a robust network of healthcare providers. This infrastructure supports the adoption and implementation of biomarker testing services across clinical and research settings.

Asia Pacific Biomarker Testing Services Market Trends

The biomarker testing services market in the Asia Pacific is expected to grow at the highest CAGR over the forecast period.APAC countries, including China, Japan, India, and South Korea, are experiencing rapid economic growth and increasing healthcare expenditures. This growth supports investments in healthcare infrastructure, including advanced diagnostic capabilities and biomarker testing services.

China biomarker testing services market held the largest share in 2024. China to grow at a considerable rate in the forthcoming years owing to the prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes is rising in APAC countries due to aging populations, urbanization, and lifestyle changes. Biomarker testing plays a crucial role in early detection, prognosis assessment, and therapeutic management of these diseases, driving overall market demand.

The biomarker testing services market in Japan is expected to grow over the forecast period. Japan boasts a highly advanced healthcare system with modern medical facilities, specialized laboratories, and a strong network of healthcare providers. This infrastructure supports the adoption and integration of biomarker testing services across clinical settings.

India biomarker testing services market is driven by rising healthcare expenditure and investments in the country are supporting the adoption of advanced diagnostic technologies, including biomarker testing, to improve healthcare outcomes and patient care. These factors are driving the country’s market growth.

Latin America Biomarker Testing Services Market Trends

The biomarker testing services market in the Latin America is expected to witness considerable growth in the coming years. The growth in the region is due to advancements in healthcare infrastructure and increasing awareness regarding personalized medicine. Countries like Brazil, Mexico, and Argentina are witnessing significant demand for biomarker testing across various applications including cardiovascular diseases, and infectious, and oncology diseases.

Brazil biomarker testing services market is driven by increasing government support aimed at enhancing healthcare infrastructure and access, as well as growing awareness among healthcare professionals and patients regarding the benefits of biomarker-based diagnostics.

Middle East and Africa Biomarker Testing Services Market

The biomarker testing services market in Middle East and Africa is expected to witness lucrative growth in the coming years. The growth in the region is due to growing chronic diseases, further increasing the demand for better treatment options. Moreover, increasing awareness among healthcare providers and patients about the benefits of personalized medicine, which relies heavily on biomarker testing for personalized treatment plans is also contributing to the regions market growth.

South Africa biomarker testing services market is driven by rising prevalence of chronic diseases in the country. Biomarker testing plays an important role in early detection, prognosis, and treatment selection for these conditions, which will further drive the market growth.

Key Biomarker Testing Services Company Insights

The key players operating across the biomarkers testing services industry implementing numerous strategic initiatives such as mergers, partnerships, collaborations, acquisitions, etc. The prominent strategies companies undertaking are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. For instance, in June 2022, Labcorp entered into a collaboration agreement with BML to increase its biomarker testing facility in Japan. The partnership broadened company’s regional presence.

Key Biomarker Testing Services Companies:

The following are the leading companies in the biomarker testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Bio Agilytix Labs

- Eurofins Scientific

- SGS SA.

- Charles River Laboratories

- Laboratory Corporation of America Holdings

- Thermo Fisher Scientific Inc. (PPD, Inc.)

- ICON Plc

- IQVIA

- Syneos Health

- Intertek Group Plc

Recent Developments

-

In June 2024, Thermo Fisher Scientific Inc., expanded its clinical research laboratory in Wisconsin. The launch of new laboratory will enhance services in the emerging and new therapeutic areas.

-

In April 2024, Labcorp expanded its precision oncology portfolio to support biopharma, clinical research and pharmaceutical companies in accelerating drug development programs. This expansion broadened company’s offerings in the significant market.

-

In March 2024, Labcorp launched a blood biomarker test for pTau217 to expedite Alzheimer's disease diagnosis and facilitate clinical trial support. Labcorp's integration of pTau217 as an independent test expanded the company's Alzheimer's diagnostic offerings, augmenting its comprehensive suite of blood-based biomarker tests.

Biomarker Testing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 699.8 million |

|

Revenue forecast in 2030 |

USD 1.06 billion |

|

Growth rate |

CAGR of 8.59% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, application, type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Indonesia; Malaysia; Singapore; South Korea; Thailand; Taiwan; Australia; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Israel, Kuwait. |

|

Key companies profiled |

Bio Agilytix Labs; Eurofins Scientific; SGS SA.; Charles River Laboratories; Laboratory Corporation of America Holdings; Thermo Fisher Scientific Inc. (PPD, Inc.); ICON Plc; IQVIA; Syneos Health; Intertek Group Plc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biomarker Testing Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomarker testing services market report based on services, application, type, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomarker Assay Development & Validation

-

Flow Cytometry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Drug Discovery & Development

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Biomarkers

-

Cellular Biomarkers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Research Institutes

-

CROs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Indonesia

-

Malaysia

-

Singapore

-

South Korea

-

Australia

-

Taiwan

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global biomarker testing services market size was estimated at USD 648.8 million in 2024 and is expected to reach USD 699.8 million in 2025.

b. The global biomarker testing services market is expected to grow at a compound annual growth rate of 8.59% from 2025 to 2030 to reach USD 1.06 billion by 2030.

b. North America dominated the biomarker testing services market with a share of 46.2% in 2024. This is attributed to the increasing number of pharmaceutical industries within the U.S. and Canada and an increasing presence of the number of major market players this region is expected to contribute significantly to the market growth.

b. Some key players operating in the biomarker testing services market include SGS SA; Toxikon, Inc.; Pace Analytical Services, LLC; Boston Analytical; Charles River Laboratories International Inc.; Nelson Laboratories and others.

b. Key factors that are driving the biomarker testing services market growth include supportive government investments in the healthcare industry, increasing R&D activities, increasing number of drug launches, and increasing focus on quality and sterility.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."