Biomarker Discovery Outsourcing Services Market Size, Share & Trends Analysis Report By Biomarker Type (Predictive, Safety), By Therapeutic Area (Oncology, Neurology), By Phase, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-139-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

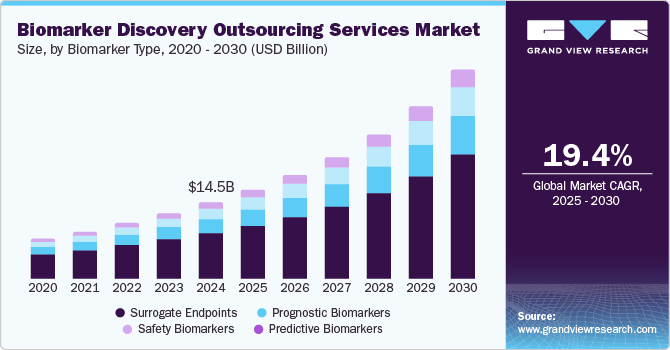

The global biomarker discovery outsourcing services market size was estimated at USD 14.53 billion in 2024 and is expected to grow at a CAGR of 19.4% from 2025 to 2030. The market growth is primarily owing to the growing demand for personalized medicine, advancements in omics technologies such as genomics, proteomics, metabolomics & several others, and the increasing adoption of artificial intelligence (AI) and machine learning (ML) for biomarker identification. Pharmaceutical and biotech companies are increasingly outsourcing biomarker research to contract research organizations (CROs) to reduce costs, accelerate drug development, and access specialized expertise. In addition, the rising prevalence of chronic diseases, stringent regulatory requirements for biomarker validation, and the need for high-throughput data analysis further boost overall market growth.

The growing demand for biomarkers in drug development drives the global market growth potential in the near future. Pharmaceutical and biotech organizations are gradually utilizing biomarkers for patient stratification, drug efficacy assessment, and early disease diagnosis, thereby accelerating R&D efficiency. Ongoing advancements in omics technologies, AI-driven biomarker identification, and increasing adoption of precision medicine further propel outsourcing demand in the industry. Regulatory agencies, including the U.S. FDA and EMA, are highlighting biomarker-based clinical trials, aiding pharmaceutical firms to partner with specialized CROs. The rise of complex diseases such as oncology, neurodegenerative disorders, and autoimmune conditions also drives biomarker innovation, creating lucrative opportunities for outsourcing service providers. Furthermore, AI-powered predictive biomarker discovery, integration of multi-omics approaches, and increasing strategic collaborations are expected to drive the market landscape.

Expanding R&D investment in biopharmaceuticals is another driving factor for market growth. With rising drug development complexities and a shift toward biologics and personalized medicine, pharmaceutical firms are allocating larger budgets to biomarker-driven research. Government initiatives, venture capital funding, and industry-academia partnerships further accelerate biomarker discovery. Emerging fields such as cell and gene therapy, immuno-oncology, and neurodegenerative disease research drive demand for specialized biomarker discovery services. Moreover, outsourcing biomarker discovery is a preferred strategy for sponsors due to the high cost of in-house infrastructure and the need for advanced bioinformatics and analytical expertise. Thus, CROs with innovative technologies, AI integration, and regulatory expertise are developing importance as strategic partners. Furthermore, increasing collaborations, automation in biomarker analysis, and growing reliance on real-world data further enhance the role of outsourcing in accelerating biopharmaceutical R&D pipelines and enhancing drug success rates.

As pharmaceutical and biotech manufacturers focus on cost efficiency and accelerated drug development, outsourcing to specialized CROs and CDMOs has become a strategic priority in the market. These contract service providers offer end-to-end biomarker discovery solutions, from early-stage validation to regulatory-compliant clinical trials, reducing time-to-market. Advanced analytical platforms, AI-driven biomarker identification, and expertise in multi-omics technologies present CROs and CDMOs as preferred partners for biopharma companies. Moreover, rising regulatory scrutiny is driving demand for compliance-ready biomarker services, further strengthening outsourcing trends in the industry. The market is witnessing a surge in strategic collaborations, acquisitions, and geographic expansions by CROs to cater to global demand. Further, increasing integration of automation, cloud-based bioinformatics, and decentralized clinical trials will enhance the role of CROs and CDMOs in driving biomarker discovery outsourcing growth in the forthcoming years.

Technology Landscape

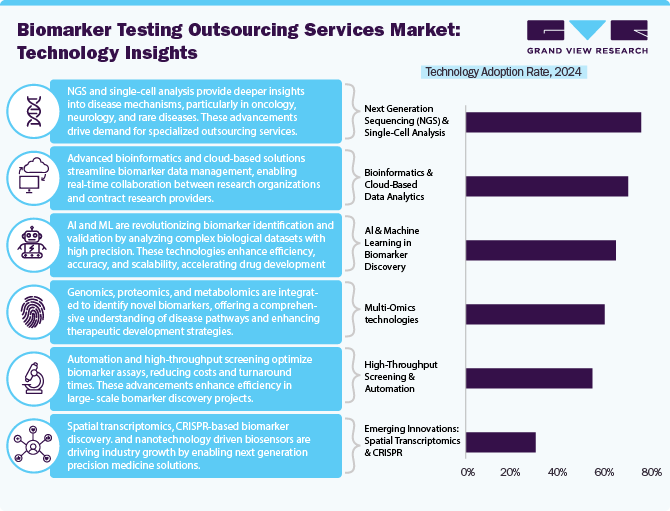

Technological advancements accelerate the market by enhancing efficiency, accuracy, and scalability. Integrating artificial intelligence (AI) and machine learning (ML) is significantly accelerating biomarker identification and validation by analyzing complex biological datasets with greater precision. Next-generation sequencing (NGS) and single-cell analysis enable deeper insights into disease mechanisms, particularly in oncology, neurology, and rare diseases, driving demand for specialized outsourcing services. Multi-omics approaches, including genomics, proteomics, and metabolomics, are increasingly being utilized to identify novel biomarkers, offering a more comprehensive understanding of disease pathways.

Furthermore, advancements in bioinformatics and cloud-based data analytics are streamlining biomarker data management, accelerating real-time collaboration between research organizations and contract research providers. The emergence of high-throughput screening and automation in biomarker assays further optimizes cost and turnaround time, offering lucrative market growth opportunities. Furthermore, advancements in liquid biopsy and digital pathology are expanding the scope of non-invasive biomarker discovery, particularly in precision medicine applications. Evolving regulatory requirements are also driving the adoption of standardized data-sharing platforms and AI-driven predictive modeling, ensuring compliance while expediting clinical translation.

Further, continuous innovation in spatial transcriptomics, CRISPR-based biomarker discovery, and nanotechnology-driven biosensors will propel industry growth. As pharmaceutical and biotech companies increasingly rely on specialized outsourcing partners to leverage these innovative technologies, the biomarker discovery outsourcing services industry is expected to witness constant growth, driven by enhanced R&D productivity and the rising demand for personalized therapeutics.

Market Concentration & Characteristics

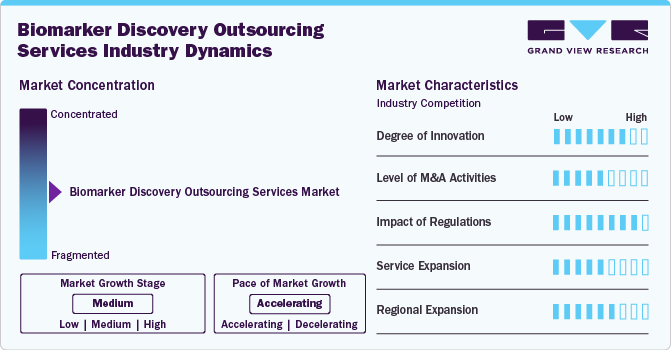

The market growth stage is medium, with an accelerating pace. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, service expansions, and regional expansions.

The degree of innovation remains high in the biomarker discovery outsourcing services industry, with continuous advancements in AI-based biomarker discovery, spatial biology, and automation in high-throughput screening. Companies are investing in proprietary platforms for biomarker validation, integrating real-world data analytics, and utilizing next-gene sequencing to enhance biomarker precision and clinical efficiency.

Regulations have a high impact on the biomarker discovery outsourcing services industry. Developing U.S. FDA, EMA, and ICH guidelines underline biomarker qualification for clinical trials, thereby increasing the demand for compliance-ready outsourcing partners. Stringent data standardization and ethical considerations further influence service offerings, necessitating regulatory-aligned bioinformatics and assay development strategies.

The level of M&A activities in the biomarker discovery outsourcing market is moderate, driven by the need for comprehensive service portfolios and advanced technological capabilities. Leading CROs and specialized biomarker firms are actively acquiring niche companies to enhance multi-omics expertise, AI-driven analytics, and regulatory compliance capabilities. Strategic acquisitions also strengthen global footprints, enabling access to diverse patient populations and clinical trial networks.

The market is witnessing rapid service expansion. Companies are broadening their portfolios by integrating multi-omics approaches, AI-driven biomarker analytics, and advanced bioinformatics solutions to provide comprehensive biomarker discovery solutions. Expansion into companion diagnostics, real-world evidence (RWE) studies, and regulatory consulting services are also gaining traction as pharmaceutical firms seek end-to-end outsourcing partnerships. The growing demand for clinical trial biomarker validation and assay development is driving service providers to invest in high-throughput screening technologies and automation.

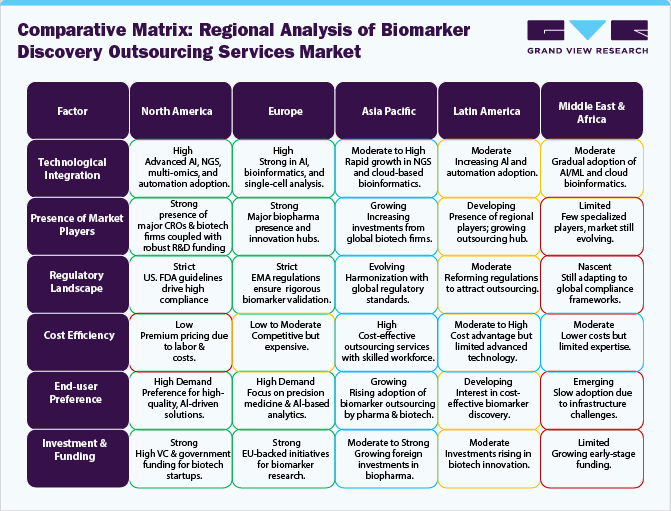

Regional expansions are reforming the biomarker discovery outsourcing services industry, with CROs and CDMOs extending their geographic presence to capture high-growth markets. North America and Europe continue to dominate due to substantial R&D investments and regulatory expertise, while Asia-Pacific is emerging as a major hub driven by cost advantages, skilled workforce, and government support for biopharma innovation. Countries such as China, India, and South Korea are witnessing increasing investments in biomarker research infrastructure, attracting global pharmaceutical companies to outsource services. Latin America and the Middle East are also gaining attention as biopharma firms seek to diversify clinical trial locations and access genetically diverse patient populations. Strategic partnerships, mergers, and acquisitions fuel cross-border expansions, enabling service providers to establish a global footprint.

Biomarker Type Insights

Based on biomarker type, the surrogate endpoints segment accounted for the largest revenue share of 54.88% in 2024. The segment growth is primarily due to their critical role in accelerating drug development and clinical trials. Surrogate biomarkers serve as substitutes for clinical outcomes, allowing pharmaceutical companies to assess the effectiveness of new therapies more quickly and with fewer patients. This reduces time-to-market and associated costs, making them highly attractive for biopharma companies. The increasing usage of surrogate endpoints in oncology, cardiovascular diseases, and rare diseases is driving their dominance in the market. Regulatory agencies like the U.S. FDA and EMA are increasingly accepting surrogate endpoints to expedite approval processes for life-saving therapies, further boosting demand. Outsourcing providers specializing in discovering and validating surrogate biomarkers are utilizing advanced technologies like AI and machine learning to enhance accuracy and predictiveness, fostering market growth in this segment.

The lymphoma segment is anticipated to witness the highest growth during the forecast period. These biomarkers help identify patients likely to respond to specific treatments, improving clinical trial efficiency and therapeutic outcomes. Proactive biomarkers offer several applications in oncology, immunotherapy, and rare diseases, such as customized treatment plans and minimizing side effects, thereby driving segment demand. Integrating AI and machine learning further enhances accuracy and validation speed. As biopharma companies focus on targeted therapies and personalized approaches, predictive biomarkers are becoming a key growth driver in the biomarker discovery outsourcing services industry.

Therapeutic Area Insights

Based on therapeutic areas, the market includes oncology, neurology, cardiology, autoimmune diseases, and others. The oncology segment accounted for the largest revenue share in 2024. The growing demand for precision medicine drives the segment growth and targeted cancer therapies. Biomarkers are essential in identifying cancer subtypes, predicting treatment responses, and monitoring therapeutic efficacy. The increasing prevalence of cancer, along with advancements in immuno-oncology, has heightened the need for innovative biomarker discovery solutions. Outsourcing services in oncology are critical for accelerating drug development, optimizing clinical trials, and ensuring regulatory compliance. As personalized cancer treatments gain momentum, the oncology segment fortifies significant growth potential in the biomarker discovery outsourcing market.

The autoimmune diseases segment is anticipated to witness the highest growth during the forecast period. The segment is driven by the increasing prevalence of autoimmune conditions and the need for precise diagnostic and therapeutic tools. Biomarkers are crucial for early disease detection, monitoring progression, and evaluating treatment responses in autoimmune disorders like rheumatoid arthritis, lupus, and multiple sclerosis. Outsourcing biomarker discovery services offers expertise in complex biomarker analysis, accelerating drug development and enhancing personalized treatment strategies for autoimmune diseases, thus fostering significant segment expansion.

Discovery Phase Insights

Based on the discovery phase, in 2024, the biomarker identification segment accounted for the largest revenue share in the market. With the increasing complexity of diseases and the demand for personalized therapies, accurate biomarker identification is crucial for improving clinical outcomes. Outsourcing services specializing in this phase offer advanced technologies, such as high-throughput screening and bioinformatics, enabling faster, more reliable biomarker discovery.

The biomarker validation segment is expected to grow at the highest CAGR over the estimated period. The segment's growth is primarily driven by the increasing need to enhance biomarkers' accuracy, reproducibility, and clinical relevance. As biomarkers move from discovery to clinical application, rigorous validation is essential for regulatory approval and widespread adoption in clinical settings. Outsourcing providers specializing in biomarker validation offer expertise in assay development, clinical trial testing, and regulatory compliance, aiding in streamlining the discovery process. With the growing prominence of personalized medicine and precision therapies, the demand for validated biomarkers is expected to accelerate segmental growth.

End Use Insights

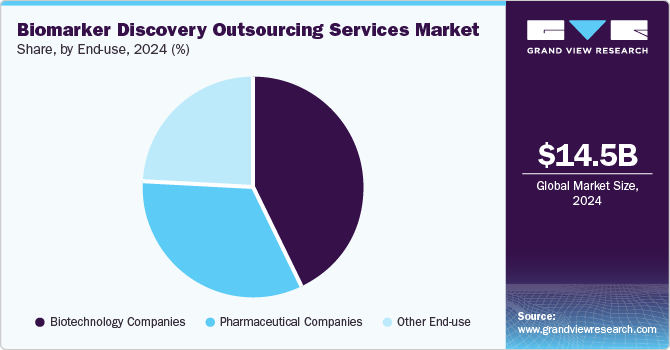

Based on end use, the market is segmented into pharmaceutical companies, biotechnology companies, and others. The biotechnology companies segment held the largest market share in the biomarker discovery outsourcing services industry in 2024. The segment growth is due to the strong focus on drug development and precision medicine innovation. Biotech companies heavily rely on outsourcing to access advanced biomarker discovery technologies, bioinformatics expertise, and regulatory support while optimizing costs and timelines. The rise of biologics, gene therapies, and immunotherapies further bolsters the demand for specialized biomarker services. Biotech companies are increasingly outsourcing biomarker discovery services to accelerate biomarker validation, enhance clinical trial success rates, and drive the development of next-generation therapeutics.

The pharmaceutical companies segment is anticipated to witness lucrative growth over the analysis timeframe. The high segment growth is owing to extensive drug development pipelines and a rising preference for personalized medicine. These companies increasingly outsource biomarker discovery to streamline R&D, improve clinical trial efficiency, and meet regulatory requirements. With growing investments in targeted therapies and biologics, pharmaceutical firms are expanding collaborations with CROs and specialized service providers to utilize advanced biomarker discovery technologies, driving substantial segment growth.

Regional Insights

North America Biomarker Discovery Outsourcing Services Market Trends

The biomarker discovery outsourcing services market in North America accounted for the largest market share of 43.96% in 2024. The regional market demand is driven by increasing R&D investments, demand for precision medicine, and growing collaborations between pharmaceutical companies and CROs. Technological advancements in omics technologies, AI-driven biomarker analysis, and regulatory support for biomarker-based drug development further boost market growth. Further, expanding bioinformatics solutions, adopting multi-omics approaches, and shifting toward decentralized clinical trials, enhancing efficiency in biomarker identification and validation for personalized therapies. The aforementioned factors are anticipated to bolster overall regional growth.

U.S. Biomarker Discovery Outsourcing Services Market Trends

The biomarker discovery outsourcing services market in the U.S. owing to the growing prevalence of chronic diseases, increasing biopharma outsourcing to specialized CROs, and strong government funding for biomarker research. The growing demand for cost-efficient drug development and the integration of big data analytics will enhance market expansion. Moreover, the growing use of liquid biopsy for non-invasive biomarker detection, AI-powered predictive modeling, and strategic partnerships between biotech firms and academia will accelerate industry growth in the U.S.

Canada biomarker discovery outsourcing services market is attributed to robust healthcare infrastructure, expanding biopharmaceutical sector, and increasing demand for cost-effective R&D solutions. Government funding for life sciences innovation and favorable regulatory frameworks further support market growth.

Europe Biomarker Discovery Outsourcing Services Market Trends

The biomarker discovery outsourcing services industry in Europe is driven by rising pharmaceutical R&D expenditures, increasing adoption of precision medicine, and strong government support for biotech innovation. The region’s growing clinical trial landscape and stringent regulatory requirements enhance outsourcing to specialized CROs for better compliance and efficiency. Advancements in AI-driven biomarker analysis and next-generation sequencing further propel market demand. Furthermore, the expansion of biobanks and collaborations between academia and industry accelerate biomarker validation, particularly in oncology, neurology, and rare disease research.

The UK biomarker discovery outsourcing services market accounts for the largest share in Europe, owing to strong government support for life sciences, increasing biopharma investments, and a growing focus on personalized medicine. The presence of advanced research institutions and innovative biotech startups fosters outsourcing partnerships. Expanding clinical trials and the adoption of AI-driven biomarker analysis accelerate market growth. Moreover, rising demand for non-invasive diagnostics, particularly in oncology and cardiovascular diseases, drives biomarker research supported by advanced genomic technologies and national precision medicine initiatives.

The biomarker discovery outsourcing services market in Germany is expanding due to the strong biotechnology sector, increasing government and private R&D investments, and a well-established regulatory framework supporting innovation. The country’s emphasis on early disease detection and precision medicine accelerates the demand for advanced biomarker research. Growing collaborations between pharmaceutical firms, research institutes, and CROs enhance outsourcing opportunities.

Asia Pacific Biomarker Discovery Outsourcing Services Market Trends

The biomarker discovery outsourcing services market in Asia Pacific is estimated to grow at the highest CAGR over the estimated timeframe. The regional growth is primarily attributed to expanding pharmaceutical R&D, increasing clinical trial activities, and cost-effective outsourcing solutions. Growing government investments in biotechnology and precision medicine further boost market growth. The region’s large patient pool accelerates biomarker research, particularly in oncology and infectious diseases. Further, advancements in genomics, AI-powered data analytics, and next-generation sequencing enhance biomarker identification. Rising collaborations between global pharma companies and regional CROs strengthen the outsourcing ecosystem across key markets like China and India.

Japan biomarker discovery outsourcing services industry accounts for the largest share of the Asia Pacific region owing to is driven by a strong pharmaceutical industry, government initiatives supporting precision medicine, and increasing investment in regenerative medicine. The country’s aging population and rising prevalence of chronic diseases further bolster demand for biomarker-based diagnostics and therapies. Advanced research in multi-omics, AI-powered data analysis, and liquid biopsy further accelerates biomarker discovery.

The biomarker discovery outsourcing services industry in China accounts for the largest share of the Asia Pacific region owing to rapid biopharmaceutical industry growth, increasing government funding for precision medicine, and expanding clinical trial activities. A strong focus on AI-driven drug discovery and advancements in next-generation sequencing enhance biomarker research. The rise of domestic CROs and international collaborations boosts outsourcing demand. In addition, a growing elderly population and high prevalence of chronic diseases drive the need for biomarker-based diagnostics and targeted therapies, accelerating market expansion.

India biomarker discovery outsourcing services market is driven by a growing biopharma sector, cost-effective research capabilities, and increasing government support for biotechnology innovation. The rise in chronic diseases and personalized medicine fosters demand for biomarker-based diagnostics and therapeutics. Further, expanding clinical trials and a skilled workforce strengthen India’s position as a global outsourcing sector.

Key Biomarker Discovery Outsourcing Services Company Insights

The global biomarker discovery outsourcing services industry is highly competitive, with key players focusing on strategic partnerships, technological advancements, and service expansion. Leading CROs and biotechnology firms dominate the market, such as Labcorp, Charles River Laboratories, ICON plc, and Thermo Fisher Scientific. These companies invest in AI-driven biomarker analysis, next-generation sequencing, and multi-omics research to enhance discovery capabilities. Emerging players and regional CROs are gaining traction by offering specialized biomarker validation and bioinformatics services. The key market players are undertaking several strategic initiatives, such as acquisitions, partnerships, expansion, agreements, collaborations, etc., to increase their market presence and gain a competitive edge, driving market growth.

Key Biomarker Discovery Outsourcing Services Companies:

The following are the leading companies in the biomarker discovery outsourcing services market. These companies collectively hold the largest market share and dictate industry trends.

- LabCorp

- Charles River Laboratories International, Inc.

- Eurofins Scientific

- Celerion

- ICON plc

- Parexel International (MA) Corporation

- Proteome Sciences

- GHO Capital

- Thermo Fisher Scientific Inc.

- Evotec

Recent Developments

-

In April 2024, LabCorp announced the expansion of its precision oncology portfolio to expand cancer research. Through this expansion, the company aimed to invest highly in diagnostic, scientific, and laboratory innovations to assist its biotechnology, pharmaceutical, and clinical research for advancement in drug development programs.

-

In February 2023, Evotec SE expanded its multi-target drug discovery collaboration with Related Sciences. This partnership will continue through 2030 and aim to further develop their joint portfolio of drug candidates. The collaboration aims to accelerate drug discovery and development, further strengthening the service offerings of both companies.

-

In January 2023, Charles River Laboratories International, Inc. acquired SAMDI Tech, Inc., a prominent player in the label-free high-throughput screening (HTS) solutions for drug discovery research. Such acquisition broadened the company’s operational capabilities in the significant market.

Biomarker Discovery Outsourcing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16.99 billion |

|

Revenue forecast in 2030 |

USD 41.27 billion |

|

Growth rate |

CAGR of 19.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Biomarker type, therapeutic area, discovery phase, end use, region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Laboratory Corporation of America Holdings; Charles River Laboratories.; Eurofins Scientific; Celerion; ICON plc; Parexel International (MA) Corporation; Proteome Sciences; GHO Capital; Thermo Fisher Scientific Inc.; Evotec |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Biomarker Discovery Outsourcing Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the biomarker discovery outsourcing services market report based on biomarker type, therapeutic area, discovery phase, end use, and region:

-

Biomarker Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Predictive Biomarkers

-

Prognostic Biomarkers

-

Safety Biomarkers

-

Surrogate Endpoints

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Autoimmune Diseases

-

Other Therapeutic Area

-

-

Discovery Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomarker Identification

-

Biomarker Validation

-

Biomarker Profiling

-

Biomarker Panel Development

-

Biomarker Selection

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomarker discovery outsourcing services market size was estimated at USD 14.53 billion in 2024 and is expected to reach USD 16.99 billion in 2025.

b. The global biomarker discovery outsourcing services market is expected to grow at a compound annual growth rate of 19.43% from 2025 to 2030 to reach USD 41.27 billion by 2030.

b. North America dominated the biomarker discovery outsourcing services market with a share of 43.96% in 2024. This is attributed to growing integration of innovative technologies, advanced healthcare infrastructure, regulatory expertise, and robust biotech industry. Moreover, the regulatory agencies in the region, such as the Canadian Food Inspection Agency (CFIA) and the U.S. Food and Drug Administration (FDA), have well-established regulatory frameworks for biomarkers in developing drugs and diagnostics.

b. Some of the key players operating in the biomarker discovery outsourcing services market include Laboratory Corporation of America Holdings, Charles River Laboratories, Eurofins Scientific, Celerion, ICON plc., Parexel International (MA) Corporation, Proteome Sciences, GHO Capital, Thermo Fisher Scientific Inc., Evotec.

b. Key factors that are driving the biomarker discovery outsourcing services market growth include the advancement of personalized medicine, the integration of omics technologies, and the rising adoption of emerging technologies. Emerging technologies such as CRISPR-based approaches and single-cell analysis are some of the emerging technologies in biomarker discovery services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."