- Home

- »

- Medical Devices

- »

-

Biologics Regulatory Affairs Outsourcing Market Report, 2030GVR Report cover

![Biologics Regulatory Affairs Outsourcing Market Size, Share & Trends Report]()

Biologics Regulatory Affairs Outsourcing Market Size, Share & Trends Analysis Report By Service (Regulatory Consulting), By Phase (Preclinical), By Modality, Phase by Service, Phase by Modality, Modality by Service, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-369-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

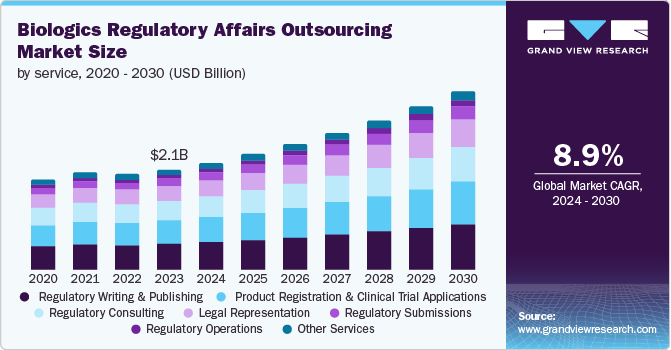

The global biologics regulatory affairs outsourcing market size was estimated at USD 2.08 billion in 2023 and is projected to grow at a CAGR of 8.87% from 2024 to 2030. Market growth can be attributed to the changing regulatory landscape, the need for companies to focus on core business activities, and economic & competitive pressures. The entry of biopharmaceutical companies into global markets and the evolution of new therapy areas such as orphan drugs, ATMPs, biosimilars, and personalized medicine are further predicted to accelerate market growth, as novel therapy areas require advanced technical expertise to comply with regulatory requirements.

Biopharmaceutical companies have to deal with continuous changes in regulatory requirements, which can differ based on business activities and geographies. Noncompliance with the changing regulatory requirement can result in penalties and delays, which may lead to loss of revenue. According to a survey sponsored by Genpact, 72.0% of executives from the life sciences industry consider regulatory compliance one of the top three challenges life sciences companies face. Regulatory departments often face the burden of handling multiple tasks simultaneously and must always ensure compliance with stringent regulatory standards. Increasing efforts by companies to expand their geographical reach and gain rapid approvals in global markets are expected to further contribute to the adoption of outsourcing models for biologics regulatory services.

Regulatory approval procedures among biologics are becoming increasingly stringent, and market players aim to receive product approvals in the first attempt to gain market share. Companies must have an in-house regulatory department or outsource their regulatory affairs due to stringent regulatory requirements in developed economies and changing regulations in developing nations. Establishing an in-house regulatory affairs department in offshore countries is not continuously feasible due to high capital investment and skilled expertise. Hence, companies tend to adopt different outsourcing models based on the size and priority of projects, thereby contributing to the global biologics regulatory affairs outsourcing market.

Moreover, several initiatives, such as the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH), promote global harmonization of regulatory guidelines. This reduces complexity for companies operating in numerous markets but requires compliance with harmonized standards. Further, Mutual Recognition Agreements (MRAs) between key countries enable easier market access and reduce the need for unnecessary testing and inspections, streamlining regulatory processes. Thus, the growing adoption of new regulatory requirements, integration of advanced technologies, and availability of specialized expertise to navigate complex environments effectively are a few factors driving overall industry progression.

Continuous technological advancements in the regulatory affairs industry are one of the major factors driving the overall market growth opportunities. Increasing integration of several technologies, such as adopting advanced analytical techniques for product characterization and quality control, requires companies to upgrade their technology and expertise. In addition, the shift towards electronic submissions (eCTD) and digital platforms for regulatory processes enhances efficiency. However, it requires significant investment in new technologies and training, leading to a preference for outsourcing such services to third-party service providers, thereby driving the market demand. Furthermore, increasing reliance on Health Technology Assessment (HTA) to access market and reimbursement decisions contributes to effective regulatory strategies. Companies must align clinical and economic evidence to meet HTA requirements. Thus, the aforementioned factors are anticipated to drive global market growth.

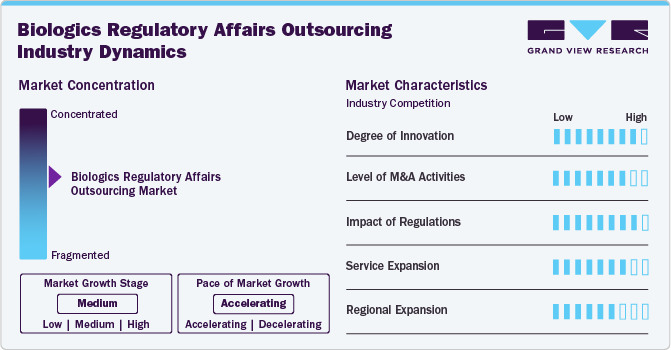

Market Concentration & Characteristics

The biologics regulatory affairs outsourcing market growth stage is medium, and its growth is accelerating. The North America regional market is characterized by a degree of innovation, the level of M&A activities, the impact of regulations, service expansions, and regional expansions.

The biologics regulatory affairs outsourcing market fortifies a high degree of innovation. There is an increasing focus on developing Advanced Therapy Medicinal Products (ATMPs), such as gene therapies, cell therapies, and tissue-engineered products requiring compliance with particular regulatory requirements. The rising trend of the development of personalized medicine is another factor driving biologics development, specifically to individual patient profiles, by leveraging biomarkers and genetic data. Regulatory frameworks are evolving to adapt ATMPs, requiring specialized regulatory knowledge and compliance with new guidelines, proliferating market growth potential.

Regulations have a high impact on the market, influencing compliance requirements, quality standards, and market entry barriers. Regulatory agencies impose rigorous guidelines to enhance safety, efficacy, and manufacturing processes, impacting the time and cost associated with novel biologics development and commercialization. Moreover, Continuous updates and amendments in regulatory guidelines require companies to stay informed and adaptable. As biopharmaceutical companies find it critical to track updated regulatory guidelines, these firms outsource regulatory affairs services to comply with updated regulatory standards.

The level of M&A (mergers and acquisitions) activities in the market is high. Several companies are undertaking mergers and acquisitions strategies to expand biologics regulatory affairs portfolios, gain access to advanced technologies, and enhance their market presence. For instance, Icon acquired PRA Health Sciences, and PharmaLex merged with Regulis Consulting Limited, are some of the key M&A activities reshaping dynamics in the significant market.

Service expansion in the market is medium due to increasing demand for specialized regulatory expertise and comprehensive support services in the biologics sector. Moreover, service providers are expanding their regulatory consulting, compliance services, and end-to-end support for biologics development to cater to customer demand and broaden revenue growth opportunities. For instance, in November 2022, Charles River Laboratories expanded its cell therapy contract development and manufacturing (CDMO) plant in Memphis, Tenn.

The market is experiencing significant regional expansion, with service providers strategically expanding their presence to new geographic areas. Biologics companies are expanding into emerging markets in Asia Pacific, Latin America, and MEA owing to growing healthcare needs and favorable regulatory environments. Thus, the growing outsourcing trend for regulatory affairs due to the rising need to navigate country-specific regulatory requirements and skilled expertise will support market expansion.

Service Insights

The regulatory writing & publishing segment dominated the market and accounted for a share of 25.9% in 2023. The high segment growth is primarily attributable to growing R&D investment, upsurge in product pipeline across various therapeutic areas, and increased outsourcing of these services by low and midsized biopharmaceutical companies. Regulatory bodies require comprehensive documentation to ensure the safety, efficacy, and quality of biologics. This includes clinical study reports, investigator brochures, and regulatory submissions such as the Common Technical Document (CTD). Adhering to complex and evolving regulatory guidelines necessitates precise and accurate regulatory writing, stimulating the outsourcing trend among biopharmaceutical companies to seek specialized expertise with reduced procedural costs.

The product registration & clinical trial applications segment is anticipated to witness a lucrative CAGR over the forecast period. The segment growth is attributed to the increasing number of clinical trials globally, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets, such as Asia Pacific and Latin America, which drive the outsourcing trend for product registration and clinical trial applications. A rise in competition among biotech companies encourages market players to outsource clinical trial activities to accelerate their approval process and gain a competitive edge. This is also anticipated to propel segment growth in the near future.

Phase Insights

The clinical phase segment accounted for the largest share in 2023. The clinical phase segment is further divided into phase I, II, III, and IV. The high segmental revenue growth can be attributed to the increasing number of clinical trial registrations over the past few years. For instance, as per ClinicalTrials.gov, as of June 2024, there are more than 180,136 active clinical trials across the globe. Furthermore, the complexity of biologics, including gene therapies and monoclonal antibodies, demands sophisticated clinical trial designs and methodologies. In addition, adopting adaptive trial designs to optimize clinical development and respond to interim results adds to the complexity and the need for specialized regulatory expertise. Regulatory affairs outsourcing accelerates the clinical trial process by safeguarding timely and accurate submissions, reducing delays, and speeding up approvals. Thus, the above-mentioned factors are anticipated to accelerate segmental revenue growth.

The preclinical segment is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, as well as the high prevalence of existing diseases, such as CVDs, cancer, and neurological diseases, among others. The high cost of animal models and associated facilities, as well as ethical issues, is anticipated to prompt several biotechnology and pharmaceutical companies to outsource these studies & related regulatory services. Increasing utilization of digital tools and platforms for data management, regulatory submissions, and communication with regulatory agencies offers a competitive edge to service providers in the preclinical regulatory affairs market.

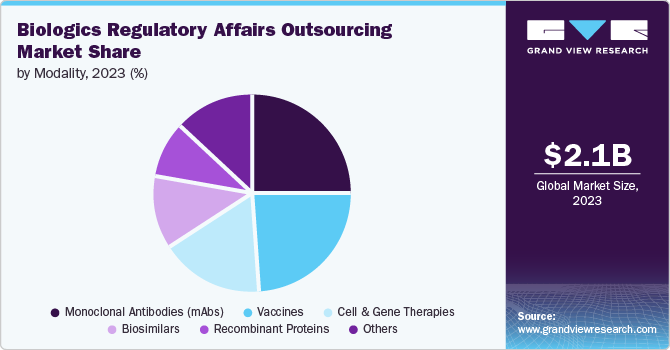

Modality Insights

The monoclonal antibodies (mAbs) segment held the largest share in 2023. A rise in the number of mAbs development to treat a wide range of diseases, including cancer, autoimmune disorders, and infectious diseases, supports the segment growth. Moreover, advancements in the development of next-generation mAbs, such as bispecific antibodies and antibody-drug conjugates, require compliance with specific regulatory requirements. In addition, advances in biomanufacturing technologies, such as single-use systems and continuous processing, require updated regulatory submissions and compliance, propelling segmental demand.

The cell and gene therapies segment is anticipated to grow at the fastest CAGR over the forecast period. The robust segment growth is owing to an expanding portfolio of cell and gene therapy products, increased researcher attention on rare diseases, rising research and development investments from both public and private sectors, growing demand for outsourced services related to cell and gene therapies, and increasing prevalence of chronic ailments such as cancer. According to the American Society of Gene & Cell Therapy (ASGCT), as of Q4 2023, more than 3,951 cell & gene and therapy candidates were under development, of which 2,111 are gene therapies and 878 are non-genetically modified cell therapies. The following table summarizes the global status of the gene therapy pipeline as of December 2023.

Table.1. The global status of the gene therapy pipeline as of December 2023

Number of Therapies

2020

2021

2022

2023

1,321

1,745

2,053

2,111

Furthermore, the globalization of clinical trials and the favorable momentum for accelerated approval pathways encourage biopharmaceutical companies to seek external partners to manage efficient regional regulatory requirements. The growing focus on personalized medicine and the distinctive challenges posed by gene editing technologies further accelerate the demand for specialized regulatory affairs outsourcing in a rapidly expanding segment.

Cross Segment (Phase by Service, Phase by Modality, Modality by Service) Insights

The Grand View Research estimated an in-depth research analysis of the adoption of biologics regulatory affairs outsourcing services by development phase and modality. The key insights are as follows:

-

The clinical regulatory writing and publishing service segment secured a significant market share in the clinical phase in 2023 owing to the complicated documentation and precision required for regulatory approval, the complex nature of biologics, and the need for clear, comprehensive submissions. Whereas, product registration & clinical trial applications is another prominent segment in the clinical phase, as these services are introductory for market entry and clinical research compliance. Increasing outsourcing demand is primarily influenced by stringent regulatory frameworks and the need for appropriate and accurate regulatory filings

-

Monoclonal antibodies (mAbs) modality held the largest revenue share in the clinical phase, followed by vaccines and cell & gene therapies therapeutics owing to increasing product pipeline, rising focus on advanced therapeutics to minimize chronic disease burden among the biopharmaceutical sector, and stringent regulatory framework to ensure safety, efficacy of the novel drugs. Moreover, growing outsourcing trend related to regulatory services among biopharmaceutical industries to focus on core competencies and streamline non-core operations with reduced costs are a few factors shaping market dynamics

-

Furthermore, the monoclonal antibodies segment showcased a high revenue share for regulatory affairs outsourcing services due to a high number of clinical trials, stringent regulatory guidelines, and high adoption of outsourcing services, among others. Whereas growing demand for the development of vaccines to treat several ailments in the past few years witnessed significant adoption of regulatory services outsourcing for novel vaccine development

Regional Insights

The biologics regulatory affairs outsourcing market in North America held the largest revenue share of 30.54% in 2023. The regional market growth is attributed to factors, such as a high number of clinical trials, increasing R&D activities, adoption of personalized medicines, and the strong presence of biopharmaceutical companies that outsource part of their regulatory functions to regulatory service providers. The high cost of R&D is a major challenge in the regional market, which has encouraged biopharmaceutical companies to outsource certain functions to service providers with a high level of expertise in the domain. Moreover, there is a growing trend of outsourcing regulatory affairs to specialized CROs and regulatory service providers to access advanced expertise, reduce time-to-market, and focus on core R&D activities.

U.S. Biologics Regulatory Affairs Outsourcing Market Trends

The U.S. biologics regulatory affairs outsourcing market held the largest share of the North American market in 2023. Strong demand for cost-effective generic and biosimilar products in the U.S. contributes to the market growth. For instance, as per Cardinal Health’s 2023 biosimilars report, in 2023, around 40 FDA-approved biosimilars were available in the U.S., 25 of which were commercially available in the market. Thus, increasing the development and approval of novel biosimilars is expected to propel the demand for regulatory services in the U.S., driving market growth. In addition, there is a significant rise in the import of generic and biosimilar products from emerging countries, increasing the demand for regulatory service providers in the region. Furthermore, the rising number of small- and medium-scale biotech companies, which may lack in-house regulatory expertise, is driving demand for outsourced regulatory services to navigate the approval process and commercialize drugs to market.

Europe Biologics Regulatory Affairs Outsourcing Market Trends

The biologics regulatory affairs outsourcing market in Europe is expected to grow significantly due to the stringent regulatory framework imposed by the European Medicines Agency (EMA), which requires specialized knowledge and compliance expertise, prompting companies to outsource these critical regulatory functions. Moreover, the market growth is driven by the need to navigate complex regulatory pathways for advanced biologics, such as gene therapies and biosimilars, which require thorough regulatory submissions and post-approval surveillance. Furthermore, the increasing adoption of digital tools for regulatory management, the growing emphasis on real-world evidence and patient-centric approaches, and the expansion of services to address the rising demand for personalized medicine are a few factors boosting regional market growth.

The Germany biologics regulatory affairs outsourcing market held the largest share in 2023 in Europe owing to a strong presence of the biopharmaceutical market and a skilled & experienced workforce.

The biologics regulatory affairs outsourcing market in the UK is anticipated to grow significantly over the forecast period. Changing regulatory scenario post Brexit in the UK is a driving factor for service providers that cater to specialized knowledge of EU and UK regulatory requirements to navigate complex pathways for biologics approvals, including advanced therapies and biosimilars.

Asia Pacific Biologics Regulatory Affairs Outsourcing Market Trends

The Asia Pacific biologics regulatory affairs outsourcing marketis expected to grow at a CAGR of 10.38% over the forecast period. The high market growth potential is attributed to an improved regulatory landscape, cost affordability, a growing number of clinical trials conducted in the region, and an increasing number of biopharmaceutical companies venturing into the region. Furthermore, the availability of a skilled workforce within the region at a lower cost than in the U.S. is another factor expected to propel growth.

The biologics regulatory affairs outsourcing market in China held the largest share in 2023. Rapid expansion in biologics development and manufacturing within China, coupled with evolving regulatory frameworks overseen by the National Medical Products Administration (NMPA), creates a demand for specialized regulatory expertise. Outsourcing regulatory affairs services influences local knowledge of regulatory processes, including registration, clinical trial applications, and compliance with emerging guidelines. The integration of digital solutions for efficient regulatory submissions, a rise of biosimilars & advanced therapies, and partnerships accelerating access to China's growing healthcare sector are expected to boost market growth. As China continues to solidify its position in biologics innovation, outsourcing regulatory affairs services becomes pivotal for global companies aiming to capitalize on this dynamic market.

The Japan biologics regulatory affairs outsourcing market is expected to grow over the forecast period due to the rising demand for new and cost-effective medicines, which may attract investments from biopharmaceutical companies in this region. Rising demand for generics due to government support and improvement in regulatory approval processes are expected to increase market entrants, thereby propelling the demand for regulatory services in this region.

The biologics regulatory affairs outsourcing market in India is anticipated to grow at the fastest CAGR over the forecast period owing to cost benefits, improved infrastructure facilities, and a large pool of technical expertise.

Latin America Biologics Regulatory Affairs Outsourcing Market Trends

The Latin America biologics regulatory affairs outsourcing market is anticipated to grow substantially over the forecast period. Global biopharmaceutical companies outsource the manufacturing of biopharmaceutical products for clinical trials or sales in emerging countries such as Brazil and Argentina. The outsourcing trend in manufacturing is expected to increase the demand for regulatory services in the region by biopharmaceutical companies, thereby providing an opportunity for regulatory service providers or CROs to explore the market.

The biologics regulatory affairs outsourcing market in Brazil is anticipated to grow at a significant CAGR over the forecast period. Restrictive pricing policies, a complex regulatory framework, and a well-established generic industry are certain factors impacting the growth of this market.

MEA Biologics Regulatory Affairs Outsourcing Market Trends

The MEA biologics regulatory affairs outsourcing market is expected to grow substantially over the forecast period. The rising number of biopharmaceutical companies undertaking outsourcing clinical trials due to advancements in technology, cost-effectiveness, and an easy patient recruitment process contribute to the rising demand for biologics regulatory affairs services in the region.

The biologics regulatory affairs outsourcing market in South Africa is anticipated to grow at the fastest CAGR over the forecast period owing to increasing investments in biotechnology and healthcare infrastructure. Additionally, South Africa's strategic location offers access to diverse patient populations for clinical research, making it attractive for global biopharmaceutical firms seeking cost-effective regulatory solutions and accelerated market entry into the African continent.

Key Biologics Regulatory Affairs Outsourcing Company Insights

The key market participants operating across the market focus on adopting several in-organic strategic initiatives such as mergers, partnerships, collaborations, acquisitions, etc. The prominent strategies companies adopt are service launches, mergers & acquisitions/joint ventures, mergers, partnership & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge driving market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players. For instance, in October 2023, Samsung Biologics partnered with Kurma Partners to develop and manufacture novel biologics of Kurma Partners. Through this partnership, Kurma Partners gained access to Samsung biologics CDMO services including regulatory support throughout the development of advanced therapeutics. Such partnerships broadened the company’s revenue growth opportunities in the market.

Key Biologics Regulatory Affairs Outsourcing Companies:

The following are the leading companies in the biologics regulatory affairs outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza AG

- Wuxi AppTec Inc.

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- Freyr solutions

- Catalent Inc.

- Piramal Group

- AGC Biologics

- ICON Plc.

- Charles River Laboratories International, Inc.

- Labcorp

- Parexel International

- Medpace Holdings, Inc.

- IQVIA

- Syneos Health

- SGS SA (SGS)

Recent Developments

-

In September 2023, Freyr Solutions partnered with PKG Group LLC.to for submission of PKG Group’s Type III Drug Master File (DMF) to the U.S. FDA. Such agreements broadened the company’s revenue growth opportunities in the market

-

In February 2022, Ergomed acquired ADAMAS Consulting Group Ltd., a prominent consulting firm in the biopharmaceutical industry. This acquisition broadened the company’s service offerings and geographical presence in the U.S., Europe, and APAC regions

Biologics Regulatory Affairs Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.22 billion

Revenue forecast in 2030

USD 3.69 billion

Growth rate

CAGR of 8.87% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, modality, phase by service, phase by modality, modality by service, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lonza AG; Wuxi Apptec Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; Freyr solutions; Catalent Inc.; Piramal Group; AGC Biologics; ICON Plc; Charles River Laboratories International, Inc.; Labcorp; Parexel International; Medpace Holdings, Inc.; IQVIA; Syneos Health; SGS SA (SGS)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biologics Regulatory Affairs Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the biologics regulatory affairs outsourcing market report based on service, phase, modality, phase by service, phase by modality, modality by service, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Strategy & Development Planning

-

QA Consulting

-

Agent Services

-

Others

-

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies (mAbs)

-

Recombinant Proteins

-

Vaccines

-

Cell & Gene Therapies

-

Biosimilars

-

Others

-

-

Phase by Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Clinical

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

-

Phase by Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Monoclonal Antibodies (mAbs)

-

Recombinant Proteins

-

Vaccines

-

Cell & Gene Therapies

-

Biosimilars

-

Others

-

-

Clinical

-

Monoclonal Antibodies (mAbs)

-

Recombinant Proteins

-

Vaccines

-

Cell & Gene Therapies

-

Biosimilars

-

Others

-

-

-

Modality by Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies (mAbs)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Recombinant Proteins

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Vaccines

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Cell & Gene Therapies

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Biosimilars

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

Others

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Other Services

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biologics regulatory affairs outsourcing market size was estimated at USD 2.08 billion in 2023 and is expected to reach USD 2.22 billion in 2024.

b. The global biologics regulatory affairs outsourcing market is expected to grow at a compound annual growth rate of 8.87% from 2024 to 2030 to reach USD 3.69 billion by 2030.

b. North America dominated the biologics regulatory affairs outsourcing market with a share of 30.54% in 2023. This is attributable to stringent regulatory framework and continuous amendments, high number of clinical trials, advanced healthcare infrastructure, strong presence of biopharmaceutical organizations, and availability of skilled professionals among others.

b. Some key players operating in the biologics regulatory affairs outsourcing market include Lonza AG, Wuxi AppTec Inc., Thermo Fisher Scientific Inc., Eurofins Scientific SE, Freyr Solutions, Catalent Inc., Piramal Group, AGC Biologics, ICON Plc., Charles River Laboratories International, Inc., Labcorp, Parexel International, Medpace Holdings, Inc., IQVIA, Syneos Health, SGS SA (SGS).

b. Key factors that are driving the market growth include a growing focus on development of novel therapeutics, and preference for personalized medicine and orphan drugs, changing regulatory scenario, increasing outsourcing trends, adoption of one-stop-shop CROs and CDMOs, and growing R&D spending among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."