Biological Seed Treatment Market Size, Share & Trends Analysis Report By Product (Microbials, Botanicals & Others), By Function (Seed Protection, Seed Enhancement), By Crop Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-419-2

- Number of Report Pages: 103

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Biological Seed Treatment Market Trends

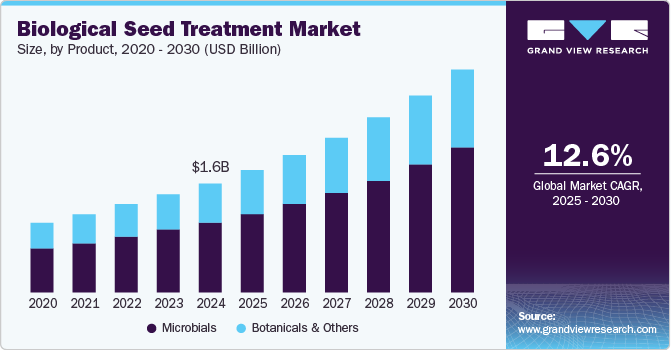

The global biological seed treatment market size was estimated at USD 1.60 billion in 2024 and is expected to grow at a CAGR of 12.6% from 2025 to 2030. The increasing demand for chemical-free crops will drive industry growth in the coming years. A shift in consumer trends towards improving personal health and choosing healthier food options will likely boost product demand. In addition, the growing elderly population is anticipated to stimulate this demand further.

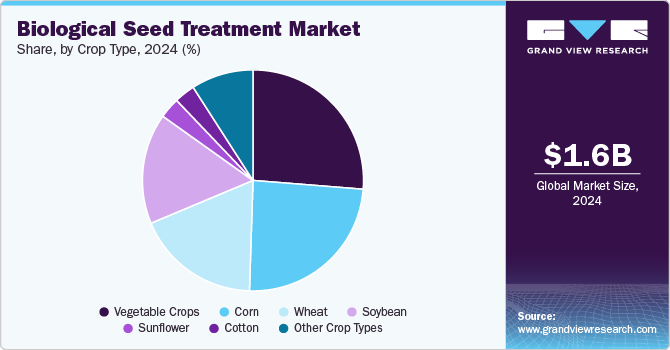

Corn is the primary crop for biological seed treatment applications in the U.S. Farmers have recognized that using the proper biological seed treatment can provide corn with a considerable advantage during germination, helping to establish yield and promote sustainability in agriculture. When biological seed treatments combine the appropriate microbial and fungal agents, they can lead to significant growth increases, yielding up to ten percent more.

The product's use in agricultural practices has significantly increased, as it helps prevent soil-borne and seed-borne infections and diseases. The product has gained importance over chemical treatments because it poses a lower risk of exceeding residue limits and meets the rising demand for sustainable agriculture. Furthermore, the growing trend of organic farming is expected to directly influence the product's market penetration.

Biological treatment plays a crucial role in sustainable agriculture by minimizing the need for chemical fertilizers, boosting plant immunity, and enhancing nutrient absorption and resistance to diseases and pests. By reducing chemical fertilizers, crops become healthier and recover more quickly from abiotic stresses like drought and salinity.

Drivers, Opportunities & Restraints

Microbial or combinations of various strains are applied to seeds during seed treatment to offer increased protection from pests and diseases. Biological uses are natural raw materials such as plants, bacteria, and fungi. Agrochemical manufacturers, such as Bayer AG and Syngenta Company, have conducted extensive research to find a close relation between microbes and plants that help formulate better raw material composition for seed treatment. Improved raw material composition increases the seed nutrient uptake and protects it from pests.

Once seeds are treated with microorganisms, they cannot be sold as grain or used as food ingredients. Due to their limited shelf life, the overproduction of biologically treated seeds is discouraged. Seeds like soybeans, in particular, lose their sprout vigor more quickly than other treated crop seeds. This limitation has led manufacturers to produce treated seeds in smaller quantities, resulting in limited availability in the market. Dry microbial formulations made with various carriers tend to have a short shelf life due to temperature sensitivity and moisture in the mixture. To maintain a longer shelf life, the moisture content of the carrier must be kept low by storing it at cooler temperatures. Alternatively, manufacturers can produce completely dry formulations with a low bacterial population, which can be stored at room temperature for extended periods.

Biological seed treatments present significant industrial opportunities by enhancing crop productivity while reducing reliance on synthetic chemicals. These treatments utilize beneficial microorganisms and natural compounds to promote seed health, improve germination rates, and increase resistance to pests and diseases. As sustainable agriculture gains momentum, the demand for eco-friendly alternatives grows, leading to market expansion. Furthermore, these products can improve soil health and promote biodiversity, aligning with global sustainability goals. Innovating in this space can create competitive advantages for companies, catering to the increasing consumer preference for organic and sustainably sourced food products.

Product Insights

The microbials segment accounted for the largest revenue market share of 65.2% in 2024 and is expected to continue to dominate the industry over the forecast period. The prosperity and health of plants significantly depend on the distribution of microbes in the rhizosphere. In the microbial treatment of seeds, beneficial bacteria such as Rhizobia, Bacillus, Pseudomonas, and Streptomyces are utilized, along with fungi like mycorrhizae, Penicillium bilaii, and Trichoderma harzianum. This treatment aims to eradicate pathogens and enhance seed health. During the microbial treatment process, seeds are immersed in the slurry of these microbes, and then they undergo drying, a process known as biopriming. Alternatively, the seeds can be coated with a polymeric substance such as xanthan gum or methylcellulose.

In botanical seed treatment, seeds are treated with plant extracts to eliminate pathogens, reduce seed-borne infections, and increase germination. One widely used extract is garlic, which contains the bioactive compound allicin. Applying garlic can significantly improve the percentage of seeds that germinate. In addition, garlic juice is a seed dressing fungicide, protecting seeds from various seed-borne infections. Other plant extracts, such as those from Azadirachta indica (neem), Polygonum hydropiper (water pepper), and Swertia, also enhance seed vitality. These extracts help eradicate seed-borne fungi and further increase seed germination rates.

Function Insights

One significant factor affecting seedling establishment and lowering germination rates is seed disease. As a result, it is essential to protect seeds from disease-causing agents before sowing. During biological seed protection treatment, seeds are coated with biofungicides and bioinsecticides. This protection helps eliminate seed-borne pathogens, thereby improving the germination rate. The increase in crop losses due to infected seeds and biotic and abiotic stresses is expected to drive industry growth in the coming years. Moreover, the rising consumer preference for organic food will likely enhance the popularity of biological protectants.

The seed enhancement sector is expected to experience significant growth in the coming years. This growth is driven by the rising use of biological treatments that improve seedling growth and germination. Various techniques enhance seed performance by boosting disease resistance and increasing vigor. As a result, this leads to higher harvest yields and improved crop quality.

Crop Type Insights

The vegetable crops segment dominated the market with a revenue market share of over 26.4% in 2024. The growing use of biopesticides for treating vegetable seeds, consumers' increasing preference for healthy lifestyles, and the demand for chemical-free food products are anticipated to drive market growth during the forecast period.

Seed rot and seedling blight are the two most common seed-borne diseases that can affect crops. Seed rot often prevents seeds from emerging, while seedling light can cause seedlings to collapse before they fully emerge. These diseases can slow plant growth, resulting in stunted plants and yellowing foliage. Such deformities make it difficult for the crop to survive. The fungi responsible for these diseases include Pythium, Fusarium, Phytophthora, and Rhizoctonia species. To control seed rot, damping-off, and seedling blight and eliminate fungal pathogens from the seed surface, corn seeds are treated with biofungicides.

Regional Insights

The biological seed treatment market in North America dominated the market and accounted for a revenue share of 41.0% in 2024. The North America market produces various crops, including specialty crops, vegetables, fruits, oilseeds, and cereals. Agribusinesses and farmers in the region are at the forefront of effective chemical application and employ advanced agricultural techniques.

U.S. Biological Seed Treatment Market Trends

The U.S. biological seed treatment marketis improving the efficiency of crop safety activities is crucial, especially when dealing with disease challenges and evolving pests. This focus is a key factor driving market growth. In addition, the United States has a significant trend towards sustainable surfactants and an increasing demand for bio-based products.

Asia Pacific Biological Seed Treatment Market Trends

The biological seed treatment market in Asia Pacific is expected to grow fastest during the forecast period. This is due to several factors, including countries with vast arable lands, rising populations, and a high demand for developed crops. Furthermore, rapid industrialization and urbanization are contributing to this growth. Key emerging Asian Pacific countries include India, Japan, China, and South Korea.

Europe Biological Seed Treatment Market Trends

The biological seed treatment market in Europe is expected to grow significantly due to the growing agricultural industry, advancement in farming practices, and increased awareness of healthy eating are some of the major factors driving the demand for agrochemicals in the region. The growing need to improve crop yield and production efficiency drives the market due to the increasing population and diminishing farmlands. This has led to increased demand for product markets in the region.

Latin America Biological Seed Treatment Market Trends

The biological seed treatment market in Latin America is expected to grow significantly due to the agriculture sector, mainly in Brazil. This is due to the increasing demand for agrochemicals in Brazil to enhance the production of Brazilian soybeans, which is the key driving factor for the growth of the agricultural adjuvants market in Latin America.

Middle East & Africa Biological Seed Treatment Market Trends

The biological seed treatment market in MEA in is expected to grow significantly over the forecast period. Pesticide consumption is increasing in Saudi Arabia and Oman, and the trend is steady for South Africa, Kuwait, and Qatar. In addition, there is tremendous growth in the consumption of pesticides in Ghana.

Key Biological Seed Treatment Company Insights

Some of the key players operating in the market include Bayer CropScience, BASF SE, and Italpollina S.p.A.

-

Bayer CropScience is a German pharmaceutical and life science company. The company offers significant products in healthcare, agriculture chemicals, high-value polymers, and biotechnology divisions. The company's life science division produces biological pesticides and innovative chemicals for agricultural purposes. The company offers sustainable solutions for farmers all over the world. Its product portfolio includes herbicides, fungicides, insecticides, harvest aids, seed treatments, and plant regulators for various crops, such as wheat, rice, corn, soy, peanuts, grapes, and corn. The company’s businesses are spread across the world and have subsidiaries in Europe, Asia Pacific, North America, Latin America, and the Middle East & Africa.

-

Syngenta AG is a Switzerland-based agrochemical company formed by merging Zeneca Agrochemicals and Novartis Agribusiness. It has 111 research and development sites and 100 production and supply sites worldwide. The company is currently owned by ChemChina, a Chinese government-owned company. Its bio-based seed treatment portfolio offers biostimulants, biofungicides, and bionematicides. It serves millions of farmers in over 90 countries.

Key Biological Seed Treatment Companies:

The following are the leading companies in the biological seed treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer CropScience

- Syngenta AG

- BASF SE

- Monsanto Company

- Italpollina S.p.A.

- Koppert Biological Systems

- Incotec

- Plant Health Care plc

- Precision Laboratories, LLC

- Verdesian Life Sciences

- Valent Biosciences LLC

Recent Developments

-

In May 2023, Syngenta Biologicals and Unium Bioscience teamed up to offer innovative biological seed treatment solutions to growers in northwest Europe. These solutions are based on NUELLO iN, which naturally enhances a plant's ability to convert and utilize atmospheric nitrogen. As a result, it can reduce nitrogen usage by more than 10%.

-

In September 2024, Bharat Certis AgriScience Ltd., a subsidiary of Mitsui & Co., Ltd. from Japan, launched its first seed treatment product, SD Macro, in Ludhiana, Punjab. This product is designed for the biological seed treatment market and is powered by Cytozyme Laboratories, a division of Verdesian Life Sciences USA.

Biological Seed Treatment Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.79 billion |

|

Revenue forecast in 2030 |

USD 3.25 billion |

|

Growth rate |

CAGR of 12.6% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, function, crop type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S. Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Ukraine; Turkey; Switzerland; Sweden; Poland; Austria; Norway; Hungary; Netherlands; China; India; Japan; Brazil |

|

Key companies profiled |

Bayer CropScience; Syngenta AG; BASF SE; Monsanto Company; Italpollina S.p.A.; Koppert Biological Systems; Incotec; Plant Health Care plc; Precision Laboratories, LLC; Verdesian Life Sciences; Valent Biosciences LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biological Seed Treatment Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biological seed treatment market report by product, function, crop type, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Microbial

-

Botanicals & Others

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Seed Protection

-

Seed Enhancement

-

-

Crop Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Corn

-

Wheat

-

Soybean

-

Cotton

-

Sunflower

-

Vegetable Crops

-

Other Crop Types

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Ukraine

-

Turkey

-

Switzerland

-

Sweden

-

Poland

-

Austria

-

Norway

-

Hungary

-

Netherland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global biological seed treatment market size was estimated at USD 1.60 billion in 2024 and is expected to reach USD 1.79 billion in 2025.

b. The global biological seed treatment market is expected to grow at a compound annual growth rate of 12.6% from 2023 to 2030 to reach USD 3.25 billion by 2030.

b. North America dominated the biological seed treatment market with a share of over 41% in 2024. This is attributable to the rising adoption of organic farming in the U.S., Mexico, and Canada.

b. Some key players operating in the biological seed treatment market include Bayer CropScience, BASF SE, Monsanto Company, and Syngenta AG.

b. Key factors that are driving the biological seed treatment market growth include surging demand for chemical-free crops and rising focus of consumers on the improvement of personal health and consumption of healthy food.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."