- Home

- »

- Catalysts & Enzymes

- »

-

Biofuel Enzymes Market Size & Share, Industry Report, 2030GVR Report cover

![Biofuel Enzymes Market Size, Share & Trends Report]()

Biofuel Enzymes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Protease, Phytase, Glucoamylase, Lipase), By Application (Biodiesel, Starch/Corn-based Ethanol, Cellulosic Ethanol), By Region, And Segment Forecasts

- Report ID: 978-1-68038-168-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Biofuel Enzymes Market Summary

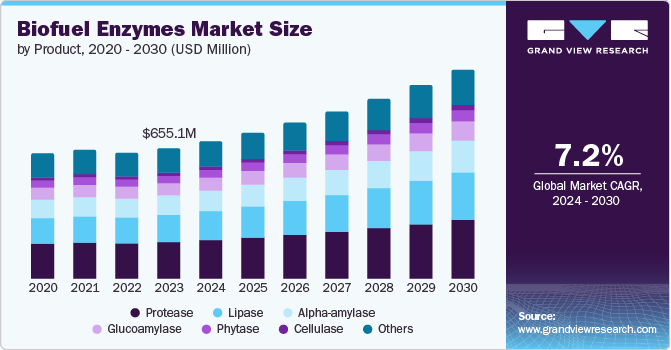

The global biofuel enzymes market size was valued at USD 655.1 million in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. Biofuel enzymes catalyze the process of biomass to biofuel conversion at optimal production costs.

Key Market Trends & Insights

- North America biofuel enzymes market dominated the global market with revenue share of 53.6% in 2023.

- By product, protease dominated the market and accounted for a share of 28.0% in 2023.

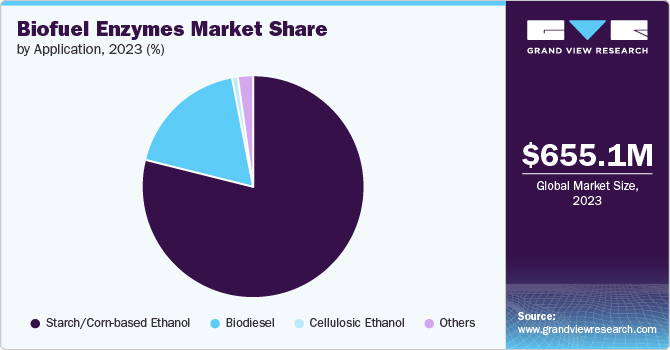

- By application, the starch/corn-based ethanol segment dominated the global market with a share of 79.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 655.1 Million

- 2030 Projected Market Size: USD 1.1 Billion

- CAGR (2024-2030): 7.2%

- North America: Largest market in 2023

Their application as sustainable and environment-friendly alternatives to fossil fuels has triggered a need for biofuel enzymes. The market is driven by increasing demand for biofuels and environmental concerns. In addition, the growing concerns about climate change and the need to reduce greenhouse gas emissions have led to a shift towards renewable energy sources.

The market for biofuel enzymes is boosted by technological progress in the realms of biotechnology and enzymology. Advancement in these sectors has facilitated the production of enzymes that can fasten biomass conversion to biofuel. Such advances lead to better returns and lower production costs. In addition, increased research and development on enzyme stability has continuously improved situations in the food industry. Hence, genetic engineering and microbial fermentation methods have improved enzyme production on a large scale at an optimized cost.

From a regulatory aspect, the adoption of environment-friendly policies has encouraged the distribution of renewable energy. Several governments implement favorable policies and offer incentives concerning the use of biofuels to reduce emissions and dependency on fossil fuels. For instance, government policies such as subsidies and tax credits have fostered demand for biofuel enzymes. In addition to these policies, significant investments in research and development programs for biofuel enzymes are anticipated to drive market growth.

Product Insights

Protease dominated the market and accounted for a share of 28.0% in 2023. Proteolytic enzymes break down proteins in biomass production. Additionally, they improve overall biofuel production by promoting a flexible cycle. Furthermore, advancements in protease technology are leading to the development of more efficient and cost-effective enzymes, thus strengthening its dominance.

The lipase segment is expected to register the fastest CAGR of 8.6% during the forecast period owing to the growing interest in second-generation biomass that uses lipid feeders such as algae. Lipases are very good at breaking down these fats and oils, which act as catalysts for producing ideal biofuels from different sources. In addition, advances in lipase engineering are expected to increase access to a wider range of raw materials and strengthen their market position.

Application Insights

The starch/corn-based ethanol segment dominated the global market with a share of 79.3% in 2023. This is attributed to the abundant availability of corn and the high yield of ethanol from corn. In addition, developments in the enzyme segment boost the process of fermentation of corn starch to ethanol, optimizing costs and productivity. Furthermore, government support and promotions have facilitated the expansion of corn-derived ethanol by mandating the blending of ethanol in gasoline.

The cellulosic ethanol segment is anticipated to witness a CAGR of 7.7% over the forecast period pertaining to the growing focus on sustainable feedstocks and cellulose-rich biomass such as wood chips and agricultural waste. Additionally, advances in cellulase enzyme technology have improved their ability to break down complex cellulose structures, making cellulosic ethanol production more cost-effective. The favorable government policies and regulations support the development of advanced biofuels and biomaterials that further drive market growth.

Regional Insights

North America biofuel enzymes market dominated the global market with revenue share of 53.6% in 2023. This is primarily driven by substantial government support, subsidies, tax incentives, and mandates for biofuel blending, which have created a favorable regulatory environment. In addition, the biotechnology industry in the region is improving in enzymatic engineering for biofuel processing. Furthermore, the availability of feedstock such as corn, and increasing investment in research and development is anticipated to drive the regional market growth.

U.S. Biofuel Enzymes Market Trends

The U.S. biofuel enzymes dominated the North America market with a share of 82.2% in 2023. This is due to the country’s extensive agricultural resources, especially the high production of corn, which provides accessibility and cost-effective feedstock for biofuel production. In addition, strong government policies and incentives such as the Renewable Fuel Standard (RFS) have made it mandatory to blend biofuels with gasoline, which is anticipated to drive market growth. Furthermore, there have been innovations in advanced biotechnology and enzyme engineering in the U.S. that have resulted in the efficiency of biofuels.

Europe Biofuel Enzymes Market Trends

Europe biofuel enzymes market share was 12.8% in 2023. Government policies are implemented to reduce CO2 emissions as biofuel sources serve environment-friendly initiatives. Additionally, there is a substantial rise in investment in research and development and advancements in enzyme technologies that have improved the efficiency of biofuel production.

The UK biofuel enzymes market growth is expected to grow significantly in the coming years due to the government’s ambitious renewable energy projects prioritizing biofuel production projects. This has led to a high demand for biofuel enzymes for efficient biofuel conversion. In addition, increasing environmental concerns and policies promoting sustainable practices have encouraged the adoption of biofuels in the UK. The increasing demand for biofuels, coupled with the UK’s push for a greener future, is anticipated to drive market growth.

Asia Pacific Biofuel Enzymes Market Trends

Asia Pacific biofuel enzymes market is anticipated to witness significant growth in the global market in the forecast period. The growing concerns about the regional environment and renewable energy targets encourage the demand for biofuels. In addition, the abundance of low-cost biofuels, such as agricultural waste, makes biofuel production attractive. The government initiatives to promote the development of biofuels and advances in enzyme production technology are accelerating the market growth.

Key Biofuel Enzymes Company Share & Insights

Some key companies in the global biofuel enzymes market include AB Enzymes, Advanced Enzymes, Novozymes, TransBioDiesel, and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

AB Enzymes focuses on producing enzymes for commercial purposes. The company operates in the core business lines of enzyme production and formulation of innovative enzyme solutions for food & beverage, animal feed, and technical industry to enhance the efficiency and quality of products.

-

Advanced Enzyme Technologies Ltd is an enzyme manufacturer based in India, specializing in the research, development, and manufacturing of a wide range of enzymes and probiotics The company serves various industries such as pharmaceuticals, food processing, animal feed, and textiles with innovative sustainable solutions.

Key Biofuel Enzymes Companies:

The following are the leading companies in the biofuel enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- AB Enzymes

- Advanced Enzymes

- Novozymes

- Agrivida

- BASF SE

- DSM

- DuPont

- Enzyme Supplies

- Iogen Corporation

- TransBioDiesel

Recent Developments

-

In January 2024, Novozymes and Chr. Hansen completed their partnership to form Novonesis, a leading player in microbial solutions for agriculture and industrial biotechnology. This merger brings together Novozymes' expertise in enzymes and Chr. Hansen's strength in microbial solutions to drive innovation and sustainable practices across agriculture and industrial sectors. Novonesis accelerates the development of bio-based solutions that address global challenges such as food security and climate change.

-

In February 2023, the distribution agreement between AB Enzymes and Barentz was prolonged for exclusive distribution of AB enzymes’ products in the European Middle Eastern and African markets. The companies’ market presence is enlarged with access to the specialized enzymes for the food, feed, and industrial segments. Moreover, the extension underlines AB Enzymes’ objective to enlarge its presence in marketplace and corresponding distribution partnerships.

Biofuel Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 690.8 million

Revenue forecast in 2030

USD 1.1 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia: China; India; Japan; Australia; South Korea; Indonesia: Thailand; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AB Enzymes, Advanced Enzymes, Novozymes, Agrivida, BASF SE, DSM, DuPont, Enzyme Supplies, Iogen Corporation, TransBioDiesel

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

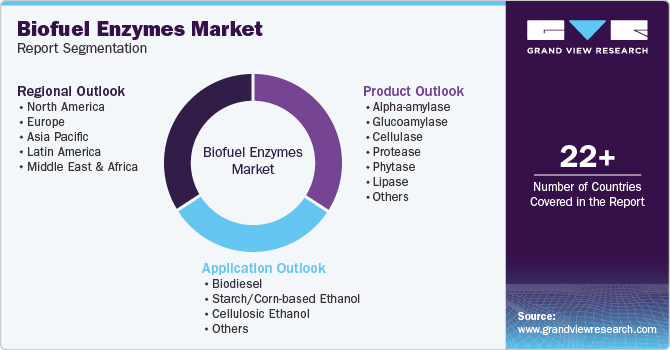

Global Biofuel Enzymes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global biofuel enzymes market report based on product, application, and region:

-

Product Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

Alpha-amylase

-

Glucoamylase

-

Cellulase

-

Protease

-

Phytase

-

Lipase

-

Others

-

-

Application Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

Biodiesel

-

Starch/Corn-based Ethanol

-

Cellulosic Ethanol

-

Others

-

-

Regional Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.