Bioenergy With CCS Market Size, Share & Trends Analysis Report By Technology (Oxy-combustion, Pre-combustion, Post-combustion), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-467-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Bioenergy With CCS Market Size & Trends

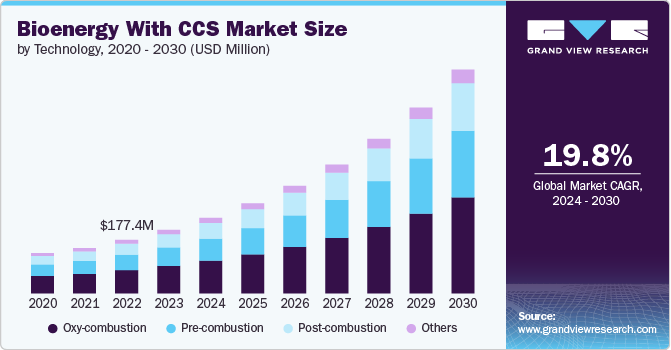

The global bioenergy with CCS market size was estimated at USD 210.68 million in 2023 and projected to grow at a CAGR of 19.84% from 2024 to 2030. The primary driver for the bioenergy with carbon capture and sequestration (CCS) market growth is the global push to combat climate change and achieve net-zero carbon emissions. Governments and organizations are increasingly committing to stringent carbon reduction targets, and BECCS presents a unique solution.

Policies like carbon taxes, carbon credits, and emissions trading schemes incentivize the adoption of BECCS by assigning a monetary value to reducing or sequestering carbon emissions. In addition, international frameworks such as the Paris Agreement push countries to adopt measures that support carbon capture technologies, boosting demand for BECCS projects.

Drivers, Opportunities & Restraints

Carbon pricing mechanisms, such as carbon taxes, cap-and-trade programs, and credits for negative emissions, provide financial incentives for BECCS adoption. These policies reward companies for reducing emissions, making BECCS a cost-effective option, especially for industries struggling to decarbonize, such as power generation, agriculture, and heavy industry. Governments also offer subsidies, tax breaks, and grants for BECCS projects, lowering the financial barriers to entry and driving market growth.

The recent advancements in carbon capture and bioenergy technologies have made BECCS more efficient and economically viable. Innovations in CO₂ capture techniques, transport infrastructure, and storage solutions are reducing the costs of implementing BECCS, making it a more attractive option for energy producers and industries seeking to lower their carbon footprint. Improved efficiency in biomass conversion processes also enhances the energy yield, making BECCS more competitive with other renewable energy sources.

One of the key opportunities in the BECCS market lies in expanding bioenergy sources from sustainable feedstock. The use of agricultural waste, forestry residues, and organic municipal waste can enhance the sustainability of bioenergy production. This creates opportunities for countries and companies to develop localized BECCS solutions that align with circular economy principles, while generating clean energy and contributing to carbon sequestration goals.

The high upfront costs associated with implementing BECCS, including investment in carbon capture technology, transportation, and storage infrastructure, pose a significant restraint. Even with technological advancements, the economic viability of BECCS is often questioned due to the substantial capital and operational expenses required. Without sufficient financial incentives, subsidies, or carbon pricing mechanisms, companies may find it difficult to justify the investment in BECCS projects.

Technology Insights

Based on technology, the oxy-combustion segment led the market with the largest revenue share of 43.43% in 2023. Oxy-combustion technology is emerging as a critical driver in the global market. This technology burns biomass using pure oxygen instead of air, significantly reducing nitrogen oxide emissions and producing a flue gas stream that is primarily carbon dioxide and water vapor. This streamlined gas composition makes it easier to capture and store CO₂. Oxy-combustion is thus well-suited for integration with carbon capture and storage (CCS) systems, aligning with global efforts to decarbonize energy production, especially in bioenergy sectors where carbon neutrality or negativity is desired.

Pre-combustion carbon capture technology is gaining momentum as a key growth driver. This process involves converting biomass into a syngas (a mix of carbon monoxide and hydrogen) before the energy is generated. CO2 is then separated from this syngas and captured before combustion occurs, preventing emissions from entering the atmosphere. The advantages of pre-combustion capture in bioenergy production include its relatively high CO2 concentration, making the capture process more efficient, and the ability to integrate it into various bioenergy platforms. These characteristics make it an appealing solution for decarbonizing sectors that rely on bioenergy.

Application Insights

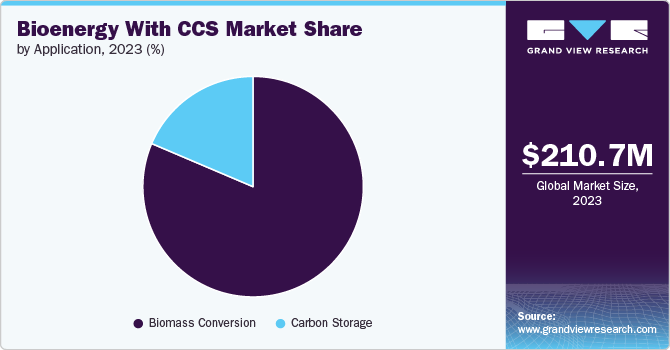

Based on application, the biomass conversion segment led the market with the largest revenue share of 81.40% in 2023. Biomass conversion, particularly when integrated with carbon capture and storage (CCS), plays a crucial role in the bioenergy market. As the demand for renewable energy sources grows, biomass conversion provides a sustainable solution by utilizing organic material from plants and waste for energy production. This method not only reduces reliance on fossil fuels but also aligns with the circular economy concept, as waste products are repurposed into usable energy. The versatility of biomass resources-ranging from agricultural residues to forestry by-products-has further propelled its application, making it a vital pillar in the decarbonization efforts globally.

Carbon storage technology is at the major segment of BECCS, and advancements in this field are unlocking new opportunities for its expansion. Innovations in carbon capture efficiency and underground CO2 storage methods are making it more feasible and cost-effective to sequester large quantities of carbon dioxide. In addition, developments in geological storage mapping, monitoring technologies, and secure transportation are improving the reliability and scalability of these projects.

Regional Insights

North America dominated the bioenergy with CCS market with the largest revenue share of 39.34% in 2023. North America boasts significant investments in research and development, leading to innovations in BECCS technologies. Enhanced efficiency in carbon capture methods and biomass conversion processes is boosting the market. Government incentives, such as tax credits and grants, promote BECCS projects. Policies aimed at reducing greenhouse gas emissions and achieving renewable energy targets further support market growth.

The region has extensive agricultural and forestry resources, providing a steady supply of biomass feedstock. This abundance facilitates the establishment of BECCS facilities and contributes to energy security. Also, many corporations in North America are setting ambitious sustainability targets. Investing in BECCS aligns with their goals of reducing carbon footprints and enhancing corporate social responsibility.

U.S. Bioenergy With CCS Market Trends

The bioenergy with carbon capture and sequestration (CCS) market in U.S. is experiencing robust growth, fueled by several key drivers. A major catalyst is the increasing emphasis on decarbonization across various sectors, aligning with national goals to reduce greenhouse gas emissions. Government initiatives, such as the Inflation Reduction Act, provide significant financial incentives for carbon capture technologies, making investments in BECCS more attractive. In addition, the U.S. has a rich supply of biomass resources, including agricultural residues and forestry by-products, which ensures a steady feedstock supply for bioenergy production.

Europe Bioenergy With CCS Market Trends

The bioenergy with carbon capture and sequestration (CCS) market in Europe is primarily driven by stringent climate policies and ambitious targets for carbon neutrality. The European Union’s commitment to becoming climate-neutral by 2050, alongside interim goals set for 2030, has galvanized investments in BECCS technologies. Legislative frameworks such as the EU Green Deal and the Fit for 55 package provide a clear regulatory pathway, incentivizing the deployment of renewable energy solutions that can effectively reduce greenhouse gas emissions. This robust regulatory support is pivotal in attracting both public and private investments in BECCS projects.

The Germany bioenergy with carbon capture and sequestration (CCS) market is emerging as a key player, propelled by its ambitious climate goals and commitment to renewable energy. One of the primary drivers of this growth is the German government's strong regulatory framework aimed at reducing greenhouse gas emissions. The Climate Action Program 2030 and various renewable energy policies provide financial incentives and support for BECCS projects, encouraging investments in carbon capture technologies and biomass utilization. This policy environment fosters innovation and facilitates the deployment of BECCS systems across various sectors.

The bioenergy with carbon capture and sequestration (CCS) market in UK is experiencing robust growth, driven by the government's commitment to achieving net-zero greenhouse gas emissions by 2050. This ambitious target has led to the implementation of supportive policies and regulatory frameworks that incentivize the development of BECCS technologies. Initiatives like the Carbon Capture Usage and Storage (CCUS) Strategy aim to integrate carbon capture solutions into the energy landscape, further fostering investment in bioenergy projects that can effectively sequester carbon while generating renewable energy.

Asia Pacific Bioenergy With CCS Market Trends

The bioenergy with carbon capture and sequestration (CCS) market in the Asia Pacific region is experiencing rapid growth, driven by innovations in carbon capture technologies, biomass conversion, and integration of BECCS with existing power generation facilities are enhancing efficiency and reducing costs. Countries in the region are actively collaborating with international partners and research institutions to accelerate the development and deployment of these technologies. In addition, the rise of start-ups focusing on clean energy solutions is fostering a dynamic ecosystem that promotes innovation and scalability in BECCS initiatives.

The China bioenergy with carbon capture and sequestration (CCS) market is anticipated to grow at the fastest CAGR during the forecast period. A significant driver of market growth is the country's vast agricultural resources, generating a considerable amount of biomass waste. This biomass, including agricultural residues and forestry by-products, offers a reliable feedstock for bioenergy production. In addition, the increasing investment in research and development has led to advancements in carbon capture technologies tailored to local conditions. These innovations not only enhance the efficiency of BECCS operations but also lower the costs associated with carbon capture and biomass conversion, making the technology more accessible and appealing.

The bioenergy with carbon capture and sequestration (CCS) market in Japan is witnessing significant growth driven by the country's commitment to achieving carbon neutrality by 2050. The government's robust policies and initiatives aimed at promoting renewable energy sources play a pivotal role in this expansion. Investments in bioenergy technologies, supported by subsidies and regulatory frameworks, are encouraging both research and commercialization of CCS systems, positioning Japan as a leader in integrating bioenergy with advanced carbon management solutions.

Central & South America Bioenergy With CCS Market Trends

The bioenergy with carbon capture and sequestration (CCS) market in Central and South America is poised for significant growth, driven by a combination of increasing energy demands, the push for renewable energy sources, and favorable governmental policies. As countries in the region seek to diversify their energy portfolios and reduce reliance on fossil fuels, bioenergy emerges as a viable solution. The abundant availability of biomass resources-such as agricultural residues, sugarcane bagasse, and forestry waste-provides a solid foundation for bioenergy production. In addition, government incentives aimed at promoting renewable energy investments are encouraging the development of bioenergy projects across various countries.

Middle East & Africa Bioenergy With CCS Market Trends

The bioenergy with carbon capture and sequestration (CCS) market in the Middle East and Africa (MEA) is poised for significant growth, driven by an increasing emphasis on sustainability and energy transition. Governments across the region are prioritizing the reduction of greenhouse gas emissions to meet international climate commitments. This shift is bolstered by the region's vast agricultural resources, which provide a reliable feedstock for bioenergy production. Initiatives like the Saudi Vision 2030 and the African Union's Agenda 2063 highlight the integration of renewable energy sources and sustainable practices, setting a strong foundation for BECCS development.

Key Bioenergy with CCS Company Insights

The market is characterized by a competitive landscape featuring key players such as Drax Group, Chevron Corporation, Sekab BioFuels & Chemicals AB, among others. These companies are focusing on research and development to enhance product offerings and meet the growing demand for efficient power transmission solutions. Regional dynamics show significant market shares in North America and Europe, with Asia-Pacific expected to exhibit the fastest growth due to rapid urbanization and renewable energy integration. Companies are also pursuing strategic partnerships and innovations to strengthen their market positions and address customer needs effectively.

Key Bioenergy with CCS Companies:

The following are the leading companies in the bioenergy with carbon capture and sequestration (CCS) market. These companies collectively hold the largest market share and dictate industry trends.

- Drax Group

- Chevron Corporation

- Sekab BioFuels & Chemicals AB

- Schlumberger New Energy

- Clean Energy System

- Shell

- Aker Carbon Capture

Recent Developments

-

In May 2023, the Denmark government released first tender of the CCUS subsidy scheme to award funds to a 0.4 Mt per year BECCS project that is planning to capture CO2 at two biomass-fired power stations for dedicated storage.

-

In February 2024, the U.S. Department of Energy announced to invest USD 100 million for CDR pilot projects, including BECCS.

Bioenergy With CCS Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 250.75 million |

|

Revenue forecast in 2030 |

USD 742.73 million |

|

Growth rate |

CAGR of 19.84% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Drax Group; Chevron Corporation; Sekab BioFuels & Chemicals AB; Schlumberger New Energy; Clean Energy System; Shell; Aker Carbon Capture |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bioenergy With CCS Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioenergy with CCS market report based on the technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxy-combustion

-

Pre-combustion

-

Post-combustion

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomass Conversion

-

Carbon Storage

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bioenergy with CCS market size was estimated at USD 210.68 million in 2023 and is expected to reach USD 250.75 million in 2024.

b. The global bioenergy with CCS market is expected to grow at a compound annual growth rate of 19.84% from 2024 to 2030 to reach USD 742.73 million by 2030.

b. Based on Technology, Oxy-combustion held the market with the largest revenue share of 43.43% in 2023. Oxy-combustion technology is emerging as a critical driver in the bioenergy with carbon capture and storage (BECCS) market.

b. Some of the key vendors of the global bioenergy with CCS market are Drax Group, Chevron Corporation, Sekab BioFuels & Chemicals AB, Schlumberger New Energy, Clean Energy System, among others.

b. The primary driver for the bioenergy with carbon capture and storage (BECCS) market is the global push to combat climate change and achieve net-zero carbon emissions. Governments and organizations are increasingly committing to stringent carbon reduction targets, and BECCS presents a unique solution.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."