- Home

- »

- Plastics, Polymers & Resins

- »

-

Biodegradable Plastic Additives Market Size Report, 2030GVR Report cover

![Biodegradable Plastic Additives Market Size, Share & Trends Report]()

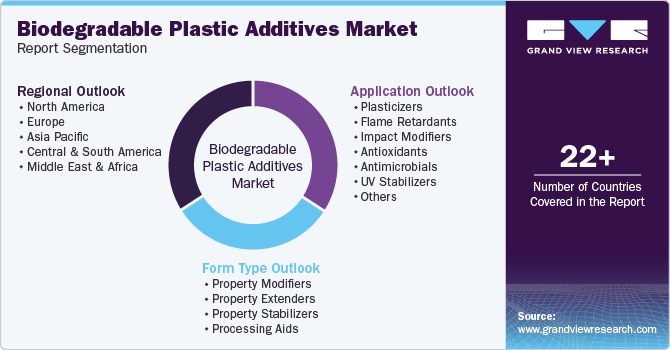

Biodegradable Plastic Additives Market Size, Share & Trends Analysis Report By Form Type (Property Modifiers, Property Extenders), By Application (Plasticizers, Flame Retardants), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-454-2

- Number of Report Pages: 111

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

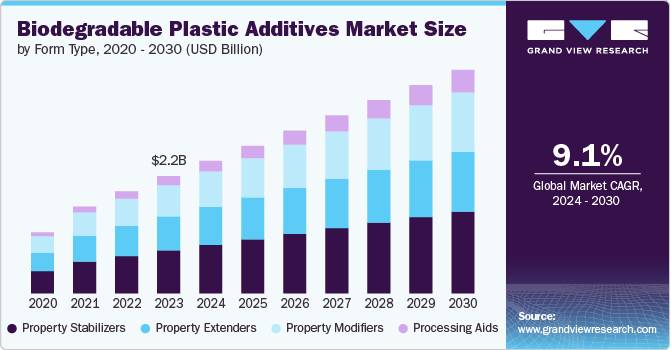

The global biodegradable plastic additives market size was estimated at USD 2,224.56 million in 2023 and is projected to grow at a CAGR of 9.12% from 2024 to 2030. Rising non-degradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution leading to a surge in the demand for sustainable alternatives to effectively manage plastic pollution.

The market is witnessing a notable shift toward sustainability as global consumers and businesses increasingly prioritize environmentally friendly alternatives. Governments and regulatory bodies are promoting eco-friendly solutions through stringent regulations and bans on single-use plastics, driving manufacturers to incorporate biodegradable plastic additives in their production processes. In addition, the growing awareness among consumers regarding the environmental impact of traditional plastics is fueling demand for biodegradable packaging, particularly in industries such as food and beverage, personal care, and healthcare.

Drivers, Opportunities & Restraints

Stringent environmental regulations imposed by various governments worldwide are a key driver for the biodegradable plastic additives industry. Many regions have implemented laws and policies aimed at reducing plastic waste and encouraging the use of biodegradable materials. For example, the European Union’s Single-Use Plastics Directive and various national bans on plastic bags have compelled manufacturers to seek biodegradable alternatives. As a result, there is a growing demand for additives that enhance the degradation process of plastics, ensuring they break down more efficiently in the environment.

The expanding packaging industry, particularly in emerging economies, presents a significant opportunity for the biodegradable plastic additives industry. With the e-commerce boom and growing consumer preference for sustainable packaging, manufacturers are exploring biodegradable solutions to meet the increasing demand. There is a clear opportunity to develop innovative biodegradable additives that can be applied across various packaging formats, from food packaging to shipping materials. As businesses seek to align with sustainability goals and reduce their carbon footprint, this presents a lucrative growth avenue for market players.

Despite its potential, the market faces challenges that could hinder its growth. One of the major restraints in the market is the high cost associated with the production of biodegradable plastics compared to conventional plastics. The raw materials and technology required to produce these additives are more expensive, which can translate into higher costs for end products. In addition, the lack of widespread infrastructure for composting and biodegradation in many regions limits the effectiveness of biodegradable plastic additives, as proper disposal and degradation conditions are not always available. This can hinder broader market adoption, particularly in cost-sensitive industries.

Form Type Insights

Based on form type, the property stabilizers segment led the market with the growing need to enhance the durability and performance of biodegradable plastics while maintaining their eco-friendly properties. Property stabilizers play a crucial role in improving the mechanical strength, flexibility, and heat resistance of biodegradable plastics, ensuring that they can withstand various environmental and operational conditions. As industries such as packaging, agriculture, and consumer goods increasingly turn to biodegradable materials, the demand for additives that offer both sustainability and reliable performance is rising. This trend is particularly important in applications where biodegradable plastics need to match the durability of traditional plastics without compromising their environmental benefits.

The property extenders segment is expected to grow at a significant rate over the forecast period. The segment is driven by the surging demand for enhancing the usability and lifespan of biodegradable plastics across various applications. Property extenders are crucial in improving the flexibility, elasticity, and processing efficiency of biodegradable plastics, allowing them to perform similarly to conventional plastics while retaining their environmentally friendly attributes. The demand is particularly driven by manufacturers seeking cost-effective solutions that balance sustainability with product functionality, making property extenders essential for broadening the range of applications for biodegradable plastics.

Application Insights

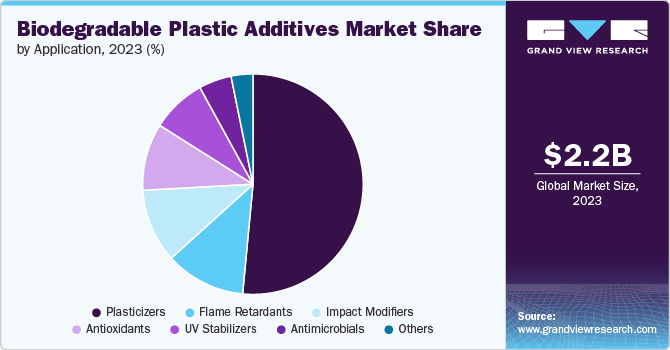

Based on application, the plasticizers segment dominated the market with the largest revenue share of 51.50% in 2023, driven bythe increasing demand for flexible and eco-friendly alternatives to conventional plastic materials. Plasticizers are essential for improving the flexibility, softness, and workability of plastics, and when paired with biodegradable additives, they enable the production of environmentally sustainable plastics with enhanced performance. Industries such as packaging, automotive, and medical devices are increasingly adopting biodegradable plasticizers to meet regulatory requirements and consumer preferences for greener products. The need to reduce plastic waste and limit the use of harmful chemicals, especially phthalates, further accelerates the adoption of biodegradable plasticizers, positioning this application as a key growth area in the market.

The flame retardants segment is poised to grow at the fastest rate from 2024 to 2030. This can be attributed to the rising need for environmentally safe, fire-resistant materials in industries such as construction, electronics, and automotive. As traditional flame retardants are often associated with harmful environmental and health effects, the demand for biodegradable alternatives that provide the same fire-resistance properties without toxic by-products is growing. Regulatory pressures to reduce the use of hazardous chemicals, combined with increasing consumer and industry focus on sustainability, are driving the adoption of biodegradable flame retardants. These additives allow manufacturers to meet stringent fire safety standards while aligning with eco-friendly production practices, making them crucial for high-performance, sustainable applications.

Regional Insights

The biodegradable plastic additives market in North America is being driven by growing corporate sustainability initiatives and rising consumer demand for eco-friendly products. Businesses in packaging, automotive, and retail are increasingly adopting biodegradable plastics to align with environmental goals and regulatory standards. The push for sustainability, combined with consumer pressure for greener solutions, is encouraging the adoption of biodegradable additives to ensure that these plastics meet performance and environmental standards.

U.S. Biodegradable Plastic Additives Market Trends

The biodegradable plastic additives market in the U.S. is driven by robust regulatory support, particularly regarding reducing plastic waste and carbon emissions. Government policies, including bans on single-use plastics and incentives for adopting sustainable practices, are pushing manufacturers to explore biodegradable alternatives. In addition, increasing investments in research and development by U.S.-based companies to improve the performance and cost-effectiveness of biodegradable plastics are driving market expansion in various sectors such as packaging, agriculture, and healthcare.

Asia Pacific Biodegradable Plastic Additives Market Trends

The Asia Pacific biodegradable plastic additives market dominated globally and accounted for the largest revenue share of 36.62% in 2023, owing to the increasing governmental regulations aimed at curbing plastic waste, particularly in countries like China and India. As these nations seek to address the environmental challenges posed by plastic pollution, the demand for biodegradable solutions, including additives, has surged. Local manufacturers are also investing in sustainable production processes to align with these new regulatory frameworks, propelling the market forward.

Europe Biodegradable Plastic Additives Market Trends

The biodegradable plastic additives market in Europe is driven primarily by stringent environmental regulations and ambitious sustainability targets. The European Union's Circular Economy Action Plan and the Single-Use Plastics Directive are compelling manufacturers to reduce their reliance on traditional plastics, creating a strong demand for biodegradable additives. Companies in the region are prioritizing biodegradable solutions to comply with these regulations while maintaining product performance, particularly in industries such as packaging, agriculture, and automotive.

Rapid urbanization and industrialization in China are fueling the demand for biodegradable plastics in packaging, agriculture, and consumer goods. With growing awareness of the environmental impacts of traditional plastics, consumers and businesses alike are pushing for alternatives that integrate biodegradable additives to enhance functionality without compromising environmental sustainability. This shift is creating strong growth prospects for biodegradable plastic additives across various applications.

Key Biodegradable Plastic Additives Company Insights

The biodegradable plastic additives industry is highly competitive, with several key players dominating the landscape. Major companies include Avient Corporation, BASF, Clariant AG, Emery Oleochemicals, Greenchemicals S.r.l., Dow, Evonik Industries AG, LANXESS, Solvay, and DIC Corporation. The market for biodegradable plastic additives is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Biodegradable Plastic Additives Companies:

The following are the leading companies in the biodegradable plastic additives market. These companies collectively hold the largest market share and dictate industry trends.

- Avient Corporation

- BASF

- Clariant AG

- Emery Oleochemicals

- Greenchemicals S.r.l.

- Dow

- Evonik Industries AG

- LANXESS

- Solvay

- DIC Corporation

Recent Developments

-

In March 2024, Baerlocher USA, a supplier of plastics additives, and Innoleics, a U.S. innovator in bio-based plasticizers, announced a partnership under which Baerlocher USA will distribute Innoleics' full line of bio-based plasticizers for flexible PVC applications in the U.S. market. This partnership expands Baerlocher USA's portfolio and strengthens its position as a solutions supplier to the plastics industry.

-

In September 2023, BASF announced the launch of the industry's first biomass-balance plastic additives, aimed at replacing fossil feedstock with renewable materials. The initial products, Irganox 1076 FD BMBcert and 1010 BMBcert have been certified by TÜV Nord under the ISCC PLUS standard, which ensures sustainability in the production process.

Biodegradable Plastic Additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,512.86 million

Revenue forecast in 2030

USD 4,242.67 million

Growth rate

CAGR of 9.12% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Avient Corporation; BASF; Clariant AG; Emery Oleochemicals; Greenchemicals S.r.l.; Dow; Evonik Industries AG; LANXESS; Solvay; and DIC Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biodegradable Plastic Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biodegradable plastic additives market report based on form type, application, and region:

-

Form Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Property Modifiers

-

Property Extenders

-

Property Stabilizers

-

Processing Aids

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plasticizers

-

Flame Retardants

-

Impact Modifiers

-

Antioxidants

-

Antimicrobials

-

UV Stabilizers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global biodegradable plastic additives market size was estimated at USD 2,224.56 million in 2023 and is expected to reach USD 2,512.86 million in 2024.

b. The global biodegradable plastic additives market is expected to grow at a compound annual growth rate of 9.1% from 2022 to 2030 to reach USD 4,242.67 million by 2030.

b. Based on application, the plasticizers segment dominated the market with the largest revenue share of 51.50% in 2023, driven by the increasing demand for flexible and eco-friendly alternatives to conventional plastic materials.

b. Major companies include Avient Corporation; BASF; Clariant AG; Emery Oleochemicals; Greenchemicals S.r.l.; Dow; Evonik Industries AG; LANXESS; Solvay; and DIC Corporation.

b. Rising non-degradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution leading to a surge in the demand for sustainable alternatives to effectively manage plastic pollution.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."