- Home

- »

- Advanced Interior Materials

- »

-

Biocomposites Market Size & Share, Industry Report, 2033GVR Report cover

![Biocomposites Market Size, Share & Trends Report]()

Biocomposites Market (2026 - 2033) Size, Share & Trends Analysis Report By Fiber Type (Wood Fibers, Non-wood Fibers), By Product (Wood Plastic Composites, Natural Fiber Composites, Hybrid Biocomposites), By Technology, By Polymer Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-199-3

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biocomposites Market Summary

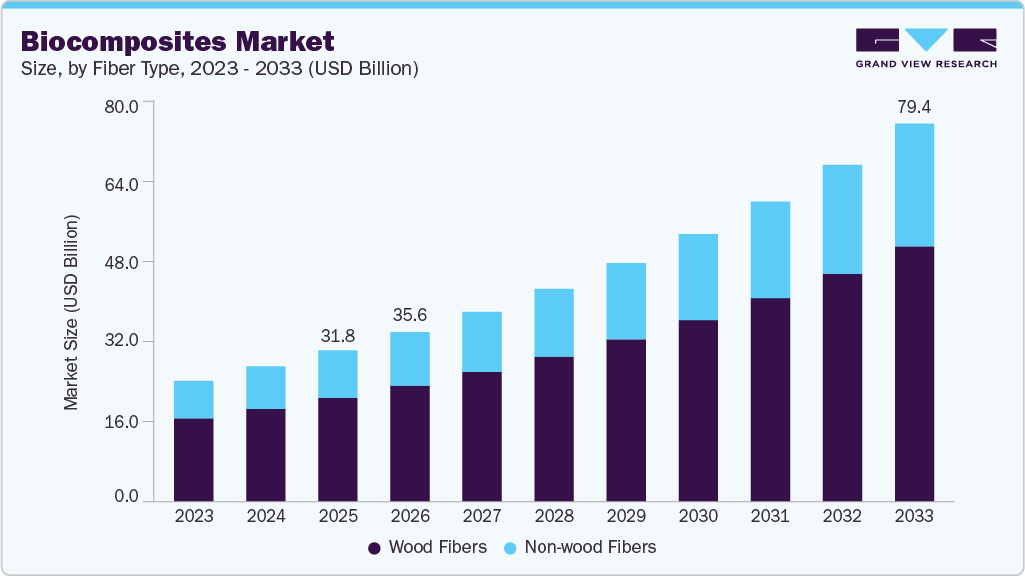

The global biocomposites market size was estimated at USD 31.76 billion in 2025 and is projected to reach USD 79.35 billion by 2033, growing at a CAGR of 12.1% from 2026 to 2033, driven by a strong global push toward sustainable, eco-friendly materials in industrial applications. As governments, corporations, and consumers aim to reduce carbon footprints and plastic dependency, biocomposites offer a renewable and biodegradable alternative to conventional composites.

Key Market Trends & Insights

- North America dominated the biocomposites market with the largest revenue share of 50.2% in 2025.

- By fiber type, the non-wood fiber segment is expected to grow at fastest CAGR of 12.6% over the forecast period.

- By product, the hybrid biocomposites segment is expected to grow at the fastest CAGR of 13.0% over the forecast period.

- By technology, the injection molding segment is expected to grow at fastest CAGR of 13.3% over the forecast period.

- By polymer type, the biodegradable polymer segment is expected to grow at fastest CAGR of 12.7% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 31.76 Billion

- 2033 Projected Market Size: USD 79.35 Billion

- CAGR (2026-2033): 12.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

With rising awareness of environmental degradation and stricter disposal norms, industries such as automotive, construction, and packaging are actively adopting biocomposites. Moreover, rising global concern around microplastics and long-term pollution is encouraging replacement with bio-based solutions. As sustainable design becomes mainstream, biocomposites are emerging as a preferred material choice. The overall value chain is also becoming more optimized, reducing costs and improving scalability. Current trends include the development of high-strength natural fiber-reinforced biocomposites and hybrid bio-synthetic composites.

Biocomposites are being integrated with nanocellulose for better performance in aerospace and electronics. 3D printing using biocomposite feedstock is expanding design possibilities in consumer goods. Companies are developing recyclable bio-resins and thermoplastic biocomposites to improve lifecycle sustainability. There is also increasing vertical integration where companies cultivate their own raw materials (such as hemp or flax) for controlled quality and supply. Startups are experimenting with agricultural waste such as coconut coir, rice husk, and banana fiber for cost-efficient, high-performance bio-fillers.

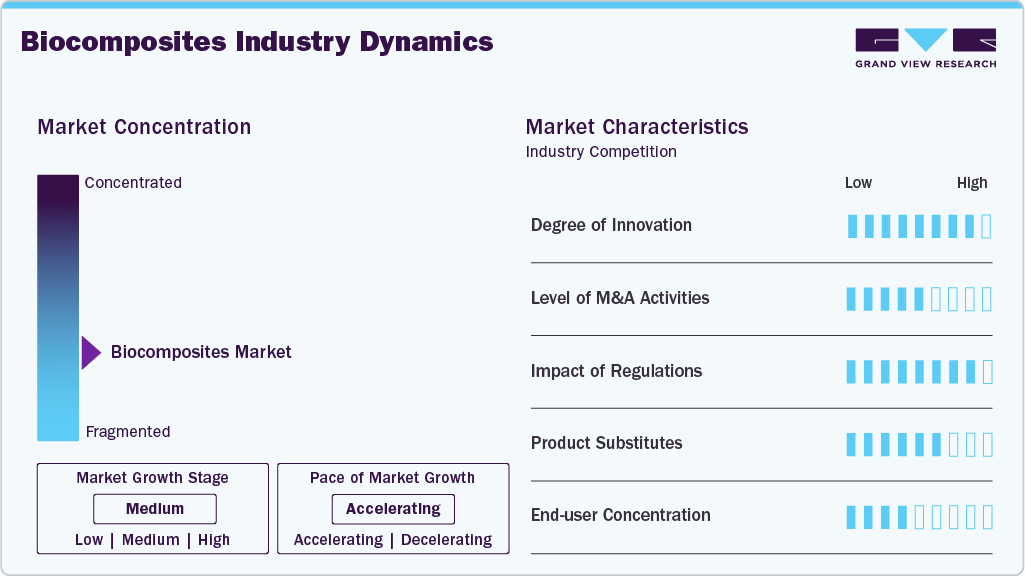

Market Concentration & Characteristics

The biocomposites market is moderately fragmented with both global material companies and regional players involved. While key players dominate supply of engineered natural fibers and resins, numerous startups and small manufacturers serve local or niche markets. Strategic partnerships between material producers and end-user industries are increasingly common. Europe and North America house most of the technology leaders, while Asia Pacific sees strong regional production growth due to abundant raw material and low-cost labor.

Biocomposites face competition from traditional synthetic composites like carbon and glass fiber-reinforced plastics, especially in high-load structural applications. Metal and engineered wood products are substitutes in the construction and transportation sectors. However, these alternatives often lack biodegradability or renewable sourcing advantages. Innovations in material strength and processing flexibility are helping biocomposites reduce this threat. Still, price sensitivity and performance constraints in certain applications remain challenges to full substitution.

Fiber Type Insights

The wood fibers segment held the highest revenue market share of 68.6% in 2025, due to their widespread availability, established processing methods, and favorable mechanical properties. They are commonly derived from softwood and hardwood sources and are used extensively in automotive interiors, construction panels, decking, and consumer goods. Their compatibility with both thermoset and thermoplastic resins, combined with cost-effectiveness, makes them a preferred reinforcement material. Major producers rely on wood flour, chips, and sawdust often by-products of the timber industry making the supply chain more sustainable. Furthermore, wood-based biocomposites exhibit good dimensional stability, processability, and strength, which support their dominant share across various end-use industries.

Non-wood fibers segment is expected to grow at the fastest CAGR of 12.6% over the forecast period, due to their superior biodegradability, lower density, and higher specific strength. These fibers are gaining traction in applications that demand lightweight and eco-friendly alternatives, such as electric vehicle interiors, sports equipment, and green packaging. As consumer preferences shift towards low-carbon products, non-wood fibers offer a sustainable substitute to conventional reinforcements. In addition, rising government support for hemp and natural fiber cultivation, especially in regions such as Asia Pacific and Europe, is fueling supply chain expansion. Their ability to be sourced from renewable and local agricultural residues also supports circular economy goals.

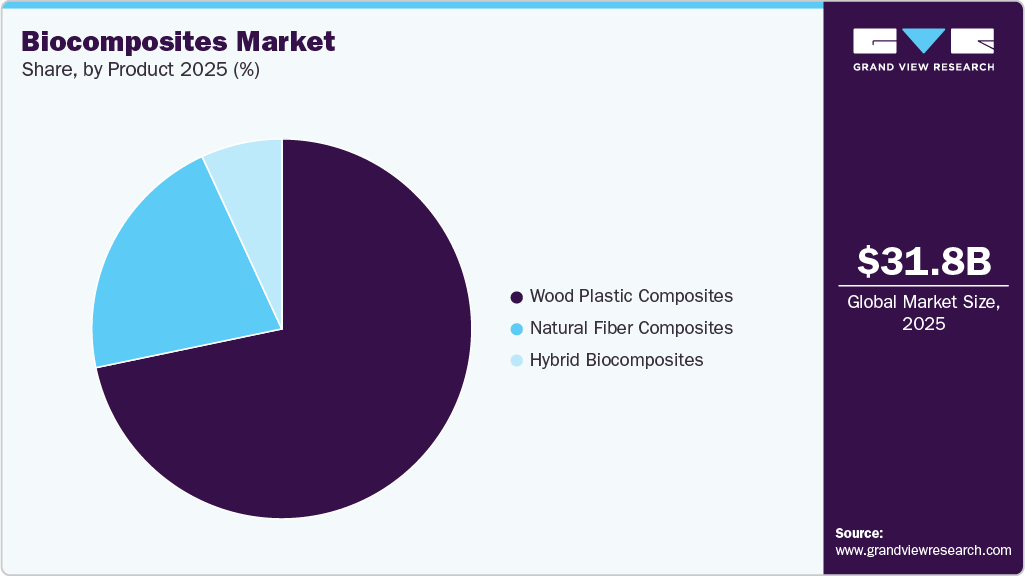

Product Insights

The wood plastic composites segment held the highest revenue market share of 71.8% in 2025. This growth is due to their durability, moisture resistance, and ability to mimic the appearance of wood while offering better longevity. Widely used in decking, fencing, outdoor furniture, and automotive interiors, WPCs are manufactured using recycled plastics and wood fibers or flour, making them both cost-effective and eco-friendly. Their compatibility with existing plastic processing techniques such as extrusion and injection molding ensures scalability in production. In addition, WPCs offer superior resistance to rot, pests, and weathering compared to natural wood, driving their popularity in construction and infrastructure applications across developed and emerging economies.

The hybrid biocomposites segment is expected to grow at the fastest CAGR of 13.0% over the forecast period, due to their ability to combine the benefits of natural and synthetic fibers, resulting in improved mechanical, thermal, and environmental performance. These composites are increasingly being used in high-performance applications such as aerospace, automotive, and consumer electronics, where strength-to-weight ratio, impact resistance, and durability are critical. By blending fibers such as flax or hemp with glass or carbon fibers, manufacturers can tailor material properties to meet specific requirements. Growing R&D investment and collaborations between material science firms and OEMs are accelerating innovation in hybrid biocomposites, pushing their adoption into more structural and high-load applications.

Technology Insights

Extrusion segment held the highest revenue market share of 42.1% in 2025, primarily due to its efficiency, scalability, and suitability for continuous production of uniform profiles. It is widely used to produce wood plastic composite decking, panels, fencing, and automotive trims. The process allows for high throughput and consistent quality, making it ideal for large-scale applications that require long, uniform shapes. Extrusion also enables easy incorporation of recycled materials and natural fibers, enhancing the sustainability of final products. Its widespread use in the construction and infrastructure sectors further strengthens its market share, supported by well-established processing lines and lower operational costs.

The injection molding segment is expected to grow at the fastest CAGR of 13.3% over the forecast period, driven by its precision, design flexibility, and suitability for complex, high-performance components. It is increasingly adopted in the automotive, electronics, and consumer goods industries for producing intricate parts such as panels, housings, and interior trims. The process supports high-volume production with minimal waste, making it ideal for biocomposites that incorporate natural fibers and biodegradable resins. As bio-based materials become more compatible with thermoplastic matrices, injection molding is enabling the transition from conventional plastics to greener alternatives. Advancements in tooling and mold design are also expanding the range of applications for bio-injection molded products.

Polymer Type Insights

The synthetic polymers segment held the highest revenue market share of 64.7% in 2025, due to their well-established compatibility with natural fibers and superior mechanical and thermal properties. These polymers provide strength, durability, and resistance to moisture and chemicals, making them suitable for a wide range of applications, including automotive components, construction materials, and consumer products. Their availability, cost-effectiveness, and ease of processing using conventional manufacturing techniques like extrusion and injection molding further support their dominant position. Moreover, the ability to reinforce these polymers with bio-fillers allows manufacturers to reduce environmental impact without compromising performance.

The biodegradable polymers segment is expected to grow at the fastest CAGR of 12.7% over the forecast period, fueled by rising environmental concerns, stricter regulations on plastic waste, and increasing consumer demand for sustainable materials. Polymers such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based resins are gaining popularity in packaging, agriculture, and single-use products. These materials offer the dual benefit of renewability and compostability, aligning with global efforts to reduce landfill burden and microplastic pollution. Technological advancements are improving the mechanical performance and processability of biodegradable polymers, making them viable alternatives to synthetics in more demanding applications. This growth is further supported by incentives and R&D in green chemistry and circular economy practices.

End Use Insights

The automotive and transportation segment held the highest revenue market share of 38.6% in 2025, owing to its strong demand for lightweight, durable, and sustainable materials. Biocomposites are widely used in car interiors, door panels, dashboards, and underbody shields to reduce vehicle weight and improve fuel efficiency. Original Equipment Manufacturers (OEMs) are increasingly incorporating natural fiber composites to meet emission norms and sustainability targets without compromising safety or aesthetics. Their sound absorption, thermal insulation, and recyclability make them ideal for electric vehicles and public transportation as well. The long-standing presence of established biocomposite formulations and material suppliers in this segment reinforces its dominant share in the global market.

Building and construction segment is expected to grow at a significant CAGR of 12.3% over the forecast period, driven by the push for green buildings, energy efficiency, and sustainable materials. Biocomposites are being used in decking, cladding, insulation, window frames, roofing, and interior elements due to their durability, resistance to moisture and pests, and lower environmental footprint. Their aesthetic appeal, low maintenance, and compatibility with green certification systems such as LEED and BREEAM are accelerating adoption. As urbanization increases and regulations around sustainable construction become stricter, architects and builders turn to biocomposites for structural and decorative applications. Innovations in fire resistance and load-bearing capabilities are also expanding their utility in modern construction.

Regional Insights

North America dominated the market and accounted for the largest revenue share of about 50.2% in 2025. North America shows strong market activity in high-value applications such as automotive, aerospace interiors, and consumer electronics. The U.S. BioPreferred Program is a key driver, mandating federal procurement of bio-based products. Companies are investing in developing biocomposites from agricultural waste such as wheat straw and corn husk. Universities and private firms are collaborating on structural-grade biocomposites. Canada is also promoting biocomposites for sustainable housing projects and automotive interiors.

U.S. Biocomposites Market Trends

The U.S. market benefits from advanced technology and policy support. Companies like Trex and Green Dot Bioplastics are innovating with recyclable and durable biocomposite solutions. Major automotive OEMs are integrating biocomposites into non-critical parts to reduce vehicle weight. Building codes in some states now allow the use of bio-based construction panels, boosting adoption. Public-private partnerships continue to accelerate R&D in sustainable material development.

Europe Biocomposites Market Trends

Europe is a leader in biocomposites technology, especially in high-end applications like consumer goods, mobility, and construction. EU regulations favor bio-based alternatives and restrict single-use plastics. Countries like Germany, Netherlands, and Austria have strong university-industry clusters developing advanced biocomposites. European automotive brands are incorporating bio-fibers in dashboards and door panels. Sustainability-driven public procurement programs are further supporting market growth.

Germany plays a central role in advancing biocomposite technologies, especially in automotive, aerospace, and construction industries. German firms collaborate closely with Fraunhofer Institutes and universities to develop lightweight, durable biocomposite solutions. Government funding supports development of biodegradable composites for packaging and construction boards. Export demand for sustainable engineered materials also boosts market revenue.

Asia Pacific Biocomposites Market Trends

Asia Pacific is expected to grow at the fastest rate in the biocomposites market, driven by the abundant availability of natural fiber feedstock like jute, hemp, bamboo, and kenaf. Rapid industrial growth in China, India, and Southeast Asia creates large end-use markets in packaging, automotive, and consumer goods. Government initiatives supporting bioeconomy development and low production costs further strengthen the region’s dominance. Domestic manufacturers are expanding capacity while multinationals are setting up local units. Biocomposites are increasingly used in furniture, electronics, and construction materials in this region.

China is expanding its role in biocomposites by investing in industrial-scale cultivation of hemp and kenaf and supporting rural bioeconomy zones. Local companies are supplying biocomposites for automotive interiors and construction boards. R&D centers are working on cost-effective bio-based thermoplastics. Government programs incentivize reduction of plastic use and encourage green building materials, directly benefiting the biocomposites sector. Export-oriented manufacturers are also rising to meet global demand.

Central & South America Biocomposites Market Trends

Central & South America shows growing interest in biocomposites driven by its rich biodiversity and agricultural base. Brazil and Argentina have pilot projects using sugarcane bagasse and coconut husk to make bio-panels and insulation materials. Regional growth is hindered by lack of processing infrastructure and limited R&D, but government efforts to promote sustainable agriculture and reduce plastic waste are helping. Domestic startups are emerging in construction and furniture sectors.

Middle East & Africa Biocomposites Market Trends

MEA's biocomposites market is in early development but shows potential due to rising construction and packaging sectors. South Africa, Egypt, and UAE are exploring biocomposites for green building applications and eco-friendly packaging. Projects using date palm fiber and agricultural waste are underway. However, lack of processing capacity, high cost of biopolymers, and limited technical know-how remain challenges. Governments are slowly integrating sustainability into public procurement.

Key Biocomposites Company Insights

Some of the key players operating in the market include Stora Enso, Bcomp Ltd

-

Stora Enso is a Finnish-Swedish renewable materials company and one of the world’s leading providers of wood-based products. The company focuses on sustainable packaging, biomaterials, wooden construction, and paper. It has been actively investing in bio-based composites and lignin-based materials as alternatives to fossil-based plastics, particularly for automotive, electronics, and industrial applications.

-

Bcomp Ltd is a Swiss innovator specializing in high-performance natural fiber composites. Known for its proprietary ampliTex and powerRibs technologies, the company supplies lightweight flax-based materials for automotive interiors, sports equipment, and aerospace components. Bcomp emphasizes sustainability by combining performance, weight savings, and environmental benefits.

UFP Industries, Inc. and Natural Fibre Technologies are some of the emerging market participants in the biocomposites market.

-

UFP Industries, based in the United States, is a diversified holding company that manufactures and distributes wood and wood-alternative products. It operates across retail, construction, and industrial markets. UFP is active in the wood-plastic composite market, offering durable and eco-friendly outdoor building materials, including decking, fencing, and trim products.

-

Natural Fibre Technologies is a Canadian company focused on converting agricultural waste and non-wood plant fibers like hemp, flax, and wheat straw into high-performance natural fiber reinforcements. NFT serves automotive, consumer goods, and packaging markets, offering customized fiber processing solutions to meet sustainable manufacturing goals.

Key Biocomposites Companies:

The following are the leading companies in the biocomposites market. These companies collectively hold the largest market share and dictate industry trends.

- Stora Enso

- UPM Biocomposites

- UFP Industries, Inc.

- Natural Fibre Technologies

- RBT BioComposites

- FiberWood

- Bcomp Ltd

- Jelu-Werk J.Ehrler GmbH

- Hemka

- Norske Skog Saugbrugs

Recent Developments

-

In January 2025, Stora Enso partnered with ECOR Global, pioneering in the industry with fully bio-based and formaldehyde-free board.

-

In May 2025, Stora Enso completed the acquisition of Finnish sawmill company Junnikkala.

-

In March 2025, Green Dot Bioplastics Announced Metallization Success with Terratek BD3003.

Biocomposites Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 35.58 billion

Revenue forecast in 2033

USD 79.35 billion

Growth rate

CAGR of 12.1% from 2026 to 2033

Base year for estimation

2025

Actual estimates/Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fiber type, product, technology, polymer type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Austria; Italy; Switzerland; Sweden; Finland; Denmark; Norway

Key companies profiled

Stora Enso; UPM Biocomposites; UFP Industries, Inc.; Natural Fibre Technologies; RBT BioComposites; FiberWood; Bcomp Ltd; Jelu-Werk J.Ehrler GmbH; Hemka; Norske Skog Saugbrugs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biocomposites Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biocomposites market on the basis of fiber type, product, technology, polymer type, end use, and region:

-

Fiber Type Outlook (Volume, Kilotons; Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wood Fibers

-

Non-wood Fibers

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wood Plastic Composites

-

Natural Fiber Composites

-

Hybrid Biocomposites

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Compression Molding

-

Injection Molding

-

Extrusion

-

Resin Transfer Molding

-

Pultrusion

-

Thermoforming

-

Others

-

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Biodegradable Polymer

-

Synthetic Polymer

-

Hybrid Polymer

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive and Transportation

-

Building and Construction

-

Consumer Goods

-

Aerospace

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Austria

-

Italy

-

Switzerland

-

Sweden

-

Finland

-

Denmark

-

Norway

-

-

Asia Pacific

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The synthetic polymers segment held the highest revenue market share of 64.7% in 2025, due to their well-established compatibility with natural fibers and superior mechanical and thermal properties.

b. Some of the key players operating in the biocomposites market include Stora Enso, UPM Biocomposites, UFP Industries, Inc., Natural Fibre Technologies, RBT BioComposites, FiberWood, Bcomp Ltd, Jelu-Werk J.Ehrler GmbH, Hemka, and Norske Skog Saugbrugs.

b. Key factors driving the biocomposites market include rising demand for sustainable materials, strict environmental regulations, growth in automotive and construction sectors, and advancements in natural fiber processing technologies.

b. The global biocomposites market size was estimated at USD 31.76 billion in 2025 and is expected to reach USD 35.58 billion in 2026.

b. The global biocomposites market is expected to grow at a compound annual growth rate of 12.1% from 2026 to 2033 to reach USD 79.35 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.