Biocompatible 3D Printing Materials Market Size, Share & Trends Analysis Report By Type (Polymer, Metal), By Application (Implants & Prosthesis, Prototyping & Surgical Guides), By Region, and Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-352-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

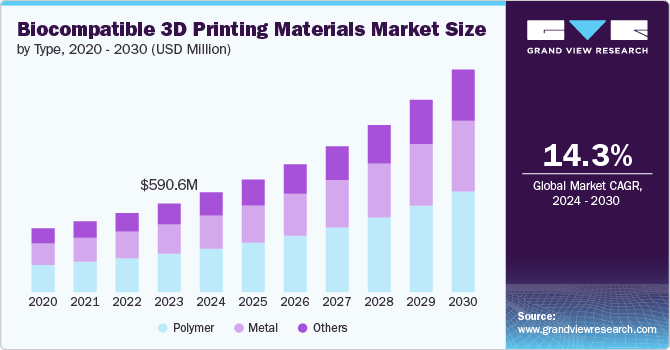

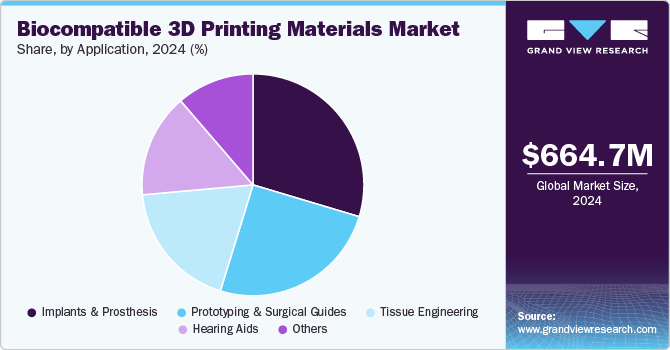

The global biocompatible 3D printing materials market size was estimated at USD 664.7 million in 2024 and is projected to grow at a CAGR of 14.6% from 2025 to 2030. Advancements in 3D printing techniques, including developing specialized biocompatible materials, enable the creation of patient-specific devices with enhanced functionality and improved integration with the human body. In April 2024, a study in Biomedicines assessed the safety and feasibility of biocompatible 3D printing materials for intra-procedural guides in cardiac ablation. Prototypes showed good geometrical integrity post-sterilization, but traces of nitrogen and sulfur were found in some samples after ablation, indicating a need for additional clinical research.

The healthcare industry is experiencing a rising demand for biocompatible materials used in medical applications such as implants, prosthetics, and tissue engineering. These materials are designed to be compatible with the human body, reducing the likelihood of rejection or negative reactions. This demand is driving the development of advanced biocompatible materials for 3D printing. In June 2024, BIO INX launched DEGRES INX, an innovative biodegradable resin with shape memory capabilities designed for DLP-based 3D-(bio)printing. This unique material can be deformed temporarily and returns to its original shape when heated to body temperature. Furthermore, it meets ISO biocompatibility standards, making it suitable for cell cultivation.

Recent technological advancements in 3D printing have significantly influenced the market for biocompatible materials. Innovations in materials and printing processes have created safe and effective options for medical applications. In October 2024, VBN Components, a Swedish company, made significant advancements in wear-resistant additive manufacturing materials. Their Vibenite portfolio featured innovative alloys poised to replace cobalt chrome in medical implants due to increasing safety concerns associated with cobalt chrome usage.

The rise of personalized medicine is further propelling the biocompatible 3D printing materials market. This approach focuses on providing customized treatments based on individual patient characteristics, such as genetic makeup and lifestyle choices. In the realm of 3D printing, personalized medicine facilitates the creation of tailored medical devices, implants, and pharmaceuticals specifically designed to address the unique needs of each patient. In October 2024, Boston Micro Fabrication (BMF) introduced four new materials for its microArch series 3D printers, specifically targeting the medical device sector. The HTF resin stands out for its high-temperature resistance, biocompatibility, and flexibility, making it ideal for medical applications where sterilization and material performance are critical.

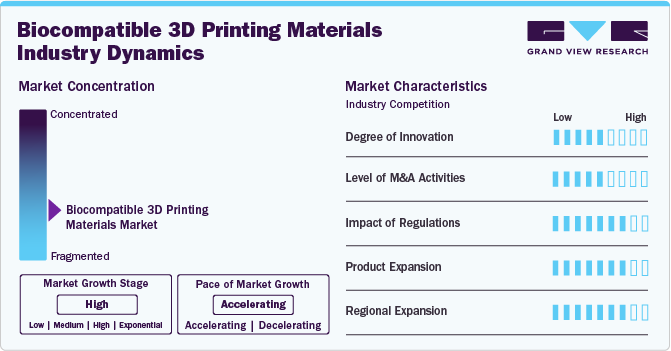

Industry Concentration & Characteristics

The degree of innovation in the biocompatible 3D printing materials industry is medium, driven by advancements in both materials science and 3D printing technology. Innovations include the development of new bioinks and polymers that can be used for medical applications such as tissue engineering, prosthetics, and implants. In October 2024, Formlabs released the large-format Form 4L and Form 4BL 3D printers. They've opened their SLA and SLS platforms for third-party materials through the Developer Platform. The company also launched new accessories, two SLS materials, five PreForm features, and new post-processing solutions.

The level of mergers and acquisitions in the biocompatible 3D printing materials industry is medium. as companies seek to expand their technological capabilities, enter new markets, or consolidate resources. These activities often involve partnerships between material manufacturers, 3D printing companies, and medical device firms. M&As allow companies to rapidly scale up their product offerings, integrate new technologies (such as bio-inks and advanced printing techniques), and establish more robust supply chains to meet increasing demand in the healthcare sector. Leading companies in this space are likely to pursue strategic acquisitions to enhance their portfolio and strengthen their competitive positioning.

Regulations play a significant role in the biocompatible 3D printing materials industry, and their impact is high, particularly in the healthcare and medical device sectors. Regulatory bodies such as the FDA (U.S.), EMA (Europe), and other regional authorities have established stringent guidelines for materials used in medical applications. These regulations ensure that 3D-printed materials meet the necessary safety and performance standards for human use. However, the regulatory landscape can sometimes be a barrier to innovation, as companies must navigate complex approval processes for new materials, devices, and technologies. Compliance with these regulations is key to gaining market acceptance and advancing the use of biocompatible 3D printing materials in medical and dental applications.

Product expansion in the biocompatible 3D printing materials industry is high, as companies are expanding their product and service offerings to cater to diverse needs across industries like healthcare, dental, and consumer products. For instance, companies are developing specialized bioinks, scaffolds, customizable printing materials for tissue engineering, and materials designed for orthopedic implants, dental crowns, and prosthetics. Additionally, there is a trend towards providing end-to-end solutions, including not just materials but also 3D printers and software for designing and printing complex medical devices.

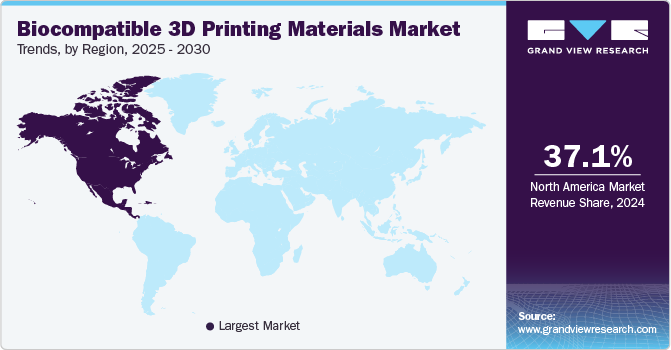

Regional expansion in the biocompatible 3D printing materials industry is high, with key markets including North America, Europe, and Asia Pacific. North America, particularly the U.S., leads in terms of research and innovation, as well as the adoption of advanced 3D printing technologies in healthcare. Europe follows with a strong emphasis on regulatory standards and the integration of 3D printing in the medical sector. Meanwhile, Asia Pacific is emerging as a fast-growing region, with countries like China, Japan, and South Korea driving adoption due to a strong manufacturing base, an increasing number of medical applications, and government support for advanced manufacturing technologies.

Type Insights

The polymer segment held the largest market share of 43.7% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Polymers are widely used in 3D printing due to their versatility and ability to be easily manipulated into complex shapes. This makes them ideal for various medical applications such as prosthetics, implants, and surgical guides. In August 2024, researchers at Duke University published a study in Angewandte Chemie International Edition, introducing a new solvent-free polymer for DLP 3D printing. This advancement eliminates shrinkage, enhances mechanical properties, and ensures biodegradability, providing notable benefits for biodegradable implants and various applications.

The metal segment is the second largest segment during the forecast period due to its widespread use in medical implants and orthopedic devices. Metals such as titanium and stainless-steel offer superior strength, durability, and biocompatibility, making them ideal for applications such as joint replacements, dental implants, and prosthetics. Advances in metal 3D printing technologies, such as direct metal laser sintering (DMLS), allow for complex, customized designs that are highly tailored to patient needs. In January 2024, an article discussed the advancements in additive manufacturing (AM) and its role in biomedical applications, particularly focusing on the use of metallic materials. It emphasized the need for selecting suitable biomaterials for 3D printing and highlighted that further innovations in this area are essential for enhancing AM technology in healthcare.

Application Insights

The implants & prosthesis segment held the largest market share of 29.6% in 2024due to its critical role in revolutionizing healthcare by offering customized solutions for patients needing implants or prosthetic devices. This segment benefits significantly from the advancements in 3D printing technology, allowing it to produce complex and personalized implants that perfectly fit the patient’s anatomy. The adoption of 3D-printed PMMA implants is rising in total joint replacement procedures, including hip, knee, and shoulder surgeries. These customized implants offer superior biocompatibility, precise fit, and long-term durability, improving joint function and patient satisfaction.In June 2024, researchers at Northwestern University focused on developing dissolvable stents using 3D printing and citrate biomaterials. The project aimed to create stents that naturally dissolve in the body, minimizing the need for removal surgery. This breakthrough could improve patient recovery times and reduce complications associated with traditional stents.

The prototyping & surgical guides segment is the fastest-growing application in the biocompatible 3D printing materials market owing to their critical role in precision healthcare applications. 3D-printed prototypes allow for rapid, cost-effective development of medical devices, implants, and tools, reducing time-to-market and enhancing design accuracy. Surgical guides, which are patient-specific, enable surgeons to plan and execute complex surgeries with high precision, improving patient outcomes. In July 2024, an article published in the Journal of Medical Physics discussed the advancements of 3D printing in creating customized surgical guides to improve surgical precision. It also highlighted a collaboration between the Cleveland Clinic and Case Western Reserve University to develop new 3D-printed implants and surgical guides for various medical procedures. This partnership aims to enhance patient outcomes by incorporating patient-specific solutions in surgeries.

Regional Insights

North America biocompatible 3D printing materials market dominated the industry with a revenue share of 37.1% in 2024 due to extensive research, innovation, and a robust healthcare industry. The U.S. plays a significant role of developing and adopting advanced 3D printing technologies, particularly in medical applications like prosthetics, implants, and surgical tools. Strong investments in R&D, along with supportive regulations, fuel market growth in the region.In January 2024, SprintRay hosted its VISION Summit, showcasing advancements in dental 3D printing and material science. Over the previous two years, the SprintRay BioMaterial Innovation Lab developed new formulations and manufacturing techniques. The summit revealed a groundbreaking lineup of materials aimed at revolutionizing the dental industry.

U.S. Biocompatible 3D Printing Materials Market Trends

The U.S. biocompatible 3D printing materials market is one of the largest globally, it is highly advanced, supported by many healthcare institutions, research universities, and a thriving medical device industry. The market benefits from cutting-edge innovations in bioinks, polymers, and metals for customized implants, tissue engineering, and surgical guides. In July 2024, an article in Advanced Healthcare Materials discussed the rising use of 3D printed medical devices, including orthopedic implants and surgical tools in clinical settings. It also highlighted the challenges facing the clinical translation of living cellular constructs due to regulatory hurdles and technological constraints. The article emphasizes the need for a multidisciplinary approach to enhance bioprinting applications and address these challenges.

Europe Biocompatible 3D Printing Materials Market Trends

The Europe biocompatible 3D printing materials market is characterized by countries like Germany, the UK, and France driving growth. The region is known for its stringent regulatory standards and emphasis on quality, which promotes the adoption of biocompatible materials in medical applications. Europe’s focus on sustainability and personalized healthcare contributes to the market's expansion. In August 2024, researchers from Heidelberg University developed inks for 3D laser printing using materials from microalgae, specifically diatoms and green algae. These biocompatible inks have potential applications in creating implants or scaffolds for cell cultures. Two-photon 3D laser printing, known for its high resolution, enables the production of complex micro- and nanoscale structures, useful in biomedicine and microfluidics.

Biocompatible 3D printing materials market in the UK is driven by strong healthcare infrastructure and government investments in cutting-edge technologies. The UK is focusing on innovations in medical devices, tissue engineering, and personalized medicine, with regulatory frameworks that ensure the safe use of 3D-printed materials in medical applications, further accelerating market adoption. In August 2024, Warwickshire NHS Trust successfully performed its first wrist surgery using a 3D printed, patient-specific implant. This innovation aims to correct post-traumatic wrist deformities, offering enhanced surgical precision and improved clinical outcomes, including faster recovery and reduced pain. The advancement reinforces the hospital’s reputation for medical innovation.

Germany biocompatible 3D printing materials market is driven by its strong industrial base, advanced manufacturing capabilities, and focus on healthcare innovation. The country is particularly active in developing materials for orthopedic implants, dental applications, and prosthetics, supported by both government and private sector investments in R&D. In November 2024, Henkel presented its latest 3D printing materials at Formnext 2024, including a high-performance resin and a new medical portfolio addition. The Loctite 3D resin complied with multiple biocompatibility standards, positioning it as a reliable choice for medical uses.

Biocompatible 3D printing materials market in Italy is gaining traction in the medical field, with advancements in creating customized implants and surgical guides. Technology is being utilized to develop more precise and patient-specific medical devices, improving surgical outcomes. In September 2024, Dentistry Journal featured an article on the promise of customized biomaterials from 3D patient data for cranial and maxillofacial bone regeneration. It examined the advantages of 3D-printed meshes, membranes, and synthetic bone grafts, highlighting their role in improving surgical outcomes and patient satisfaction.

Asia Pacific Biocompatible 3D Printing Materials Market Trends

The Asia Pacific region is rapidly expanding in the biocompatible 3D printing materials market, driven by countries such as China, Japan, and India. This region benefits from increasing healthcare demand, a rising middle class, and government support for technological innovation. Advancements in materials and 3D printing capabilities are accelerating, particularly in medical devices, implants, and dental applications. In April 2024, a study in Scientific Reports found that washing 3D printed dental resins with water for 20 minutes preserved their mechanical strength and biocompatibility. This method enhances the development of water-washable materials and improves clinical washing practices.

China biocompatible 3D printing materials market is growing due to its large-scale manufacturing capacity and growing healthcare sector. The Chinese government has supported the integration of 3D printing technologies in medical applications through investment and infrastructure development. China's market is expanding, especially in dental implants, prosthetics, and custom medical devices. In March 2024, Anisoprint announced the opening of a new office in China as part of its expansion plans, which also include upcoming locations in Europe and the U.S. The company has appointed a new CEO and CTO to lead this growth. Following a successful Series A funding round in July 2023, Anisoprint is preparing for its next funding round this spring.

The biocompatible 3D printing materials market in India is growing with increasing investments in healthcare and manufacturing sectors. The country is seeing rising demand for customized medical devices, implants, and prosthetics, especially in affordable healthcare solutions. India’s skilled labor force and government initiatives in technology and healthcare innovation are fostering the growth of the biocompatible 3D printing market.The February 2024 article in Materials Advances highlights 3D printing of magnetic shape memory polymers (SMPs), specifically polylactide-co-trimethylene carbonate (PLMC) with iron oxide nanoparticles. This composite achieves high shape fixity and rapid recovery through remote heating, making it a promising candidate for deployable scaffolds and medical devices.

Latin America Biocompatible 3D Printing Materials Market Trends

Biocompatible 3D printing materials market in Latin American countries such as Brazil and Argentina are leading the adoption of 3D printing technologies in the healthcare sector, with applications in dental and orthopedic devices. As healthcare infrastructure improves and awareness of 3D printing grows, the demand for biocompatible materials is expected to increase significantly. A January 2024 article in the American Journal of Biomedical Science & Research highlights the significant psychological and social impacts of breast cancer diagnosis and mastectomy on women. It emphasizes the need for ultra-personalized external breast prostheses made using 3D technology, addressing the lack of tailored options in the market.

Brazil’s biocompatible 3D printing materials market is agrowing healthcare sector due to the advancements in healthcare and increasing demand for customized medical solutions. The country is focusing on developing affordable, high-quality 3D-printed implants and prosthetics. Brazil's growing healthcare sector and government-backed initiatives to promote innovation further support the growth of the biocompatible 3D printing materials market.In January 2024, an article published in the journal Compounds highlights the use of three-dimensional printing (3DP) technologies for creating complex and personalized objects, particularly in education, engineering, and biomedicine. It focuses on developing polymeric drug delivery systems (DDSs) using 3D printing, discussing various techniques, their advantages, and the potential synthetic and natural polymers employed in these applications.

Middle East And Africa Biocompatible 3D Printing Materials Market Trends

The Middle East and Africa’s markets are experiencing growing demand for biocompatible 3D printing materials. Key markets like the UAE and South Africa are investing in advanced 3D printing technologies for medical applications, especially in dental and orthopedic sectors. Government-backed healthcare improvements and technological initiatives are driving the demand for biocompatible materials in the region. In June 2024, Tinta Lab established a 3D print hub in partnership with Ortholife Group in the UAE and Egypt, with plans for expansion to Saudi Arabia. The acquisition of three Embrace Seat solutions enabled the production of customized medical and consumer products using advanced Programmable Foam technology, as stated by Tinta Lab.

The market for biocompatible 3D printing materials in Saudi Arabia is expanding due to the country’s Vision 2030 initiative, which encourages technological innovation and investment in healthcare. The demand for 3D-printed medical devices, implants, and surgical tools is increasing, and the government’s efforts to modernize healthcare infrastructure are expected to further drive the growth of the biocompatible 3D printing materials market. In May 2024, an article in the Saudi Pharmaceutical Journal highlighted the shift from traditional pharmaceutical manufacturing to 3D printing, which allowed for personalized medicine tailored to individual needs. While interest in 3D printing within the MENA region grew, research and development in pharmaceuticals remained limited.

Key Biocompatible 3D Printing Materials Company Insights

Some of the key market players operating in the biocompatible 3D printing materials market include Formlabs Inc., 3D Systems Inc., Evonik Industries AG, Stratasys and Concept Laser Gmbh. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of materials worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Biocompatible 3D Printing Materials Companies:

The following are the leading companies in the biocompatible 3D printing materials market. These companies collectively hold the largest market share and dictate industry trends.

- Formlabs Inc.

- 3D Systems Inc.

- Evonik Industries AG

- Stratasys

- Concept Laser Gmbh

- Renishaw plc

- ENVISIONTEC US LLC

- Cellink

- DETAX Ettlingen

- Hoganas AB

Recent Developments

-

In September 2024, Fiocruz made an investment in affordable, open-source 3D bioprinters developed in partnership with the Oswaldo Cruz Institute and Veiga de Almeida University. This technology was intended to produce artificial biological tissues for various applications, including biomedical research, healthcare, and the food industry, utilizing bioink rather than conventional printing materials.

-

In April 2024, Materialise and Renishaw announced a partnership to enhance efficiency and productivity for manufacturers using Renishaw’s RenAM 500 series of additive manufacturing systems. This collaboration provides Renishaw users access to Materialise's advanced build processor software and Magics for data preparation, enabling a streamlined workflow from design to finished part, while optimizing production time and operations.

-

In April 2024, Materialise expanded its 3D printing portfolio by introducing new materials, including Polyamide 12S, Polyamide 11 for Multi Jet Fusion, and Carbon Fiber Reinforced Polyamide. This enhancement enables companies to utilize 3D printing for serial production and prototyping, particularly benefiting the medical technology sector due to PA 11's biocompatibility and durability for applications like orthotics and prosthetics.

-

In December 2023, Stratasys Ltd. announced it won a 3D Printing Industry Award in the Medical, Dental, or Healthcare Application category for its J5 DentaJet, J5 MediJet, and Digital Anatomy 3D printers, acknowledging significant market growth. The company also received honorable mentions for Company of the Year (Enterprise) and for its Neo450 series as Enterprise 3D Printer of the Year (Polymers) during the awards ceremony in London.

Biocompatible 3D Printing Materials Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 751.2 million |

|

Revenue forecast in 2030 |

USD 1483.7 million |

|

Growth rate |

CAGR of 14.6% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Formlabs Inc.; 3D Systems Inc.; Evonik Industries AG; Stratasys Ltd.; Concept Laser Gmbh; Renishaw plc; ENVISIONTEC US LLC; Cellink; DETAX Ettlingen; Hoganas AB |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Biocompatible 3D Printing Materials Market Report Segmentation

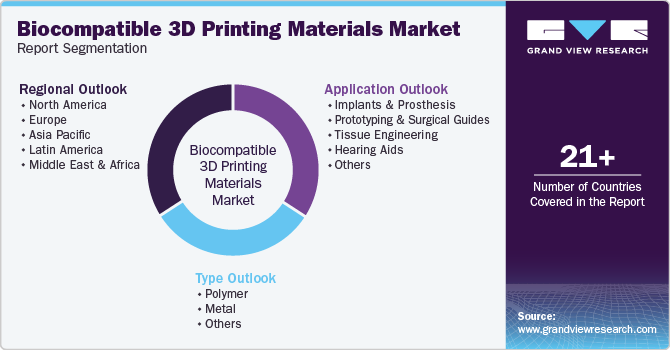

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biocompatible 3D printing materials market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer

-

Metal

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants & Prosthesis

-

Prototyping & Surgical Guides

-

Tissue Engineering

-

Hearing Aids

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biocompatible 3D printing materials market size was estimated at USD 664.7 million in 2024 and is expected to reach USD 751.2 million in 2025.

b. The global biocompatible 3D printing materials market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2030 to reach USD 1483.7 million by 2030.

b. North America dominated the biocompatible 3D printing materials market with a share of 37.1% in 2024. This is attributable to increasing investments in healthcare, rising demand for personalized medical devices, and advancements in 3D printing technologies.

b. Some prominent players in the biocompatible 3D printing materials market include Formlabs Inc.; 3D Systems Inc.; Evonik Industries AG; Stratasys Ltd.; Concept Laser Gmbh; Renishaw plc; ENVISIONTEC US LLC; Cellink; DETAX Ettlingen; Hoganas AB

b. Key factors that are driving the market growth include Advancements in 3D printing techniques, such as developing specialized biocompatible materials, enabling the creation of patient-specific devices with enhanced functionality and improved integration with the human body

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."