Biochar Market Size, Share & Trends Analysis Report By Technology (Gasification, Pyrolysis), By Application (Agriculture, Others), By Region (North America, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-681-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Biochar Market Size & Trends

The global biochar market size was estimated at USD 541.8 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2024 to 2030. Increasing product consumption in producing organic food and its ability to enhance soil fertility & plant growth are expected to be key factors driving market growth. The European Biochar Certificate has passed regulations on its direct utilization in soil across several European countries including Austria and Switzerland. Biochar is a charcoal derived by controlled heating of waste materials, such as agricultural waste, wood waste, forest waste, and animal manure. Among all end-uses, it is widely used in a soil amendment to reduce pollutants and toxic elements and to prevent reducing moisture level, soil leaching, and fertilizer runoff.

Environmental awareness, cheaper cost of raw materials, and cohesive government policies for waste management are key factors anticipated to create greater avenues for market expansion. The industry comprises the organized and unorganized sectors owing to a strong presence of a few large-scale manufacturers and a growing number of small- and medium-scale manufacturers, especially in North America and Europe. Counties in Asia Pacific and Middle East are expected to grow at a sluggish rate with a lack of product awareness and its long-term advantages. Manufacturing of high-quality biochar requires heavy capital investment. As a result, several companies have exited the market place in the past few years.

In rural areas of countries, such as China, Japan, Brazil, and Mexico, a large amount of this product is produced in collaboration with research groups and institutions. The number of organized players in the industry manufacturing high-quality products is expected to increase with the growing demand for organic food. The full potential of this product is yet to be realized in other sectors than the agricultural sector. It is used as a fabric additive in the textile industry, as a raw material in the manufacturing of building materials, and as a shield against electromagnetic radiation in electronics industry.

Growing demand from the food sector is expected to be an extremely important factor in boosting market growth. The product usage in the water treatment process is anticipated to be another important application in near future supported by rising demand for water treatment facilities, especially in emerging economies. Moreover, the production of biochar using biogas and crop residue is expected to complement market growth. The raw materials required for product manufacturing are wood waste, forest waste, agricultural waste, and animal manure. These are mainly procured from suppliers of the wood and forest-based product sector.

Companies, such as Georgia-Pacific, Weyerhaeuser, and West Fraser, are among the few major suppliers of wood pellets and residue to various manufacturers. The EU Commission and the U.S. (Environmental Protection Agency) EPA are the regulatory authorities governing the market. It has made regulations related to the use of products in agricultural production and waste management. Several new rules have been released by the U.S. EPA regarding the production and by the EU commission regarding product manufacturing & consumption. As the product is still in the preliminary stage, there are huge opportunities for the development of blended products in future.

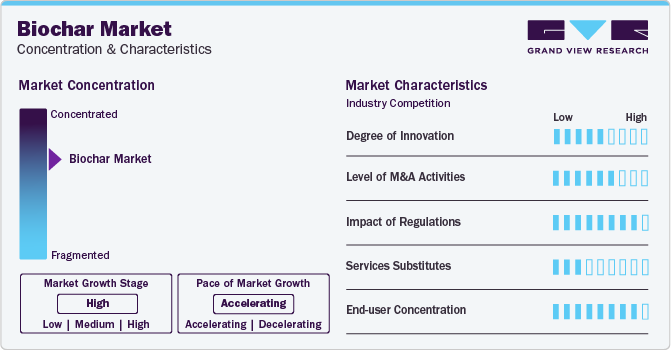

Market Concentration & Characteristics

The biochar market is at its nascent stage and is fragmented in nature. It comprises very few producers with small to large production capacities. It is an emerging market that has promising potential to grow in the near future. The companies are aiming at backward integration i.e., internally producing raw materials to reduce cost. The market players tend to compete based on quality and price of the product at a competitive price throughout the global market.

More than 80.0% of medium- and large-scale manufacturers are concentrated in North America while Asia Pacific and Europe comprise lesser concentration. The market, especially in North America, has numerous small entrepreneurs who are completely integrated into the value chain, from the production stage to the selling stage. Aberystwyth University, Massey University, Federal Rural University of the Amazon, and the University of East Anglia are among the few research institutions engaged in the production and R&D activities of biochar.

Timber manufacturers, such as Georgia-Pacific, West Fraser, and Weyerhaeuser, supply wood pellets and waste wood to various manufacturers in North America. This industry has numerous small manufacturers including Cool Planet Energy Systems Inc., who have integrated their value chain at all levels. Companies, such as 3R ENVIRO TECH Group, Phoenix Energy, and Pacific Pyrolysis, deliver pyrolysis technology to manufacture the product and waste to energy solutions.

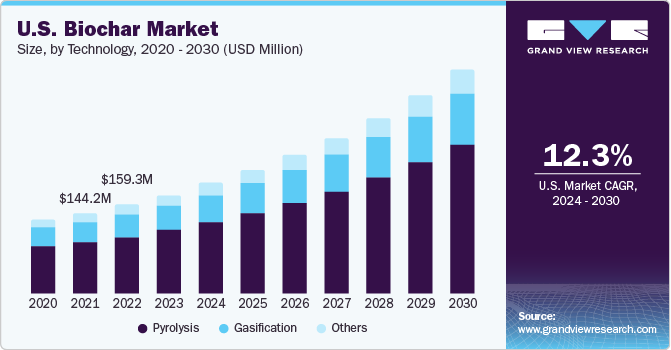

Technology Insights

On the basis of technology, the market has been further categorized into pyrolysis, gasification, and others. Pyrolysis was the dominating technology segment in 2023 and accounted for the highest revenue share of over 65.1% owing to high end-product yield of high carbon content and stability of a process. The growing need for electricity generation has displayed a moderate rise in the use of gasification technology.

Since the process does not yield stable biochar that can be used in agricultural applications, it is expected to lose its market share during the forecast period. Other manufacturing processes, such as hydrothermal carbonization, acid hydrolysis, and cooking stove, are used by small-scale producers to gain high profit. Asia Pacific has witnessed strong growth in the use of such processes owing to the rising number of small-scale producers.

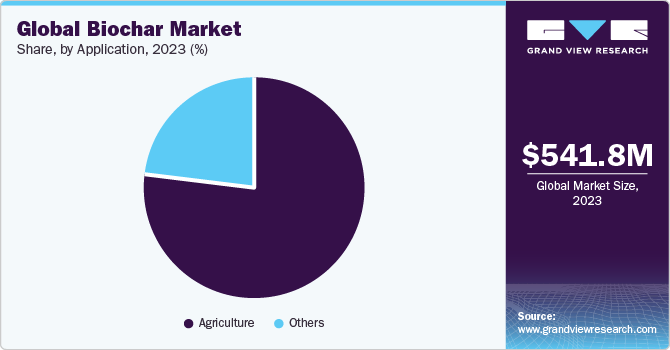

Application Insights

Agriculture was the dominating application segment in 2023 accounting for a revenue share of over 77.0%. Biochar helps enhance water and fertilizer holding capacity and improve soil’s biological productivity, which helps in providing crop nutrition and accelerating growth. However, a large number of farmers still lack knowledge about the product and its benefits. In agricultural applications, general farming is a major segment that is expected to rise substantially and augment the demand of the overall market owing to increasing efforts by research groups & institutes to spread awareness among farmers. Livestock farming contributes to a large proportion of the overall consumption in agricultural applications.

The product’s ability to provide essential nutrients and maintain the health of livestock has increased its consumption in livestock farming, including poultry farming, cattle farming, and meat production. Growing government support for organic farming is expected to create huge potential in coming years. Other major applications including water and waste treatment have witnessed rising demand in emerging economies, such as China and India, along with a growing need for advanced water infrastructure and hygiene awareness.

Factors, such as growing demand for organic food, rising health consciousness, and increasing consumer spending capacity, are complementing the organic farming sector’s growth. However, conventional farming is still used in several rural areas as it provides more yield. The use of biochar in mixed farming, zero tillage farming, and biodynamic agriculture would witness strong growth with supportive initiatives taken by the governments and private institutions.

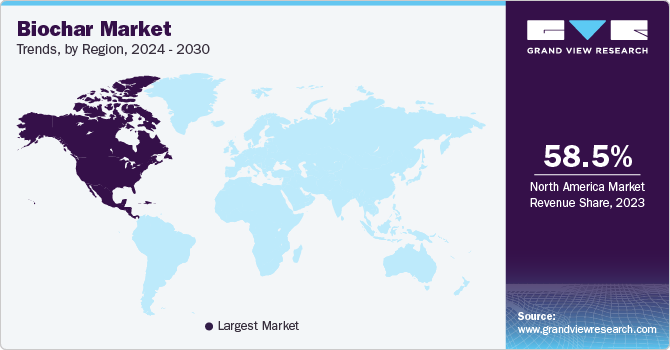

Regional Insights

North America dominated the market and held a revenue share of over 58.5% in 2023 owing to the increasing demand for organic food and high consumption of meat. Moreover, increasing awareness about the product and its benefits, especially among the farming community, support region’s growth. Low feed costs for livestock are also expected to boost product consumption in this sector. The U.S. has been generating the highest revenue in the world as a result of high awareness about the product in the country. Numerous small- and large-scale manufacturers have contributed to the growth of this sector. Despite several companies exiting from the industry, owing to lack of capital and expected growth, the overall growth prospects will be highly positive in the coming years.

Asia Pacific is expected to witness extremely high growth owing to the presence of large and developing agriculture sector in economies, such as China and India. Various R&D activities and government initiatives are expected to contribute to increasing awareness about biochar and its benefits among the farming community and would result in a high demand. China is the third-largest organic food-producing country in the world. The use of genetically modified crops has affected the soil and crop productivity in the agricultural fields of this country. An amalgamation of biochar in farming led by several research initiatives is expected to increase product awareness and thus, boost its consumption.

Biochar market in India is a growing at a significant pace due to increasing relevance of thermal chemical process as an economical method for the conversion of crop residue into biochar. It further helps in effective disposal and management of agroforestry residue. Biochar can be used to improve soil’s physical properties such as drainage, water holding capacity, porosity, and bulk density. Moreover, the agricultural industry in India is witnessing a growing demand to enhance the soil health via effective use of crop residues as a source of soil nutrient.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In July 2023, a consortium of Canadian and French companies, including Airex Energy, Groupe Rémabec, and SUEZ, invested C$80 million to construct North America’s largest biochar production facility.

-

In July 2023, Eco Allies, a Stereovision subsidiary, announced that Eco Allies, Inc. and Biochar Now, LLC have expanded their J/V's terms. A second plant in Mexico is added, and an increase in the number of kilns for each plant to be built goes from 120 to 180, or 360 kilns in total.

Key Biochar Companies:

- Biochar Products, Inc.

- Biochar Supreme, LLC

- ArSta Eco

- Carbon Gold Ltd

- Airex Energy Inc.

- Pacific Biochar Benefit Corporation

Global Biochar Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 614.7 million |

|

Revenue forecast in 2030 |

USD 1,350 million |

|

Growth rate |

CAGR of 13.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, company market positioning, competitive landscape, growth factors, trends |

|

Segments covered |

Technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Sweden; Denmark; China; India; Japan; Malaysia; Australia |

|

Key companies profiled |

Biochar Products, Inc.; Biochar Supreme, LLC; ArSta Eco; Carbon Gold Ltd; Airex Energy Inc.; Pacific Biochar Benefit Corp.; Biochar Ireland; Swiss Biochar GmbH; Sonnenerde GmbH; Pyro power; Stiesdal; Novocarbo |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase option |

Global Biochar Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the biochar market report based on technology, application, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pyrolysis

-

Gasification

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Animal Farming

-

Industrial Uses

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Malaysia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Increasing the consumption of products in producing organic food and its ability to enhance soil fertility and plant growth is expected to be the key growth driver.

b. The global biochar market size was estimated at USD 541.8 million in 2023 and is expected to reach USD 614.7 million in 2024.

b. The global biochar market size is estimated to reach USD 1.35 billion by 2030. It is expected to expand at a CAGR of 13.9% over the forecast period.

b. The agriculture application was the dominating segment accounting for a revenue share of over 77.0% in 2023 as biochar helps to enhance water and fertilizer holding capacity and improve soil’s biological productivity, which helps in providing crop nutrition and accelerating growth.

b. Key players involved in the manufacturing of Biochar include Biochar Products, Inc., Biochar Supreme, LLC, ArSta Eco, Carbon Gold Ltd, Airex Energy Inc., Pacific Biochar Benefit Corporation, and others.

Table of Contents

Chapter 1 Biochar Market: Methodology And Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Gvr’s Internal Database

1.3.3 Secondary Sources & Third-Party Perspectives

1.4 Information Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Research Scope And Assumptions

Chapter 2 Biochar Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Biochar Market: Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Global Biochar Market Outlook

3.2 Industry Value Chain Analysis

3.2.1 Manufacturing/Technology Trends

3.2.2 Sales Channel Analysis

3.2.3 List Of Potential End-Users

3.3 Price Trend Analysis, 2018 - 2030

3.3.1 Factors Affecting Prices

3.4 Regulatory Framework, By Regions

3.5 Market Dynamics

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Market Challenges Analysis

3.5.4 Market Opportunity Analysis

3.6 Business Environment Analysis

3.6.1 PORTER’S Analysis

3.6.2 PESTEL Analysis

Chapter 4 Biochar Market: Supplier Portfolio Analysis

4.1 List Of Key Raw Material Suppliers

4.2 Raw Material Trends

4.3 Portfolio Analysis/Kraljic Matrix

4.4 Engagement Model

4.5 Negotiation Strategies

4.6 Sourcing Best Practices

Chapter 5 Biochar Market: Technology Estimates & Trend Analysis

5.1 Technology Movement Analysis & Market Share, 2023 & 2030

5.1.1 Pyrolysis

5.1.1.1 Pyrolysis Market Estimates And Forecast, 2018 - 2030 (Kilotons) (USD Million)

5.1.2 Gasification

5.1.2.1 Gasification Market Estimates And Forecast, 2018 - 2030 (Kilotons) (USD Million)

5.1.4 Other Technology

5.1.4.1 Other Technology Market Estimates And Forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Biochar Market: Application Outlook Estimates & Forecasts

6.1. Biochar Market: Application Movement Analysis, 2023 & 2030

6.2. Agriculture

6.2.1. Biochar Market Estimates and Forecast, In Agriculture, 2018-2030 (Kilotons) (USD Million)

6.3. Animal Farming

6.3.1. Biochar Market Estimates and Forecast, In Animal Farming, 2018 - 2030, (USD Million) (Kilotons)

6.4. Industrial Uses

6.4.1. Biochar Market Estimates and Forecast, In Industrial Uses, 2018 - 2030, (USD Million) (Kilotons)

6.5. Other Applications

6.5.1. Biochar Market Estimates and Forecast, In Other Applications, 2018 - 2030, (USD Million) (Kilotons)

Chapter 7 Biochar Market: Regional Estimates & Trend Analysis

7.1 Biochar Market: Regional Outlook

7.2 North America

7.2.1 North America Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.2.2 North America Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.2.3 U.S.

7.2.3.1 Key Country Dynamics

7.2.3.2 U.S. Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.2.3.3 U.S. Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.2.4 Canada

7.2.4.1 Key Country Dynamics

7.2.4.2 Canada Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.2.4.3 Canada Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.2.5 Mexico

7.2.5.1 Key Country Dynamics

7.2.5.2 Mexico Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.2.5.3 Mexico Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.3 Europe

7.3.1 Europe Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.3.2 Europe Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.3.3 Germany

7.3.3.1 Key Country Dynamics

7.3.3.2 Germany Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.3.3.3 Germany Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.3.4 UK

7.3.4.1 Key Country Dynamics

7.3.4.2 UK Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.3.4.3 UK Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.3.5 France

7.3.5.1 Key Country Dynamics

7.3.5.2 France Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.3 France Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.3.6 Sweden

7.3.6.1 Key Country Dynamics

7.3.6.2 Sweden Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.3.6.3 Sweden Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.3.7 Denmark

7.3.7.1 Key Country Dynamics

7.3.7.2 Denmark Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.3.7.3 Denmark Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.4 Asia Pacific

7.4.1 Asia Pacific Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.4.2 Asia Pacific Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.4.3 China

7.4.3.1 Key Country Dynamics

7.4.3.2 China Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.4.3.3 China Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.4.4 India

7.4.4.1 Key Country Dynamics

7.4.4.2 India Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.4.4.3 India Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.4.5 Japan

7.4.5.1 Key Country Dynamics

7.4.5.2 Japan Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.3 Japan Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.4.6 Malaysia

7.4.6.1 Key Country Dynamics

7.4.6.2 Malaysia Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.3 Malaysia Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.4.7 Australia

7.4.7.1 Key Country Dynamics

7.4.7.2 Australia Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.3 Australia Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.5 Central & South America

7.5.1 Central & South America Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.5.2 Central & South America Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

7.6 Middle East & Africa

7.6.1 Middle East & Africa Biochar Market Estimates And Forecasts, By Technology, 2018 - 2030 (Kilotons) (USD Million)

7.6.2 Middle East & Africa Biochar Market Estimates And Forecasts, By Application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 8 Competitive Landscape

8.1 Recent Development & Impact Analysis, By Key Market Participants

8.2 Company Categorization

8.3 Company Market Positioning Analysis, 2023

8.4 Company Heat Map Analysis

8.5 Strategy Mapping

8.6. Company Listing (Business Overview, Financial Performance, Product Benchmarking)

8.6.1 Biochar Products, Inc.

8.6.2 Biochar Supreme, LLC

8.6.3 ArSta Eco

8.6.4 Carbon Gold Ltd

8.6.5 Airex Energy Inc.

8.6.6 Pacific Biochar Benefit Corporation

8.6.7 Biochar Ireland

8.6.8 Swiss Biochar GmbH

8.6.9 Sonnenerde GmbH

8.6.10 Pyro power

8.6.11 Stiesdal

8.6.12 Novocarbo

List of Tables

Table 1 List Of Key End Users

Table 2 Global Biochar Market Estimates & Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 3 Global Biochar Market Estimates & Forecast, By Technology, 2018 - 2030 (USD Million)

Table 4 Global Biochar Market Estimates & Forecast, By Application, 2018 - 2030 (Kilotons)

Table 5 Global Biochar Market Estimates & Forecast, By Application, 2018 - 2030 (USD Million)

Table 6 Global Biochar Market Estimates & Forecast, By Region, 2018 - 2030 (Kilotons)

Table 7 Global Biochar Market Estimates & Forecast, By Region, 2018 - 2030 (USD Million)

Table 8 North America Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 9 North America Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 10 North America Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 11 North America Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 12 U.S. Macro-Economic Outlay

Table 13 U.S. Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 14 U.S. Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 15 U.S. Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 16 U.S. Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 17 Canada Macro-Economic Outlay

Table 18 Canada Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 19 Canada Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 20 Canada Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 21 Canada Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 22 Mexico Macro-Economic Outlay

Table 23 Mexico Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 24 Mexico Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 25 Mexico Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 26 Mexico Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 27 Europe Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 28 Europe Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 29 Europe Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 30 Europe Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 31 Germany Macro-Economic Outlay

Table 32 Germany Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 33 Germany Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 34 Germany Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 35 Germany Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 36 UK Macro-Economic Outlay

Table 37 UK Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 38 UK Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 39 UK Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 40 UK Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 41 France Macro-Economic Outlay

Table 42 France Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 43 France Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 44 France Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 45 France Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 46 Sweden Macro-Economic Outlay

Table 47 Sweden Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 48 Sweden Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 49 Sweden Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 50 Sweden Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 51 Denmark Macro-Economic Outlay

Table 52 Denmark Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 53 Denmark Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 54 Denmark Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 55 Denmark Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 56 Asia Pacific Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 57 Asia Pacific Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 58 Asia Pacific Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 59 Asia Pacific Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 60 China Macro-Economic Outlay

Table 61 China Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 62 China Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 63 China Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 64 China Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 65 India Macro-Economic Outlay

Table 66 India Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 67 India Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 68 India Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 69 India Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 70 Japan Macro-Economic Outlay

Table 71 Japan Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 72 Japan Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 73 Japan Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 74 Japan Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 75 Malaysia Macro-Economic Outlay

Table 76 Malaysia Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 77 Malaysia Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 78 Malaysia Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 79 Malaysia Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 80 Australia Macro-Economic Outlay

Table 81 Australia Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 82 Australia Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 83 Australia Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 84 Australia Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 85 Central & South America Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 86 Central & South America Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 87 Central & South America Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 88 Central & South America Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 89 Middle East & Africa Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (Kilotons)

Table 90 Middle East & Africa Biochar Market Estimates And Forecast, By Technology, 2018 - 2030 (USD Million)

Table 91 Middle East & Africa Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (Kilotons)

Table 92 Middle East & Africa Biochar Market Estimates And Forecast, By Application, 2018 - 2030 (USD Million)

Table 93 Participant’s Overview

Table 94 Financial Performance

Table 95 Application Benchmarking

Table 96 Recent Developments & Impact Analysis, By Key Market Participants

Table 97 Company Heat Map Analysis

List of Figures

Fig. 1 Biochar Market Segmentation & Scope

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Biochar Market Snapshot

Fig. 7 Biochar Market Regional Snapshot

Fig. 8 Biochar Market Segment Snapshot

Fig. 9 Biochar Market Competitive Landscape Snapshot

Fig. 10 Biochar Market Value, 2022 (USD Million)

Fig. 11 Biochar Market - Value Chain Analysis

Fig. 12 Biochar Market - Price Trend Analysis 2018 - 2030 (USD/Kg)

Fig. 13 Biochar Market - Market Dynamics

Fig. 14 Porter’s Analysis

Fig. 15 Pestel Analysis

Fig. 16 Biochar Market Estimates & Forecasts, By Technology: Key Takeaways

Fig. 17 Biochar Market Share, By Technology, 2022 & 2030

Fig. 18 Pyrolysis Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 19 Gasification Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 20 Other Technologies Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 21 Biochar Market Estimates & Forecasts, By Application: Key Takeaways

Fig. 22 Biochar Market Share, By Application, 2023 & 2030

Fig. 23 Biochar Market Estimates & Forecasts, In Agriculture, 2018 - 2030 (Kilotons) (USD Million)

Fig. 24 Agriculture Biochar Market Estimates & Forecasts, Livestock, 2018 - 2030 (Kilotons) (USD Million)

Fig. 25 Agriculture Biochar Market Estimates & Forecasts, In Farming, 2018 - 2030 (Kilotons) (USD Million)

Fig. 26 Agriculture Biochar Market Estimates & Forecasts, In Others, 2018 - 2030 (Kilotons) (USD Million)

Fig. 27 Biochar Market Estimates & Forecasts, In Others Applications, 2018 - 2030 (Kilotons) (USD Million)

Fig. 28 Biochar Market Revenue, By Region, 2023 & 2030 (USD Million)

Fig. 29 North America Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (Kilotons) (USD Million)

Fig. 30 U.S. Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 31 Canada Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 32 Mexico Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 33 Europe Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 34 Germany Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 35 UK Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 36 France Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 37 Sweden Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 38 Denmark Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 39 Asia Pacific Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 40 China Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 41 India Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 42 Japan Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 43 Malaysia Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 44 Australia Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 45 Central & South America Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 46 Middle East & Africa Biochar Market Estimates & Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Fig. 47 Key Company Categorization

Fig. 48 Company Market Positioning

Fig. 49 Strategy Mapping

Market Segmentation

- Biochar Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Pyrolysis

- Gasification

- Others

- Biochar Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Biochar Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- North America Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- U.S. Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- U.S. Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Canada Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Canada Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Mexico Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Mexico Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- North America Biochar Market, By Technology

- Europe

- Europe Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Europe Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Germany Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Germany Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- UK Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- UK Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- France Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- France Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Sweden Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Sweden Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Denmark Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Denmark Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Europe Biochar Market, By Technology

- Asia Pacific

- Asia Pacific Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Asia Pacific Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- China Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- China Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- India Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- India Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Japan Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Japan Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Malaysia Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Malaysia Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Australia Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Australia Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Asia Pacific Biochar Market, By Technology

- Central & South America

- Central & South America Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Central & South America Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Brazil Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Brazil Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Central & South America Biochar Market, By Technology

- Middle East & Africa

- Middle East & Africa Biochar Market, By Technology

- Pyrolysis

- Gasification

- Others

- Middle East & Africa Biochar Market, By Application

- Agriculture

- Animal Farming

- Industrial Uses

- Others

- Middle East & Africa Biochar Market, By Technology

- North America

Biochar Market Dynamics

Driver: Increasing Use For Soil Enhancement

Biochar is a charcoal derived by controlled heating of waste materials, such as agricultural waste, wood waste, forest waste, and animal manure.Biochar is primarily used in agricultural operations owing to its soil amending abilities. This is the largest application of biochar and is responsible for driving the overall market growth. Biochar is responsible for providing essential nutrients to the crop and, in turn, enhancing crop yield. It is very helpful in areas facing soil depletion, very limited organic resources, lack of access to agrochemical fertilizers, and insufficient water. The quality and quantity of food are the two important issues that are expected to be addressed with the development of biochar. The ability of biochar to provide and retain essential nutrients to the soil is expected to result in the growing product demand for improving soil fertility. Biochar, with its soil amendment abilities, has helped farmers and agricultural industry improve their crop yield and overall productivity.

Driver: Growing Demand For Organic Food

Organic farming is expected to gain a lot from the use of biochar as it helps improve productivity by providing essential nutrients for plant growth. Biochar is an excellent carbon carrier, which enhances plant growth. Organic food sector witnessed significant growth over the past few years owing to rising health concerns among consumers. Organic vegetables and fruits witnessed a significant rise in demand over the past couple of years owing to their high nutritional value, low pesticide usage, and high sustainability. Organic products are generally perceived to have lower pesticide residues, as synthetic pesticides are prohibited in organic production. Consumers may view organic products as a way to promote sustainable and community-based agriculture.

Restraint: Lack Of Consumer Awareness

Lack of awareness about biochar among consumers has been a major concern. Most of the farmers are still using synthetic pesticides for crop protection and enhancing plant growth. A large section of farmers across the world is still unaware of biochar advantages over other fertilizers and does not use biochar for soil amendment or crop growth. Farmers and consumers have to be educated by soil scientists and horticulturalists about the potential benefits of biochar. A robust biochar industry would only be possible if farmers and consumers are aware of the potential benefits of biochar over other fertilizers and its application as a soil enhancer. Farm planning and management, crop advisors, and representatives from various seed companies are some of the ways through which consumer and buyer awareness can be increased.

What Does This Report Include?

This section will provide insights into the contents included in this biochar Market market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Biochar market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Biochar market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the biochar market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for biochar market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of biochar market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Biochar Market Categorization:

The biochar market was categorized into three segments, namely technology (Pyrolysis, Gasification), application (Agriculture, Animal Farming, Industrial Uses), and regions (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa).

Segment Market Methodology:

The biochar market was segmented into technology, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The biochar market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into thirteen countries, namely, the U.S.; Canada; Mexico; Germany; the UK; France; Sweden; Denmark; China; India; Japan; Malaysia; Australia.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Biochar market companies & financials:

The biochar market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Global Biochar Market Companies & Financials, The global biochar market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Biochar Solutions, Inc. - Biochar Solutions, Inc. is engaged in engineering of biochar value added products, conduct restoration work, and also provides research & development support to its clients. The product portfolio of the company comprises of feedstock testing, material characterization, analysis, equipment design & fabrication and also involved in providing training & technical support along with marketing & technology transfer.

-

Biochar Supreme, LLC. - Biochar Supreme, LLC. is engaged in providing complete integrated solutions for soil and water needs, indoor gardening, horticulture, and agriculture. The primary objective of the company is to provide premium biochar products. The company’s products are a combination of organic ingredients, which cater to horticulture and agriculture markets. Its biochar products are used in marine areas, mine reclamation, watersheds, rain gardens, green roofs, and storm water.

-

ArSta Eco (P) Ltd. - ArSta Eco (P) Ltd. is typically engaged in animal husbandry and agricultural services. The primary objective of the company is to produce clean energy and deliver a holistic approach by providing socially responsible, environment-friendly, and sustainable solutions.

-

Carbon Gold Ltd. - Carbon Gold Ltd. is the leading biochar company, with a commitment to improving soil health, plant health and human health. Their products are 100% free from peat and synthetic chemicals. By restoring soil health, the company can help mitigate climate change and provide people with access to healthy food.

-

Airex Clean Energy - Airex Clean Energy is engaged in developing technology for biomass torrefaction. The company was funded by the proprietors of a multistate Caterpillar authorization. The company’s patented cyclonic bed reactor CarbonFX enables large-scale biocoal and biochar production from a variety of feedstock, including woody biomass and agricultural waste.

-

Pacific Biochar Benefit Corporation - Pacific Biochar Benefit Corporation is currently engaged in developing and commercializing slow pyrolysis technology, which is used to deliver biochar and waste-to-energy solutions. The pyrolysis technology of the company bridges gap between market issues with local sustainability solutions and is engaged in distributing energy, sequestering carbon, mitigating greenhouse gases, enhancing soil health and more.

-

Swiss Biochar GmbH - Swiss Biochar GmbH is headquartered in Switzerland and is a biochar research network of 14 independent institutions. The primary objective of the company is to provide premium biochar products for various applications such as liquid waste, vegetable cows for plants, carbon feed, agriculture, and others. The company produces biochar from wood, miscanthus, urban lop, grape pomace, and other suitable biomasses, and supplies to horticulture and agriculture markets.

-

Sonnenerde GmbH - Sonnenerde GmbH is a producer of numerous products for soil treatment and plant growth solutions. The company is one of the leading producers of biochar and is among the pioneer manufacturers of biochar in Europe that has been approved under waste law.

-

pyropower GmbH - pyropower GmbH is an integrated company with its dominance in multiple steps of the value chain of pyrolysis plant business. The company offers biochar products that helps to save CO2 working in line with their sustainability target.

-

Novocarbo Biochar - Novocarbo Biochar is one of Europe‘s leading biochar providers. The company offers high-quality products that provide significant benefits in terms of carbon reduction, as well as improved product characteristics and agricultural or industrial output.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Biochar Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2018 to 2022, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Biochar Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."