- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Bioceramics Market Size, Share And Growth Report, 2030GVR Report cover

![Bioceramics Market Size, Share & Trends Report]()

Bioceramics Market (2024 - 2030 ) Size, Share & Trends Analysis By Material (Alumina, Zirconia), By Application (Dental, Orthopedic), By Region (Europe, APAC, MEA), And Segment Forecasts

- Report ID: 978-1-68038-726-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioceramics Market Summary

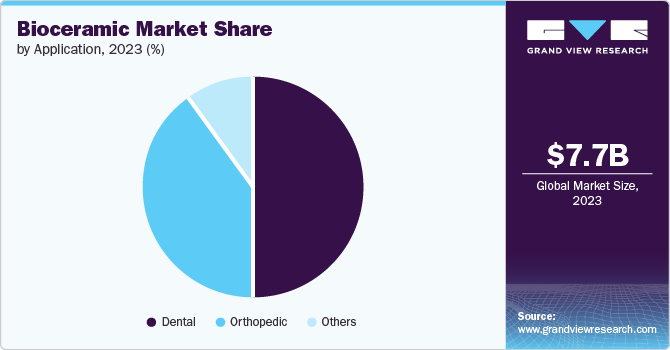

The global bioceramics market size was estimated at USD 7.67 billion in 2023 and is projected to reach USD 12.33 billion by 2030, growing at a CAGR of 7.0% from 2024 to 2030. The rising incidence of musculoskeletal conditions, including osteoporosis, osteoarthritis, and rheumatoid arthritis, among the senior population is expected to fuel the market growth.

Key Market Trends & Insights

- The North America bioceramics market secured the dominant share, 42.2%, in 2023.

- The bioceramics market in Europe accounted for 34.2% in 2023 with the region’s increasing aging population.

- Based on material, the alumina-based bioceramics accounted for 63.2% of the market share in 2023.

- Based on application, the dental segment held the dominant market share in 2023

Market Size & Forecast

- 2023 Market Size: USD 7.67 Billion

- 2030 Projected Market USD 12.33 Billion

- CAGR (2024-2030): 7.0%

- North America: Largest market in 2023

Bioceramics are biocompatible materials that are accepted by patient's bodies and help reduce post-surgery infections. Moreover, they find wide-ranging applications in orthopedic load-bearing coatings, dental implants, bone graft substitutes, and bone cement for various medical needs.

Advancements in medical technology have led to an increase in spinal and orthopedic surgeries. Bioceramics are extensively used in spinal fusion, joint replacements, and bone grafts. They are also used for hard tissue (bones) and soft tissue (skin, cartilage) repair for aging populations and trauma-related injuries. Hence, ongoing innovations in tissue engineering and regenerative medicine are expected to contribute to market growth.

Another major driving factor is the changing food consumption patterns and inadequate nutrition, leading to increased cavity formation and deteriorated dental health. Dental procedures, including cleanings, fillings, and cosmetic treatments, contribute to the bioceramics market growth as these materials are increasingly used in dental care for crowns, bridges, and bristles.

However, ensuring the long-term durability and performance of bioceramic implants and devices throughout a patient's life is crucial to minimize the risk of implant failure, revision surgeries, and related healthcare expenses. In addition, the cost of bioceramic implants—covering manufacturing, materials, and associated healthcare can be substantial compared to alternative biomaterials. Balancing performance, quality, and affordability while adhering to budget constraints presents significant challenges.

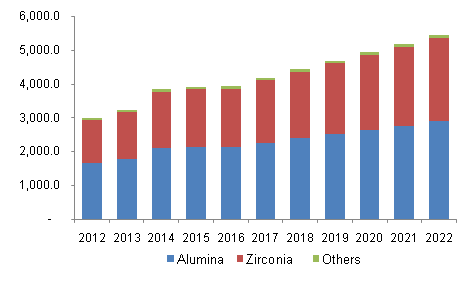

Material Insights

Alumina-based bioceramics accounted for 63.2% of the market share in 2023 owing to their excellent biocompatibility, which is increasingly well-accepted by patients' bodies during implantation. The material's strength and wear resistance are ideal for load-bearing applications, including joint replacements and orthopedic implants. In addition, alumina remains stable in various physiological environments to minimize adverse reactions and ensure long-term performance. It is corrosion-resistant, which ensures durability and longevity in medical applications. Lightweight carbon bioceramics, often reinforced with alumina, offer convenience to patients and surgeons during implant positioning. This popularity significantly contributes to market expansion.

Zirconia-based bioceramics have emerged as the fastest-growing segment during the forecast period owing to its biocompatibility, high strength, and fracture toughness. The rising senior population has increased demand for joint replacements and dental procedures, resulting in a boost in zirconia bioceramics. Zirconia-based hip and knee implants have gained significant popularity due to wear-resistant performance and reduced risk of adverse conditions, including the need for frequent replacements. In addition, this material is widely used in dentistry for crowns, bridges, and dental implants owing to its natural appearance and durability.

Application Insights

Dental applications held the dominant market share in 2023 due to the growing prevalence of dental ailments, including cavities, tooth decay, and gum diseases. Bioceramics addresses such treatments with its use of dental crowns, bridges, and implants. Furthermore, technological advancements improve dental implant procedures, making bioceramics more effective and reliable.

Orthopedic applications are projected to witness substantial growth at a CAGR during the forecast period due to the rising incidence of degenerative joint diseases and musculoskeletal disorders. Bioceramic implants are crucial for well-tolerated bioactivity and better patient outcomes in knee, shoulder, and hip replacement procedures. The growing geriatric population, susceptible to bone-related conditions due to low bone density, increases demand for orthopedic biomaterials.

Regional Insights

The North America bioceramics market secured the dominant share, 42.2%, in 2023 owing to the advanced technological infrastructure and research facilities with cutting-edge bioceramic materials and technologies. The region's robust healthcare system, high per capita healthcare expenditure, and stringent regulatory environment have garnered widespread adoption and trust in bioceramic products. Moreover, North America's aging population drove demand for orthopedic implants, dental restorations, and other medical devices, contributing to market growth.

U.S. Bioceramics Market Trends

The rising demand for bioceramics in medical applications, including orthopedics, tissue engineering, and restorative dentistry, has augmented the bioceramics market in the U.S. Additionally, the market has witnessed a surge in implant surgeries, particularly hip and knee joint replacements, where patients opted for bioceramics as durable, biocompatible implants for enhanced patient outcomes.

Europe Bioceramics Market Trends

The bioceramics market in Europe accounted for 34.2% in 2023 with the region’s increasing aging population. Treatments for dental, bone, and other lifestyle-related chronic diseases have further contributed to the need for bioceramics. Rising healthcare expenditures in economies including the UK, Germany, Italy, France, and Denmark have significantly driven the market demand. Additionally, Europe is a key player in manufacturing bioceramics for hard tissue replacements.

Asia Pacific Bioceramics Market Trends

The Asia Pacific bioceramics market held 22.9% of the global revenue share in 2023. Factors driving this growth include the expanding population and robust economic development, leading to higher healthcare requirements. Improved healthcare infrastructure, especially in countries such as China and India, has facilitated the adoption of advanced medical technologies including bioceramics applications. Additionally, ongoing technological advancements and government initiatives to enhance healthcare access have further propelled market expansion.

Key Bioceramics Company Insights

Some of the key players in the market are Amedica Corporation, Tosoh Corporation, Coorstek, and others. The global market is consolidated with key players employing organic and inorganic approaches including extensive R&D activities to enhance the durability of bioceramics.

-

Zimmer Biomet Holdings, Inc., based in the U.S., provides musculoskeletal health solutions. The company offers creative and effective orthopedic solutions for surgeons. This includes hip replacement products, spine surgery products, hand and wrist surgery products, foot and ankle systems, biologics solutions, knee replacement products, trauma products, and dental implants.

-

Straumann is engaged in researching, developing, and manufacturing tissue regeneration products, prosthetics, instruments, dental implants for the prevention of tooth loss, restoration solutions, and tooth replacement. The company is engaged in providing intra-oral scanning, CAD/CAM prosthetics, and computer-guided surgery. Furthermore, it manufactures products that are used in the preservation of teeth and regeneration of oral tissue.

Key Bioceramics Companies:

The following are the leading companies in the bioceramics market. These companies collectively hold the largest market share and dictate industry trends.

- Amedica Corporation

- Bonesupport AB

- Comp3

- Carborundum Universal Ltd.

- CoorsTek

- Jyoti Ceramic Industries Pvt Ltd.

- Kyocera Corporation

- Morgan Advanced Types

- Nobel Biocare Holding AG

- Sagemax Bioceramics

- Tosoh Corporation

- Zimmer Biomet Holdings, Inc.

Recent Development

-

In June 2024, Kyocera Corporation introduced the “KGZ,” a novel clamp structure featuring three distinct mechanisms. These mechanisms securely lock the insert in position, effectively minimizing chatter during machining and ensuring stable performance.

-

In June 2023, BONESUPPORT, a prominent player in orthobiologics, launched CERAMENT G—a next-generation antibiotic-eluting bone graft substitute. The company has implemented several enhancements for user-friendliness.

Bioceramics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.20 billion

Revenue forecast in 2030

USD 12.33 billion

Growth Rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Amedica Corporation; Bonesupport AB; Carborundum Universal Ltd.; CoorsTek; Jyoti Ceramic Industries Pvt Ltd.; Kyocera Corporation; Morgan Advanced Types; Nobel Biocare Holding AG; Sagemax Bioceramics; Tosoh Corporation; Zimmer Biomet Holdings, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioceramics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioceramics market report based on product, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Alumina

-

Zirconia

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental

-

Orthopedic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.