- Home

- »

- Biotechnology

- »

-

Biobanks Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Biobanks Market Size, Share & Trends Report]()

Biobanks Market (2026 - 2033) Size, Share & Trends Analysis Report By Product & Services (LIMS, Biobanking Equipment), By Biospecimen Type (Organs, Stem Cells), By Biobank Type (Real, Virtual), By Service, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-564-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biobanks Market Summary

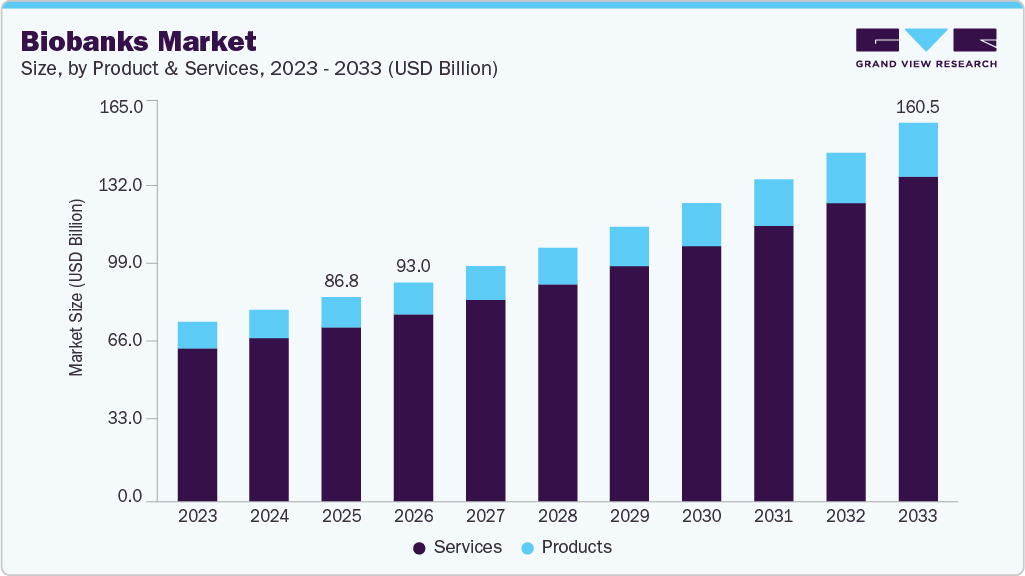

The global biobanks market size was estimated at USD 86.82 billion in 2025 and is anticipated to reach USD 160.54 billion by 2033, growing at a CAGR of 8.11% from 2026 to 2033. High investments in the R&D of advanced therapies, such as regenerative medicine, personalized medicine, and cancer genomic studies, are some of the driving factors.

Key Market Trends & Insights

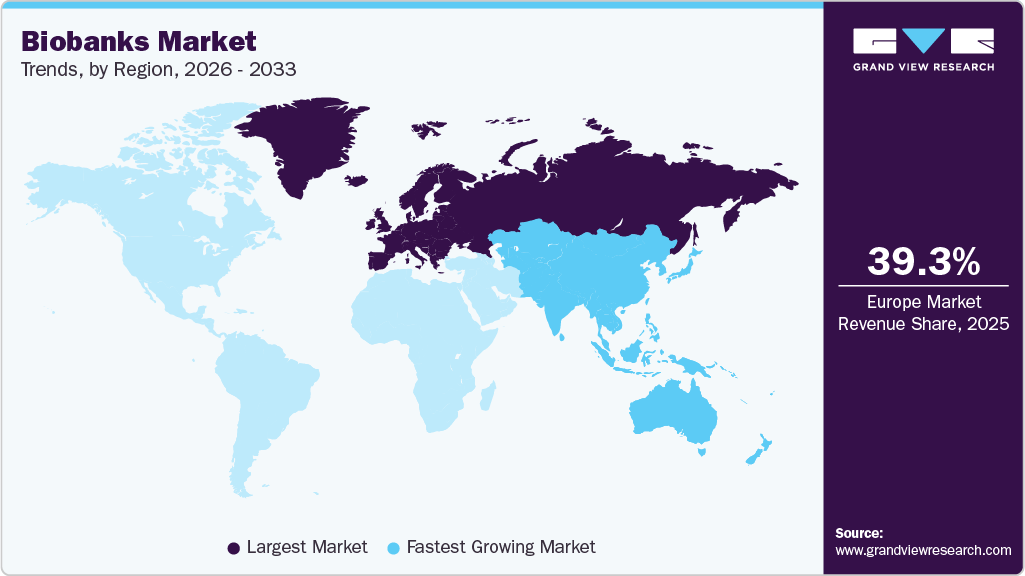

- The Europe biobanks market held the largest global share of 39.26% in 2025.

- The biobank industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By product & services, the services segment held the highest market share of 85.50% in 2025.

- By biospecimen type, the human tissues segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 86.82 Billion

- 2033 Projected Market Size: USD 160.54 Billion

- CAGR (2026-2033): 8.11%

- Europe: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

Growing biobanking industry and research collaborations

Collaborations between private & public institutions in biobanking have played a crucial role in market progression. Digitalization, precision medicine, and virtualization are rapidly transforming the biobanking industry by developing novel methods and concepts that synergize initiatives from public & private organizations. Companies across all fields are partnering with biobanks, driving revenue generation. For instance, BC Platforms, a Switzerland-based company, partnered with Tieto, a large healthcare IT company in Northern Europe, to propel developments in precision medicine.

List of the largest biobanks across the globe

Name

Size

Sample Type

Biobank Graz

20 million

Serum, EDTA-plasma, buffy coat, urine, whole blood, Na-citrate plasma, fresh frozen tissue, FFPE tissue, PAXgene blood, cerebrospinal fluid, stool, throat swabs, placenta, umbilical cord blood, mononuclear cells.

Shanghai Zhangjiang Biobank

10 million

It is reported that the biobank is projected to reach a storage capacity of 10 million human-derived samples, including human tissue, cells, blood, and intestinal microflora.

“All of Us” Biobank

1 million

Blood, urine, saliva, physical measurements, electronic health records, and wearable device data.

The International Agency for Research on Cancer (IARC) Biobank (IBB)

562,000

Most of the samples are body fluids, including plasma, serum, urine, and extracted DNA samples.

China Kadoorie Biobank

510,000

Blood (plasma, buffy coat), urine, saliva, fecal samples.

UK Biobank

500,000

Blood, urine, saliva, physical measurements, imaging data, genetic data, and health records.

FINNGEN biobanks

500,000

Blood samples, DNA, and health registry data.

Canadian Partnership for Tomorrow’s Health

330,000

Blood, urine, physical measurements, lifestyle, and health questionnaires.

Estonian Biobank

200,000

DNA, blood, phenotype data, microbiome samples, RNA, and metabolomics data.

EuroBioBank network

150,000

DNA, RNA, plasma, serum, muscle tissue, fibroblasts, cell lines, and other rare disease biospecimens.

Source:Biobanking.com

Collaborative networks within the biobanking landscape are an economically efficient means of accelerating translational research. Considerable investments were made in projects that encouraged coordination of activities and standardization at the regional, national, and international levels.

Increased focus on precision medicine and genetic testing

The increasing popularity of precision/personalized medicine, as well as genetic testing, has been a key driver of the global biobanks market. Biobanks have been playing a significant role in biomedical research. Over the past few decades, numerous advancements have been made in the platforms & tools used in genetic studies. This led to increased demand for biospecimens from clinical labs to develop assays & tissue models for genetic testing. With the advancements in the field of personalized & regenerative medicines, there is an increase in demand for specimens by biotechnology companies.

The future of biobanking in precision oncology hinges on technological advancements, data integration, and global collaboration. Biobanking provides an opportunity to understand the genetic foundations of diseases. Biobanks facilitate drug discovery and the development of personalized medicines and therapies by providing sample collection, storage, and distribution services. Biobank data can be leveraged to translate genetic discoveries into practical, personalized treatments.

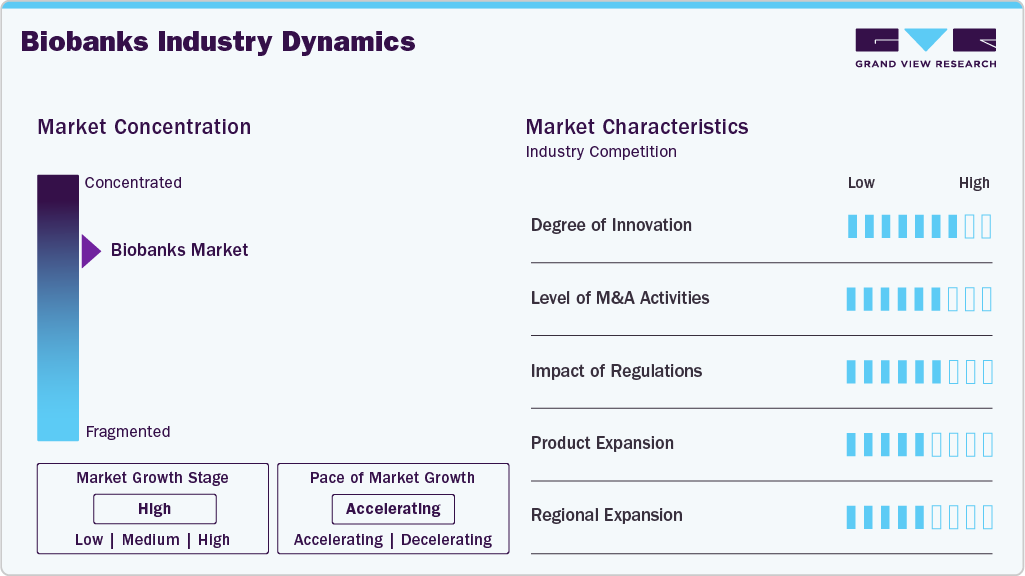

Market Concentration & Characteristics

The biobanks market has witnessed significant innovation, from traditional methods of sample storage to the utilization of cutting-edge technologies for data management, analytics, and automation. The integration of omics technologies, such as genomics, and increased global collaboration have further enhanced research capabilities. These developments accelerate biomedical research and contribute to the evolution of personalized medicine.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new biobank technologies, the need to consolidate in a rapidly growing market, and its usage in research and development.

The biobanks industry has come under regulatory scrutiny, and this is now a part of the trend in regulation. The standards set by the rules cover the entire lifecycle of biological samples, that is, collection, storage, and use with special regard to informed consent, privacy, and data protection. Compliance with regulations is the key to the reliability of preserved samples, and the key to international cooperation and the tackling of ethical issues that come up with the increasing use of technology in genomics and data analytics.

Product expansion in biobanks involves implementing strategic initiatives to offer new services and products. The main companies aim to diversify sample collections, utilize modern data management systems, offer specialized services, develop collaboration platforms, integrate omics technologies, employ robots for work, and collaborate with partners worldwide.

In the biobanks industry, regional expansion involves biobanking entities strategically broadening their activities beyond current geographic boundaries. Hence, key players undertake various business initiatives, such as geographical expansion, partnerships, and collaborations, to establish a regional customer base.

Product & Services Insights

The services segment dominated the biobanks market, accounting for the largest revenue share in 2025, and is anticipated to grow at the fastest CAGR during the forecast period. Governments and research institutions are investing funds in large-scale genomics and biomarker studies, which in turn lead to a constant demand for the highest quality biospecimen collection, processing, and storage. The introduction of automated storage, digital sample tracking, and cloud data systems is contributing to the optimization and enlargement of biobanking operations.

The product segment is expected to grow at a significant CAGR during the forecast period. The primary factor driving this trend is the growing demand for advanced storage and preservation devices, which can effectively handle the large and diverse biological samples used in research and clinical applications. In February 2023, UK Biobank announced that it had made a public dataset from 45,000 Magnetic Resonance Imaging (MRI) scans.

Biospecimen Type Insights

The human tissues segment dominated the biobanks industry, capturing the largest revenue share of 36.26% in 2025. This is due to the presence of many biobanks with facilities to store tissues, the easy availability of tissues, and the availability of advanced technology for the storage and retrieval of banked tissues. Growing investment in disease-specific R&D is anticipated to foster the demand for diseased tissue samples, such as lymphoma, myeloma, ovarian leukemia, brain, prostate, colorectal carcinoma, breast, and lung tissues for oncology studies.

The stem cells segment is expected to witness the fastest CAGR during the forecast period. The number of established stem cell biobanks has been increasing rapidly worldwide. Promising applications of stem cells in regenerative medicine, cell therapy, developmental biology, toxicology, and drug development can be attributed to the rapid increase in the number of stem cell banks. Preservation of cellular characteristics, preventing deterioration & contamination, use in basic & translation research, and potential and current use in clinical applications are factors that significantly contributed to the adoption of stem cell banking.

Biobank Type Insights

The physical/real biobanks segment dominated the market in 2025, with the largest revenue share. These biobanks have a well-established network, thereby holding a high revenue share. Rapid progress in the fields of bioinformatics analysis and precision medicine can be attributed to this change in the operating strategy of the biobanks.

The virtual biobanks segment is expected to witness the fastest CAGR over the forecast period. Virtual biobanks have emerged to address problems related to the accessibility of biospecimens. Tissue Solutions (Scotland) and Human Focused Testing (Littleport) are examples of organizations whose core operating activities involve the procurement and distribution of samples as required. The potential to fulfill the need for biospecimens and the ability to trace and obtain rare samples improve with virtual biobanking. Also, easy accessibility associated with virtual biobanks contributes to the lucrative growth of the segment.

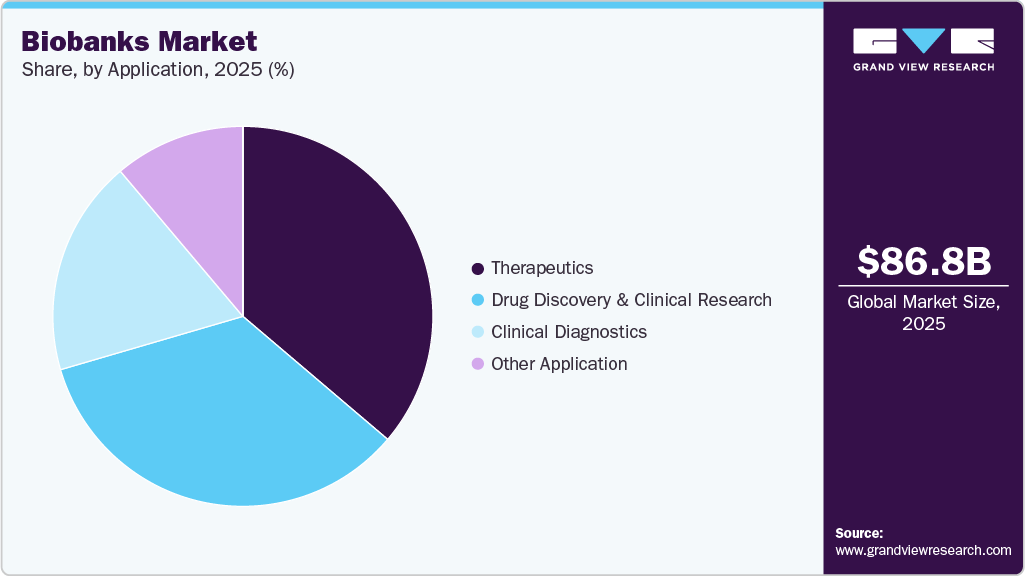

Application Insights

In 2025, the therapeutics application segment dominated the biobanks industry, with the largest revenue share of 36.21%. This can be attributed to the ever-increasing demand for advanced therapies for the treatment of chronic diseases. Growing investments in precision medicine and targeted biologics are further strengthening the segment’s position.

The clinical diagnostics segment is anticipated to witness significant growth over the forecast period. Comparison of biospecimens obtained from healthy and diseased individuals advances the clinical diagnosis process, especially for cancer. It helps investigate the treatment response of the patient and identify new tumors in patients with a history of cancer.

Regional Insights

The North America biobanks market accounted for the significant revenue share in 2025, owing to the advanced healthcare infrastructure, strong government and private sector funding for genomics and personalized medicine, and a well-established regulatory framework supporting biobanking practices. The presence of large-scale initiatives, such as the NIH-funded “All of Us” research program, and extensive academic and commercial research in genomics fuels demand for biobanking services and products. High awareness and adoption of digital and automated storage solutions further accelerate market growth in the region.

U.S. Biobanks Market Trends

In the U.S., the growth of the biobank industry is driven by major government-led initiatives in precision medicine, increased investments in cancer and rare disease research, and the presence of prominent research institutions and pharmaceutical companies.

Europe Biobanks Market Trends

Europe accounted for the largest revenue share of 39.26% in 2025, owing to the continuous investment in the collection, establishment, and processing of large-scale datasets. Furthermore, countries like the UK, Germany, and France contribute to the regional market growth by investing in biobank solutions. For instance, in June 2023, The Medicines and Healthcare products Regulatory Agency (MHRA) collaborated with Genomics England to launch its genetic biobank.

The UK biobanks market is significantly driven by national-scale programs such as the UK Biobank project, which supports broad research initiatives in public health, genomics, and epidemiology. The need for biobanking infrastructure and data analytics tools is greatly supported by close collaborations between academia and industry, government financial aid, and NHS-sanctioned health research projects that involve biobanking. Moreover, the accompanying policies encouraging open data sharing have a positive impact on the innovation process and on the collaboration between multiple institutions.

The biobanks market in Germany is influenced by initiatives such as the German Biobank Node (GBN) and its integration into the Network of University Medicine (NUM), which aim to centralize and digitize biobanking resources. Government grants from the likes of BMBF aid in the establishment of common practices for standardization, quality control, and cross-institutional interoperability, and the strong pharmaceutical and diagnostics industries are driving up the demand for samples. Well-established hospital networks and research universities are also factors contributing to the growth of the market.

Asia Pacific Biobanks Market Trends

The Asia Pacific biobanks industry is expected to witness the fastest CAGR of 9.72% during the forecast period. The increase can be attributed to the investments of developing economies, such as India, China, and Japan. These countries are actively engaged in developing the biobank market by undertaking several business initiatives to strengthen their market position. For instance, in November 2023, AIG Hospital launched its first biobank in India’s southern region. The biobank will collect over one lakh tissue and blood samples for the upcoming decade.

China’s biobanks market is rapidly expanding, fueled by national efforts to become a global leader in biomedical research, large-scale population genomics projects, and increasing health data digitization. The government-supported programs, such as the China Kadoorie Biobank, along with the increasing investment in the biotechnology sector, are the main factors that create a huge market for the storage system, sample preparation, and high-throughput sequencing tools. The increase in local manufacturing and partnerships with foreign companies also encourages the market for these products and services.

The biobanks market in Japan is largely influenced by the research on aging-related issues and personalized medicine. Along with government initiatives like BioBank Japan, chronic disease research highly benefits from massive data collections. Innovations in technology, along with the quality of healthcare and the integrity of research in Japan, are the driving forces behind the demand for comprehensive biobanking solutions. Furthermore, partnering with global biopharma firms is another factor that drives the need for uniform and automated systems.

MEA Biobanks Market Trends

Middle East & Africa shows growing interest in biobanking due to increasing investments in healthcare infrastructure, precision medicine, and population health research. However, challenges such as limited standardization and funding disparities persist, although international collaborations are helping to close these gaps and drive adoption.

The Kuwait biobanks market is expected to grow during the forecast period. In Kuwait, biobank development is emerging in tandem with public health and precision medicine initiatives, with support from the Ministry of Health and regional research collaborations. Focused efforts on chronic disease research, especially diabetes and cardiovascular conditions, are driving demand for sample collection and storage infrastructure. However, the market is still in its early stages and is likely to benefit from partnerships with global biobank technology providers.

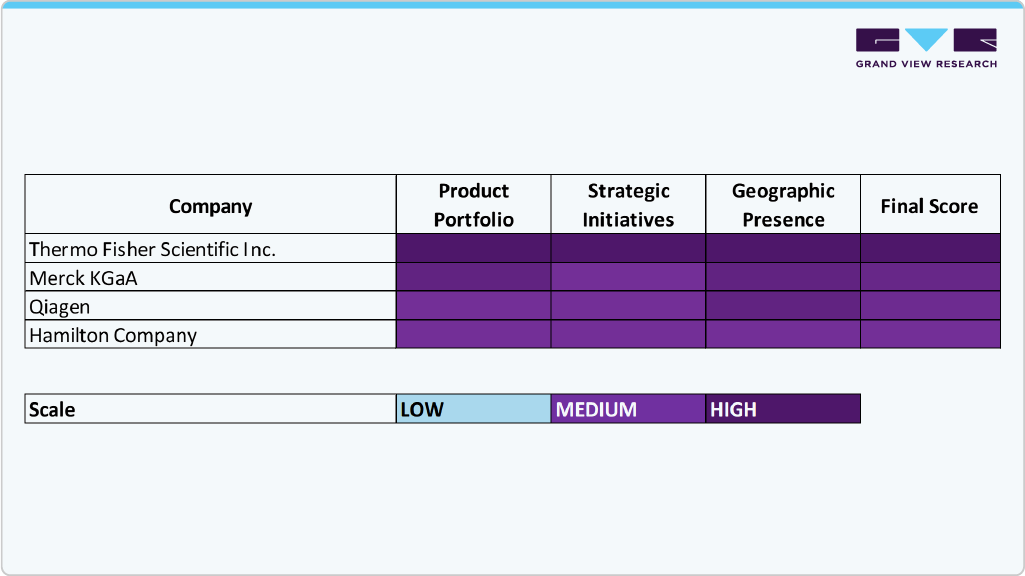

Heat Map Analysis

The biobanking market is supported by key players including Thermo Fisher Scientific Inc.; Merck KGaA; Qiagen; Stemcell Technologies; and PromoCell GmbH; each offering specialized products and services. Thermo Fisher dominates with a broad portfolio including cryogenic storage, automated sample handling, and data management systems, making it a comprehensive solutions provider with a global footprint. Merck KGaA focuses on cell culture media, cryopreservation reagents, and biobank-compatible consumables, leveraging its strong European presence.

Qiagen is recognized for its sample preparation kits and automation systems, such as QIAsymphony and QIAcube, which are particularly well-suited for genomic and molecular biobanking. Stemcell Technologies supports regenerative medicine and stem cell biobanking with advanced cell culture tools and reagents, particularly in North America and Europe. PromoCell GmbH, while more niche, contributes through its high-quality human primary cells and cryopreserved samples used in research biobanks across Europe. Together, these players represent the technological and regional diversity driving innovation and adoption in the biobanking product and service landscape.

Key Biobanks Company Insights

Some of the key players operating in the market are adopting various organic & inorganic strategies, such as collaborations with biobanking service providers and technological innovation, to advance their product offerings in the biobanking industry.

Key Biobanks Companies:

The following are the leading companies in the biobanks market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Qiagen

- Hamilton Company

- Tecan Trading AG

- Danaher Corporation

- Becton, Dickinson, and Company (BD)

- Biocision, LLC.

- Taylor-Wharton

- Charles River Laboratories

- Lonza

- Stemcell Technologies

- Biovault Family

- Promocell GmbH

- Precision Cellular Storage Ltd. (Virgin Health Bank)

Recent Developments

-

In July 2025, the German Biobank Node (GBN) will become part of the Network of University Medicine (NUM). This integration aligns with the recent approval of NUM’s new funding phase (NUM 3.0) by the Federal Ministry of Education and Research (BMBF) last week.

-

In May 2024, EIT Health introduced a new Biobanks and Health Data Portal designed to enhance collaboration and promote the broader use of biobanks.

-

In December 2023, Charles River Laboratories International, Inc. announced an agreement with CELLphenomics. The CELLphenomics biobank has over 500 in vitro models from around 20 tumor entities. It offers one of the largest complex in vitro models of rare and ultra-rare tumors, such as thymomas or sarcomas.

-

In October 2023, AstraZeneca research announced unique relationships between rare changes in plasma proteins and genes that could enhance drug discovery with data from more than 50,000 UK Biobank participants.

-

In July 2023, Tecan announced the launch of Phase Separator. It has several applications in biobanking and liquid biopsy, and is expected to benefit proteomics, genomics, and numerous disease areas, including neurodegenerative and oncological diseases, as well as metabolic disorders.

Biobanks Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 93.02 billion

Revenue forecast in 2033

USD 160.54 billion

Growth rate

CAGR of 8.11% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, biospecimen type, biobank type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Thailand; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Qiagen; Hamilton Company; Tecan Trading AG; Danaher Corporation; Becton, Dickinson, and Company (BD); Biocision, LLC.; Taylor-Wharton; Charles River Laboratories; Lonza; Stemcell Technologies; Biovault Family; Promocell Gmbh; Precision Cellular Storage Ltd. (Virgin Health Bank)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biobanks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global biobanks market report based on product & service, biospecimen type, biobank type, application, and region:

-

Product & Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Product

-

Biobanking Equipment

-

Temperature Control Systems

-

Freezers & Refrigerators

-

Cryogenic Storage Systems

-

Thawing Equipment

-

-

Incubators & Centrifuges

-

Alarms & Monitoring Systems

-

Accessories & Other Equipment

-

-

Biobanking Consumables

-

Laboratory Information Management Systems

-

-

Services

-

Biobanking & Repository

-

Lab processing

-

Qualification/ Validation

-

Cold Chain Logistics

-

Other Services

-

-

-

Biospecimen Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Human Tissues

-

Human Organs

-

Stem Cells

-

Adult Stem Cells

-

Embryonic Stem Cells

-

IPS Cells

-

Other Stem Cells

-

-

Other Biospecimens

-

-

Biobank Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Physical/Real Biobanks

-

Tissue Biobanks

-

Population-Based Biobanks

-

Genetic (DNA/RNA)

-

Disease-Based Biobanks

-

-

Virtual Biobanks

-

-

Application Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Therapeutics

-

Drug Discovery & Clinical Research

-

Clinical Diagnostics

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biobank market size was estimated at USD 86.82 billion in 2025 and is expected to reach USD 93.02 billion in 2026.

b. The global biobank market is expected to grow at a compound annual growth rate of 8.11% from 2026 to 2033 to reach USD 160.54 billion by 2033.

b. On the basis of product & services, the services segment dominated the market and accounted for the largest revenue share in 2025 and is anticipated to grow at the fastest CAGR during the forecast period. Governments and research organizations are investing heavily in large-scale genomics and biomarker studies, creating sustained demand for high-quality biospecimen collection, processing, and storage. Additionally, advancements in biobanking technologies—such as automated storage systems, digital sample tracking, and cloud-based data integration—are enhancing the efficiency and scalability of biobank operations.

b. Some key players operating in the biobank market include Thermo Fisher Scientific Inc.; Merck KGaA; QIAGEN; Hamilton Company; Tecan Trading AG; Danaher Corporation; Becton, Dickinson and Company (BD); BioCision, LLC; Taylor-Wharton; Charles River Laboratories; Lonza; STEMCELL Technologies; Biovault Family; PromoCell GmbH; Precision Cellular Storage Ltd. (Virgin Health Bank)

b. Key factors that are driving the biobank market growth are the increasing popularity of fertility preservation services, investment in facility expansion for biobanking, and growing collaborations between biobanks and end-users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.