- Home

- »

- Medical Devices

- »

-

Bioactive Wound Care Market Size And Share Report, 2030GVR Report cover

![Bioactive Wound Care Market Size, Share & Trends Report]()

Bioactive Wound Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial, Active Dressing), By Application (General Surgery, Minimally invasive Surgery), By Region, And Segments Forecasts

- Report ID: GVR-1-68038-081-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioactive Wound Care Market Summary

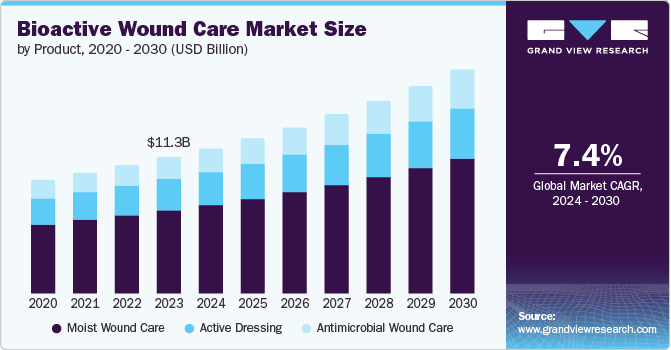

The global bioactive wound care market size was estimated at USD 11.3 billion in 2023 and is projected to reach USD 18.4 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. Key market drivers include the increasing prevalence of chronic wounds among the aging population and those with diabetes, which is driving the demand for advanced wound care solutions.

Key Market Trends & Insights

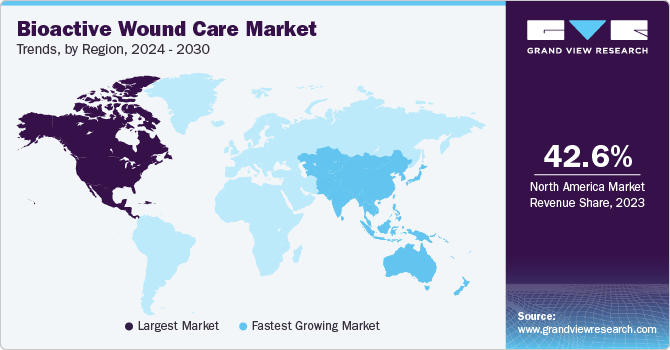

- In terms of region, North America was the largest revenue generating market in 2023.

- The bioactive wound care market in the U.S. accounted for the largest revenue share of 75.3% in the North American region in 2023.

- In terms of product, moist wound care dominated the market and accounted for a share of 61.1% in 2023.

- Antimicrobial wound care is expected to register the fastest CAGR of 8.2% during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 11.3 Billion

- 2030 Projected Market Size: USD 18.4 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

The growing adoption of bioactive dressings due to their enhanced healing properties is also contributing to market growth.

Infections in wounds pose a significant risk globally, impacting both healthcare workers and patients. To prevent infections, there is an increasing demand for advanced wound care solutions. According to the National Library of Medicine, in the U.S., chronic wounds affect 6.5 million patients, costing the healthcare system over USD 25 billion annually. The growing patient population, particularly aging population with diabetes, is driving the demand for wound management further.

The increasing incidence of diabetes among the elderly population is resulting in more health issues, including slow wound healing due to elevated blood sugar levels. This is further exacerbating the need for efficient and cost-effective wound care products. As a result, the bioactive wound care market is being propelled by the rising prevalence of chronic injuries and the higher demand for surgical procedures.

The increasing awareness among healthcare professionals about wound management effectiveness is contributing to market growth. Tissue replacement procedures and a greater understanding of the importance of wound care are also driving the demand for bioactive wound care products. As a result, the market is expected to continue growing as healthcare professionals seek more effective solutions to manage wounds and promote healing.

Product Insights & Trends

Moist wound care dominated the market and accounted for a share of 61.1% in 2023. Moist wound dressings create an optimal healing environment by maintaining the right moisture level, preventing dehydration, and promoting cell migration for faster closure. This approach reduces pain, minimizes scar formation, and lowers infection risk compared to dry dressings. The growing prevalence of chronic wounds such as diabetic ulcers and pressure sores drives demand for effective moist wound care solutions.

Antimicrobial wound care is expected to register the fastest CAGR of 8.2% during the forecast period. Antimicrobial wound care is further divided based on the presence of silver or non-silver components. These products provide different advantages such as simplicity in usage, widespread availability, and increased cost-efficiency when compared to antibiotics. Furthermore, these items can be acquired over the counter and carry a minimal risk of causing antimicrobial resistance, aiding segment growth in the market.

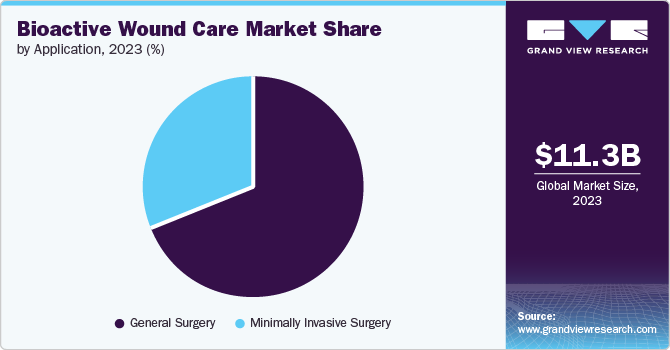

Application Insights & Trends

General surgery accounted for the largest market revenue share of 68.6% in 2023. The general surgery segment is further classified into plastic, dermatological, pediatric and others applications. The growing demand for general surgery is fueled by population growth, aging demographics, and increased access to healthcare services.

Minimally invasive surgery is expected to register the fastest CAGR of 8.0% during the forecast period. In minimally invasive surgery, surgeons utilize different methods to perform operations with less harm to the body compared to open surgery. Typically, minimally invasive surgery results in reduced pain, shorter hospital stays, and fewer complications. Laparoscopy involves performing surgery through small incisions using small tubes, tiny cameras, and surgical tools.

Regional Insights & Trends

North America bioactive wound care market dominated the global bioactive wound care market with a revenue share of 42.6% in 2023, driven by the existence of a substantial number of individuals with diabetes and the quick acceptance of modern wound treatment methods. The main factor driving the industry’s high proportion in global revenue growth is the increasing number of people affected by both acute and chronic infections.

U.S. Bioactive Wound Care Market Trends

The bioactive wound care market in the U.S. accounted largest revenue share of 75.3% in the North America region in 2023. This is attributable to the rise in incidence of conditions such as diabetes and obesity, which has led to an increase in chronic wounds that do not heal easily. For instance, the American Podiatric Medical Association (APMA) suggests that diabetic foot ulcers affect millions of Americans and are leading cause of lower limb amputations.

Europe Bioactive Wound Care Market Trends

Europe bioactive wound care market is thriving, driven by advanced healthcare infrastructure, patient awareness, and the region’s aging population with rising chronic conditions such as diabetes. Manufacturers are investing in R&D to develop innovative dressings with antimicrobial and growth factors to accelerate healing. Favorable government initiatives are fueling the market’s growth in major European economies.

The bioactive wound care market in the UK is expected to grow rapidly in coming years due to factors including the rising number of diabetic patients suffering from foot injuries and other chronic wounds, the presence of several small and mid-sized companies, and expansion strategies adopted by key companies in terms of manufacturing and distribution.

Spain bioactive wound care market held a substantial market share in 2023 owing to the growing expenditure on healthcare, increasing geriatric population, rising disposable income levels and high prevalence of chronic diseases in the country. According to the NCBI, chronic diseases cause more than 90% of the deaths in the country.

Asia Pacific Bioactive Wound Care Market Trends

The bioactive wound care market in Asia Pacific is anticipated to witness the fastest growth with a CAGR of 8.2% over the forecast period. Key drivers for market growth include the region’s large and aging population, as well as the increasing prevalence of chronic diseases such as diabetes. Governments’ efforts to reduce healthcare costs and hospital stays are also driving adoption of bioactive dressings that accelerate healing. Technological advancements in infection control and wound management, including antimicrobial dressings and negative pressure therapy, have expanded treatment options in outpatient settings, further boosting market growth.

India bioactive wound care market is experiencing growing use of sophisticated wound dressings. These dressings are created to speed up healing and reduce the risk of infection. They are also easier to wear and can be applied and removed with ease. Another emerging trend in the market is the increasing popularity of wound closure devices such as sutures and staples. These tools are employed to seal cuts and support the process of recovery. Customers favor them because they are efficient and user-friendly.

Key Bioactive Wound Care Company Insights

Some of the key companies in the bioactive wound care market include B. Braun SE; Essity Health & Medical; 3M; Convatec Group PLC; Covalon Technologies Ltd; and DermaRite Industries LLC. In a bid to gain a competitive advantage in the market, organizations are prioritizing the expansion of their customer base. To achieve this goal, key players are engaging in strategic initiatives, including mergers and acquisitions, as well as collaborations with other major companies.

-

B. Braun SE is a medical technology company offering a comprehensive portfolio of advanced wound dressings and management solutions, leveraging novel technologies and active ingredients to accelerate healing. The company engages with healthcare professionals through educational initiatives to drive awareness and adoption.

-

3M is a global company that offers advanced wound dressings and management systems incorporating bioactive ingredients, leveraging antimicrobials, hydrogels, and other agents to promote healing and reduce infection risk. Its materials science expertise and R&D capabilities position it as a prominent player in the industry.

Key Bioactive Wound Care Companies:

The following are the leading companies in the bioactive wound care market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Essity Health & Medical

- 3M

- Convatec Group PLC

- Covalon Technologies Ltd

- DermaRite Industries LLC

- Hollister Incorporated

- Integra LifeSciences Corporation

- Johnson & Johnson Services, Inc.

- Medtronic

- Monlnlycke Health Care AB

- Smith+Nephew

Recent Developments

-

In May 2024, Convatec shared findings from a recent multinational RCT demonstrating significant progress in venous leg ulcer healing with AQUACEL Ag+ Extra compared to standard dressing care.

-

In March 2024, Integra LifeSciences Holdings Corporation revealed the launch of MicroMatrix Flex in the U.S. This new dual-syringe system allows for easy blending and accurate application of MicroMatrix paste, facilitating accessibility to difficult-to-reach areas and promoting the preparation of a smooth wound surface in complex wound sites.

Bioactive Wound Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.0 billion

Revenue forecast in 2030

USD 18.4 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, France, Germany, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

B. Braun SE; Essity Health & Medical; 3M; Convatec Group PLC; Covalon Technologies Ltd; DermaRite Industries LLC; Hollister Incorporated; Integra LifeSciences Corporation; Johnson & Johnson Services, Inc.; Medtronic; Monlnlycke Health Care AB; Smith+Nephew

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bioactive Wound Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bioactive wound care market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Moist Wound Care

-

Foam

-

Alginate

-

Film

-

Hydrocolloid

-

Hydrogel

-

-

Antimicrobial Wound Care

-

Silver Based

-

Non-Silver Based

-

-

Active Dressing

-

Biomaterial

-

Skin Substituents

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Plastic

-

Dermatological

-

Pediatric

-

-

Minimally Invasive Surgery

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.