- Home

- »

- Plastics, Polymers & Resins

- »

-

Bio-polybutadiene Market Size, Share, Growth Report, 2030GVR Report cover

![Bio-polybutadiene Market Size, Share & Trends Report]()

Bio-polybutadiene Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (High CIS Polybutadiene, Low CIS Polybutadiene, High Trans Polybutadiene), By Application (Tire Manufacturing, Polymer Modification), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-072-7

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-polybutadiene Market Size & Trends

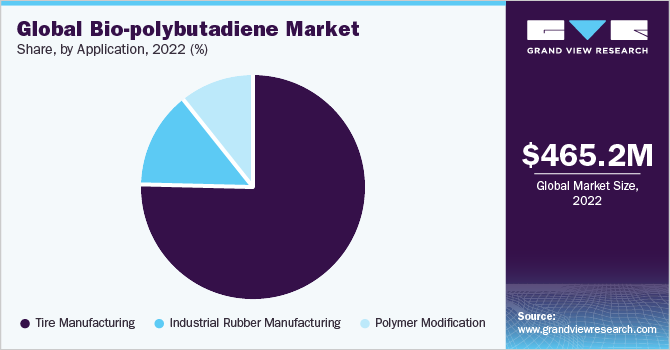

The global bio-polybutadiene market size was estimated at USD 465.20 million in 2022, expected to grow at a compound annual growth rate (CAGR) of 20.1% from 2023 to 2030. The demand for bio-polybutadiene is driven by a growing global focus on sustainability and the need to reduce reliance on fossil fuels. Additionally, increasing regulations on emissions and waste management in many countries are also driving the demand for sustainable materials. The market for bio-polybutadiene is still in its early stages of development, and the availability and cost of biomass sources can be a limiting factor for large-scale production. However, advances in biotechnology and process engineering are making it more feasible to produce biobased polybutadiene on a larger scale, which is expected to drive market growth in the coming years.

The United States is one of the largest consumers of bio-polybutadiene in the world, and the market is expected to grow at a steady pace over the forecast period. The increasing demand for sustainable and eco-friendly products in various industries is driving the growth of the market in the U.S. The automotive industry is one of the major end-users of bio-polybutadiene in the U.S., particularly in the production of tires. The construction industry is also a significant consumer of biobased polybutadiene, as it is used in the production of sealants, adhesives, and other construction materials. Additionally, the biomedical industry is a growing market for bio-polybutadiene due to its biocompatibility and other desirable properties.

The country has implemented several environmental regulations, including the Clean Air Act and Clean Water Act, which are driving demand for sustainable materials. Moreover, some of the key players operating in the U.S. market include Kraton Corporation, Trinseo LLC, ExxonMobil Chemical Company, and Dow Chemical Company, among others. These companies are focusing on expanding their production capacity and developing new products to meet the growing demand for Bio-Polybutadiene in the U.S. market.

The U.S. bio-polybutadiene market is also influenced by various government regulations and policies aimed at promoting sustainability and reducing carbon emissions. The increasing awareness and focus on sustainability among consumers and businesses in the U.S. are expected to further drive the growth of the market for market in the country.

Product Insights

High cis polybutadiene product segment led the market and accounted for more than 63.0% share of the global revenue in 2022. The products in the market comprise High cis polybutadiene, high vinyl polybutadiene, low cis polybutadiene, and high trans polybutadiene. The increase in demand for high cis polybutadiene derivatives can be attributed to the elevated growth resistance and durability exhibited by these products. Demand for high cis polybutadiene derivatives is expected to grow rapidly due to increasing tire manufacturing applications.

The low cis polybutadiene is expected to grow at a significant growth rate from 2023 to 2030 on account of growing applications in polymer modification and industrial rubber manufacturing. The low cis polybutadiene comprises 36% cis, 54% trans and 10% vinyl contents. Low cis polybutadiene is used in tire manufacturing and is blended with other tire polymers. It can also be used as an additive in plastics due to its low gel content. The low cis polybutadiene also finds application in the manufacture of high impact polystyrene and polystyrene ABS grades.

The high trans polybutadiene derivative is expected to grow at a CAGR of 18.9% from 2023 to 2030. It was majorly used in the manufacture of golf balls, but manufacturers are now looking at other application to increase the commercial importance of the product. The low commercialization of high trans butadiene can be attributed to the high crystalline nature of this product. However, blends of this product are used with neoprene, styrene butadiene rubber, and natural rubber for tire building. The presence of rubber manufacturers in the Asia Pacific region is driving the demand for high trans polybutadiene.

Application Insights

Tire manufacturing application segment led the market and accounted for more than 75.0% share of the global revenue in 2022 due to its high resilience and excellent wear resistance properties. The use of bio-polybutadiene in tire manufacturing offers several advantages over traditional synthetic rubber. Bio-polybutadiene is a type of synthetic rubber that is derived from renewable resources, such as plant-based materials, which makes it more environmentally friendly. It also has unique properties that can improve the performance of tires.

One of the main advantages of using bio-polybutadiene in tire manufacturing is its ability to improve the wet traction and rolling resistance of tires. Bio-polybutadiene has a higher glass transition temperature than traditional synthetic rubber, which means that it is more resistant to deformation at high temperatures. This results in tires that have a better grip on wet roads and a lower rolling resistance, which can lead to improved fuel efficiency. In addition to these benefits, the use of bio-polybutadiene in tire manufacturing can also help to reduce the carbon footprint of the industry. By using renewable resources to produce synthetic rubber, tire manufacturers can reduce their reliance on fossil fuels and reduce their greenhouse gas emissions.

However, there are also some challenges associated with the use of bio-polybutadiene in tire manufacturing. For example, the cost of producing bio-polybutadiene is currently higher than traditional synthetic rubber, which can make it less attractive to some manufacturers. There may also be issues with the availability of the raw materials needed to produce bio-polybutadiene at scale. Despite these challenges, the use of bio-polybutadiene in tire manufacturing is likely to continue to grow in the coming years as tire manufacturers look for ways to improve the performance of their products and reduce their environmental impact. As such, we can expect to see more research and development in this area, as well as increased investment in the production of bio-polybutadiene.

Regional Insights

Asia Pacific dominated the market and accounted for more than 46% share of the global revenue in 2022. This region is still in its early stages, with only a few key players in the market. However, there is growing interest in bio-based materials in the region, driven by the increasing demand for sustainable products and the government's focus on reducing carbon emissions. The market is also driven by the growing automotive industry in countries of China, India and Japan and presence of large-scale automotive manufacturers such as Toyota, SAIC, and KIA Motors is expected to boost the demand for bio-based polybutadiene in the region.

The demand in this region is expected to grow at a significant rate due to high growth in the end application industries. The capacity additions in U.S. and Canada are expected to augment the demand for polybutadiene in this region over the forecast period. North America has been one of the key markets for bio-polybutadiene due to the growing demand for sustainable products. The region has seen several initiatives to promote the use of renewable resources in the production of various products, including rubber.

Companies in North America have also been investing in research and development of bio-polybutadiene to improve its properties and expand its applications. The automotive industry, in particular, is a major consumer of bio-polybutadiene in North America. The use of bio-polybutadiene in tires and other automotive components offers several benefits, such as improved fuel efficiency, reduced greenhouse gas emissions, and increased sustainability. In addition, the increasing popularity of electric vehicles is also driving the demand for bio-polybutadiene as it can be used in the production of batteries and other components.

Other industries, such as packaging and construction are also adopting bio-polybutadiene as a sustainable alternative to traditional materials. For example, bio-polybutadiene can be used in the production of biodegradable packaging materials, reducing the amount of waste generated by these industries. Similarly, in the construction industry, bio-polybutadiene can be used as a sustainable substitute for traditional materials in products such as sealants and adhesives, which will boost the demand for bio-polybutadiene in the region.

Key Companies & Market Share Insights

Key manufacturers operating bio-polybutadiene include Lanxess AG, Kuraray Co., Ltd., Kraton Corporation, Sibur, JSR Corporation, Zeon Corporation, Sinopec, LG Chem, Versalis S.p.A, Goodyear Tire & Rubber Company, Trinseo LLC, Jilin Chemical Industry Co., Ltd., Asahi Kasei Corporation, Evonik Industries AG, ExxonMobil Chemical Company, and others. The market participants are engaged in expanding the range of bio-polybutadiene as well as their applications. As the technologies are rapidly advancing, the manufacturers of bio-polybutadiene are also focusing upon streamlining the pre and postproduction process.

In July 2022, Evonik Industries AG launched a Sustainable Bio-based Liquid Polybutadiene in its manufacturing facility based in Marr, Germany with the brand name POLYVEST eCO which will reduce the feedstock of fossil raw materials by 99.9%. Some prominent players in global bio-polybutadiene market include:

-

Lanxess AG

-

Kuraray Co., Ltd.

-

Kraton Corporation

-

Sibur

-

JSR Corporation

-

Zeon Corporation

-

Sinopec

-

LG Chem

-

Versalis S.p.A

-

Goodyear Tire & Rubber Company

-

Trinseo LLC

-

Jilin Chemical Industry Co., Ltd.

-

Asahi Kasei Corporation

-

Evonik Industries AG

-

ExxonMobil Chemical Company

Bio-polybutadiene Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 538.2 million

Revenue forecast in 2030

USD 1.93 billion

Growth Rate

CAGR of 20.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; The Netherlands; China; India; Japan; South Korea; Thailand; Indonesia; Australia; Singapore; Brazil; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

Lanxess AG; Kuraray Co., Ltd.; Kraton Corporation; Sibur; JSR Corporation; Zeon Corporation; Sinopec; LG Chem; Versalis S.p.A; Goodyear Tire & Rubber Company; Trinseo LLC; Jilin Chemical Industry Co.; Ltd.; Asahi Kasei Corporation; Evonik Industries AG; ExxonMobil Chemical Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

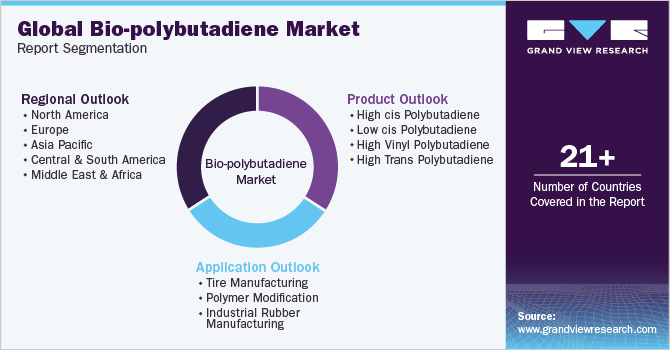

Global Bio-polybutadiene Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the global bio-polybutadiene market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High cis Polybutadiene

-

Low cis Polybutadiene

-

High Vinyl Polybutadiene

-

High Trans Polybutadiene

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tire Manufacturing

-

Polymer Modification

-

Industrial Rubber Manufacturing

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-polybutadiene market size was estimated at USD 465.20 million in 2022 and is expected to reach USD 538.22 million in 2023.

b. The global bio-polybutadiene market is expected to grow at a compound annual growth rate of 20.1% from 2023 to 2030 to reach USD 1.93 billion by 2030.

b. The High cis polybutadiene dominated the product segment of the bio-polybutadiene market and accounted for the largest revenue share of 63.06% in 2022, owing to a wide range of applications, including tire manufacturing, polymer modification, and industrial rubber manufacturing.

b. The Tire manufacturing application segment dominated the market for bio-polybutadiene and accounted for the largest revenue share of 75.34% in 2022.

b. Asia Pacific dominated the bio-polybutadiene market with a share of 46.35% in 2022. This is attributable to a strong and established manufacturing base for synthetic rubber, which has enabled companies to efficiently produce and supply bio-polybutadiene to the market. This has given the region a competitive advantage over other regions that are less developed in this area.

b. Some key players operating in the bio-polybutadiene market include Lanxess AG, Kuraray Co., Ltd., Kraton Corporation, Sibur, JSR Corporation, Zeon Corporation, Sinopec, LG Chem, Versalis S.p.A, Goodyear Tire & Rubber Company, Trinseo LLC, Jilin Chemical Industry Co., Ltd., Asahi Kasei Corporation, Evonik Industries AG, ExxonMobil Chemical Company.

b. Key factors that are driving the bio-polybutadiene market growth include their application for tire manufacturing, polymer modification, and industrial rubber manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.