- Home

- »

- Renewable Chemicals

- »

-

Bio-polyamide Market Size & Share, Industry Report, 2030GVR Report cover

![Bio-polyamide Market Size, Share & Trends Report]()

Bio-polyamide Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PA-6, PA-66, Specialty Polyamides), By Application (Fiber, Engineering Plastics), By End Use (Textile, Automotive, Film & Coating), By Region, And Segment Forecasts

- Report ID: 978-1-68038-417-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-polyamide Market Size & Trends

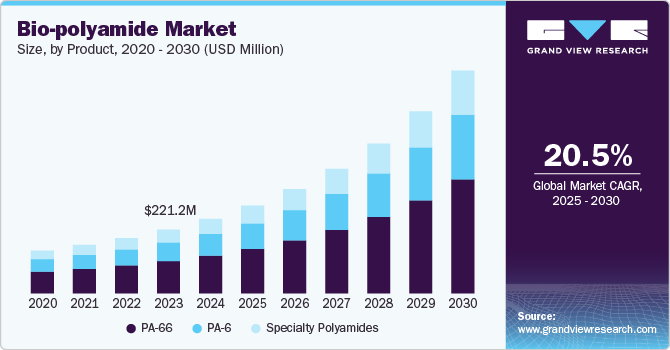

The global bio-polyamide market size was valued at USD 258.07 million in 2024 and is expected to grow at a CAGR of 20.50% from 2025 to 2030. The significant consumer demand, along with increasing regulations such as global warming initiatives and plastic bag bans, are driving market opportunities for bio-based plastics. Limited availability and increasing cost of fossil resources have forced manufacturers to shift their focus toward bio-based products. Bio-based polymers generally have a lower CO2 footprint and are associated with efforts to create more sustainable and environmentally friendly products. One of the main reasons for the increasing level of interest in bio-based products is the fact that these products may contribute to more efficient use of natural resources, which is a necessary condition for creating a more sustainable economy.

The bio-polyamide market is experiencing a significant shift toward sustainable production practices, with companies increasingly investing in bio-based materials. This trend is driven by the need for renewable alternatives to traditional petroleum-derived polyamides, reflecting broader market preferences for eco-friendly solutions. Advanced bio-polyamide grades are being developed for applications in industries such as automotive, textiles, and electronics, where high-performance and lightweight materials are in demand. Innovations in feedstock, including the use of castor oil and other plant-based raw materials, are gaining traction as they reduce greenhouse gas emissions compared to fossil-based polyamides. This trend is further reinforced by stricter environmental regulations, especially in Europe, which are encouraging companies to adopt sustainable solutions across their product lines.

Drivers, Opportunities & Restraints

The automotive industry’s shift toward fuel efficiency and emission reductions has become a powerful driver for the bio-polyamide market. Bio-polyamides are increasingly used to manufacture lightweight components that maintain durability and safety standards, supporting automakers’ goals to improve vehicle fuel efficiency. As electric vehicle (EV) adoption grows, the demand for bio-based materials in EV batteries, wiring, and other components is also increasing, providing a direct growth driver for bio-polyamides. Additionally, partnerships between material suppliers and automakers are accelerating the integration of bio-polyamides into vehicle manufacturing, as these materials offer both environmental benefits and cost-effectiveness over time.

An emerging opportunity for bio-polyamides lies in the textile industry, where sustainability has become a core competitive factor. As consumers demand greener products, fashion and sportswear brands are incorporating bio-polyamides into their collections to reduce environmental impact. These materials offer high resistance to abrasion, elasticity, and thermal stability, making them suitable for high-performance textiles. Additionally, bio-polyamides are increasingly used in 3D-printed fabrics, expanding their appeal to innovative designers and tech-savvy consumers. This opportunity is poised for growth as major textile manufacturers prioritize eco-friendly materials to enhance their brand image and meet evolving regulatory standards on sustainability.

One of the main restraints in the market is the high production cost associated with bio-based materials compared to conventional polyamides. The manufacturing process for bio-polyamides, which often involves complex feedstock sources like castor oil, requires substantial investment in specialized technology and supply chain adjustments, making it more expensive. Additionally, fluctuations in bio-feedstock prices, driven by agricultural uncertainties and limited raw material suppliers, further contribute to cost instability. This pricing challenge hinders the widespread adoption of bio-polyamides, especially in price-sensitive industries where margins are low, and affects market growth despite rising environmental awareness.

Product Insights

The PA-66 segment dominated the market with the largest share of over 50.78% in 2024. Increasing applications in the electrical & electronics, automotive, aerospace and marine segment is expected to foster market demand. The strength and wear resistance of PA-66 makes it a suitable product for manufacturing high quality cable ties. Its property of absorbing slightly less moisture than PA-6 gives it a competitive edge over other substitutes.

Growing end-use industries such as manufacturing, automobile, marine, electrical & electronics, and others are driving the product demand over the forecast period. Moreover, the presence of well-established film & coating companies, which is a major consumer of bio-based polyamide, is anticipated to drive the demand for the product across the globe.

Furthermore, the PA-6 product segment is anticipated to experience significant growth owing to properties such as better ductility, long-term thermal resistance, surface quality, creep resistance, and UV resistance over other PA-66. PA-6 ability to provide resistance from impact in low temperatures and its low cost over other substitutes. It is widely used in various applications such as automotive, manufacturing, textiles, film & coating, and the electrical & electronics industry. In the automotive sector, it is used as a cover for crash-active engines, oil pans, transmission cross beams, and air intake manifolds.

Application Insights

The engineering plastics segment dominated the market and accounted for the largest share of 67.24% in 2024, owing to its wide scope of application. Development in energy saving and demand for environment-friendly solutions is anticipated to augment market growth. These plastics are widely used in the electronic and automobile sectors on account of their light weight and strength to weight ratio.

Development in automobile technology and changing consumer buying behavior are positively impacting this segment. The requirement for fuel-efficient products & solutions coupled with stringent emission norms is pushing the end use industry to use such products. The growing economy, rise in consumer spending power, and technological innovation are creating a strong growth potential for this segment.

Fibers application segment is growing with a substantial CAGR owing to its superior benefits such as light weight, less expensive than other substitutes, high electrical & mechanical resistivity and capability to withstand high temperatures on account of its high tensile strength. It is used in many applications by various end use industries such as automobiles, electrical & electronics, manufacturing, aerospace, and others

End Use Insights

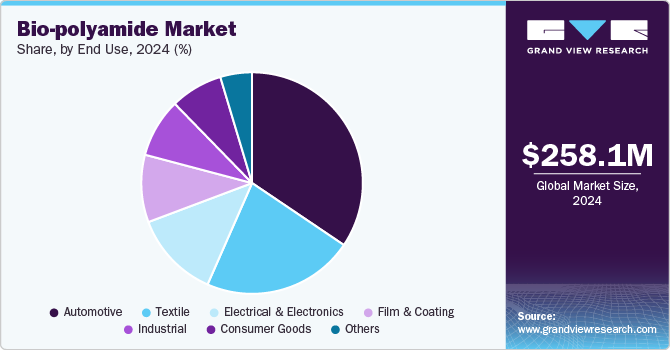

The automotive segment dominated the market and accounted for the largest share of over 34.45% in 2024. Bio-polyamide is used in the automobile industry for various applications such as transmission cross beams, air intake manifolds, crashworthy engine covers, oil pans, etc. From dashboards to complicated ABS and engines, these polyamides have diversified applications that provide improved specifications and features with a reduction in weight and size. Technological advancements in the automobile field with improvements in infrastructure are creating more demand for automobile products.

Textile is one of the major end-use industries of the bio-polyamide market. Growing consumer awareness of the product regarding its aesthetics, recyclability and impact on the environment is a major driver for environment-friendly products. Energy conservation practices coupled with changed social orientation toward products & services are pushing the bio-polyamide market toward growth.

Regional Insights

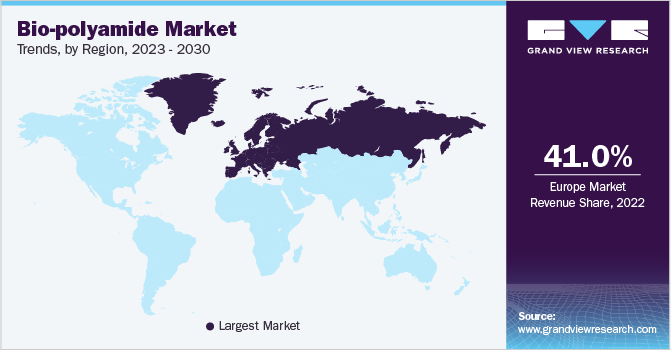

North America bio-polyamide market is driven by a strong focus on sustainable practices within the automotive and packaging industries. Companies across these sectors are actively adopting bio-based polymers to meet corporate sustainability targets and to respond to consumer demand for eco-friendly products. In the automotive industry, lightweight and durable bio-polyamides are gaining attention as carmakers strive to improve fuel efficiency and reduce emissions.

U.S. Bio-polyamide Market Trends

The bio-polyamide market in the U.S. is driven by the country’s robust regulatory framework focused on reducing plastic waste and promoting sustainable materials. Federal and state initiatives, including incentives and grants for sustainable manufacturing practices, are encouraging companies to use bio-based alternatives in a wide range of applications. In particular, the construction and textile sectors are adopting bio-polyamides due to their durability and eco-friendliness, helping firms align with "green building" standards and sustainable fashion trends. The growing demand for sustainable clothing and construction materials, combined with government support, is expected to boost the bio-polyamide market in the U.S.

Europe Bio-polyamide Market Trends

The bio-polyamide market in Europe dominated the global industry and accounted for the largest revenue share of 36.15% in 2024, which is attributable to strict environmental regulations and a strong consumer preference for sustainable products. The European Union’s Green Deal and its stringent carbon reduction goals have created a high demand for bio-based materials, with bio-polyamides positioned as a favorable alternative to traditional plastics. This shift is particularly evident in sectors like consumer goods, automotive, and personal care, where European consumers show strong demand for eco-friendly and biodegradable materials. Additionally, funding programs by the European Union to support innovation in sustainable materials are accelerating research and development, making bio-polyamides increasingly accessible to various industries across Europe.

The bio-polyamide market in Germany is primarily driven by the country’s leadership in automotive engineering and its commitment to sustainability. German automotive manufacturers are at the forefront of integrating bio-based materials into vehicle production to meet national emissions targets and EU regulations. As part of Germany's "Industry 4.0" movement, which promotes advanced and sustainable manufacturing, companies are investing in bio-polyamides for automotive components like engine covers, fuel lines, and interior parts. Moreover, Germany’s focus on circular economy principles is encouraging companies across sectors to adopt bio-polyamides, fostering a strong domestic demand for bio-based and recyclable materials.

Asia Pacific Bio-polyamide Market Trends

The bio-polyamide market in Asia Pacific is growing due to the rapid expansion of the automotive and electronics sectors. Countries like China, Japan, and South Korea are leaders in electronics manufacturing, and the increasing adoption of bio-based materials in electronic casings and connectors is boosting demand for bio-polyamides.

Key Bio-polyamide Company Insights

The market is highly competitive, with several key players dominating the landscape. The market is also characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Bio-polyamide Companies:

The following are the leading companies in the bio-polyamide market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Huntsman International LLC

- LANXESS

- BASF SE

- UBE Corporation

- INVISTA

- DOMO Chemicals GmbH

- Arkema

- Asahi Kasei Corporation

- Honeywell International Inc.

- DSM

- TORAY INDUSTRIES, INC.

- Radici Partecipazioni SpA

- DuPont

- Solvay

- ZIG SHENG INDUSTRIAL CO., LTD

- Quadrant Group Limited

- LEALEA ENTERPRISE CO., LTD.

- EMS-CHEMIE HOLDING AG

Recent Developments

-

In June 2024, Fulgar, an innovative Italian company, launched Q-Geo, a new bio-based polyamide yarn aimed at transforming the textile market. This yarn is made from 46% non-edible corn, which is grown on land unsuitable for food production, significantly reducing its environmental impact compared to traditional materials.

-

In February 2024, LG Chem and CJ CheilJedang announced a partnership to build a bio-polyamide plant in South Korea, aiming to create a domestic supply chain for bio-nylon. This collaboration formalized through a non-binding agreement, will involve CJ CheilJedang using advanced fermentation technology to produce pentamethylenediamine (PMDA), a key ingredient for bio-nylon. LG Chem will then polymerize PMDA into bio-nylon and manage its sales.

Bio-polyamide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 304.07 million

Revenue forecast in 2030

USD 772.39 million

Growth rate

CAGR of 20.50% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, The Netherlands; Turkey, China; India; Japan; South Korea, Australia, Malaysia, Singapore, Thailand, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

Evonik Industries AG, Huntsman International LLC, LANXESS, BASF SE, UBE Corporation, INVISTA, DOMO Chemicals GmbH, Arkema, Asahi Kasei Corporation, Honeywell International Inc., DSM, TORAY INDUSTRIES, INC., Radici Partecipazioni SpA, DuPont, Solvay, ZIG SHENG INDUSTRIAL CO., LTD, Quadrant Group Limited, LEALEA ENTERPRISE CO., LTD., EMS-CHEMIE HOLDING AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-polyamide Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-polyamide market report on the basis of product, application, end use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PA-6

-

PA-66

-

Specialty Polyamides

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fiber

-

Engineering Plastics

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Textile

-

Automotive

-

Film & Coating

-

Consumer Goods

-

Industrial

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

The Netherlands

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-polyamide market size was estimated at USD 258.07 million in 2024 and is expected to reach USD 304.07 million in 2025.

b. The global bio-polyamide market is expected to grow at a compound annual growth rate of 20.5% from 2025 to 2030 to reach USD 772.39 million by 2030.

b. The automotive segment dominated the bio-polyamide market with a share of 22.98% in 2024. This is attributable to the rising demand for lightweight vehicles and stringent environmental regulations regarding CO2 emissions.

b. Some key players operating in the bio-polyamide market include Evonik Industries AG, Huntsman International LLC, LANXESS, BASF SE, UBE Corporation, INVISTA, DOMO Chemicals GmbH, Arkema, and others.

b. Key factors that are driving the market growth include increasing preference for eco-friendly and sustainable solutions among end-use industries and increasing awareness about the environmental degradation caused by the extraction of petroleum derivatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.