- Home

- »

- Plastics, Polymers & Resins

- »

-

Bio-PET Film Market Size, Share & Growth Report, 2030GVR Report cover

![Bio-PET Film Market Size, Share & Trends Report]()

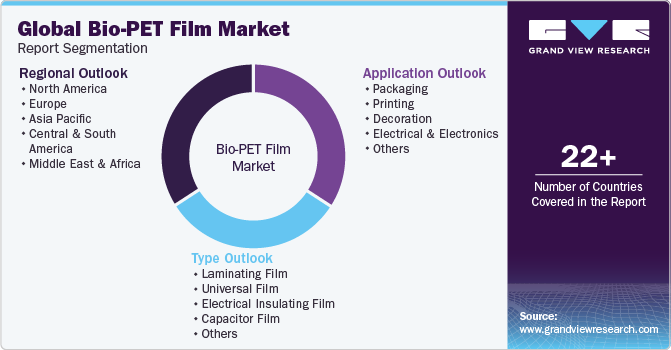

Bio-PET Film Market Size, Share & Trends Analysis Report By Type (Laminating Film, Universal Film, Electrical Insulating Film, Capacitor Film), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-141-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Bio-PET Film Market Size & Trends

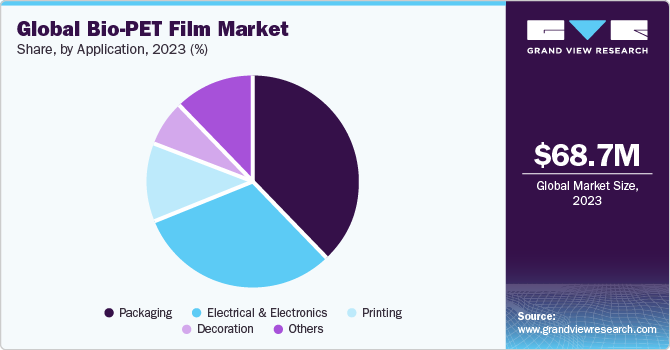

The global bio-PET film market size was estimated at USD 68.73 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.6% from 2024 to 2030. The rising sustainability and environmental concerns among people across the globe are positively influencing the market growth. Moreover, factors such as the inclination toward bioplastics, favorable government policies, and increasing application of bio-polyethylene terephthalate (PET) films in packaging, printing, electrical & electronics, pharmaceutical, and cosmetic sectors are driving the demand for bio-PET films.

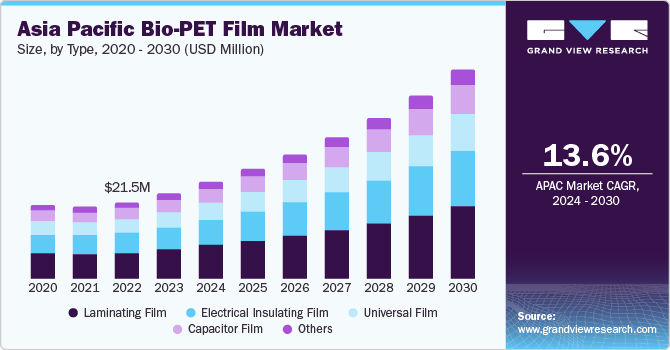

Asia Pacific bio-PET film market is characterized by various manufacturing industry, as a result of the increased emphasis on research and development, combined with favorable government initiatives towards sustainability, is likely to result in regional market expansion. Growing concern about environmental sustainability has resulted in a trend toward bio-based products. The market is projected to expand as government limitations on conventional plastics tighten and demand for plastic packaging grows. Moreover, automotive sales and manufacturing in Asia Pacific countries are likely to expand, so will market demand for these films.

Moreover, the increase in ongoing research and development in the region to improve the performance and properties of bio-PET films is expected to drive the market growth. China is one of the prominent consumers of non-alcoholic beverages across the globe, which, in turn, contributes to the demand for bio-PET film in the packaging sector. The country is also one of the biggest consumers of packaged food products including fresh food, ready-to-eat food, and processed food, which further paves way for the use of bio-PET film in packaging applications.

In addition, growing concerns about plastic waste among the public is a major factor driving the bio-PET film market in the region. Government initiatives to reduce the use of single-use plastics in the country are anticipated to augment the demand for bio-PET film over the forecast period. Under the “Clean India Mission” initiative, the government intends to end the use of single-use plastic films by 2022.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The bio-PET film market is characterized by a high degree of innovation owing to the rapid technological advancements along with the shift towards sustainability driven by factors such as advancements in the production of bio-PET film, the availability of raw materials, and increasing plastics consumptions across several applications including packaging, electrical & electronics, printing, among others. Subsequently, innovative bio plastics applications are constantly emerging, disrupting existing industries and creating new ones.

The bio-PET film market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market, and increasing strategic initiatives of bio-PET film.

The market is also subject to increasing regulatory scrutiny. The global bio-PET film market is subject to numerous regulations, guidelines, and restrictions regarding plastic recycling and its applications owing to the toxic nature of raw materials coupled with certain health hazards of improperly disposed products and over-exposure to chemicals contained in these films.

There are a limited number of direct product substitutes for bio-PET film. However, there are only few number of technologies that can be used to achieve sustainable outcomes to bio-PET film. While these materials offer environmental benefits by reducing dependence on fossil fuels, their production tends to be more expensive compared to traditional petrochemical-based plastics.

End-user concentration is a significant factor in the market. Since there are a number of end-user industries that are driving demand for bio-PET film. The concentration of demand in a small number of end-user industries creates opportunities for companies that focus on developing bio-PET film solutions. However, it also creates challenges for companies that are trying to compete in a crowded market.

Type Insights

Laminating Film type sector dominated the market and accounted for a share of 33.9% in 2023. Bio-PET films are extensively used for laminating applications owing to their excellent optical properties, providing high transparency and clarity. This makes them ideal for laminating applications where maintaining the visibility and appearance of the underlying material is crucial, such as laminated cards, photos, and documents. In addition, bio-PET films have low shrinkage, allowing them to maintain their original size and shape even when exposed to heat or moisture. This dimensional stability is crucial in laminating to prevent warping or distortion of laminated items. Furthermore, these films are strong and durable, resistant to chemicals and temperature variations, and environmentally friendly.

The electrical insulating film segment is expected to grow at the fastest CAGR of 13.1% over the forecast period. The increasing adoption of bio-PET films in electrical insulation can be linked to the expansion of the electrical industry and the rising need for effective insulating materials.Bio-PET films have excellent dielectric properties, they are highly effective at insulating against electrical current. They have a high dielectric strength, making them suitable for use in high-voltage applications. These films exhibit a low dissipation factor, indicating that they have minimal energy loss when subjected to alternating electrical current. In addition, these films can withstand a wide range of temperatures, they have low thermal expansion and maintain their shape and size over a wide temperature range, these films are flexible and can be easily molded or shaped to fit the specific needs of electrical components.

Application Insights

The packaging segment dominated the market in 2023.The increasing demand for packaging, especially in the food sector, is driving the demand for bio-based food packaging plastics. This, in turn, is expected to propel the bio-PET market. Rising environmental concerns and regulations on single-use plastics are driving the demand for bio-based plastics in the packaging sectors. For instance, in July 2022, the government of India banned the manufacture, sale, use, import, stocking, and distribution of single-use plastic items. Such regulations are expected to drive the demand for alternative plastics, such as bio-PET, which can be degradable and environmentally friendly compared to the conventional plastics.

The electrical & electronics application segment is projected to grow at a significant CAGR over the forecast period. Consumer preferences for environmentally friendly products, as well as growing awareness of environmental issues, fuel demand for sustainable electronics. The increasing demand for electronic devices and growing concerns about plastic waste are encouraging manufacturers to incorporate bioplastics into various electrical and electronic devices.

Printing application segment is also anticipated to witness substantial upsurge in adoption of bio PET Films.Bio-PET films are used in the printing industry for several packaging applications. Due of their superior barrier qualities against moisture and gases, they can be utilized as primary packaging for food products, pharmaceuticals, cosmetics, and other consumer goods, providing product protection and shelf life extension. Growing environmental concerns and laws concerning the use of traditional polymers in printing applications are driving demand for eco-friendly alternatives such as bio-PET films.

Regional Insights

Asia Pacific dominated the market and accounted for a 35.2% share in 2023. The increased demand for packaged food owing to lifestyle changes, rising disposable income, and consumer preference for fast food is likely to fuel demand for bio-PET films in the region. Furthermore, the rising environmental concerns related to single-use plastics and the government’s initiatives to reduce global warming and greenhouse gas emissions are expected to provide lucrative opportunities for market growth in the coming years.

Europe is anticipated to witness significant growth in the market. Europe has a strong focus on sustainability and environmental protection. With a growing awareness of plastic pollution and its impact on the environment, there is a heightened demand for alternatives to traditional plastics. Bioplastics, such as bio-PET, are viewed as a more environment-friendly option because they contain renewable, non-fossil components. According to European Bioplastics e.V., Europe is the second-largest market for bioplastics in terms of production, accounting for around 26.5% of the global bioplastics production capacity.

Key Bio-PET Film Market Company Insights

Some of the key players operating in the market include TORAY INDUSTRIES, INC. and KURARAY CO., LTD.

-

TORAY INDUSTRIES, INC., operates in various business segments, including fibers and textiles, performance chemicals, carbon fiber composite materials, environment and engineering, life science, and others. In addition, it has a global presence in 29 countries around the world

-

KURARAY CO., LTD. operates in three business segments, namely resins and chemicals, fibers, and others. The resins and chemicals segment involves the production and sale of polyvinyl butyral (PVB) resin and film, isoprene chemicals, methacrylic resin, polyvinyl alcohol (PVOH) resin and film, polyamide resin, elastomer, ethylene vinyl alcohol (EVOH) resin and film, and medical products. Furthermore, the fibers segment involves the production and sale of polyester fibers, man-made leather, PVA fiber, hook-and-loop fasteners, and nonwoven fabrics. Moreover, the other segment encompasses the production and sale of activated carbon and high-performance membranes and systems for water treatment

-

PLASTIPAK HOLDINGS, INC. and UFlex Limited are some of the emerging market participants in the global market.

-

PLASTIPAK HOLDINGS, INC. specializes in the design and production of plastic containers for the food, beverage, and consumer products sectors. Its primary focus lies in providing comprehensive services that encompass labeling, packaging design, filling, and delivery. Besides, it offers a wide range of products, including resins, blow moldings, injection moldings, thermoshaping solutions, filling and capping products, extrusion systems, and direct printing services. These offerings cater to various markets, including aerosol, carbonated soft drinks and water, consumer cleaning products, juice, food and dairy items, automotive products, industrial goods, agricultural products, personal care items, and alcoholic beverages

-

UFlex Limited operates in seven business segments, namely flexible packaging, packaging films, chemicals, printing cylinders, holography, engineering, and aseptic liquid packaging. It provides flexible packaging solutions to a wide range of sectors, including FMCG, automobile, pharmaceuticals, building materials, and others. The company serves customers across 150 countries, including the U.S., Canada, South America, Europe, CIS countries, the UK, South Africa, other African countries, and the Middle East, as well as South Asian countries

Key Bio-PET Film Companies:

The following are the leading companies in the bio-PET film market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these bio-PET film companies are analyzed to map the supply network.

- TORAY INDUSTRIES, INC.

- Polyplex

- TEIJIN LIMITED

- KURARAY CO., LTD.

- Qingdao Kingchuan Packaging

- Far Eastern New Century Corporation

- PLASTIPAK HOLDINGS, INC.

- Anellotech

- Indorama Ventures Public Company Limited

- Carbios

- NatureWorks LLC

- UFlex Limited

- FKuR

- Saipet Samartha Private Limited

- Iwatani Corporation

- LOTTE Chemical Corporation

Recent Developments

-

In September 2023, LOTTE Chemical introduced a new environmentally friendly material brand called 'ECOSEED'. ECOSEED encompasses physically and chemically recycled materials, including post-consumer recycled materials and bioplastics, such as Bio-PET. This strategic initiative is anticipated to assist the company in reaching its target of supplying 1 million tons of the resource circulation material 'ECOSEED' by 2030.

-

In June 2023, Indorama Ventures Public Company Limited, a leading global sustainable chemical producer, and Carbios, a biotech company focused on developing biological solutions for plastic and textile recycling, signed a non-binding Memorandum of Understanding (MOU) to establish a joint venture. The purpose of this partnership is to build the world's first PET biorecycling plant in France. The estimated capital investment for the construction of this innovative facility is approximately USD 245.7 million.

-

In May 2023, Origin Materials, Inc., a company specializing in carbon-negative materials, and Indorama Ventures Public Company Limited, a leading producer of virgin and recycled PET resins, formed a strategic partnership to expedite the large-scale production of bio-based materials. These materials have the potential to be utilized in a wide range of applications including packaging, automotive components, films, and textiles. The partnership is aimed at developing bio-PET, advanced bio-based chemical furan-dicarboxylic acid, bio-PTA, and co-polyesters that offer advantages over conventional PET plastics.

Bio-PET Film Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 76.90 million

Revenue forecast in 2030

USD 156.63 million

Growth rate

CAGR of 12.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

TORAY INDUSTRIES, INC.; Polyplex; TEIJIN LIMITED; KURARAY CO., LTD.; Qingdao Kingchuan Packaging; Far Eastern New Century Corporation; PLASTIPAK HOLDINGS, INC.; Anellotech; Indorama Ventures Public Company Limited; Carbios; NatureWorks LLC; UFlex Limited; FKuR; Saipet Samartha Private Limited; Iwatani Corporation; LOTTE Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-PET Film Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global bio-PET film market report based on type, application, and region.

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Laminating Film

-

Universal Film

-

Electrical Insulating Film

-

Capacitor Film

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Printing

-

Decoration

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global Bio-PET film market size was estimated at USD 68.73 million in 2023 and is expected to reach USD 76.90 million in 2024

b. The global Bio-PET film market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 156.63 million by 2030.

b. Asia Pacific dominated the Bio-PET film market with a share of 36.6% in 2023. Increasing demand for plastic packaging and several government regulations on conventional plastics in countries such as China, Japan, and India are expected to drive market growth.

b. Some key players operating in the Bio-PET Film market include Polyplex, TORAY INDUSTRIES, INC., TEIJIN LIMITED, KURARAY CO., LTD., MG Chemicals, PLASTIPAK HOLDINGS, INC., Danone, Toyota Tsusho Corporation, Indorama Ventures Public Company Limited., SABIC, Biokunststofftool, The Coca‑Cola Company, FKuR, Saipet Samartha Private Limited, Iwatani Corporation., and LOTTE Chemical Corporation

b. Key factors driving the market growth include the rising sustainability and environmental concerns among people worldwide and increasing adoption of Bioplastics globally

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."