- Home

- »

- Medical Devices

- »

-

Bio Decontamination Market Size And Share Report, 2030GVR Report cover

![Bio Decontamination Market Size, Share & Trends Report]()

Bio Decontamination Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Equipment), By Agent (Hydrogen Peroxide), By Type (Chamber Decontamination), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-348-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 – 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio Decontamination Market Size & Trends

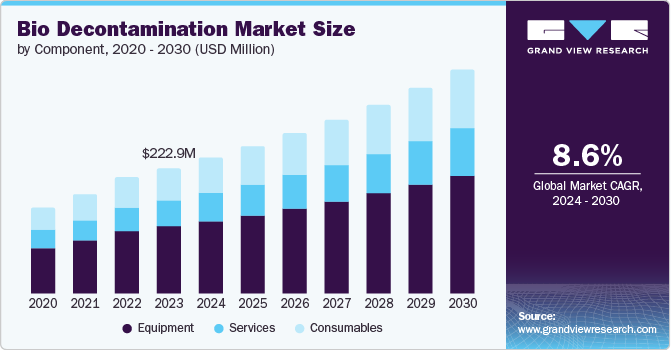

The global bio decontamination market size was estimated at USD 222.96 million in 2023 and is expected to grow at a CAGR of 8.62% from 2024 to 2030. Market growth can be attributed to the increasing number of surgical procedures, growth in the healthcare & pharmaceutical/biotechnology industries, and rising incidence of Hospital-Acquired Infections (HAIs). According to the WHO, in high-income countries, 7 out of every 100 patients in acute-care hospitals acquire at least one HAI; in low- and middle-income countries, this number is 15 of 100. On average, 1 out of every 10 patients affected by an HAI will die from it during their hospital stay. This alarming trend has heightened the need for stringent bio decontamination measures in healthcare facilities.

The growing prevalence of cancer & other chronic diseases, the rapidly aging population, and advancements in medical technology have led to a rise in the number of surgical procedures. This trend has increased the demand for these services to ensure the sterility and safety of equipment & facilities. The rise in surgical procedures has heightened the need for stringent bio decontamination measures to maintain sterile operating rooms, equipment, and facilities. This drives the demand for bio decontamination services and technologies to prevent surgical-site infections & ensure patient safety. The growth of the healthcare, pharmaceutical, and biotechnology industries has significantly driven the market. These sectors require meticulous decontamination protocols to maintain sterile, contamination-free environments, including R&D & manufacturing processes.

Hydrogen-peroxide-based decontamination equipment has become increasingly prevalent in these industries. For instance, in May 2022, Bionova Capital announced that Delox, a company in its portfolio, raised an additional EUR 750,000, bringing its total capital to over EUR 1.3 million. This investment, supported by Bionova Capital, Caixa Capital, Kiilto Ventures, and a Portuguese family office, would help Delox launch its patented antimicrobial system. Delox’s proprietary bio decontamination system can remove 99.9999% of all microbial entities, such as bacteria and viruses, from lab equipment & work areas.

Governments and regulatory agencies worldwide are enforcing more stringent rules and guidelines regarding bio decontamination procedures, especially in healthcare, pharmaceutical manufacturing, & food processing. Compliance with these regulations has compelled organizations to adopt advanced decontamination methods and technologies to ensure the safety and sterility of their facilities & products. For instance, the U.S. Environmental Protection Agency (EPA) regulates disinfectants and sterilants under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). In addition, the U.S. FDA provides guidelines for validating and monitoring sterilization processes for medical devices.

Component Insights

The equipment segment dominated the market and accounted for a share of 53.71% in 2023. The market is significantly driven by the advancement of innovative equipment, offering versatile and efficient solutions across various applications. For instance, in April 2021, Amira Srl launched the Bioreset Max, a compact and lightweight vapor generator that automatically adjusts hydrogen peroxide levels for optimum efficacy. This launch enhanced Amira Srl’s portfolio in cutting-edge bio decontamination technologies. Such high-tech equipment is essential despite the increasing focus on infection control, sterile production, and biosafety. Consequently, the equipment segment is expected to remain central in the market, responding to the pressing need for more effective decontamination solutions.

The consumables segment is projected to grow at a significant rate over the forecast period. Segment growth can be attributed to the increasing adoption of advanced decontamination agents and the need for reliable, high-quality consumables to ensure the effectiveness of bio decontamination processes. Consumables such as disinfectants, sterilants, and cleaning solutions are essential for successfully implementing bio decontamination protocols across various industries. Developing specialized consumables, such as biological indicators and chemical integrators, has enabled more robust validation and monitoring of bio decontamination processes, further driving the demand for these products. As the need for reliable and efficient bio decontamination continues to rise across industries, the consumables segment is expected to experience accelerated growth, outpacing the other components of the overall market.

Agent Insights

On the basis of agent, the hydrogen peroxide segment held the largest share of 43.05% in 2023 and is anticipated to grow rapidly over the forecast period. Hydrogen peroxide is widely recognized for its antimicrobial properties, making it essential for decontaminating biological contaminants. Its use in healthcare settings, especially hospitals, is critical for preventing the spread of infections, such as ventilator-associated pneumonia & Clostridium difficile. Recent advancements have led to the development of innovative delivery methods, including vaporized and gas plasma technologies, significantly boosting its effectiveness. For instance, in September 2021, STERIS launched new vaporized hydrogen peroxide bio decontamination systems, the VHP 100i and 1000i. These are designed for the pharmaceutical and medical device sectors, aiming for a 6-log reduction in bioburden with user-friendly features.

The peracetic acid segment is the second largest segment in the market. Peracetic acid is gaining popularity for its superior disinfection ability against microbes, including bacteria and viruses. It is ideal for healthcare, pharmaceuticals, and food processing for high-level disinfection or sterilization. It is particularly valued for its material compatibility, speed, and efficiency in cleaning surfaces, notably for sterilizing medical devices like endoscopes that cannot withstand high-temperature methods, such as autoclaving. With an increasing emphasis on infection control, the demand for peracetic acid solutions is expected to rise significantly.

Type Insights

On the basis of type, the chamber decontamination segment held the largest share of 58.28% in 2023. Chamber decontamination systems have become preferred over manual cleaning and disinfection, especially in highly regulated industries where strict standards must be met. Industries such as pharmaceutical and biotechnology rely on these systems to ensure the sterility of critical equipment, materials, and production environments. As the focus on infection control, product quality, and worker safety grows, chamber decontamination systems are expected to remain a key component in the overall market.

The room decontamination segment is anticipated to grow significantly over the forecast period. There is a growing awareness of the need to keep environments clean and sterile, particularly in healthcare settings, pharmaceutical production areas, and scientific research facilities. This is due in part to an increase in infectious diseases and the necessity for effective sterilization methods. As a result, there is a heightened interest in room decontamination solutions, notably by deploying advanced technologies such as vaporized hydrogen peroxide systems, UV-C light sanitation devices, ozone generators, and other innovative approaches that provide comprehensive & effective cleansing of confined areas.

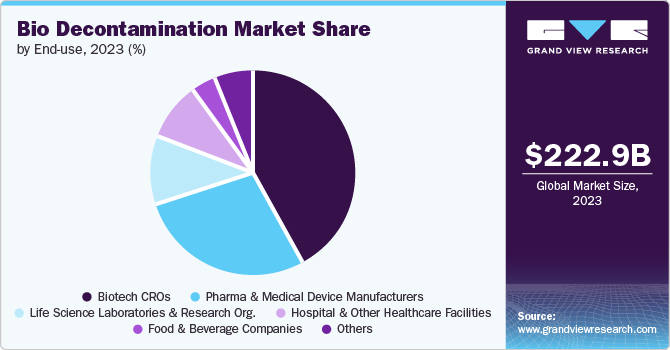

End-use Insights

The biotech companies & research organizations segment held the largest share of 42.21% in 2023 and is growing at the fastest CAGR over the forecast. Biotechnology and life sciences companies engaged in the research, development, and manufacture of pharmaceuticals, vaccines, & other biological products require stringent bio decontamination protocols to prevent cross-contamination and ensure the integrity of their products. Similarly, academic and government research institutions handling recombinant DNA, cell cultures, and other biohazardous materials have implemented comprehensive bio decontamination programs to safeguard their personnel & research. The growing emphasis on biosafety and biosecurity in these settings has been a key driver for adopting robust decontamination solutions.

The hospital & other healthcare facilities segment was the second-largest segment in the market. Its rapid growth can be attributed to the increasing incidence of HAIs and the need to maintain sterile environments for patient safety. Healthcare facilities are under immense pressure to curb the spread of HAIs. The growing prevalence of antibiotic-resistant superbugs, including Methicillin-Resistant Staphylococcus aureus (MRSA) and Clostridioides difficile, has highlighted the importance of effective bio decontamination measures in hospitals, clinics, & long-term care facilities. Techniques such as hydrogen peroxide vapor and peracetic acid are being widely adopted to decontaminate patient rooms, operating theaters, and medical equipment, helping reduce the transmission of infections.

Regional Insights

The North America bio decontamination market accounted for 44.08% share in 2023. The robust growth of the pharmaceutical and biotechnology industries in North America, particularly in the U.S. & Canada, has fueled the demand for bio decontamination technologies. For instance, in April 2022, CURIS System, a prominent player in the bio decontamination industry, obtained approval from Health Canada to introduce and distribute its products in the Canadian market. This regulatory approval signifies a significant milestone for CURIS System, allowing it to expand its reach and offer its innovative bio decontamination solutions to customers in Canada.

U.S. Bio decontamination Market Trends

The bio decontamination market in the U.S. is expected to grow substantially over the forecast period. The U.S. is experiencing a surge in demand for advanced bio decontamination solutions, driven by the high prevalence of HAIs and an emphasis on patient safety. The Department of Health and Human Services reports that 1 in 31 hospital patients acquire infections during their stay, leading to deaths and costing the healthcare system billions annually. Furthermore, leading pharmaceutical and biotech companies are investing in advanced facilities with state-of-the-art bio decontamination technologies to meet regulatory standards & ensure a sterile work environment.

Europe Bio decontamination Market Trends

The bio decontamination market in Europe is expected to witness lucrative growth over the forecast period. The European market is characterized by a focus on sustainable and eco-friendly solutions. The EU’s Biocidal Products Regulation (BPR) sets high standards for disinfectants and sterilants, encouraging the development of innovative bio decontamination technologies that minimize environmental impact. For instance, in July 2022, Ecolab’s Bioquell HPV-AQ, a disinfectant consisting of 35% hydrogen peroxide, was approved by the Biocidal Products Committee (BPC) of the European Chemicals Agency (ECHA) for an EU authorization under the BPR. This has led to the adoption of hydrogen peroxide vapor systems and ozone generators, which are gaining popularity in the region due to material compatibility & reduced chemical residues.

Asia Pacific Bio decontamination Market Trends

The bio decontamination market in Asia Pacific is anticipated to witness significant growth over the forecast period. This can be attributed to the expanding healthcare infrastructure, rising incidence of infectious diseases, and increasing awareness about the importance of sterile environments. For instance, India and China invest heavily in modernizing their healthcare systems, leading to a surge in demand for bio decontamination solutions. The region’s growing pharmaceutical and biotechnology sectors further contribute to market growth, as these industries require stringent decontamination protocols to maintain clean facilities and ensure product quality.

Key Bio Decontamination Company Insights

Some of the key players operating in the market are STERIS, Ecolab, and TOMI Environmental Solutions, Inc. These companies invest in product development, geographic expansion, and strategic partnerships to capitalize on the growing demand for bio decontamination solutions across various industries, particularly healthcare, pharmaceuticals, & biotechnology.

Key Bio Decontamination Companies:

The following are the leading companies in the bio decontamination market. These companies collectively hold the largest market share and dictate industry trends.

- Amira Srl

- ClorDiSys Solutions, Inc.

- Ecolab

- Fedegari Autoclavi S.p.A.

- Howorth Air Technology Limited

- JCE Biotechnology

- Noxilizer, Inc.

- STERIS

- TOMI Environmental Solutions, Inc.

- Zhejiang TAILIN Bioengineering Co., Ltd.

Recent Developments

-

In February 2024, CURIS System and AST announced a groundbreaking partnership in the pharmaceutical manufacturing industry. This collaboration aims to revolutionize the bio decontamination of aseptic fill-finish isolators by combining CURIS’s vapor decontamination technology with AST’s expertise in aseptic fill-finish processing.

-

In October 2022, ChargePoint Technology Group, a powder & liquid transfer solutions specialist, partnered with STERIS, a leading provider of infection prevention products and services, to deliver a successful sterile solution to the specialty chemicals company Evonik. This partnership aimed to provide Evonik with advanced technology and expertise to ensure the sterility of its processes and products.

Bio decontamination Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 241.45 million

Revenue forecast in 2030

USD 396.49 million

Growth rate

CAGR of 8.62% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, agent, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Amira Srl; ClorDiSys Solutions, Inc; Ecolab; Fedegari Autoclavi S.p.A.; Howorth Air Technology Limited.; JCE Biotechnology; Noxilizer, Inc.; STERIS; TOMI Environmental Solutions, Inc.; Zhejiang TAILIN Bioengineering Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country or regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Bio decontamination Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Bio decontamination market report based on component, agent, type, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Services

-

Consumables

-

-

Agent Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrogen Peroxide

-

Chlorine Dioxide

-

Peracetic Acid

-

Nitrogen Dioxide

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chamber Decontamination

-

Room Decontamination

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotech Companies & Research Organizations

-

Pharmaceutical & Medical Device Manufacturers

-

Life science Laboratories & Research Organizations

-

Hospital & Other Healthcare Facilities

-

Food & Beverage Companies

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bio decontamination market size was estimated at USD 222.96 million in 2023 and is expected to reach USD 241.45 million in 2024.

b. The global bio decontamination market is expected to grow at a compound annual growth rate of 8.62% from 2024 to 2030 to reach USD 396.49 million by 2030.

b. The hydrogen peroxide dominated the market with a share of 43.05% in 2023 and is anticipated to grow rapidly over the forecast period. Hydrogen peroxide is widely recognized for its antimicrobial properties, making it essential for decontaminating biological contaminants.

b. Some key players operating in the bio decontamination market include Amira Srl; ClorDiSys Solutions Inc; Ecolab; Fedegari Autoclavi S.p.A.; Howorth Air Technology Limited. ; JCE BIOTECHNOLOGY; Noxilizer, Inc.; STERIS. ; TOMI Environmental Solutions, Inc.; Zhejiang TAILIN Bioengineering Co., LTD

b. Key factors that are driving the bio decontamination market growth include increasing number of surgical procedures, growth in the healthcare sector and pharmaceutical/biotechnology industries, and rising incidence of hospital- acquired infections (HAIs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.