Bio-butanol Market Summary

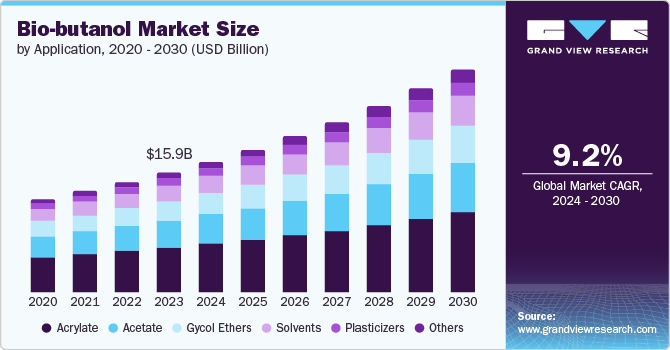

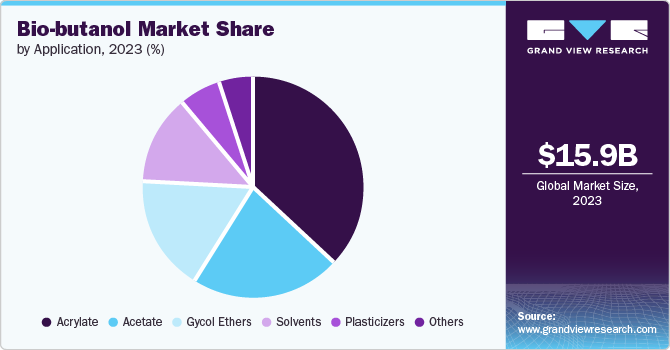

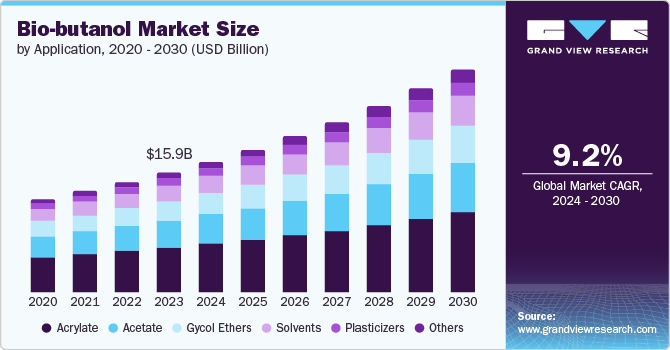

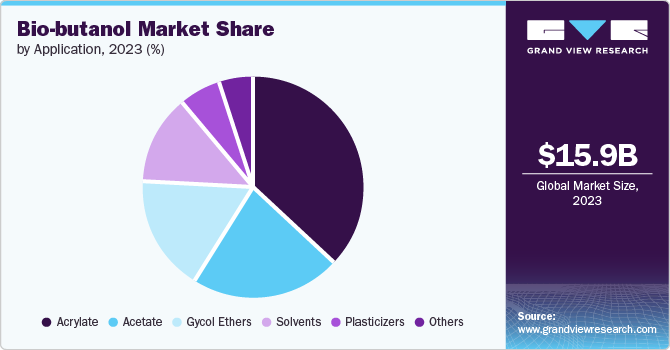

The global bio-butanol market size was estimated at USD 15.86 billion in 2023 and is projected to reach USD 29.37 billion by 2030, growing at a CAGR of 9.2% from 2024 to 2030. This growth is driven by increase in demand for renewable fuels, along with growing environmental concerns and regulations demanding a shift away from traditional fossil fuels.

Key Market Trends & Insights

- Asia Pacific dominated the global bio-butanol with the largest revenue share in 2023.

- By application, the acrylate segment led the market with the largest revenue share of 37.4% in 2023.

- The glycol ethers segment is expected to witness at the fastest CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 15.86 Billion

- 2030 Projected Market Size: USD 29.37 Billion

- CAGR (2024-2030): 9.2%

- Asia Pacific: Largest market in 2023

In addition, the potential of bio-butanol as a clean heat fuel and bio-based material is expected to generate significant demand and drive the market growth.

Bio-butanol is used as a key raw material in the production of paints, coatings, plastics and adhesives. It is used as a substitute for petroleum-based butanol in most applications. Its ability to be used as a supplement has increased interest in the pharmaceutical industry.

Most of the world's biobutanol production comes from sugarcane and starch, and the remaining from cellulosic sugar and sweet sorghum juice. In recent years, sugary foods have become increasingly popular, due to the lack of availability of sugar as it is used for food. This is anticipated to be important in determining growth.

Application Insights & Trends

The acrylate segment dominated the market and accounted for a share of 37.4% in 2023. This is attributable to the fact that bio-butanol's is used as a key ingredient in the production of butyl acrylate, which is widely used in paints, coatings and adhesives. Additionally, improved properties of bio-based acrylates, including sustainability and environmental benefits, will contribute to market penetration. As a result, the trend in the paints, coatings and adhesives industry will continue to drive the growth of the acrylate segment in the bio-butanol market.

The glycol ethers segment is expected to witness significant growth over the forecast period. This is owing to as glycol ethers is derived from bio-butanol which offers a sustainable and environmentally friendly alternative to their petroleum counterparts. This aligns with the increasing focus on bio-based materials across various industries. In addition, glycol ethers have many applications in industrial cleaning products, cosmetics, and pharmaceuticals. As demand for these products continues to increase, the use of bio-based glycol ethers will increase and this segment is anticipated to grow rapidly in the bio-butanol market.

Regional Insights & Trends

Asia Pacific bio-butanol market dominated the market in 2023. This is attributable to strong economies in the region, especially China, a major producer of paints and automobiles, are driving demand for bio-butanol as a sustainable feedstock for various industries. Additionally, stringent environmental laws in these countries are promoting a shift away from traditional fossil fuels, making bio-butanol's clean-burning properties highly attractive. The government initiatives promoting biofuel production are strengthening incentives for bio-butanol adoption, strengthening Asia-Pacific's dominance in this market.

China bio-butanol market held a substantial market share in 2023 owing to a strong industrial sector promoting the efficiency of bio-butanol, stricter environmental regulations favoring cleaner fuels, and government support for bio production.

Europe Bio-butanol Market Trends

Europe bio-butanol market was identified as a lucrative region in this industry. Europe enforces some of the most stringent environmental regulations globally, mandating a significant reduction in greenhouse gas emissions. Bio-butanol, as a clean-burning fuel option, aligns perfectly with these goals. Additionally, government policies in Europe are actively promoting the development and adoption of renewable fuels by providing financial incentives for the production of bio-butanol. Furthermore, the focus on sustainable practices in various European industries is driving the demand for bio-based materials such as bio-butanol, further driving market growth.

UK bio-butanol market is expected to grow rapidly in the coming years due to UK's ambitious carbon reduction targets that requires a move away from fossil fuels, and this is supported by the clean burning properties of bio-butanol. In addition, growing environmental awareness among consumers is increasing demand for sustainable products and driving government support for biofuels and bio-butanol research.

Key Bio-butanol Company Insights

-

Cathay Industrial Biotech Ltd., is a producer of bio-based materials utilizing fermentation and synthetic biology. Their product portfolio includes innovative bio-based chemicals such as long-chain diacids and biobutanol, catering to sustainable alternatives in various industries.

-

Gevo is a company focused on developing and producing advanced renewable fuels. They utilize a proprietary fermentation process to convert renewable feedstocks into isobutanol, a versatile building block for creating sustainable aviation fuel, renewable gasoline, and bio-based chemicals.

Key Bio-butanol Companies:

The following are the leading companies in the bio-butanol market. These companies collectively hold the largest market share and dictate industry trends.

- GranBio

- Eastman Chemical Company

- Abengoa

- Cobalt Technologies

- Metabolic Explorer

- Phytonix

- Celtic Renewables

- Working Bugs

Recent Developments

-

In January, 2024 Cathay Biotech and 3P.COM formed a joint venture to develop bio-based polyamide composites for sustainable applications in energy, transportation and construction. This joint venture will focus on developing these composites for applications in hydrogen storage, transportation, and wind turbine blades This collaboration aims to reduce emissions and replace less sustainable materials.

Bio-butanol Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 17.27 billion

|

|

Revenue forecast in 2030

|

USD 29.37 billion

|

|

Growth Rate

|

CAGR of 9.2% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

|

|

Key companies profiled

|

Cathay Industrial Biotech Ltd, Gevo, GranBio, Eastman Chemical Company, Abengoa, Cobalt Technologies, Metabolic Explorer, Phytonix, Celtic Renewables, Working Bugs

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Bio-butanol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the bio-butanol market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acrylate

-

Acetate

-

Gycol Ethers

-

Solvents

-

Plasticizers

-

Others

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)