- Home

- »

- Petrochemicals

- »

-

Bio-butadiene Market Size, Share & Trends Report, 2030GVR Report cover

![Bio-butadiene Market Size, Share & Trends Report]()

Bio-butadiene Market (2024 - 2030) Size, Share & Trends Analysis Report By Grade (Industrial Grade, Laboratory Grade), By Application (Styrene Butadiene Rubber, Styrene Butadiene Latex), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-331-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-butadiene Market Size & Trends

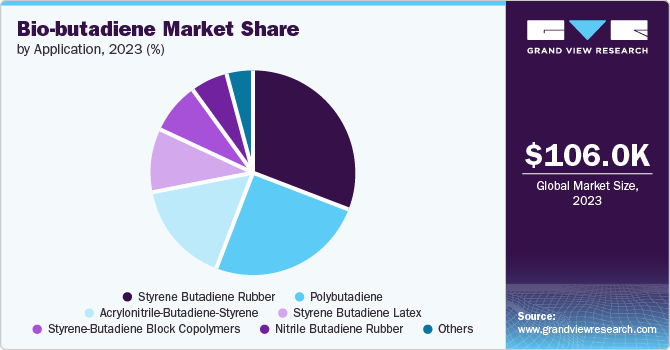

The global bio-butadiene market size was estimated at USD 106 thousand in 2023 and is projected to grow at a CAGR of 9.75% from 2024 to 2030. The growth is attributed to the increasing demand for green tires in automotive industry which are manufactured from synthetic rubber derived from bio-based monomers such as bio-butadiene.

Bio-butadiene is a sustainable alternative to traditional petroleum-derived butadiene. It is produced from biomass sources such as sugar, starch, or vegetable oils through advanced biochemical or chemical processes. This renewable approach aims to reduce reliance on fossil fuels, mitigate environmental impact, and meet the growing demand for eco-friendly materials in various industries.

Drivers, Opportunities & Restraints

The automotive industry is increasingly focusing on sustainability and reducing its environmental impact. As a result, there is a growing demand for bio-based alternatives, including bio-butadiene, which can be used in the production of sustainable tires and automotive components.

Butadiene is a critical component in synthetic rubber, particularly Styrene-Butadiene Rubber (SBR) widely used in tire production. Bio-butadiene can replace petroleum-derived butadiene, leading to a significant reduction in the carbon footprint of tires. For instance, Michelin's BioButterfly project aims for bio-based butadiene in tires, promoting an eco-friendlier tire industry.

The product also finds application in adhesives and coatings used in construction and various industrial processes. The product can contribute to the development of bio-based alternatives in these sectors, promoting a more sustainable construction industry and eco-friendly industrial processes. For example, companies like Arkema are researching bio-based butadiene for bio-sourced adhesives.

One of the primary challenges for bio-butadiene is the cost of production. Compared to conventional petroleum-based butadiene, bio-based production processes can be more expensive due to the complexities involved in biomass feedstock sourcing, conversion technologies, and scale-up. Achieving cost competitiveness with petroleum-derived counterparts requires significant advancements in process efficiency, feedstock availability, and economies of scale.

Bio-butadiene may exhibit variations in purity and chemical composition depending on the biomass feedstock and production method used. These variations can affect the performance characteristics of downstream products, such as synthetic rubbers and plastics. Ensuring consistent quality and performance standards that meet or exceed those of petroleum-derived butadiene is crucial for industrial applications.

Industry Dynamics

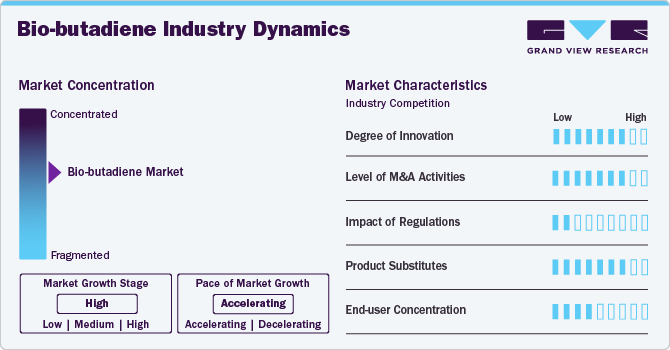

The market is moderately consolidated as some key companies account for its significant share. Emerging economies such as India and China are expected to provide growth opportunities to manufacturers of the product over the forecast period.

Some of the companies enjoy a majority of the market share by achieving optimum business growth and strong market positioning through partnerships and mergers & acquisitions. For instance, in April 2021, Zeon Corporation developed the world’s first technology that efficiently produces butadiene from biomass (biotic resources), under a collaborative research project with RIKEN and Yokohama Rubber Co., Ltd. and at the Bio-monomer Production Laboratory.

Grade Insights & Trends

The industrial grade segment is expected to witness a CAGR of 10.2% over the forecast period. The segment was valued at USD 87.3 thousand in 2023 and is projected to reach USD 17,902.0 billion by 2030. Industrial grade of the product finds applications in industries such as plastics, rubber, and chemical synthesis. It is used as a raw material for the production of synthetic rubber, fine chemicals, and plastics.

In terms of chemical properties and performance, industrial-grade bio-butadiene typically matches or closely resembles petroleum-derived butadiene, making it a viable substitute in industries where butadiene is a critical raw material. These industries primarily include the production of synthetic rubbers (such as styrene-butadiene rubber and polybutadiene rubber) and various plastics.

Application Insights & Trends

The Styrene-butadiene rubber (SBR) segment was valued at USD 32.4 thousand in 2023 and is projected to reach USD 6,907.2 thousand by 2030. It is a versatile synthetic rubber derived from the copolymerization of styrene and butadiene monomers. It is renowned for its excellent abrasion resistance, durability, and elasticity, making it a cornerstone material in various industrial applications as a synthetic polymer, SBR offers consistency in quality and properties, contributing to its widespread adoption in industries where robust and resilient materials are essential.

A sustainable variant of SBR finds applications across diverse industries, particularly in tire manufacturing, automotive components, adhesives, and coatings. By reducing dependence on fossil fuels and mitigating carbon emissions, bio-based SBR supports efforts to achieve environmental sustainability goals. Despite challenges related to cost competitiveness and scaling up production, ongoing research and development efforts are driving innovations to enhance the efficiency and cost-effectiveness of bio-based SBR.

End Use Insights

The automotive and transportation segment accounted for the largest revenue share of 33.35% of the market in 2023 owing to the increasing consumption of the product in manufacturing tires and other rubber-based material in the automotive industry.

Butadiene-based elastomers are also used in the manufacturing of seals, gaskets, and hoses in automotive engines, transmissions, and braking systems. These elastomers offer flexibility, durability, and resistance to heat and chemicals, ensuring reliable performance and sealing capabilities.

In addition, the product is also used in the production of adhesives and sealants used in the automotive industry. These materials are essential for bonding and sealing various components, ensuring structural integrity, and preventing leaks in vehicles.

Regional Insights

North America bio-butadiene market is growing due to the increased tire production in the region. The rapidly flourishing automotive industry is a key driver for the growth of the product market in North America. As per OICA, the production of cars and commercial vehicles in the region in 2020 was 8.82 million units, while it grew to 10.61 million units in 2023. Thus, the flourishing end-use industries in the region are driving the growth of the market for the product in North America.

U.S. Bio-butadiene Market Trends

The bio-butadiene market in the U.S. is driven by several key factors aimed at enhancing sustainability and reducing reliance on fossil fuels. One significant driver is the increasing regulatory focus on environmental sustainability. Policies promoting renewable energy sources and reducing carbon emissions incentivize industries to explore bio-based alternatives like bio-butadiene. For instance, initiatives such as the Renewable Fuel Standard (RFS) encourage the use of biofuels derived from biomass, indirectly supporting the development of bio-based chemicals like bio-butadiene.

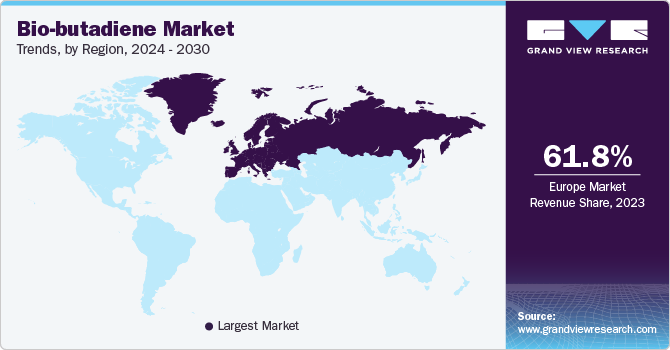

Europe Bio-butadiene Market Trends

Europe is a prominent consumer of bio-butadiene in the world with a revenue share of 61.8% in 2023 owing to strong environmental regulations, like the European Union's Green Deal, which push for decreased reliance on fossil fuels and promote bio-based alternatives. This fosters demand for bio-butadiene, a sustainable replacement for traditionally produced butadiene. Additionally, government incentives like subsidies make bio-butadiene economically attractive.

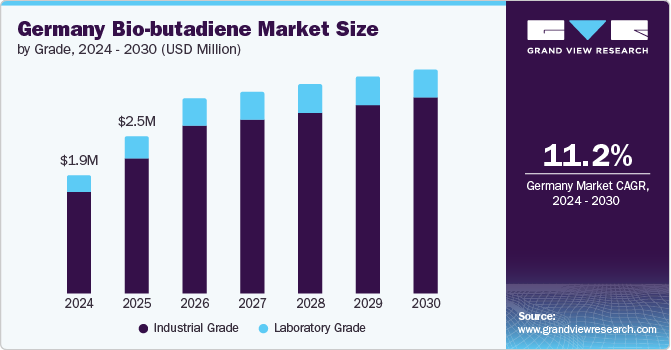

Germany bio-butadiene market is growing as the country is a major player in Europe's automotive industry, and is experiencing a strong push for bio-butadiene driven by several factors. Growing consumer demand for sustainable vehicles aligns perfectly with bio-butadiene's eco-friendly nature. Car manufacturers like BMW are already exploring its use in tires.

Secondly, Germany's strong focus on renewable energy and reducing its carbon footprint makes bio-butadiene an attractive alternative. Government initiatives like the Bioeconomy Strategy support research and development in this area, exemplified by the collaboration between BASF and Deinove to develop innovative processes for bio-butadiene production in Germany.

Asia Pacific Bio-butadiene Market Trends

The bio-butadiene market growth in Asia Pacific can be attributed to the increasing demand for the product in various end-use industries including tires and industrial rubber. The population of Asia Pacific is dependent on industrial rubber owing to its wide application in daily life. It is used in almost every end-use industry, ranging from automotive and construction to electrical.

China bio-butadiene market is growing as the country is a prominent producer and consumer of rubber in Asia Pacific owing to the presence of a large number of its manufacturers in the country. Surging rubber production and consumption are increasing the market demand for products in the country.

Central & South America Bio-Butadiene Market Trends

The bio-butadiene market in Central and South America is in its nascent stages, but promising drivers are emerging. A growing focus on sustainability is evident in countries like Brazil, which has a strong biofuels industry and ambitious plans to reduce its reliance on fossil fuels.

Argentina has set ambitious goals for renewable energy use and reducing its carbon footprint. This could lead to government policies that incentivize bio-butadiene production. Moreover, Argentina's strong agricultural sector, particularly its corn production, presents a viable source of renewable feedstock for bio-butadiene. Companies might explore utilizing corn or corn derivatives as a feedstock.

Middle East & Africa Bio-Butadiene Market Trends

The bio-butadiene market in the Middle East & Africa is driven by a growing focus on economic diversification and reducing dependence on fossil fuels. Countries like the United Arab Emirates (UAE) have sustainability goals, exemplified by the Dubai Green Deal.

Saudi Arabia's Vision 2030, a strategic plan to diversify its economy and reduce dependence on oil is one of the factors driving the product demand in the country. Initiatives like the Saudi Green Initiative further highlight the country's commitment to a greener future.

Key Bio-butadiene Company Insights

Some of the key players operating in the market include SABIC, Michelin, Zeon Corporation, Evonik Industries and Synthos and among others.

-

Established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reducing the production & operating costs. Companies are also integrating in the value chain in order to save the operations cost involved in raw material procurement.

-

For instance, Michelin (tire manufacturing company) along with IFPEN and Axens, have inaugurated the first large-scale facility in France that can produce butadiene, a crucial material, from bioethanol derived from plants. This project aims to replace petroleum-based butadiene with a bio-based alternative, potentially making tires and other products like plastics more sustainable. The plant's success could significantly impact the production of various materials in the future.

Key Bio-butadiene Companies:

The following are the leading companies in the bio-butadiene market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- Michelin

- Zeon Corporation

- Trinseo

- Braskem

- Versalis

- Lummus Technology

- Invista

- Evonik Industries

- Synthos

Recent Developments

-

In January 2024, Michelin, IFPEN (French Institute of Petroleum and New Energies), and Axens jointly launched France's inaugural industrial-scale demonstrator plant for producing butadiene from bioethanol.

-

In March 2022, SABIC partnered with Kraton to develop certified renewable styrenic block copolymers using SABIC’s certified renewable butadiene. This bio-based butadiene is sourced from 'second generation' renewable feedstocks like tall oil, a by-product from the wood pulping process in the paper industry. Notably, the feedstock used is animal-free and palm oil-free, aligning with sustainable sourcing practices.

-

In April 2021, Trinseo and ETB signed a letter of intent to collaborate on the development of purified bio-based 1,3-butadiene. The two companies combined their respective technology and process expertise to accelerate the development of viable, renewably sourced material solutions.

Bio-butadiene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12,111 thousand

Revenue forecast in 2030

USD 21,164 thousand

Growth rate

CAGR of 9.75% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in tons; revenue in USD thousand and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, type, end use and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

SABIC; Michelin; Zeon Corporation; Trinseo; Braskem; Versalis; Lummus Technology; Invista; Evonik Industries and Synthos.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

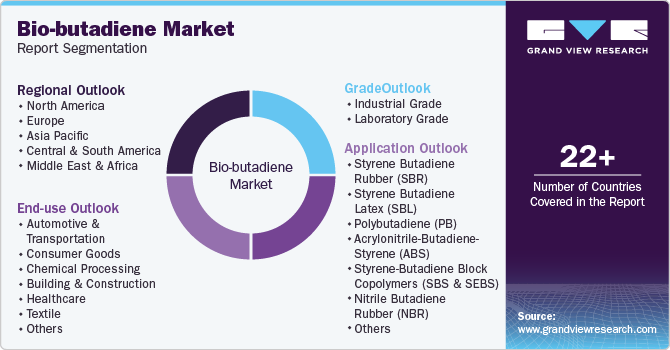

Global Bio-butadiene Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-butadiene market report based on grade, type, end use, and region.

-

Grade Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Industrial Grade

-

Laboratory Grade

-

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Styrene Butadiene Rubber (SBR)

-

Styrene Butadiene Latex (SBL)

-

Polybutadiene (PB)

-

Acrylonitrile-Butadiene-Styrene (ABS)

-

Styrene-Butadiene Block Copolymers (SBS & SEBS)

-

Nitrile Butadiene Rubber (NBR)

-

Others

-

-

End Use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Automotive & Transportation

-

Consumer Goods

-

Chemical Processing

-

Building & Construction

-

Healthcare

-

Textile

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include increasing demand for green tires in automotive industry which are manufactured from synthetic rubber derived from bio-based monomers such as bio-butadiene.

b. The global bio-butadiene market size was estimated at USD 106 thousand in 2023 and is expected to reach USD 12,111 thousand in 2030.

b. The global bio-butadiene market is expected to grow at a compound annual growth rate of 9.75% from 2024 to 2030 to reach USD 21,164 thousand by 2030.

b. Europe dominated the bio-butadiene market with a share of 61.8% in 2023. This is attributable to strong environmental regulations, like the European Union's Green Deal, push for decreased reliance on fossil fuels and promote bio-based alternatives.

b. Some key players operating in the bio-butadiene market include SABIC, Michelin, Zeon Corporation, Trinseo, Braskem, Versalis, Lummus Technology, Invista, Evonik Industries AG, and Synthos

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.