Bio-based Polypropylene In Medical Devices Market Size, Share & Trends Analysis Report By Application (Heart Valve Structures, Surgery Sutures, Surgical Mesh), By Region (North America, Asia Pacific, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-114-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

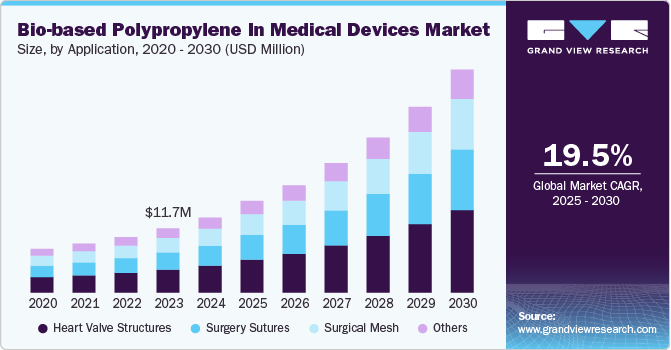

The global bio-based polypropylene in medical devices market size was valued at USD 13,670.79 thousand in 2024 and is expected to grow at a CAGR of 19.47% from 2025 to 2030. Cost-effectiveness and advancement in technology are factors propelling the demand for bio-based polypropylene for the manufacturing of medical devices, especially used as implants across the human anatomy. The biocompatibility of bio-based polypropylene makes the resin suitable for the manufacturing of surgical sutures. Medical sutures are not limited to surgical procedures only, however are additionally utilized to fix and heal wounds and slight concussions injuries. Such cases of injuries have propelled the demand for bio-based polypropylene for the manufacturing of surgical sutures, hence boosting the demand for bio-based polypropylene across the medical industry.

The bio-based polypropylene (PP) market for medical devices is seeing a surge in demand as healthcare providers increasingly prioritize sustainable and eco-friendly materials. Medical institutions are under pressure to lower their carbon footprints, aligning with a global shift toward circular economy practices and reduced reliance on fossil-based plastics. Bio-based PP, produced from renewable feedstocks like corn and sugarcane, offers comparable durability and safety to conventional polypropylene, essential for strict medical applications. This trend is particularly evident in Europe and North America, where regulatory incentives and consumer expectations around sustainability are high. As a result, more medical device manufacturers are integrating bio-based materials, setting a trend for sustainable practices in the sector.

Drivers, Opportunities & Restraints

A primary driver for bio-based polypropylene in medical devices is the heightened regulatory and consumer demand for sustainable and non-toxic materials in healthcare. Regulatory bodies, especially in developed markets, are increasingly implementing stringent environmental guidelines that incentivize the use of bioplastics to reduce reliance on petrochemical products. Additionally, healthcare providers are aiming to improve patient safety with materials that have lower toxicity and allergenicity. Bio-based polypropylene addresses both environmental and health concerns, providing a strong value proposition for hospitals and clinics seeking compliant, high-quality materials with fewer harmful effects on both patients and the environment.

The market offers vast opportunities for innovation in materials engineering, especially for companies developing proprietary formulations that meet rigorous medical standards. As bioplastics are still an emerging segment in medical applications, companies that can produce bio-based PP with enhanced properties-such as higher resistance to sterilization processes and improved biocompatibility-stand to gain a competitive edge. This potential is especially high in emerging economies, where the medical sector is expanding and looking for cost-effective, sustainable solutions. Partnerships with research institutions and healthcare providers could further advance material quality, positioning bio-based PP as a viable option for a broader array of medical devices.

Despite its advantages, the adoption of bio-based polypropylene in medical devices faces significant cost-related restraints. Producing bio-based polymers is currently more expensive than conventional, fossil-based polypropylene, as renewable feedstocks and processing technologies incur higher production costs. This cost premium can limit its use in budget-sensitive markets and smaller healthcare institutions. Additionally, bio-based PP still faces challenges in meeting the stringent performance and regulatory requirements of the medical sector, which can delay product approvals and market entry. These factors make large-scale adoption of bio-based PP challenging, particularly in markets with tight budget constraints.

Application Insights & Trends

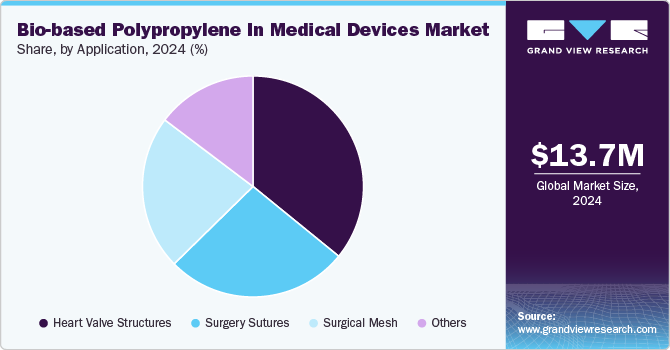

Heart valve structures dominated the market with a revenue share of 35.88% in 2024. Rising heart ailments and increasing death rates due to cardiac arrest have propelled the demand for technological advancements across the cardiac sector of the medical industry globally. This is anticipated to boost the demand for bio-based polypropylene heart valve structures during the forecast period.

The surgery sutures segment is gaining attention as healthcare systems increasingly prioritize eco-friendly solutions without compromising on safety or performance. Bio-based polypropylene sutures offer similar tensile strength, durability, and flexibility to traditional, petroleum-derived polypropylene sutures, making them highly suitable for wound closure in various surgical procedures. Moreover, as patient demand rises for materials with lower toxicity and environmental impact, bio-based sutures align well with sustainability goals. Although the market is still in its early stages, advancements in bio-based polypropylene production are driving down costs, making these sutures more viable. This shift is evident, particularly in Europe and North America, where regulatory bodies are setting stricter environmental standards, encouraging hospitals to adopt sustainable alternatives for surgical supplies.

Regional Insights & Trends

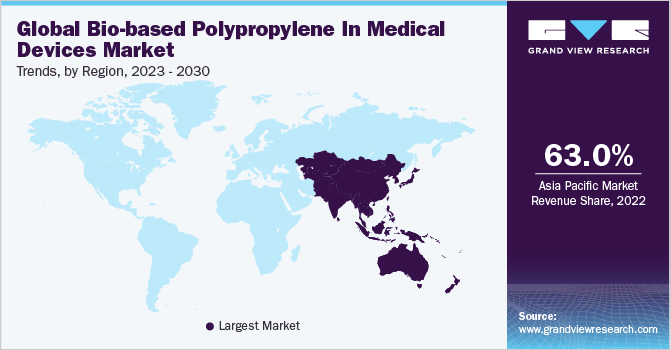

North America bio-based polypropylene in medical devices market is largely driven by government-backed sustainability initiatives, alongside strong consumer demand for eco-friendly healthcare products. This region has seen significant growth in the bio-based sector as manufacturers benefit from subsidies and tax credits for producing and using renewable materials. Healthcare providers are also responding to the growing preference for environmentally responsible materials, aiming to lower the sector’s carbon footprint. North American research institutions actively contribute to advancing bio-based polymer technologies, enhancing the appeal of bio-based polypropylene by improving its performance and cost-effectiveness, which drives its uptake in medical applications.

U.S. Bio-based Polypropylene In Medical Devices Market Trends

The bio-based polypropylene in medical devices market in the U.S. is driven by the tightening regulatory framework focused on sustainability, particularly under the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA). These agencies are promoting the use of sustainable materials, pushing medical device manufacturers to explore bio-based alternatives to meet evolving environmental standards. There’s also a strong push from healthcare facilities and providers looking to differentiate themselves by offering greener choices. As such, demand for bio-based polypropylene is rising, supported by substantial federal investments in bioplastics research and development, making the U.S. a significant market for bio-based PP adoption in healthcare.

Asia Pacific Bio-based Polypropylene In Medical Devices Market Trends

The bio-based polypropylene in medical devices market in Asia Pacific dominated the global industry and accounted for the largest revenue share of 63.45% in 2024, which is attributable to the growing commitment by governments to reduce environmental pollution and foster sustainable healthcare solutions. With countries like Japan, South Korea, and Australia taking the lead in green policies, medical device manufacturers are under pressure to adopt eco-friendly materials. The region’s strong investment in renewable technologies and rising patient awareness around sustainable healthcare are encouraging medical device producers to shift towards bio-based options. Additionally, regional trade agreements promoting green initiatives are making it easier for bio-based materials to gain traction in the healthcare sector, boosting demand for bio-based polypropylene in medical applications.

China bio-based polypropylene in medical devices market stems from its commitment to addressing pollution and environmental sustainability as part of the nation’s long-term “Green Development” plans. With increasing scrutiny on pollution from traditional petrochemical industries, China is actively promoting bioplastics as alternatives in various sectors, including healthcare.

Europe Bio-based Polypropylene In Medical Devices Market Trends

The bio-based polypropylene in medical devices market in Europe is driven by stringent environmental regulations and ambitious circular economy goals. The EU’s Green Deal and related policies aim to cut down on single-use plastics and carbon emissions across industries, including healthcare. Consequently, medical device manufacturers in Europe are increasingly adopting bio-based materials to comply with these policies and maintain market access. Additionally, European consumers are highly conscious of sustainability, which pushes healthcare providers to use materials that are both safe for patients and environmentally friendly. The availability of government grants and funding for sustainable innovation in healthcare further accelerates the demand for bio-based polypropylene in the region.

Key Bio-based Polypropylene In Medical Devices Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include SABIC; LyondellBasell Industries Holdings B.V.; Mitsui Chemicals, Inc.; Borealis AG; Braskem; Total S.A.; Danimer Scientific; FKuR Kunststoff GmbH; GREENMANTRA; Avient Corporation. The bio-based polypropylene in medical devices market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Bio-based Polypropylene In Medical Devices Companies:

The following are the leading companies in the bio-based polypropylene in medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- Borealis AG

- Braskem

- Total S.A.

- Danimer Scientific

- FKuR Kunststoff GmbH

- GREENMANTRA

- Avient Corporation

Recent Developments

-

In October 2024, Ducor Petrochemicals announced a new exclusive distribution agreement with KUNSTSTOFFEXPRESS, which will enable KUNSTSTOFFEXPRESS to distribute Ducor's DuCare medical polypropylene in Germany, Austria, and Switzerland.

-

In January 2024, Avient Corporation showcased its bio-based polymer solutions at Pharmapack 2024, a significant trade show for the pharmaceutical packaging and drug delivery industry, held in Paris on January 24-25, 2024. These solutions include bio-based polypropylene, polymer colorants and additives as well as bio-derived thermoplastic elastomers designed to lower the carbon footprint of healthcare products.

Bio-based Polypropylene In Medical Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 16,695.36 thousand |

|

Revenue forecast in 2030 |

USD 40,626.42 thousand |

|

Growth rate |

CAGR of 19.47% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in tons; revenue in USD thousand, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; The Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; United Arab Emirates (UAE); and South Africa |

|

Key companies profiled |

SABIC; LyondellBasell Industries Holdings B.V.; Mitsui Chemicals, Inc.; Borealis AG; Braskem; Total S.A.; Danimer Scientific; FKuR Kunststoff GmbH; GREENMANTRA; Avient Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bio-based Polypropylene In Medical Devices Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-based polypropylene in medical devices market report on the basis of application, and region:

-

Application Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Heart Valve Structures

-

Surgery Sutures

-

Surgical Mesh

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-based polypropylene in medical devices market size was estimated at USD 13.67 million in 2023 and is expected to reach USD 16.70 million in 2025.

b. The global bio-based polypropylene in medical devices market is expected to grow at a compound annual growth rate of 19.5% from 2025 to 2030 to reach USD 40.63 million by 2030.

b. Heart Valve Structures accounted to the largest share in global bio-based polypropylene in medical devices market with revenue share of 35.50% in 2022.

b. Major players present across the market include SABIC; LyondellBasell Industries Holdings BV; Mitsui Chemicals, Inc.; Borealis AG; Braskem; Total S.A.; Danimer Scientific; FKuR Kunststoff GmbH; GREENMANTRA; and Avient Corporation.

b. Cost-effectiveness and advancement in technology are factors propelling the demand for bio-based polypropylene for manufacturing of medical devices, especially used as implants across the human anatomy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."