Bio-based Polypropylene Market Size, Share & Trends Analysis Report By Application (Injection, Textile, Films), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-317-1

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Bio-based Polypropylene Market Trends

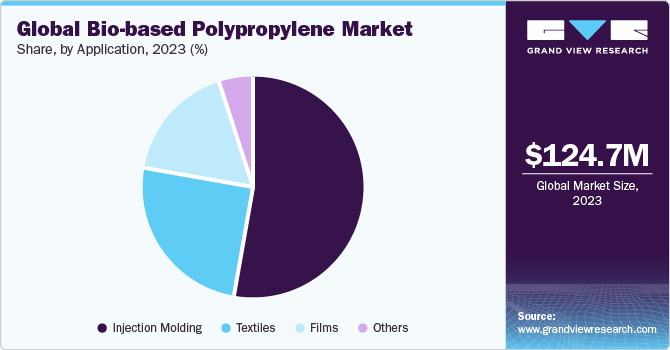

The global bio-based polypropylene market size was estimated at USD 124.7 million in 2023 and is expected to grow at a CAGR of 18.2% from 2024 to 2030. The global demand for bio-based polypropylene is expected to increase due to the growing use of environmentally friendly plastic products in various industries, such as food, textiles, and pharmaceuticals. Growing global concerns about petrochemical toxicity and the depletion of crude oil reserves have led to the development of bio-based polymers worldwide. The global plastics industry is expected to increase bioplastic production in the coming years to comply with government regulations that restrict the consumption of petroleum-based plastics in the automotive and food packaging industries, as well as in medical devices.

Thus, rising environmental concerns over the use of petroleum-based plastics have led to the global demand for alternative plastics. As manufacturers are shifting their focus toward developing bioplastics, they carry out continuous innovations in their existing products and develop new products. The global demand for bio-based polypropylene is expected to increase in the coming years due to the increasing use of environmentally friendly plastics in the food and beverage, textiles, and pharmaceutical industries.

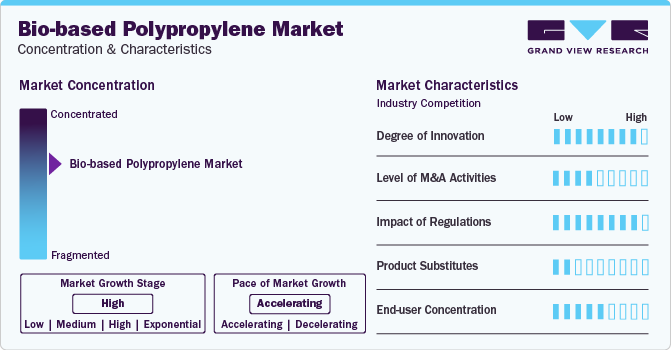

Market Concentration & Characteristics

The market space is slightly consolidated by the presence of key companies, such as Braskem, Biobent Polymers, SABIC, LyondellBasell Industries Holdings B.V., Nature Plast, Prime Polymer Co., Ltd., and FKuR Kunststoff GmbH. These companies undertake various strategic initiatives, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their presence in the market. For instance, in August 2023, Kikkoman Biochemifa Company announced the adoption of 100% biomass-based polypropylene by replacing petroleum-based polypropylene using the mass balance approach.

Industries are resorting to alternatives to petroleum-based plastics owing to increasing environmental awareness and sustainability initiatives worldwide. Bio-based polypropylene, which is derived from renewable biomass sources, is an eco-friendly option. It reduces the requirement for finite fossil fuel resources for developing plastics and mitigates greenhouse gas (GHG) emissions throughout its lifecycle.

Application Insights

The injection molding segment accounted for the largest revenue share of 53.4% in 2023 in terms of revenue. The rising usage of injection molded bio-based polypropylene products for the production of several automotive interior and exterior components is expected to boost the segment growth.

The incorporation of bio-based polypropylene into the textile industry is prompted by many drivers, reflecting a growing recognition of the imperative for sustainable practices within textile manufacturing. One of the significant drivers is the growing awareness of environmental degradation caused by conventional textile production. As competition in the global market increases, textile manufacturers are seeking ways to differentiate their products while optimizing costs.

Regional Insights

The North American bio-based polypropylene market is expected to grow at a CAGR of 17.8% from 2024 to 2030 due to the increasing demand for lightweight automotive materials and the growing textile industry. This polymer is crafted from vegetable oils, corn, and sugarcane, making it a sustainable innovation in the market. This has created opportunities for new players to enter the regional market. For instance, in April 2023, Lummus Technology and Citronq Chemicals signed a letter of intent (LOI) to develop Citroniq's green polypropylene projects in North America.

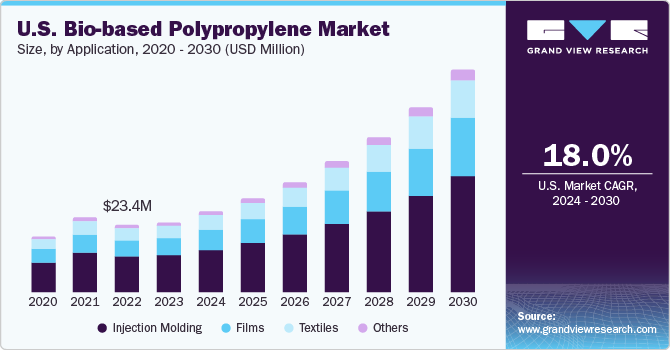

U.S. Bio-based Polypropylene Market Trends

The bio-based polypropylene market in the U.S. dominated the North America regional market in 2023 with a share of 73.4%. In January 2023, Braskem announced its investment in the production of bio-based polypropylene with a negative carbon footprint in the U.S. The bio-based polypropylene produced by Braskem will be a drop-in solution and possess the same recyclability and technical properties as those found in its current PP portfolio.

Europe Bio-based Polypropylene Market Trends

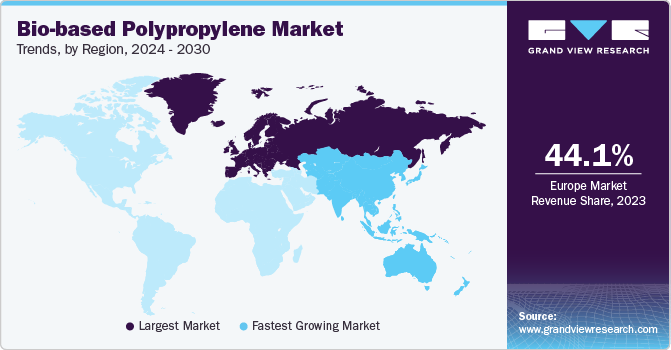

The Europe bio-based polypropylene market accounted for a revenue share of 44.1% in 2023. The regional market growth is attributed to several regulations implemented by the European Commission that support the use of bio-based polymers in various applications, such as the automotive industry, pharmaceutical, and food & beverage industries, owing to their high biomass content and low GHG emissions during manufacturing.

The bio-based polypropylene market in the UK is projected to grow over the forecast period owing to increasing awareness among the masses regarding environmental sustainability and plastic pollution. As the local government is focusing on transitioning toward clean and highly sustainable energy sources, the demand for bio-based polypropylene for use in renewable energy systems is increasing.

The France bio-based polypropylene market is anticipated to grow at a significant pace of 18.8% from 2024 to 2030. The focus of the Government of France on advancing its infrastructure, particularly related to water and wastewater management, drives product usage. The Government of France has also undertaken initiatives to manage plastic waste in the country. This is expected to help it develop a circular economy for plastic waste.

The bio-based polypropylene market in Germany is projected to witness considerable growth in the future. The rapidly expanding packaging industry in Germany boosts product demand, thereby supporting market growth. As Germany is a trade and commerce hub in Europe, there is an increasing demand for efficient and sustainable packaging solutions in the country. The role of bio-based polypropylene in the manufacturing of cost-effective and reliable packaging solutions aligns with the evolving requirements of sustainable packaging, in the packaging industry in the country, thereby contributing to its consistent demand.

Asia Pacific Bio-based Polypropylene Market Trends

The Asia Pacific bio-based polypropylene market is estimated to register the fastest CAGR of 19.2% from 2024 to 2030 due to the high demand for automobiles, improving infrastructure in manufacturing facilities, and a rise in consumer disposable income levels.

The bio-based polypropylene market in Australia is projected to grow significantly over the forecast years. The rising awareness among the masses in the country toward environmental sustainability and plastic pollution has surged the demand for bio-degradable plastics in Australia. This has attracted companies to enter the market in the country and tap its growth potential.

The China bio-based polypropylene market dominated the APAC regional market in 2023 with a share of 37.4%. The country is one of the prominent consumers of non-alcoholic beverages in the world. This, in turn, contributes to the demand for bio-based polypropylene in the packaging industry in China.

The bio-based polypropylene market in India is projected to have significant growth from 2024 to 2030. The automotive industry in India is experiencing continuous growth and modernization in terms of technology and environmental sustainability. This, in turn, is leading to an increased product demand for use in various applications in this industry.

Central & South America Bio-based Polypropylene Market Trends

The Central & South America bio-based polypropylene market is anticipated to grow at a CAGR of 16.6% from 2024 to 2030. The focus on sustainability and environmental considerations is expected to drive the regional market growth. With the growing awareness of environmental issues, there is an increasing emphasis on adopting eco-friendly practices and materials.

Middle East & Africa Bio-based Polypropylene Market Trends

The Middle East & Africa bio-based polypropylene market is showing promising growth, driven by investments in sustainable materials and the increasing adoption of bio-based alternatives due to strict regulations on single-use plastics.

Key Bio-based Polypropylene Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, research & development, new product launches, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In August 2023, Neste, LyondellBasell Industries Holdings B.V., Biofibre, and Naftex Internacional developed a value chain that combines bio-based polymers including polypropylene (PP) with natural fiber to produce construction elements. The use of PP with detectable bio-based content and natural fiber in construction elements results in carbon storage, which can help combat climate change

-

In January 2023, Braskem announced a project to evaluate an investment in producing carbon-negative bio-based polypropylene (PP) in the U.S. The project would make use of Braskem's proven, proprietary technology to convert bioethanol into physically segregated bio-based polypropylene. The company explored collaboration prospects for this initiative with several clients, brand owners, and suppliers

Key Bio-based Polypropylene Companies:

The following are the leading companies in the bio-based polypropylene market. These companies collectively hold the largest market share and dictate industry trends.

- Braskem

- Biobent Polymers

- SABIC

- LyondellBasell Industries Holdings B.V.

- NaturePlast

- Prime Polymer Co., Ltd.

- FKuR

- CITRONIQ, LLC.

- BiologiQ, Inc.

- Trellis Bioplastics

Bio-based Polypropylene Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 143.7 million |

|

Revenue forecast in 2030 |

USD 391.6 million |

|

Growth rate |

CAGR of 18.2% from 2024 to 2030 |

|

Base year |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Australia; Brazil; Saudi Arabia |

|

Key companies profiled |

Braskem; Biobent Polymers; SABIC; LyondellBasell Industries Holdings B.V.; NaturePlast; Prime Polymer Co., Ltd.; FKuR; CITRONIQ, LLC.; BiologiQ, Inc.; Trellis Bioplastics |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bio-based Polypropylene Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the bio-based polypropylene market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Textiles

-

Films

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bio-based polypropylene market size was estimated at USD 124.7 million in 2023 and is expected to reach USD 143.7 billion in 2024.

b. The global bio-based polypropylene market is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 391.6 million by 2030.

b. Europe dominated the bio-based polypropylene market with a share of 44% in 2023. This is attributable to rising application bio-based polymers owing to high biomass content and low GHG emissions during manufacturing.

b. Some key players operating in the bio-based polypropylene market include Evonik Industries AG; BASF SE; Saudi Basic Industries Corporation (SABIC); DowDuPont Inc.; Arkema SA; Celanese Corporation; and Toray Industries, Inc.

b. Key factors that are driving the market growth include increase in demand for lightweight automotive materials and rising adoption of sustainable packaging solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."