Bio-based Polyethylene Market Size, Share & Trends Analysis Report By Type (Bio-based LDPE, Bio-based HDPE, Bio-based LLDPE), By Material (Rigid, Flexible), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-258-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Bio-based Polyethylene Market Trends

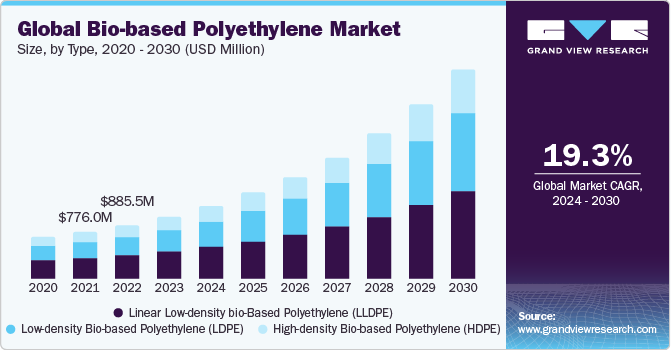

The global bio-based polyethylene market size was estimated at USD 1,030.3 million in 2023 and is expected to grow at a CAGR of 19.3% from 2024 to 2030. The global demand for recycled polyethylene (PE), coupled with efforts to promote circular economy practices is expected to drive innovations in material recovery and recycling technologies to address environmental challenges and foster sustainability. The increasing emphasis on reducing plastic waste and addressing environmental concerns is driving the adoption of bio-based PE in the U.S. Bio-based PE supports the country’s commitment to mitigating plastic pollution, reducing dependence on fossil fuels, and promoting a circular economy by offering a viable solution for more sustainable and environmentally friendly material use.

Moreover, with the growing awareness of the finite nature of fossil fuel resources and concerns about energy security, there is an increasing emphasis on transitioning toward renewable and bio-based alternatives.For instance, in April 2023, the U.S. Department of Energy (DOE) allocated funding worth USD 13.4 million for innovative technologies to reduce energy consumption and carbon emissions associated with single-use plastics. This financial commitment aligns with the DOE's commitment to tackling the challenges of plastic waste recycling.

It establishes a clean energy economy, ultimately working toward achieving net-zero carbon emissions in the U.S. by 2050. One of the major challenges faced by the market includes the high cost of product materials compared to conventional polymers, which are subject to fluctuate according to demand and supply. This can make it difficult for companies to plan for the long term and can also make it challenging to ensure that the price of bio-based PE provides a sufficient financial incentive for production.

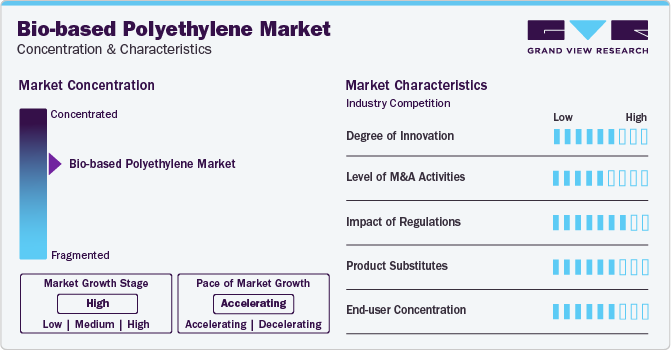

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include LyondellBasell Industries Holdings B.V., Borealis AG, Iwatani Corporation, Braskem, and Dow, among others. Several players are engaged in framework development to improve their market share.

For instance, in January 2024, INEOS Olefins & Polymers Europe launched the world's first fully sustainable gas pipeline, crafted from bio-based high-density polyethylene (HDPE) manufactured by INEOS. This bio-based, certified HDPE boasts a substantially reduced carbon footprint as compared to traditional fossil-based polymers. Notably, all polymers provided by INEOS Olefins & Polymers Europe are not only 100% recyclable but also contribute to the overall lower carbon footprint associated with the bio-based HDPE

Regulations in the plastic industry have a significant impact, driving industry players to invest in advanced technologies and quality assurance measures for the production of sustainable materials, which can be recycled. Compliance with regulatory frameworks ensures patient safety, fosters innovation, and establishes trust among customers.

Bio-based PE technologies are more expensive to develop, manufacture, and implement than conventional plastic technologies, especially for smaller manufacturers with limited resources. This can create potential growth for conventional substitutes for the market, mainly in underdeveloped economies.

Companies are pursuing regional expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for bio-based materials including bio-based polyethylene in each region.

Type Insights

In terms of revenue, the HDPE segment accounted for the largest revenue share of 44.20% in 2023. The increasing global attention toward mitigating plastic waste and addressing environmental pollution is driving the HDPE segment’s growth. Moreover, the increasing global emphasis on sustainability and growing awareness of environmental concerns associated with traditional plastic materials are driving the segment's growth.

Low-density polyethylene (LDPE), derived from renewable biomass sources, aligns with the growing demand for eco-friendly alternatives, thus contributing to the growth of the LDPE type segment. The increased focus on reducing carbon footprints and adopting more sustainable practices across industries fuels the adoption of LDPE in the market.

Material Insights

In terms of materials, the flexible material segment led the market in 2023 and accounted for a substantial revenue share of 63.11% owing to the huge volume of sales and production of flexible bio-based PE globally. Bio-based LDPE offers high flexibility in several packaging applications, including trash bags, liners, and films.

The rigid material segment is projected to grow significantly at a CAGR of 18.9% over the forecast period. The automotive sector increasingly incorporates rigid materials for interior components, benefiting from the sustainability profile and versatile mechanical properties of bio-based PE.

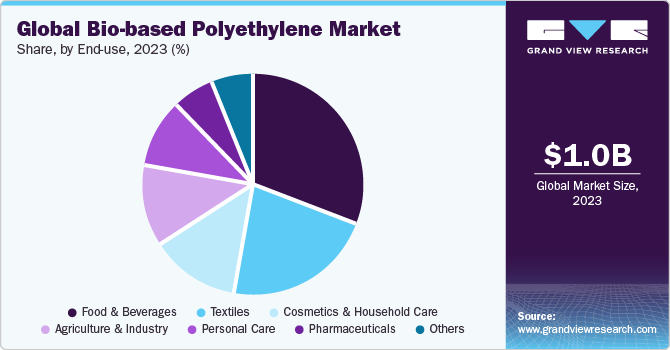

End-use Insights

The food & beverages segment accounted for the largest revenue share of over 31.10% in 2023. The increasing demand for sustainable packaging solutions in the food & beverage industry is expected to drive product demand in this end-use segment. Bio-based PE offers a more environmentally friendly alternative to traditional petroleum-based plastics. With growing awareness of environmental consciousness, food and beverage companies are seeking packaging materials that align with sustainable practices, thus driving the adoption of bio-based polyethylene in this industry.

In addition, the agriculture & industry segment is anticipated to grow at the fastest CAGR of 21.3% from 2024 to 2030 owing to the increasing awareness of environmental sustainability in agriculture practices. Bio-based PE from renewable sources like sugarcane, provides a greener alternative to conventional plastics commonly used in agricultural applications. As the agricultural sector seeks more eco-friendly solutions, there is a rising demand for bio-based polyethylene in applications such as mulch films, greenhouse films, and agricultural packaging.

Regional Insights

North America bio-based polyethylene (PE) market accounted for a share of 20.55% in 2023. With an increasing focus on reducing dependency on imported fossil fuels and promoting domestic industries, governments in the region are exploring ways to support the growth of bio-based materials.Favorable trade policies and economic incentives are expected to encourage businesses in North America to adopt bio-based PE, thus fostering robust and sustainable market growth.

U.S. Bio-Based Polyethylene Market Trends

The Bio-Based Polyethylene (PE) Market in the U.S. is expected to grow over the forecast period. The increasing emphasis on reducing plastic waste and addressing environmental concerns is driving product adoption in the U.S. Bio-based PE supports the country’s commitment to mitigating plastic pollution, reducing dependence on fossil fuels, and promoting a circular economy by offering a viable solution for more sustainable and environmentally friendly material use.

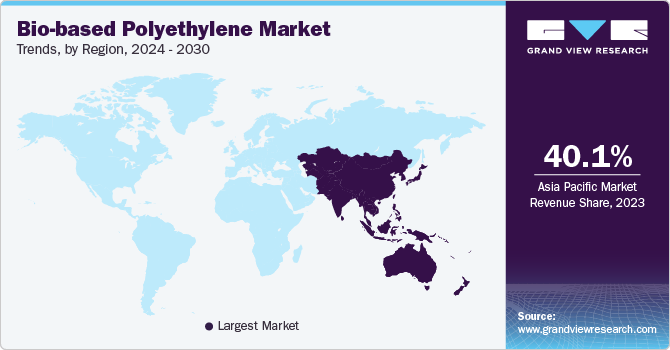

Asia Pacific Bio-Based Polyethylene Market Trends

The Asia Pacific bio-based polyethylene (PE) market dominated the global market in 2023 with a share of over 40.15%. Growing concerns over energy security are driving product demand in Asia Pacific. In addition, the rise of e-commerce is expected to drive regional market growth. With a surge in online shopping and home deliveries, there is an increased demand for bio-based PE packaging. Bio-based PE, being biodegradable and derived from renewable sources, is well-suited for eco-friendly packaging applications.

Bio-Based Polyethylene (PE) Market in China held a significant share of the Asia Pacific regional market. The market is anticipated to register a CAGR of 21.1% over the forecast period. The fluctuating prices of petrochemical-based PE have led industries to explore alternatives that offer price stability. Bio-based PE, derived from renewable resources, provides a more predictable cost structure compared to its petroleum-based counterparts.

India Bio-Based Polyethylene (PE) Market is expected to grow at the fastest CAGR from 2024 to 2030. Infrastructure development and urbanization are propelling the market growth in the country. The Indian government is investing in urban expansion and modern infrastructure, leading to the growing demand for sustainable construction materials. Product integration into construction materials aligns with sustainable building practices and contributes to the overall green initiatives associated with urban development in the country.

Europe Bio-Based Polyethylene Market Trends

Bio-based polyethylene (PE) market in Europe is expected to witness significant growth over the forecast period. The transition toward a circular economy in Europe is accelerating product adoption. European countries are promoting circular practices prioritizing resource efficiency, waste reduction, and recycling.

Germany Bio-Based Polyethylene (PE) Market held a significant share in Europe. The market is anticipated to register a CAGR of 21.2% over the forecast period. The transition toward a circular economy in Europe is accelerating product adoption.

The bio-Based Polyethylene (PE) Market in Italy is expected to grow significantly in the coming years. The role of certification and eco-labeling programs in Italy drives the adoption of bio-based PE. Moreover, the surge in online shopping has led to a heightened awareness and demand for sustainable and eco-friendly packaging solutions. Product adoption in packaging materials for shipped goods aligns with broader e-commerce trends in Italy and reflects the industry's commitment to addressing environmental concerns.

Central & South America Bio-Based Polyethylene Market Trends

Central & South America Bio-Based Polyethylene (PE) Market is expected to witness significant growth over the forecast period. Government policies and initiatives supporting sustainability contribute to the adoption of bio-based polyethylene in Central and South America.

The bio-Based Polyethylene (PE) Market in Brazil held a significant share in 2023. The market is anticipated to register a CAGR of 14.5% over the forecast period. Environmental certification standards and eco-labeling have been playing a major role in driving product adoption in Brazil. Adopting bio-based PE allows businesses to align with these certification standards, meeting consumer expectations for eco-friendly and responsibly sourced materials.

Middle East & Africa Bio-Based Polyethylene Market Trends

Middle East & Africa Bio-Based Polyethylene (PE) Market is expected to witness significant growth over the forecast period. The product adoption in the region is driven by various factors, such as the availability of rich biomass resources and commitment to sustainable development.

Bio-Based Polyethylene (PE) Market in UAE held a significant share in Central & South America. The market is anticipated to register a CAGR of 14.5% over the forecast period. The tourism industry's focus on sustainability and eco-friendly practices contributes to adopting bio-based polyethylene in the UAE. With the UAE being a major tourism hub, the hospitality sector increasingly incorporates sustainable practices including bio-based materials.

Key Bio-based Polyethylene Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In November 2023, Neste partnered with Prime Polymer, a subsidiary of Mitsui Chemicals, Inc., to develop an innovative renewable polypropylene packaging material for a seaweed snack sold under the CO/OP brand. The bio-content of the packaging is established using the mass balance method, representing a breakthrough in sustainable packaging solutions. Initially focused on seaweed packaging, Neste and Prime Polymer aim to extend the use of bio-based raw materials to other products in subsequent phases of their collaboration, reinforcing their commitment to environmental stewardship

-

In August 2023, Braskem and SCG Chemicals signed an agreement to establish Braskem Siam Company Limited. This collaborative effort is aimed at commercializing bio-based polyethylene (PE). The partnership leverages Braskem's expertise in bio-based plastics and SCG Chemicals' strong presence in the Asian market, coupled with their proficiency in PE production

-

In June 2023, Dow, an international materials science company, partnered with Procter & Gamble China (P&G China) to develop innovative e-commerce packaging featuring air capsules. This packaging solution comprises P&G China's inventive approach and Dow's advanced PE resins and is designed to provide an effective and efficient means of product protection in e-commerce

Key Bio-based Polyethylene Companies:

The following are the leading companies in the bio-based polyethylene market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Iwatani Corporation

- Braskem

- Dow

- INEOS Group

- Avery Dennison Corporation

- FKuR

- Trioworld

- Gilac

Bio-Based Polyethylene Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1,211.3 million |

|

Revenue forecast in 2030 |

USD 3,491.2 million |

|

Growth rate |

CAGR of 19.3% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, material, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia, Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

LyondellBasell Industries Holdings B.V.; Borealis AG; Iwatani Corp.; Braskem; Dow; INEOS Group; AVERY DENNISON CORP.; FKuR; Trioworld; Gilac |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bio-based Polyethylene Market Report Segmentation

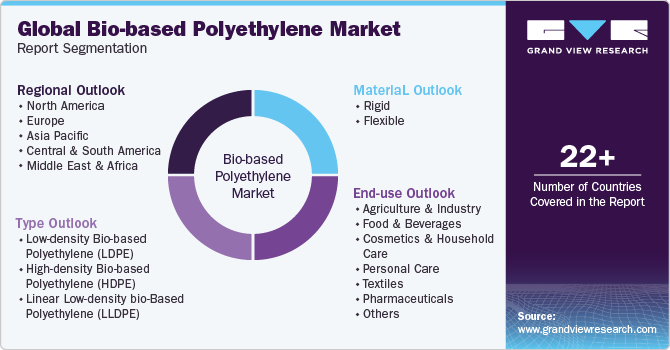

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-based polyethylene market report based on type, material, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Low-density Bio-based Polyethylene (LDPE)

-

High-density Bio-based Polyethylene (HDPE)

-

Linear Low-density bio-Based Polyethylene (LLDPE)

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture & Industry

-

Food & Beverages

-

Cosmetics & Household Care

-

Personal Care

-

Textiles

-

Pharmaceuticals

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-based polyethylene market size was estimated at USD 1,030.3 million in 2023 and is expected to reach USD 1,211.3 million in 2024.

b. The global bio-based polyethylene market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030 to reach USD 3,491.2 million by 2030.

b. High-density Bio-Based Polyethylene (HDPE) held the largest share in the global bio-based polyethylene type segment with more than 44.15% in 2023.

b. Some of the key players operating in the bio-based polyethylene market include LyondellBasell Industries Holdings B.V., Borealis AG, Iwatani Corporation, Braskem, Dow, INEOS Group, and AVERY DENNISON CORPORATION.

b. Key factors driving the bio-based polyethylene market growth include the growing demand for recycled polyethylene, coupled with efforts to promote circular economy practices.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."