- Home

- »

- Renewable Chemicals

- »

-

Bio-based Polycarbonate Market Size & Share Report, 2030GVR Report cover

![Bio-based Polycarbonate Market Size, Share & Trends Report]()

Bio-based Polycarbonate Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Optical Grade, General Purpose Grade), By End Use (Transportation, Electrical And Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-126-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio-based Polycarbonate Market Trends

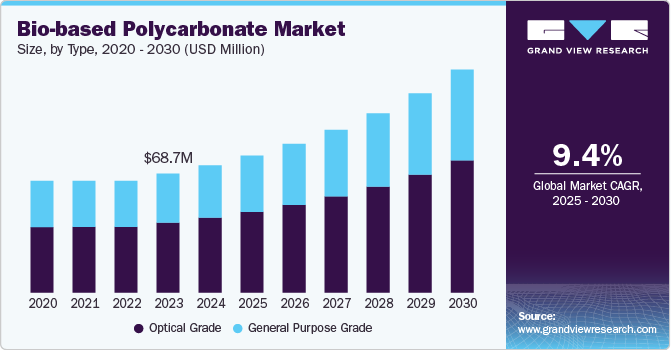

The global bio-based polycarbonate market size was estimated at USD 73.48 million in 2024 and is projected to grow at a CAGR of 9.40% from 2025 to 2030. Growing thermoplastic industrial applications and increased awareness about the environmental impact of petrochemical disposals are projected to fuel global bio-based polycarbonate (PC) growth in the coming years.

The U.S. market for bio-based PC is projected to witness growth due to awareness regarding environmental concerns, technological improvements, regulatory measures, and the shift in consumer preferences for bio-based products. Bio-based polycarbonate is very effective, accounting for its properties such as high thermal resistance, hardness, and transparency. These products help in reducing the carbon footprint due to their high bio-content.

The market is seeing increased traction as industries move toward sustainable alternatives to fossil-based plastics. Bio-based polycarbonate, derived from renewable sources like plant sugars, has been growing in popularity due to its reduced environmental impact and alignment with carbon reduction goals. As consumer awareness and demand for eco-friendly products rise, bio-based polycarbonate is gaining recognition in sectors such as automotive, electronics, and packaging. Furthermore, as regulatory pressures intensify, especially in Europe and North America, manufacturers are increasingly investing in bio-based materials. These shifts are driving R&D activities and partnerships among industry players to create polycarbonate options that offer both performance and environmental advantages.

Drivers, Opportunities & Restraints

A major driver in the market is the push from governments and international organizations for carbon footprint reduction. Policies in regions like the European Union, which promote bio-based and biodegradable materials, incentivize companies to adopt sustainable alternatives. Tax credits, subsidies, and support for R&D into sustainable materials provide a solid foundation for growth. Bio-based polycarbonates help companies meet emissions targets, enhancing brand image and allowing them to address consumer preferences for green products. This supportive regulatory framework makes bio-based polycarbonate a highly attractive option for manufacturers seeking sustainable compliance and eco-friendly innovation.

The emergence of bio-based polycarbonate in high-performance applications presents an untapped opportunity for market growth. Industries such as automotive, consumer electronics, and construction are increasingly seeking sustainable materials that also offer resilience and durability. Bio-based polycarbonate fulfills these requirements, positioning it as a viable alternative to traditional polycarbonate. With companies focusing on renewable materials, there is significant potential for bio-based polycarbonate to capture a larger market share by aligning with sustainability objectives. Leveraging these advantages, companies can enter into lucrative partnerships with eco-focused brands, increasing market penetration in sectors where durable, high-performance plastics are essential.

A notable restraint in the bio-based polycarbonate market is the high production cost compared to conventional polycarbonate derived from petrochemical sources. The complexity of extracting and refining bio-based raw materials, coupled with limited production facilities, raises the cost of bio-based polycarbonate, making it less competitive in price-sensitive applications. While demand is growing, economies of scale have yet to be achieved, limiting wider adoption. In addition, the dependency on specific raw materials, which may fluctuate in availability and price, further impacts the cost structure. These cost-related challenges could inhibit the rapid expansion of bio-based polycarbonate in the global market.

Type Insights

Based on type, the optical grade segment led the market with a revenue share of 58.91% in 2024, owing to its increased adoption in high-precision applications, particularly in the electronics and automotive sectors, where optical clarity and environmental responsibility are crucial. Optical grade bio-based polycarbonate offers similar clarity and light transmission properties as conventional optical plastics but with the added benefit of a reduced environmental impact. This makes it particularly appealing for use in lenses, light covers, and smartphone displays, which demand high-quality, clear materials. As consumer electronics and automotive industries face regulatory and market pressure to reduce carbon emissions, they are increasingly sourcing sustainable materials.

The growing demand for sustainable and versatile materials across a variety of applications is a significant driver for general-purpose bio-based polycarbonate. This type is widely used in products where strength, durability, and environmental compatibility are essential but where optical clarity is not a primary concern, such as in housing parts, containers, and construction materials. The shift toward greener products in consumer goods and industrial applications has increased interest in bio-based alternatives that offer similar durability and heat resistance to traditional polycarbonate but with lower environmental impact.

End Use Insights & Trends

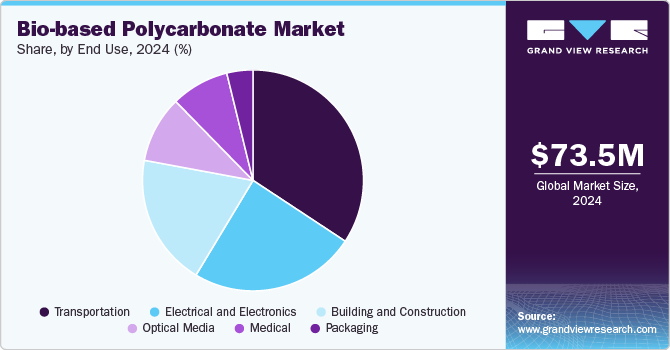

Based on end use, the transportation segment dominated the market with the largest revenue share of 34.28% in 2024, driven by the shift toward sustainable, lightweight materials that enhance fuel efficiency and reduce emissions. Bio-based polycarbonate provides a robust yet lightweight alternative to metal and traditional petrochemical plastics, making it particularly advantageous for automotive components such as dashboards, headlamp lenses, and interior panels. As regulatory pressures for reduced vehicle emissions grow, especially in North America and Europe, automakers are increasingly integrating materials that support sustainability goals.

In the electrical and electronics industry, the push for environmentally friendly, high-performance materials is a key driver for the use of bio-based polycarbonate. This material’s excellent insulation properties, combined with its durability and resistance to high temperatures, make it well-suited for electronic housings, circuit boards, and components. As consumers increasingly prioritize eco-friendly electronics, manufacturers are under pressure to reduce their carbon footprint across all production stages, from materials to manufacturing processes. Bio-based polycarbonate not only meets the stringent safety and functional requirements for electronic components but also aligns with the growing trend of using sustainable materials in consumer and industrial electronics.

Regional Insights

The North America bio-based polycarbonate market is driven by the corporate and consumer preferences for sustainable materials. Many industries, including automotive, electronics, and packaging, are embracing green materials to meet corporate sustainability targets and align with environmental goals. Furthermore, several major companies in the U.S. and Canada have set ambitious carbon neutrality targets, which are pushing them to explore bio-based alternatives. Bio-based polycarbonate, with its versatility and lower environmental impact, is becoming a favored option, especially as regulatory bodies implement more policies to curb plastic waste. These factors collectively support the growth of bio-based polycarbonate adoption across North America.

U.S. Bio-based Polycarbonate Market Trends

The bio-based polycarbonate market in the U.S. is gaining momentum largely due to federal and state policies that promote the use of sustainable materials. Recent government incentives, grants, and R&D funding are enabling companies to explore renewable materials to replace fossil-fuel-derived plastics. Bio-based polycarbonate offers a strong alignment with these policy trends, making it increasingly popular in sectors like automotive, healthcare, and electronics. Consumer interest in environmentally conscious products further supports this shift, particularly among millennials and Gen Z, who are increasingly driving purchasing trends toward sustainable options. This combination of policy support and changing consumer preferences is propelling bio-based polycarbonate adoption in the U.S.

Europe Bio-based Polycarbonate Market Trends

The bio-based polycarbonate market in Europe is driven by strict environmental regulations and aggressive targets to reduce greenhouse gas emissions. The European Union’s Green Deal and Circular Economy Action Plan emphasize the importance of renewable and recyclable materials, creating a favorable environment for bio-based polycarbonate growth. Industries across Europe, from automotive to packaging, are transitioning to sustainable materials to meet EU targets and avoid penalties associated with excessive carbon emissions.

Asia Pacific Bio-based Polycarbonate Market Trends

The Asia Pacific bio-based polycarbonate market dominated globally and accounted for the largest revenue share of 38.15% in 2024, which is attributed to the growing focus on sustainable development and eco-friendly materials is a significant driver for the bio-based polycarbonate market. Rapid industrialization, especially in countries like India, Japan, and South Korea, has brought attention to the environmental impact of conventional plastics. Governments are encouraging industries to adopt renewable materials through initiatives promoting greener supply chains and reduced emissions. Bio-based polycarbonate fits well within this framework as it allows manufacturers to produce high-performance products while reducing their carbon footprint.

China bio-based polycarbonate market is driven by the push for advanced manufacturing and reduced reliance on fossil-based materials. The Chinese government has introduced environmental policies that encourage companies to reduce emissions and invest in cleaner technologies. Bio-based polycarbonate, offering high-performance qualities similar to traditional polycarbonate but with lower environmental impact, is gaining traction in the automotive, electronics, and packaging sectors. As China positions itself as a global leader in sustainable manufacturing, domestic companies are increasingly adopting bio-based materials to enhance their international competitiveness and align with the nation’s environmental goals. This industrial shift is expected to drive significant growth for bio-based polycarbonate within China’s rapidly modernizing economy.

Key Bio-based Polycarbonate Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Mitsubishi Chemical Corp., Covestro AG; SABIC; and TEIJIN LIMITED. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Bio-based Polycarbonate Companies:

The following are the leading companies in the bio-based polycarbonate market. These companies collectively hold the largest market share and dictate industry trends.

- Mitsubishi Chemical Corp

- Covestro AG

- SABIC

- TEIJIN LIMITED

Recent Developments

-

In February 2023, Mitsui Chemicals and Mitsubishi Gas Chemical Company announced a collaboration to produce and market biomass polycarbonate products as part of their commitment to achieving carbon neutrality by 2050. Mitsubishi Gas Chemical (MGC) started manufacturing biomass PC using biomass-derived bisphenol A (BPA) provided by Mitsui Chemicals. This BPA is developed under Mitsui's BePLAYER brand.

-

In January 2023, Teijin Limited announced that it is now producing and marketing polycarbonate resin made from BPA, having received ISCC PLUS certification for these sustainable products. This makes Teijin the first Japanese company to achieve this certification for polycarbonate resin. The new biomass-based resins maintain the same physical properties as traditional petroleum-based resins, making them suitable for applications like automotive headlamps and electronic components.

Bio-based Polycarbonate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 79.19 million

Revenue forecast in 2030

USD 128.84 million

Growth rate

CAGR of 9.40% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Mitsubishi Chemical Corp.; Covestro AG; SABIC; TEIJIN LIMITED

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-based Polycarbonate Market Report Segmentation

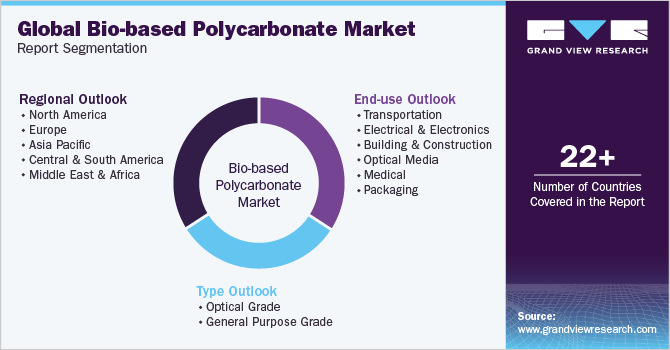

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-based polycarbonate market report based on type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Optical Grade

-

General Purpose Grade

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Electrical and Electronics

-

Building and Construction

-

Optical Media

-

Medical

-

Packaging

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-based polycarbonate market size was estimated at USD 73.48 million in 2024 and is expected to reach USD 79.19 million in 2025.

b. The global bio-based polycarbonate market is expected to grow at a compound annual growth rate of 9.40% from 2025 to 2030 to reach USD 128.84 million by 2030.

b. Based on type, the optical grade segment led the market with a revenue share of 58.91% in 2024 owing to its increased adoption in high-precision applications, particularly in electronics and automotive sectors where optical clarity and environmental responsibility are crucial.

b. Some key players operating in the bio-based polycarbonate market include Mitsubishi Chemical Corp., Covestro AG, SABIC, and TEIJIN LIMITED

b. Key factors that are driving the bio-based polycarbonate market growth include growing thermoplastics industrial applications and increased awareness about the environmental impact of petrochemical disposals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.