Bio-based Isocyanate Market Size, Share & Trends Analysis Report By Application (Foams, Adhesives & Sealants, Paints & Coatings), By Region (North America, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-546-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Bio-based Isocyanate Market Size & Trends

The global bio-based isocyanate market size was estimated at USD 5.75 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The global bio-based isocyanate industry growth is driven by increasing consumer and regulatory pressure for sustainable and environmentally friendly products. Governments worldwide are implementing stringent regulations aimed at reducing carbon emissions and encouraging the use of bio-based chemicals over petrochemical-based alternatives. This has created significant opportunities for bio-based isocyanates, which are used in various applications, including coatings, adhesives, sealants, and elastomers. The rising awareness among industries about the benefits of bio-based products, such as reduced ecological footprint and enhanced product performance, further fuels market growth.

Advancements in bio-based chemical technologies are also a crucial factor driving the market growth. Innovations in bio-based feedstock processing and the development of cost-effective production methods have improved the scalability and economic feasibility of bio-based isocyanates. Additionally, collaborations between industry players and research institutions are fostering the development of new applications and products, further boosting the market’s expansion. These technological advancements align with global sustainability trends, making bio-based isocyanates a preferred choice for various end-use industries.

Another key driver is the growing demand for bio-based polyurethanes across industries such as automotive, construction, and furniture. In the automotive sector, for instance, manufacturers are increasingly adopting bio-based materials to meet sustainability goals while maintaining performance standards. Similarly, the construction industry is witnessing a shift towards eco-friendly materials for insulation, flooring, and other applications. The versatility of bio-based isocyanates in these sectors, coupled with their ability to enhance durability and functionality, is significantly propelling market demand.

Drivers, Opportunities & Restraints

The growing focus on reducing reliance on non-renewable resources is a key driver of the bio-based isocyanate industry. Governments and organizations worldwide are promoting the use of bio-based materials through incentives and subsidies, encouraging industries to transition to sustainable alternatives. Increasing consumer demand for eco-friendly products, especially in sectors such as automotive, packaging, and construction, has further fueled the adoption of bio-based isocyanates. Additionally, advancements in biotechnology and bio-refining processes have made it easier to produce bio-based isocyanates with enhanced properties, improving their competitiveness with petroleum-based counterparts. This aligns with global sustainability goals, driving greater adoption across industries.

The market presents significant growth opportunities due to ongoing advancements in bio-based polymer technology and the increasing availability of renewable feedstocks. Innovations in agricultural waste utilization and lignocellulosic biomass conversion are expected to enhance the cost-effectiveness and scalability of bio-based isocyanate production. Moreover, the rising trend of green building initiatives and sustainable manufacturing practices across various sectors creates an opportunity for manufacturers to expand their product portfolios with bio-based options. Additionally, untapped markets in developing regions, where industrialization and environmental regulations are gaining traction, offer a lucrative space for market expansion.

Despite its potential, the global bio-based isocyanate market faces challenges such as high production costs compared to conventional isocyanates. Limited availability of raw materials and the complexities involved in processing bio-based alternatives pose further constraints to market growth. Additionally, the lack of awareness about bio-based isocyanates in emerging economies and the resistance to adopting new materials in traditional industries can hinder market penetration. Competitive pricing from well-established petroleum-based isocyanates also presents a barrier, especially for cost-sensitive applications in developing markets.

Application Insights

The paints & coatings segment held the largest revenue share of over 31.0% in 2024. The booming construction and automotive industries are driving the adoption of bio-based isocyanates. Paints and coatings play a vital role in these industries, and the increasing focus on sustainability and green building initiatives has led to a rise in demand for bio-based solutions. Similarly, advancements in bio-based isocyanate technology have enhanced the performance of paints and coatings, improving their durability, chemical resistance, and adhesion, making them a viable alternative to traditional products.

The foams segment is anticipated to grow significantly at a CAGR of 5.8% over the forecast period. A key driver is the increasing adoption of bio-based foams in the automotive sector. Automakers are under pressure to reduce vehicle weight to improve fuel efficiency and meet emissions standards. Bio-based foams, used in vehicle interiors, seating, and cushioning, offer a lightweight and sustainable solution. This trend is particularly strong in electric vehicles, where reducing weight is critical to maximizing battery performance and range.

Regional Insights

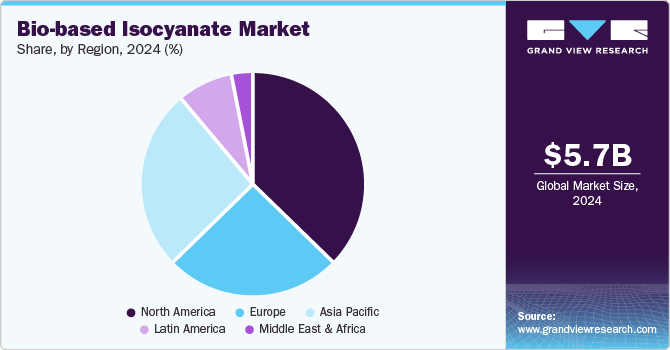

The North America bio-based isocyanate industry held the highest revenue share of 37.4% in 2024. The market growth is driven by the increasing environmental consciousness and the growing demand for sustainable solutions across industries. As consumers and businesses alike focus on reducing their carbon footprint, the adoption of bio-based materials, including isocyanates, is gaining significant traction. Governments and regulatory bodies in North America are also implementing stringent environmental policies to reduce emissions and phase out petroleum-based chemicals, creating a favorable environment for the growth of bio-based isocyanates.

U.S. Bio-based Isocyanate Market Trends

The U.S. automotive industry plays an important role in driving the demand for bio-based isocyanates. As the country pushes for greener transportation solutions, automakers are increasingly turning to bio-based materials for vehicle interiors, seating, and other components to reduce vehicle weight and improve fuel efficiency. This trend is particularly evident in the rising production of electric vehicles (EVs), where the lightweight and eco-friendly nature of bio-based isocyanates supports manufacturers' sustainability goals.

Asia Pacific Bio-based Isocyanate Market Trends

The construction sector is one of the primary regional growth drivers, fueled by urbanization and large-scale infrastructure projects. The demand for energy-efficient and sustainable building materials, such as bio-based foams for insulation, is on the rise as countries adopt green building initiatives to meet energy conservation goals. Similarly, the automotive industry in Asia Pacific is contributing significantly to market growth. With the increasing production of vehicles and a strong emphasis on lightweight, fuel-efficient designs, bio-based isocyanates are being widely used in vehicle interiors, seating, and cushioning.

China bio-based isocyanate market is expected to grow during the forecast period. China's focus on reducing carbon emissions and promoting sustainable development has led to stricter environmental regulations. These policies encourage industries to adopt eco-friendly materials, boosting the demand for bio-based isocyanates. The rapid growth of sectors such as automotive, construction, and furniture in China has increased the demand for polyurethane products which utilize isocyanates. Bio-based isocyanates offer a sustainable alternative to traditional petrochemical-based options, aligning with the country's industrial expansion and environmental goals.

Europe Bio-based Isocyanate Market Trends

The rise in demand for energy-efficient products and the ongoing innovation in bio-based raw materials are fostering growth of the Europe bio-based isocyanate industry. Government incentives and policies promoting renewable resources further encourage the adoption of bio-based isocyanates, offering significant growth opportunities for manufacturers in the region.

Latin America Bio-based Isocyanate Market Trends

Rising consumer awareness about the environmental impact of products is pushing manufacturers to adopt bio-based solutions to cater to this demand. Government initiatives supporting the use of renewable resources and the development of bio-based chemicals also contribute to the market’s growth. The expanding availability of bio-based feedstocks and advancements in production technologies further enhance the potential for bio-based isocyanate adoption in Latin America, driving the growth of the Latin America bio-based isocyanate industry.

Key Bio-based Isocyanate Company Insights

Some of the key players operating in the market include BASF and Covestro.

-

BASF's product offerings include bio-based polyols and isocyanates, such as its "Impranil" series, which are derived from renewable resources and used in applications like coatings, adhesives, and sealants. These products are part of BASF's broader commitment to sustainability, focusing on reducing environmental impact while meeting the performance demands of various industries, including automotive, construction, and furniture.

-

Covestro is a global producer of high-performance materials with a strong focus on sustainability and innovation. The company is actively involved in the bio-based isocyanate market, offering a range of environmentally friendly products that cater to various industries, including automotive, construction, and furniture. Covestro’s bio-based isocyanates, such as Desmodur eco, are made from renewable raw materials and contribute to reducing the carbon footprint of polyurethane applications.

Key Bio-based Isocyanate Companies:

The following are the leading companies in the bio-based isocyanate market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Dow Chemical

- Covestro

- Wanhua Chemical

- Huntsman

- Bayer MaterialScience

- Mitsui Chemicals

- Sinochem International Corporation

Bio-based Isocyanate Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.07 billion |

|

Revenue forecast in 2030 |

USD 8.09 billion |

|

Growth rate |

CAGR of 5.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

BASF; Dow Chemical; Covestro; Wanhua Chemical; Huntsman; Bayer MaterialScience; Mitsui Chemicals; Sinochem International Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Bio-based Isocyanate Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global bio-based isocyanate market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foams

-

Adhesives & Sealants

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bio-based isocyanate market size was estimated at USD 5.75 billion in 2024 and is expected to reach USD 6.07 billion in 2020.

b. The global bio-based isocyanate market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 8.09 billion by 2030.

b. The North America bio-based isocyanate industry held the highest revenue share of 37.4% in 2024. The market growth is driven by the increasing environmental consciousness and the growing demand for sustainable solutions across industries.

b. Some key players operating in the bio-based isocyanate market include BASF; Dow Chemical; Covestro; Wanhua Chemical; Huntsman; Bayer MaterialScience; Mitsui Chemicals; and Sinochem International Corporation.

b. Key factors that are driving the market growth include advancements in bio-based chemical technologies and increasing consumer and regulatory pressure for sustainable and environmentally friendly products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."