- Home

- »

- Renewable Chemicals

- »

-

Bio-Based Construction Polymer Market Size Report, 2030GVR Report cover

![Bio-Based Construction Polymer Market Size, Share & Trends Report]()

Bio-Based Construction Polymer Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Polyurethane, Polyethylene Terephthalate, Epoxies), By Application (Pipes, Insulation, Profile), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-101-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

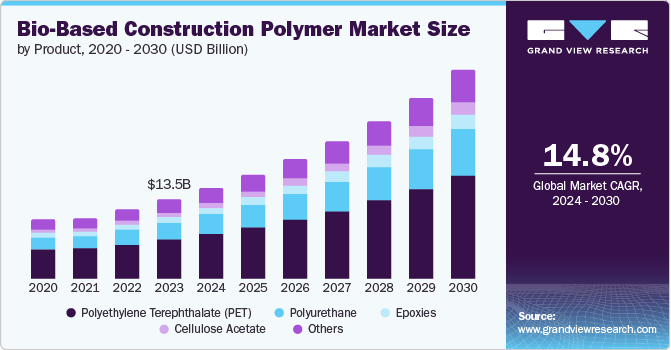

The global bio-based construction polymer market was valued at USD 13.49 billion in 2023 and is expected to grow at a CAGR of 14.8% from 2024 to 2030. This anticipated growth can be attributed to the strategic utilization of renewable resources. Manufacturers have increasingly utilized biomass, agricultural waste, and other renewable feedstocks as raw materials for bio-based polymers. This has aligned with sustainable construction practices, including green building solutions.

In addition, the increasing emphasis on sustainability and environmental consciousness has significantly propelled the demand for bio-based polymers. The polymers derived from natural sources offer an eco-friendly alternative to traditional petroleum-based plastics. The production of bio-based polymers emits fewer greenhouse gases compared to petroleum-based plastics. This reduction in carbon footprint is crucial for mitigating climate change. Additionally, bio-based polymers exhibit biodegradability and compostability as they break down naturally without leaving persistent microplastics.

Furthermore, governments and organizations' increasing prioritization of waste reduction with LEED certification has resulted in the increased usage of bio-based construction polymers. Government investments have increased in research and development to create environmentally friendly renewable products, further leading to the increased utilization of bio-based polymers in the construction industry.

However, high production costs and underdeveloped global supply chains may impede further growth. Despite growing demand for bio-based products, the market has yet to fully capitalize on economies of scale and compete with well-established petroleum-based alternatives.

Product Insights

Polyethylene terephthalate (PET) dominated the market, with 49.5% of the share in 2023. This is attributable to the continued volatility in petroleum prices, which has driven manufacturers and consumers toward sustainable alternatives. Bio-based PET, derived from renewable feedstocks, offers a relatively more stable, eco-friendly option than petroleum-based plastics. Moreover, as environmental awareness grows, manufacturers increasingly utilize bio-based PET as a recyclable, biodegradable, and renewable material for construction.

Polyurethane (PU) is expected to grow substantially during the forecast period, owing to the increasing demand for rigid foam. These materials have excellent thermal insulation properties, which contribute to energy efficiency and reduce the negative impact on the environment. Moreover, the material's superior qualities, including corrosion resistance, strength, and lightweight design, have made it an ideal option for applications in pipes, panels, flooring, and roofing.

Application Insights

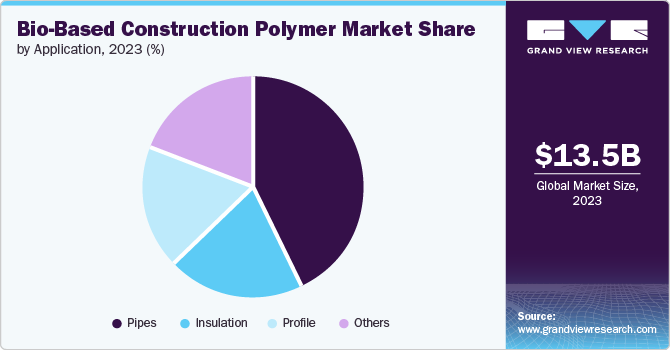

Pipes accounted for the dominant market share in 2023 as bio-based polymers are extensively applied in pipe insulation and fittings. With regulations tightening around energy conservation, the market witnessed a significant demand for bio-based polymers for their thermal properties to enhance energy efficiency in pipes and panels that are essential components in buildings. In addition, the shift toward bio-based materials aligns with global efforts to reduce carbon emissions. The construction industry increasingly seeks eco-friendly materials, including bio-based polymers, as a renewable alternative to traditional plastics, which makes them ideal for pipe applications.

Insulation has emerged as the fastest-growing segment, at a CAGR of 14.8% during the forecast period. This can be credited to the increasing demand for polyurethane, which has insulation properties. These materials are majorly applied in coatings, paints, adhesives, and other construction polymers, particularly in Europe and the U.S.

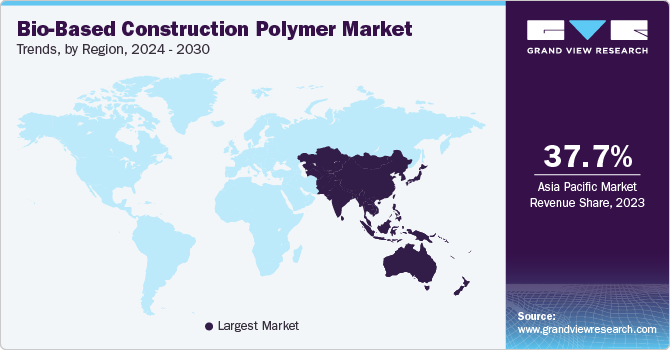

Regional Insights

The Asia Pacific bio-based construction polymer market has dominated with 37.7% of the share in 2023. Factors such as launching new construction projects, rapid economic expansion, and introducing novel products have primarily driven the market growth. China, India, and Japan infrastructure enhancement initiatives, particularly in China, India, and Japan, have created significant demand for paints and other construction materials. The region's favorable environment for bio-based products and increased public construction projects in developing nations are expected to boost demand in the forecast period.

China Bio-Based Construction Polymer Market Trends

The China bio-based construction polymer market dominated the Asia Pacific market. The rapid advancements in biotechnology contributed to the growth of bio-based polymers. Researchers and manufacturers have increasingly explored innovative production methods, cost-effective processes, and improved material properties. These developments enhanced the utilization of bio-based polymers in various construction applications, including insulation, pipes, and flooring products.

North America Bio-Based Construction Polymer Market Trends

The North American bio-based construction polymer market held a share of 22.0% in 2023. The region's escalating construction activities and rapid urbanization have primarily driven the demand for sustainable building materials, including bio-based polymers. Moreover, North American governments have actively promoted green practices with initiatives aimed at reducing carbon footprints to encourage renewable alternatives.

U.S. Bio-Based Construction Polymer Market Trends

Stringent environmental regulations significantly augmented the growth of the U.S. bio-based construction polymers market. These regulations have encouraged builders, architects, and developers to prioritize eco-friendly options and use green certifications such as LEED and Energy Star. Furthermore, industry collaborations, research projects, and partnerships have fostered innovation to develop and promote sustainable building solutions.

Europe Bio-Based Construction Polymer Market Trends

The Europe bio-based construction polymer market held a significant market share in 2023. The region places significant emphasis on circular economy principles, promoting resource efficiency, waste reduction, and material reuse. Green building polymers fit well within this framework, offering recyclability and reducing environmental impact. Moreover, European governments have incentivized sustainable practices through grants, tax breaks, and subsidies, increasing demand for bio-based construction polymer.

Key Bio-Based Construction Polymer Company Insights

Some of the major players in the market are BASF SE, Evonik Industries, and Nature Works LLC. The bio-based construction polymers market operates in a highly competitive environment, with companies increasingly seeking strategic advantages through mergers, acquisitions, and collaborations.

-

Evonik Industries has a significant presence in North America, with over 30 major production sites in the U.S., Canada, and Mexico. The company emphasizes market-oriented research and development and close collaboration with customers to cater to their exact needs.

Key Bio-Based Construction Polymer Companies:

The following are the leading companies in the bio-based construction polymer market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Evonik Industries

- Mitsubishi Gas Chemical Company Inc.

- Nature Works LLC

- Bio-On.it

- Toyobo Co. Ltd.

- DuPont

- TEIJIN limited

- Avient Corporation

- Tate & Lyle

- Hiusan Biosciences

- Kaneka Corporation

- SK Chemicals

- BEWI

- Green Dot Bioplastic

- Solvay

- Trinseo

- World Centric.Com

- Yield10 Bioscience, Inc.

Recent Development

-

In March 2023, BASF SE introduced Sovermol - a bio-polyol product, in Mangalore India. This product caters to the growing demand for environmentally friendly solutions in the Asia Pacific region. It is applied in New Energy Vehicles (NEV), windmills, flooring, and protective industrial coatings.

Bio-Based Construction Polymer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.43 billion

Revenue forecast in 2030

USD 35.33 billion

Growth Rate

CAGR of 14.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, function, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait

Key companies profiled

BASF SE; Evonik Industries ; Mitsubishi Gas Chemical Company Inc.; Nature Works LLC; Bio-On.it; Toyobo Co. Ltd.; DuPont; TEIJIN limited; Avient Corporation; Tate & Lyle; Hiusan Biosciences; Kaneka Corporation; SK Chemicals; BEWI; Green Dot Bioplastic; Solvay; Trinseo; World Centric.Com; Yield10 Bioscience, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio-Based Construction Polymer Market Report Segmentation

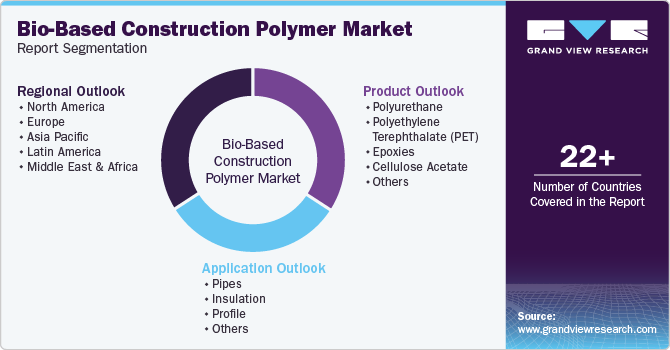

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio-based construction polymer market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Polyethylene Terephthalate (PET)

-

Epoxies

-

Cellulose Acetate

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pipes

-

Insulation

-

Profile

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.