Billboard And Outdoor Advertising Market Size, Share & Trends Analysis Report By Application (Highways, Railway Stations, Buildings, Automobiles), By Type, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-153-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

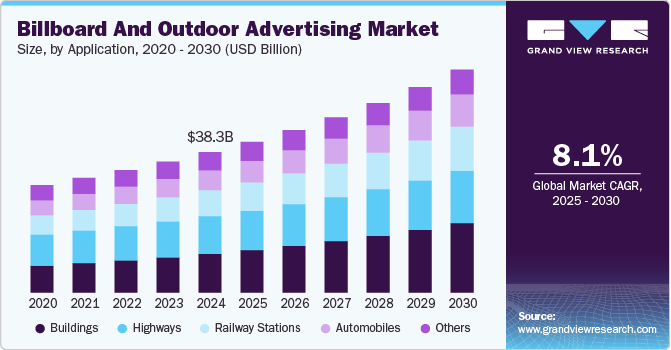

The global billboard & outdoor advertising market size was estimated at USD 38.32 billion in 2024 and is expected to grow at a CAGR of 8.1% from 2025 to 2030, driven by the rising demand for innovative and visually engaging brand promotion in high-traffic locations. This market includes billboards, displays, street furniture, and digital displays, plays a crucial role in reaching large audiences with high-frequency messaging. Outdoor advertising's key advantage lies in its ability to provide continuous exposure, making it especially effective in bustling urban areas. In recent years, digital transformation has reshaped the landscape of billboard advertising, with digital billboards and LED displays allowing dynamic content changes and targeted messaging based on data analytics, weather, or time of day.

The growth in the industry is fueled by advancements in technology, rising urbanization, and increased spending by companies on out-of-home (OOH) advertising, particularly as a complement to digital advertising. As people resume outdoor activities post-pandemic, advertisers are leveraging billboards and other outdoor spaces to capture consumers’ attention outside of digital screens. Billboard advertising remains a pivotal component of the advertising landscape, with the proliferation of digital billboards and the adoption of programmatic purchasing mechanisms fueling growth within the industry. In an ever-evolving technological landscape, it becomes imperative for the industry to remain flexible and seize novel prospects to maintain its relevance and efficacy.

Programmatic digital out-of-home advertising (pDOOH) is experiencing an increasing surge in popularity, driven by the influential factors of data-driven targeting, versatile procurement choices, and the contextual appropriateness of advertising within specific environments. Digital billboards now often incorporate programmatic advertising, allowing advertisers to target specific demographics, adjust campaigns in real-time, and maximize the efficiency of their ad spend.

Application Insights

The highways segment dominated the global market and accounted for a revenue share of over 26.0% in 2024, primarily due to its exceptional visibility and capacity to reach high volumes of daily commuters and long-distance travelers. Highways are prime locations for large-format billboards that can capture attention for extended periods, making them highly effective for brand reinforcement and broad audience reach. Advertisers favor highway billboards to promote products and services as these locations offer sustained exposure, maximizing the impact of campaigns. In addition, advancements in digital billboard technology allow for dynamic, data-driven content, further enhancing engagement.

The buildings segment is expected to experience the fastest CAGR from 2025 to 2030. Billboard advertising on buildings, also known as building wrap advertising, is a dynamic form of outdoor advertising that utilizes the exteriors of tall structures as advertising space. Some buildings are equipped with digital LED screens that serve as dynamic building wraps. These screens allow for real-time content changes, video advertisements, and even interactive elements, providing advertisers with more flexibility and opportunities for engagement. Building wraps have evolved to include 3D elements and interactive features.

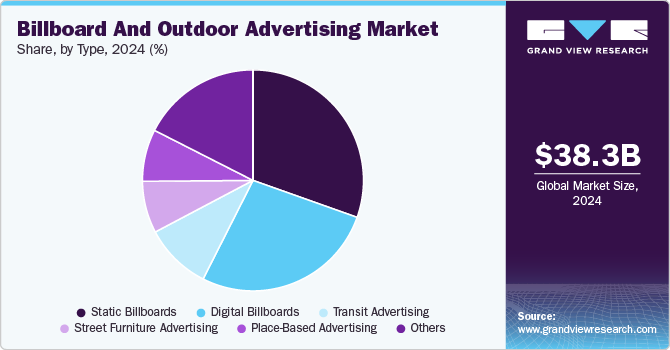

Type Insights

The static billboards segment held the largest revenue share of this market in 2024. Even in the era marked by the ubiquity of digital devices, online advertising, and digital billboards, static billboards maintain their significance and occupy a prominent position within out-of-home (OOH) advertising strategies. A primary factor contributing to the enduring relevance of this medium is its capacity to engage audiences effectively, penetrating the digital noise to leave a lasting impression on viewers. According to the Out of Home Advertising Association of America (OAAA) 2022 report, more than half of urban residents have observed an increased occurrence of OOH messaging and signage compared to the period prior to the pandemic.

The digital billboards segment is projected to grow at the fastest CAGR from 2025 to 2030, driven by its dynamic content capabilities and flexibility. Unlike traditional static billboards, digital billboards allow advertisers to update messaging in real-time, enabling targeted campaigns that can adjust based on factors like time of day, weather, and audience demographics. This adaptability significantly enhances engagement and relevance, as brands can deliver timely, tailored ads that resonate with viewers. Additionally, digital billboards offer higher revenue potential, as multiple ads can be displayed in rotation, maximizing advertiser exposure within a single location.

End-use Insights

The retail segment dominated the market in 2024. The retail industry is constantly evolving, and outdoor advertising plays a significant role in capturing consumer attention and driving foot traffic to physical stores. Retailers are using AR technology in outdoor ads to allow consumers to virtually try on clothing or accessories or see how furniture or home decor items would look in their own homes. Some retailers are incorporating voice-activated ads into their outdoor campaigns, leveraging voice search and smart assistant technology to provide information, answer questions, or direct shoppers to the nearest store location.

The media & advertising segment is expected to witness the fastest CAGR from 2025 to 2030. Media and advertising companies prioritize outdoor advertising as it effectively complements digital strategies by engaging consumers in real-world environments. This segment benefits from a broad array of advertising formats, including billboards, transit ads, and street furniture, making it versatile for various campaigns. Additionally, advances in data analytics and programmatic advertising allow for better targeting and tracking, maximizing the return on investment for advertisers.

Regional Insights

The North America billboard and outdoor advertising market held a significant revenue share in 2024, driven by high advertising expenditures, widespread urbanization, and advanced digital out-of-home (DOOH) infrastructure. The U.S. and Canada boast extensive highway networks, bustling metropolitan areas, and major transit systems, all prime settings for impactful outdoor advertising. The region’s early adoption of digital billboards and data-driven advertising strategies allows brands to reach broad audiences with targeted, real-time messaging. Moreover, North America’s focus on innovation has led to the integration of dynamic content, augmented reality, and interactive features, enhancing viewer engagement.

U.S. Billboard And Outdoor Advertising Market Trends

The billboard and outdoor advertising market in the U.S. dominated the regional industry in 2024, driven by extensive urbanization, high advertising spending, and a robust digital out-of-home (DOOH) infrastructure. The U.S. market also benefits from advanced digital billboards, which enable real-time content updates and targeted campaigns, enhancing ad relevance and engagement. Additionally, the country’s extensive network of highways and transit systems offers abundant opportunities for large-format advertising.

Asia Pacific Billboard And Outdoor Advertising Market Trends

Asia Pacific billboard and outdoor advertising market dominated the industry with a revenue share of 33.0% in 2024. The Asia Pacific region's OOH media landscape is evolving beyond traditional ad spots and locations and incorporating a range of advancements from different printing techniques and digital screen technologies to data-informed creative strategies and the inventive use of public spaces and hardware, which contributes significantly to this evolution. OOH advertisers in China are actively exploring avenues to enhance their return on investment (ROI), and the landscape is being reshaped by technological advancements that bring about efficiency gains. The integration of digital screens has emerged as a cost-effective means of delivering timely information through outdoor advertisements.

Europe Billboard And Outdoor Advertising Market Trends

The billboard and outdoor advertising market in Europe held a significant revenue share in 2024. European cities, with dense populations and extensive public transit networks, provide ideal conditions for impactful outdoor advertising, allowing brands to reach diverse audiences across busy metropolitan areas. Moreover, Europe’s strong regulatory support for sustainable advertising practices has accelerated the adoption of digital billboards and energy-efficient technologies. Countries like the UK, France, and Germany lead the region, with brands heavily investing in high-visibility locations and innovative ad formats.

Key Billboard And Outdoor Advertising Company Insights

Some key companies in the billboard and outdoor advertising industry include JCDecaux SE, Capitol Outdoor, LLC., Intersection, Outfront Media, Inc., Clear Channel Outdoor, LLC and others.

-

JCDecaux SE, headquartered in France, is a global leader in the billboard and outdoor advertising market, specializing in street furniture, transport advertising, and large-format billboards. The company pioneered the concept of street furniture advertising, providing practical public amenities like bus shelters and benches that double as advertising platforms. JCDecaux operates in over 80 countries, reaching millions daily through its extensive portfolio of urban spaces, airports, rail stations, and transit systems. A key player in digital out-of-home (DOOH) advertising, JCDecaux integrates technology and data-driven insights to deliver dynamic, targeted campaigns. The company’s commitment to innovation, sustainable practices, and strategic urban partnerships solidifies its position as a major company in outdoor advertising worldwide.

-

Outfront Media, Inc. is a prominent U.S.-based company in the billboard and outdoor advertising industry, specializing in out-of-home (OOH) advertising across high-traffic locations, primarily in the U.S. and Canada. The company manages an extensive network of billboards, transit displays, and digital out-of-home (DOOH) assets, covering major urban centers, highways, and public transit systems. Known for its innovative digital displays and data-driven advertising solutions, Outfront Media enables brands to engage audiences with dynamic and location-specific content. The company emphasizes creativity, technology integration, and audience targeting, allowing advertisers to optimize reach and impact.

Key Billboard And Outdoor Advertising Companies:

The following are the leading companies in the billboard and outdoor advertising market. These companies collectively hold the largest market share and dictate industry trends.

- JCDecaux SE

- Clear Channel Outdoor, LLC

- Outfront Media, Inc.

- Lamar Advertising Company

- Adams Outdoor Advertising

- Capitol Outdoor, LLC.

- FOCUS MEDIA INC

- Intersection

- Ströer CORE GmbH & Co. KG

- Global

View a comprehensive list of companies in the Billboard And Outdoor Advertising Market

Recent Developments

-

In September 2024, Occtagon Media Networks successfully launched an extensive outdoor advertising campaign for Hindustan Pencils' new product, Nataraj Gelix Pens. The campaign covered ten states and fifteen cities, including major locations like Delhi, Mumbai, Kolkata, and Chennai. By utilizing various outdoor formats such as billboards, bus shelters, unipoles, and gantries, the campaign sought to maximize visibility and establish a strong brand presence in key urban markets.

-

In September 2024, Godrej & Boyce Mfg. Co. Ltd. launched a new out-of-home (OOH) campaign to promote its latest AI-powered washing machine. Aimed at increasing awareness and highlighting the machine’s advanced technology, the campaign targets urban consumers in key cities. It is being executed in high-traffic areas of Bangalore and Chennai, focusing on locations with maximum visibility to ensure broad product reach. This strategic placement allows Godrej to engage with a wide audience in busy metropolitan hubs effectively.

-

In April 2024, Vistar Media announced that Lamar Advertising Company, one of the world's largest outdoor advertising firms, chose Vistar's Cortex, a content management software to manage its network of DOOH billboards across the U.S.

Billboard And Outdoor Advertising Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 41.16 billion |

|

Revenue forecast in 2030 |

USD 60.81 billion |

|

Growth rate |

CAGR of 8.1% from 2025 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

JCDecaux SE; Clear Channel Outdoor, LLC; Outfront Media, Inc.; Lamar Advertising Company; Adams Outdoor Advertising; Capitol Outdoor, LLC.; FOCUS MEDIA INC; Intersection; Ströer CORE GmbH & Co. KG; Global |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

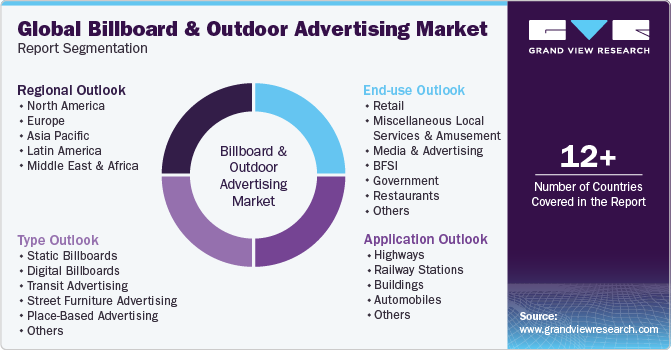

Global Billboard And Outdoor Advertising Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global billboard and outdoor advertising market based on application, type, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Highways

-

Railway Stations

-

Buildings

-

Automobiles

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Static Billboards

-

Digital Billboards

-

Transit Advertising

-

Street Furniture Advertising

-

Place-Based Advertising

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Miscellaneous Local Services & Amusement

-

Media & Advertising

-

BFSI

-

Government

-

Restaurants

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global billboard and outdoor advertising market size was estimated at USD 38.32 billion in 2024 and is expected to reach USD 41.16 billion in 2025.

b. The global billboard and outdoor advertising market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 60.81 billion by 2030.

b. Asia Pacific dominated the billboard and outdoor advertising market with a market share of 34.1% in 2024. This can be attributed to the high penetration of billboards and other outdoor advertisement channels in China and Japan. Also, the increasing adoption in emerging economies such as India and Malaysia contribute to market growth.

b. Some key players operating in the billboard and outdoor advertising market include JCDecaux SE; Clear Channel Outdoor, LLC; Outfront Media, Inc.; Lamar Advertising Company; Adams Outdoor Advertising; Capitol Outdoor, LLC.; FOCUS MEDIA INC; Intersection; Ströer CORE GmbH & Co. KG; Global.

b. Factors such as the integration benefits of outdoor advertisement with other media and the rising local advertising through billboards are expected to drive market growth. Moreover, the advancement of technology in outdoor advertisement space and the creativity of marketers present significant growth opportunities for the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."